Age Partnership Equity Release Advice (2026): Could It Be Right for You?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Age Partnership, an award-winning equity release broker, has provided specialist later-life financial advice since 2004.

- They offer guidance on equity release, pensions, mortgages, wills, and lasting power of attorney.

- Clients receive tailored recommendations from a dedicated advisor, with free initial consultations available.

- Equity release can impact inheritance, benefits eligibility, and overall debt owing to compound interest.

- Age Partnership has high client satisfaction ratings and is a member of the Equity Release Council.

Navigating the world of later-life mortgages can be complex, but Age Partnership's equity release advice may help you find a product that suits your needs.

As Age Partnership was named Equity Release Broker of the Year at the 2025 Mortgage Awards1, they have a solid reputation when it comes to advising on equity release.

Our dedicated team of SovereignBoss researchers and writers diligently review the latest information on all aspects of later-life mortgages, ensuring our content remains current and based on accurate data.

In This Article, You Will Discover:

Here’s what we’ve discovered about Age Partnership

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Age Partnership. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Age Partnership.

Who Are Age Partnership and What Do They Offer for Equity Release?

Age Partnership is a retirement income specialist that provides later-life financial advice.

Strategically positioned in Leeds, West Yorkshire, Age Partnership has carved out a significant niche for itself in the equity release world.

Their passionate team of equity release experts and customer service agents are trained to make your application process run as smoothly as possible.2

Since opening its doors in 2004, Age Partnership has become a trusted advisor for those in or nearing retirement, offering tailored advice on everything from mortgages to pensions and will creation, and even detailed discussions on lasting power of attorney.3

Why Consider Age Partnership for Your Equity Release Needs?

You might consider Age Partnership for equity release planning for a number of reasons.

These include:

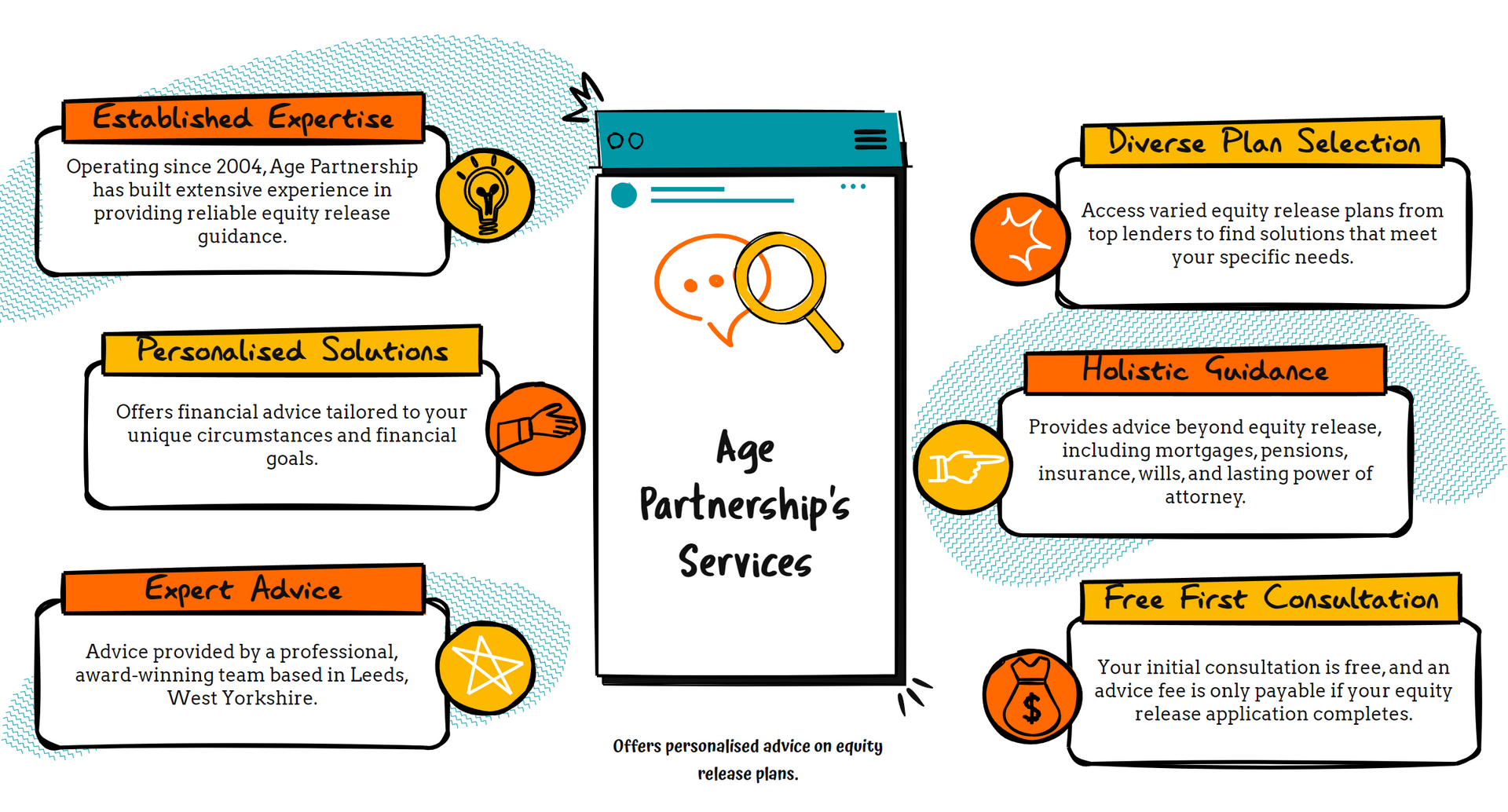

- Expertise & Experience: Since 2004, Age Partnership has accumulated nearly two decades of experience, offering well-informed and tested equity release guidance.

- Wide Range of Plans: Access an extensive selection of equity release plans through partnerships with top lenders, ensuring diverse options to suit your needs.

- Tailored Solutions: Receive personalised financial solutions that address your unique circumstances and goals.

- Comprehensive Guidance: Beyond equity release, Age Partnership provides holistic advice on mortgages, pensions, insurance, wills, and lasting power of attorney, ensuring you have a clear understanding of your financial landscape.

- Qualified Team: Benefit from advice delivered by a robust team of professionals based in Leeds, West Yorkshire, ensuring expertise and reliability.

- Proven Track Record: With a strong market presence, Age Partnership has earned a reputation as a trusted advisor in equity release, solidifying its position through transparency and reliability.

Taking a look at the pros and cons of using Age Partnership for equity release advice can also be useful.

What Are the Benefits of Using Age Partnership?

The benefits of using Age Partnership for equity release advice include being advised on leading equity release plans from a number of top providers.

Other benefits include:

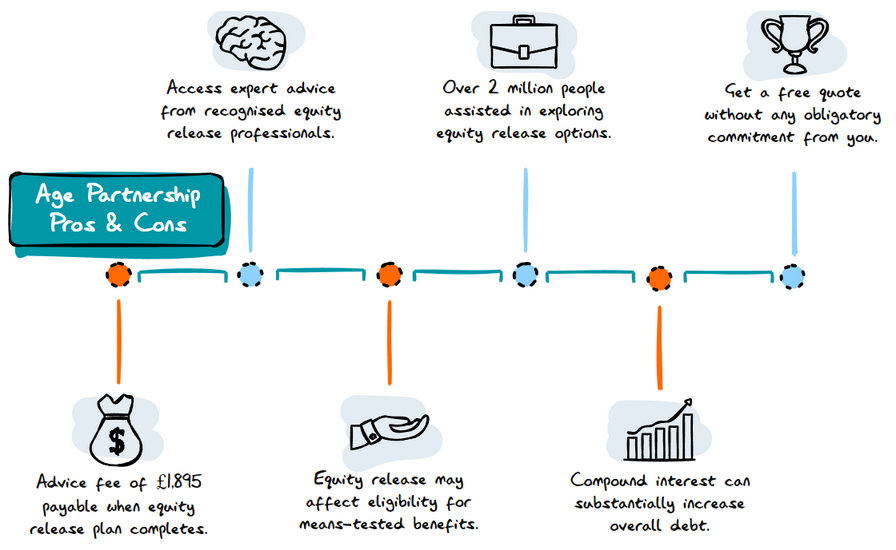

- Access to award-winning equity release advisors.4

- A dedicated advisor to review a wide range of plans from leading lenders.

- Access to a wealth of experience, as the company has helped over 2 million people explore their equity release options since 2004.5

- Free initial advice to help you determine if equity release is right for you—a fee is only payable if your case completes.

- A free, no-obligation quote from an advisor.

- The company is a member of the Equity Release Council.

- Age Partnership is authorised and regulated in the UK by the Financial Conduct Authority (FCA).6

What Are the Drawbacks to Using Age Partnership?

The drawbacks to using Age Partnership for equity release advice include the potential implications of taking out an equity release plan.

Downsides include:

- An advice fee of £1,895 is payable when your equity release plan completes.

- Releasing equity will reduce the amount of inheritance that can be left to loved ones.

- Equity release is not suitable for everyone, so an advisor will encourage consideration of alternative options before proceeding.

- Once an equity release plan is in place, no further borrowing can be secured against the property.

- Borrowing through equity release may affect eligibility for means-tested benefits or grants.

- Over time, compound interest can substantially increase the overall debt from equity release.

- Early repayment of a lifetime mortgage may incur significant charges.

How Does Age Partnership Stand Out Among Equity Release Advisors?

In a market filled with numerous options for equity release advice, Age Partnership's blend of expertise, personalised service, and commitment to client satisfaction sets them apart in the field.

Age Partnership's Industry Awards

Age Partnership's industry awards illustrate the company's profile in the later-life sector.

Their accolades include:

- Equity Release Broker of the Year at the 2025 Mortgage Awards7

- Later-Life Adviser of the Year (Hayley Larham) at the 2023 Women’s Recognition Awards8

- Investor in Customers Gold (2023)9

- Standard Investors in People award10

- Best Financial Adviser – 20+ advisers at the 2022 Equity Release Awards11

- Best broker for equity release at the 2019 Mortgage Strategy Awards12

Which Equity Release Options Does Age Partnership Offer Guidance On?

Age Partnership offers guidance on a range of equity release options to suit various homeowner needs.

The two main types include:

- Lifetime Mortgages: They provide advice on different types of lifetime mortgages, such as lump sum, where you receive a one-off cash amount, or drawdown, which allows you to access money as and when you need it.

- Home Reversion Plans: They also advise on home reversion plans, a less common option where you sell a part or all of your home to a provider in exchange for a lump sum or regular withdrawals, while retaining the right to live in your home for life.

Through their comprehensive advisory services, Age Partnership ensures you are well-informed about your equity release options, helping you choose the right solution tailored to your financial situations and goals.

What Equity Release Schemes Does Age Partnership Recommend?

Age Partnership works in collaboration with multiple lenders, rather than relying on a single source.13

By conducting comprehensive research into all available plans from its panel of lenders, Age Partnership's advisors can pinpoint the most suitable option tailored to your specific circumstances.

Key Features of Equity Release Schemes Recommended by Age Partnership

Age Partnership recommends equity release plans with features designed to provide flexibility, security, and peace of mind for homeowners.

Depending on the selected plan, the available features may include:14

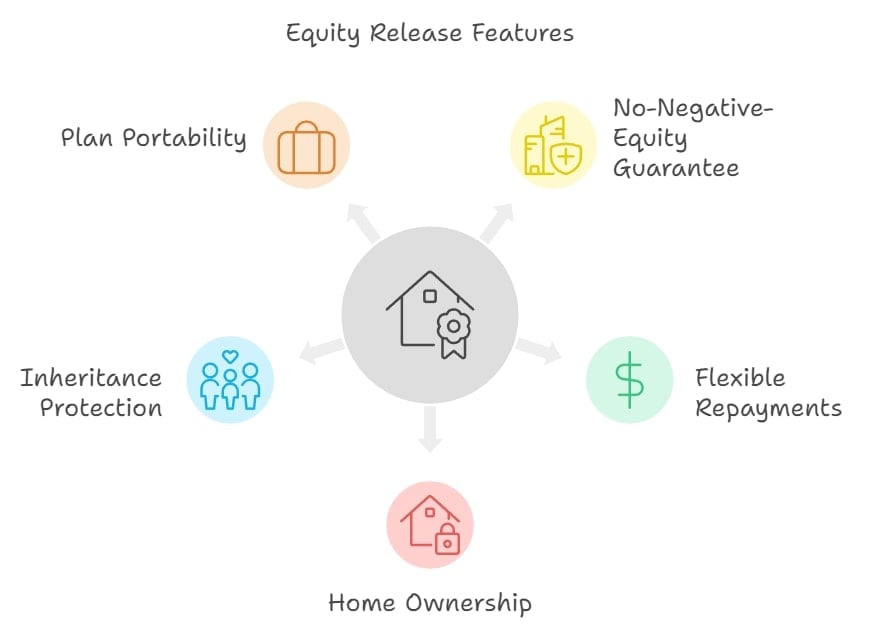

- No Negative Equity Guarantee: Ensures your estate will never owe more than the value of your property at the time of sale, safeguarding your financial legacy.

- No Mandatory Monthly Repayments: Offers the flexibility of not having to make monthly loan repayments, easing your financial burden.

- Voluntary Repayments Option: You have the choice to make voluntary repayments within certain limits to reduce your loan size over time, though early repayment charges may apply if you exceed a predetermined threshold.

- Home Ownership: With a lifetime mortgage you retain ownership of your home, allowing you to benefit from any potential increase in house prices.

- Inheritance Protection Guarantee: This option allows you to protect a portion of your home’s equity to pass on to your loved ones, ensuring your legacy.

- Plan Portability: The plans are designed to be portable, offering the flexibility to move to a new home in the future, subject to meeting the lender’s criteria.

Remember, equity release can have long-term implications for your financial situation and your estate.

It is vital to understand the specific plan features and consult with your advisor to make informed decisions that align with your circumstances and goals.

Who Qualifies for Equity Release Plans Through Age Partnership and How Can You Apply?

To access equity release plans through Age Partnership, you must typically be a homeowner aged 55 or over, although specific criteria can vary depending on the plan.

Who Is Eligible for Equity Release Through Age Partnership?

To be eligible for equity release with Age Partnership, you must meet certain criteria.

These include:15

- You must be a homeowner with a property worth at least £70,000

- You must be aged 55 or over (or 65 or over for home reversion plans)

- You must live in the UK

- You must have little or no outstanding mortgage or secured debt on your property (or be able to repay it with the money you release)

Other factors might influence your eligibility, such as whether your home is deemed to be of non-standard construction or if your home is located in certain geographic areas.

While these factors won’t necessarily disqualify you from getting equity release, they might limit the plans Age Partnership can suggest for you.

What Is the Step-by-Step Process for Applying for an Equity Release Plan Through Age Partnership?

The process begins with an initial consultation to discuss your needs and determine eligibility.

Next, you'll receive personalised advice and a recommendation for the most suitable equity release plan, and after choosing to proceed, Age Partnership handles all the paperwork and liaises with solicitors on your behalf, leading up to the release of funds.

This streamlined process ensures that, from your first inquiry to receiving funds, you're supported at every step.

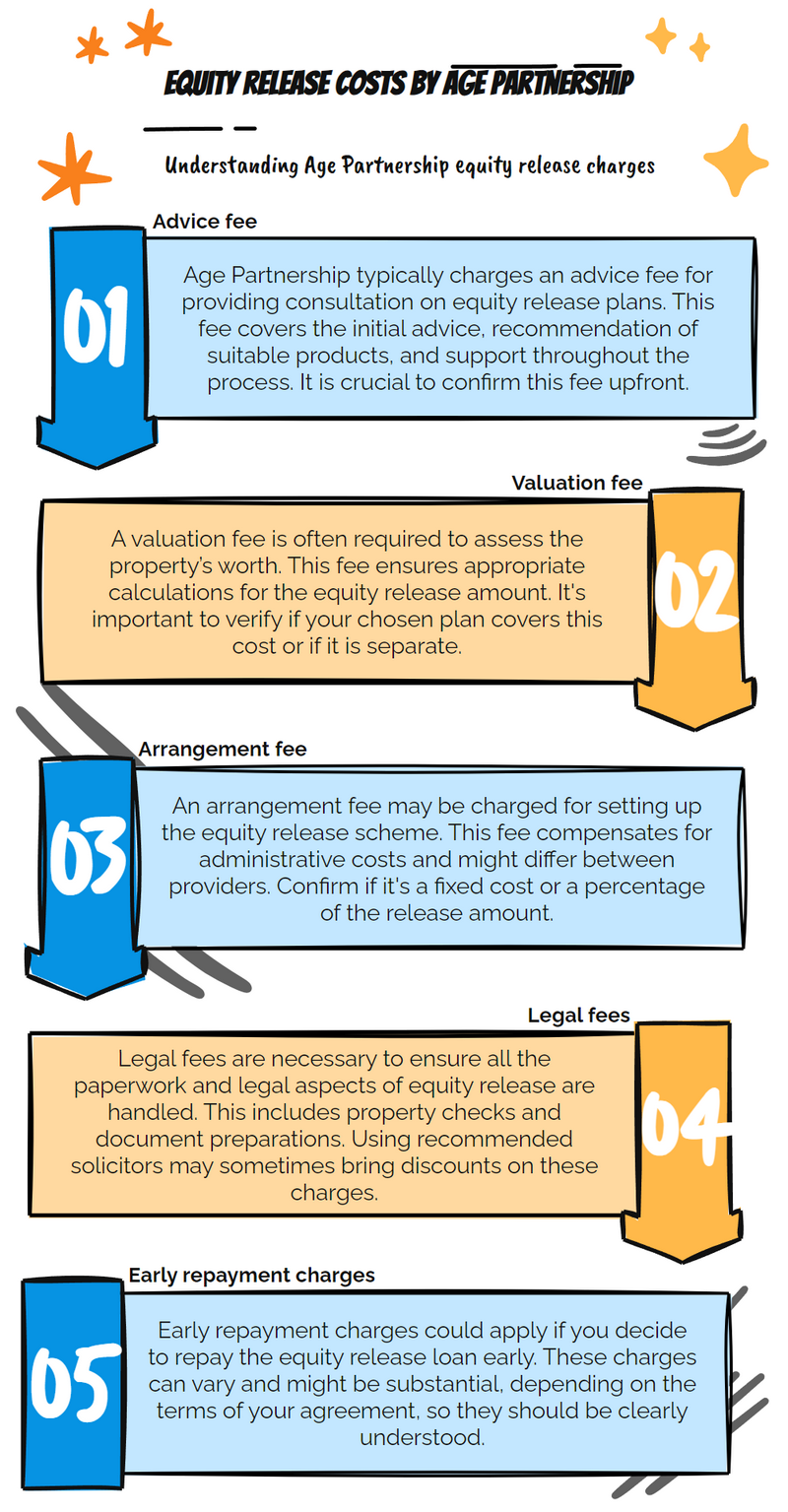

What Are the Costs Associated with Equity Release Through Age Partnership?

The costs associated with equity release through Age Partnership include an advice fee of £1,895, which only applies if your case completes.16

There are also those costs that come with the equity release plan itself.

These may include:

- a valuation fee

- an arrangement fee

- legal fees

- Early Repayment Charges

What Does Age Partnership Advise Regarding Interest Rates?

The interest rate for equity release varies depending on the lender and plan you choose, as well as your personal circumstances.

Age Partnership will search the market for the best rates available for your situation and provide you with a personalised illustration that shows how much interest will accrue over time.

Age Partnership's Equity Release Calculator

Age Partnership provides a free and easy-to-use equity release calculator on its website; a tool to get an instant estimate of how much money you could release from your home based on your age, property value, and outstanding mortgage.17

Start by entering some basic information about yourself and your property, such as your age, property value, and outstanding mortgage.

The calculator then uses this information to provide an estimate of how much equity you could release.

It is a useful tool for getting a quick, initial understanding of your options before diving deeper into the equity release process with a specialist.

You can also try our easy-to-use equity release calculator as a starting point.

Client Reviews of Age Partnership's Equity Release Advice Services

Client reviews of Age Partnership's equity release advice services can be found on online review sites.

Take a look:

- Age Partnership client reviews on TrustPilot: 4,6 out of 5 based on over 9,000 reviews.

- Age Partnership client reviews on Google: 4,2 out of 5 based on more than 300 reviews.

- Age Partnership client reviews on Review Centre: 4,3 out of 5 based on 75 reviews.

*While these review scores were accurate at the time, they may have changed since our last update.

Client feedback highlights Age Partnership's responsive customer service, contributing to the company's positive reputation.

How Did We Review Age Partnership?

We reviewed Age Partnership by exploring the company's official website, using its equity release calculator, examining customer feedback, and verifying the firm's details with the Financial Conduct Authority (FCA).

More Information on Age Partnership

More information on Age Partnership can be found on the FCA's register.

Trading Names

- Age Partnership Limited

- Age Partnership

- Age Partnership Plus

- Property Wealth

FCA Permitted Services

- Insurance

- Mortgages and Home Finance

- Consumer Credit

Registration Numbers

- FCA Ref Number: 425432

- Registered Company Number: 05265969

FCA & Companies House Link

- FCA Link: Age Partnership Limited

- Companies House Link: Age Partnership Limited

How Can You Contact Age Partnership?

You can contact Age Partnership in a few different ways.

These include:

- Phone: 08080 555 222 (free from UK landlines and mobiles)

- Email: enquiries@agepartnership.com

- Post: Age Partnership Limited, 2200 Century Way, Thorpe Park, Leeds LS15 8ZB

- online form: available here

Frequently Asked Questions About Age Partnership Equity Release

Who Owns Age Partnership?

Is Age Partnership Accredited by the Equity Release Council?

How Reputable Is Age Partnership as an Equity Release Advisor?

What Is the Timeline for the Age Partnership Equity Release Process?

Can You Remain in Your Home with an Equity Release Plan Recommended by Age Partnership?

Is Early Repayment Possible with Equity Release Plans Recommended by Age Partnership?

How Does Equity Release Through Age Partnership Impact Means-Tested Benefits?

What Ongoing Support Does Age Partnership Offer Post-Equity Release?

Are There Any Hidden Fees in Age Partnership's Equity Release Advice and Recommendations?

Conclusion: Is Age Partnership the Right Equity Release Partner for You in 2026?

In the ever-evolving landscape of financial solutions for retirees, Age Partnership has emerged as a reputable and trusted figure in the UK equity release sector.

Its tailored product recommendations, commitment to transparency, and adherence to industry standards make it a standout choice for homeowners looking to unlock the potential of their properties.

As with all financial decisions, it is imperative to consult professionals and weigh all options.

If it's a solution that suits your needs, Age Partnership's equity release recommendations may offer a promising avenue to enjoyable retirement years.

The features mentioned and the amounts raised are subject to the lender’s criteria and terms and conditions. These may take into account the borrower's age and health and lifestyle factors in order to provide an enhanced amount.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.