Aviva Equity Release (2026): A Detailed Overview

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Aviva stands out with tailor-made terms and diverse choices for varied financial scenarios, and with a solid reputation built over the years, their scheme is a reliable bet.

- Upsides? Aviva’s adaptability and stellar customer care. Downsides? Potentially steeper rates and fees.

- Want to leave something for the family? Aviva’s schemes also allow for inheritance protection options, so you can safeguard a portion of your home's value for heirs.

Are you thinking about using Aviva's equity release for when you retire? Having helped more than 270,000 customers release equity from their properties, Aviva is a clear expert in the field.1

Now, the question is, is Aviva the right fit for you?

At SovereignBoss, our research team has spent countless hours reviewing, analysing, and organising this equity release information in a user-friendly manner, so you can find out if Aviva's the ideal company to assist you and your family.

Keep reading to get a comprehensive review...

In This Article, You Will Discover:

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Aviva. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Aviva.

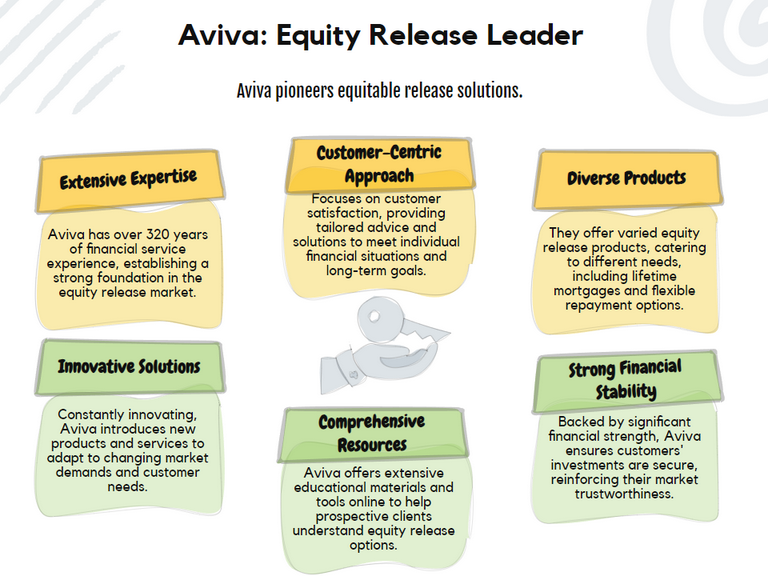

Who Is Aviva and How Do They Contribute to the Equity Release Market?

Aviva is a leading insurance and financial services provider, and they contribute to the equity release market by offering diverse equity release products to UK homeowners seeking financial flexibility.

Here's what you need to know:

Who Is Aviva and What Do They Offer in Equity Release?

Aviva is a "composite insurer," meaning it consists of smaller units specialising in different types of insurance; in equity release (and general financial services), they offer car, home, and health insurance, pensions, investments, and asset management.

With a rich history spanning over 3 centuries, Aviva offers a wide range of products backed by extensive experience.

How Has the Transition from Norwich Union to Aviva Influenced Their Equity Release Offerings?

The transition from Norwich Union to Aviva has influenced their equity release offerings by enhancing them, leveraging global resources to provide innovative products, displaying competitive rates, and showing transparent, customer-friendly services.

The change has solidified Aviva's position as a leading provider in the equity release market, dedicated to helping homeowners make the most of their retirement years.

Why Should You Consider Aviva for Your Equity Release Needs?

You should consider Aviva for your equity release needs because of factors such as their strong market reputation.

Consider all of these factors:

- Strong Market Reputation: A trusted name with over 3 centuries of experience.

- Competitive Interest Rates: Offering great value for your equity release.

- Comprehensive Customer Support: Dedicated to providing exceptional service and support throughout your equity release journey.

Why Choose Aviva for Your Equity Release or Lifetime Mortgage?

You should choose Aviva for your equity release or lifetime mortgage because it has a proven track record and is one of the most established equity release companies in the UK.

Additionally, the Financial Conduct Authority (FCA)2, the Prudential Regulatory Authority (PRA), and the Equity Release Council (ERC) regulate its products to ensure your safety.

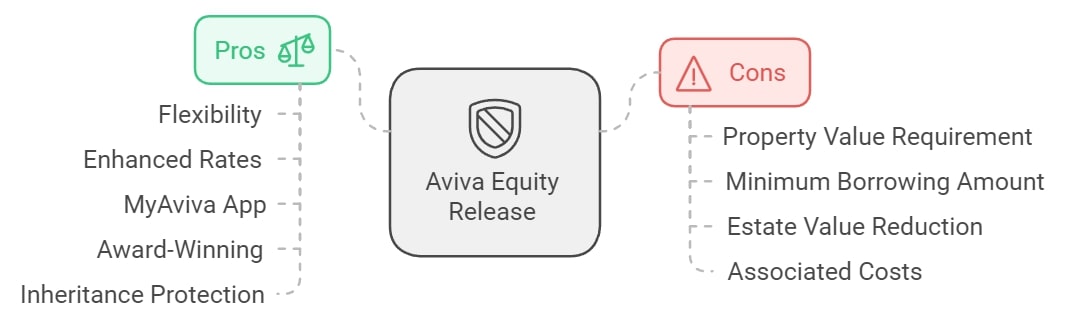

What Are the Pros and Cons of Aviva Equity Release?

The pros and cons of Aviva equity release are that it allows you to release tax-free cash, but it only has one, albeit flexible, product offering.

Let's take a look at the pros and cons:

Pros

The pros of Aviva equity release include inheritance protection and easy money management through the MyAviva app.

These are the pros of Aviva's equity release:

- Its product is very flexible, including a lump sum or drawdown.

- It offers enhanced rates if you have a health and lifestyle condition.

- Manage your money on the MyAviva app.

- Aviva and its lifetime mortgage product have received awards.

- You have the option to protect a portion of your inheritance.

Cons

The cons of Aviva equity release include the costs involved, as well as the reduction in inheritance.

The cons you may experience are:

- Your property must be worth at least £75,000, while some lenders have a minimum value of £70,000.

- You will need to borrow a minimum of £15,000.

- Your loan will reduce the value of your estate and inheritance.

- There are costs involved with equity release from Aviva.

- It has a comprehensive website with a variety of equity release articles.

What Equity Release Schemes Does Aviva Offer and Who Qualifies?

Aviva offers lifetime mortgage schemes, qualifying individuals based on age, property value, and personal financial circumstances.

Let's look at this in more detail:

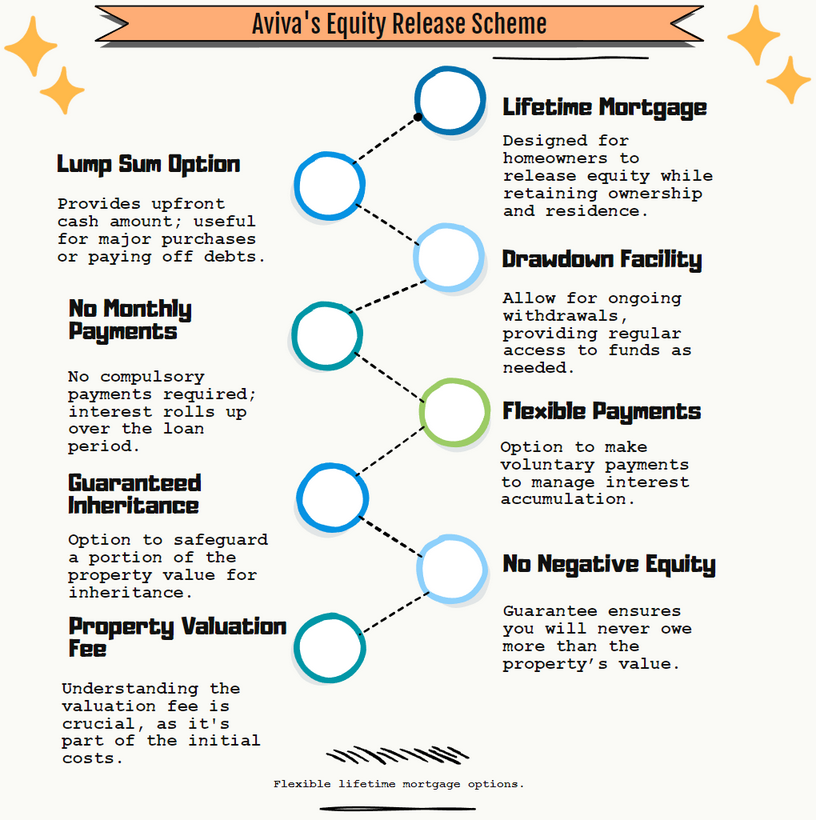

What Types of Equity Release Schemes Are Offered by Aviva?

The types of equity release schemes offered by Aviva are lifetime mortgages; this plan is available as a lump sum or drawdown option.

What Are the Qualification Criteria for Aviva’s Equity Release?

The qualification criteria for Aviva's equity release includes your property value standing at a minimum of £75,000, with a homeowner being at least 55 years and above.

You can expect the following qualification criteria:

- It is available for homeowners over 55, with no upper age limit.

- Your property must be a minimum of £75,000, with no maximum.

- The home must be located in England, Northern Island, Scotland, or Wales, but not the Channel Islands or the Isle of Man.

- You are looking to borrow between £15,000 and £1mln however, the amount you may qualify to borrow depends on your age, property value, and health condition.

How Do Aviva's Lifetime Mortgage Options Cater to Different Customer Needs?

Aviva's lifetime mortgage options cater to different customer needs by offering solutions to every financial situation—whether you're looking for a lump sum payment, a drawdown facility to access funds as needed, or an option to make voluntary payments to manage the loan balance, Aviva has you covered.

This flexibility ensures that there's a plan that fits your unique circumstances.

Overview of Aviva's Equity Release Scheme

Aviva’s equity release scheme is a lifetime mortgage lifestyle flexible option, designed to offer product flexibility for both lump sum and drawdown clients.3

Features of Aviva’s Equity Release Scheme

The features of Aviva’s equity release scheme features include 24/7 online access for policy reviews and the ability to maintian home ownership until you pass or move into care.

All of these features include the following:

- Enhanced rates for certain health and lifestyle conditions.

- You will maintain home ownership and live in it until you pass away or move to long-term care.

- You can get a minimum of a £15,000 cash lump sum or a minimum of a £10,000 lump sum with a minimum of a £5,000 reserve.

- You can pay up to 10% of the initial loan and further advances annually without incurring penalties. You can make multiple payments of £50 or more.

- Online access means you can review your policy 24/7.

- Your plan will come with downsizing protection after 3 years of use.

- You can withdraw a minimum of £500 from your drawdown facility.

- You will not pay interest on your drawdown unless the money is released.

- You are protected by a no negative equity guarantee.

- You have the option to protect some of your estate as an inheritance for your heirs.

- You can transfer your home if it meets your new lender’s criteria.

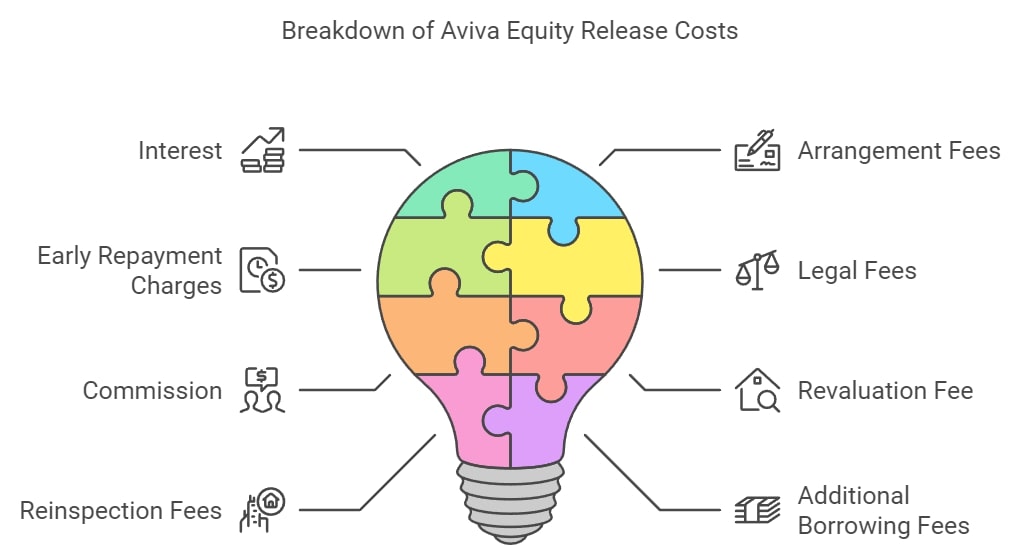

What Are the Costs and Customer Experiences with Aviva Equity Release?

The costs with Aviva equity release include initial advice fees, valuation charges, and interest rates, with generally positive customer experiences reported.

Here's a peek at fees and feedback:

What Are the Costs Associated With Aviva Equity Release?

The costs associated with Aviva equity release include legal and valuation fees.

Aviva’s costs for equity release include:

- Interest - It compounds annually and is calculated daily.

- Arrangement fees - These are presented on your Key Features Illustration if you sign up for an equity release loan with Aviva.

- Fixed percentage early repayment charges - These range between 1% and 9%, depending on the length of your loan. You will not incur these charges from 16 years, onwards.

- Legal fees - You will need to pay your own legal fees. The arrangement fee you pay will cover Aviva's legal expenses and any associated disbursements.

- Commission - If a cash reserve option is selected, a commission of 2.25% of the starting loan and an additional 0.75% of the reserve will be charged.

- Revaluation fee - If your equity release loan takes more than six months to complete, you will be charged a revaluation fee as your home will need an additional valuation to determine its worth.4

- Reinspection fees - You will need to pay £60 if your home needs a new inspection or if there have been major changes to your property.

- Additional borrowing fees - If you have additional equity and choose to remortgage your equity release, you can expect an application fee, re-evaluation fee, re-inspection fee, and legal fees.

- Valuation fees - You will not need to pay valuation fees on your initial loan amount if your property’s value is anything up to and including £5mln.

Aviva Equity Release Reviews: What Do Customer Ratings and Feedback Look Like?

Aviva’s customer ratings and feedback score at 4.1/5 on Trustpilot and 25% of customers recommend Aviva on REVIEWS.oi.

Take a look online:

How Can Aviva's Equity Release Calculator Help You Plan Financially?

Aviva's equity release calculator can help you plan financially by providing a personalised estimate of potential loan amounts, helping you to make informed financial decisions.

Check out the importance of estimates during planning:

Does Aviva Have an Equity Release Calculator?

Yes, Aviva does have an equity release calculator to help you determine how much equity you can unlock with its lifetime mortgage.5

You can also try our free equity release calculator to provide an approximation of what you could get from a plan with a regulated lender.

How Can You Effectively Use Aviva's Equity Release Calculator to Estimate Your Loan?

Using Aviva's equity release calculator is a straightforward way to estimate how much you could release from your home.

By inputting details like your age, property value, and any outstanding mortgage, you can get an instant estimate of the funds available to you.

This tool is invaluable for initial financial planning, helping you to understand the potential impact of an equity release on your finances before you commit to anything.

How to Address Concerns or Obtain More Information About Aviva Equity Release

Addressing concerns or obtaining more information about Aviva equity release can be done through their customer service, online resources, or financial advisers.

Here's how:

Where Can You Direct Your Complaints About Aviva Equity Release?

If you are unhappy with the service received, you can direct your complaints about Aviva equity release and launch a customer complaint by telephone, or by completing this complaints form here.

How Can You Contact Aviva for Equity Release Queries?

- +44 207 283 2000

- helpdesk@aviva.co.uk

- Aviva PLC. Registered Office: St Helen’s, 1, Undershaft, London EC3P 3DQ.

What Additional Resources and Support Does Aviva Provide?

Aviva provides additional resources and support like detailed guides, FAQs, and access to professional advice, supporting customers through the equity release process.

Get all the help you need through these channels:

What Resources Does Aviva Provide for Financial Advisers on Equity Release?

The resources that Aviva provides for financial advisers on equity release are comprehensive solutions, including detailed product information, training modules, and marketing materials—all designed to empower advisers with the knowledge and tools they need to provide their clients with informed, tailored advice on equity release options.

They offer dedicated adviser support lines and online platforms, where professionals can access the latest industry news, legislative changes, and best practice guides.

Aviva's Registration and Compliance Details with the FCA

Avivas registration and compliance details with the FCA include their registartions numbers and FCA details.

See below:

Registration Numbers

- FCA Ref Number: 310433

- Companies House Reg Number: 03286484

FCA and Company House Links

- FCA Link: FCA Link

- Companies House Link: Companies House Link

What Was the Methodology Behind Our Review of Aviva?

We reviewed Aviva based on the following:

- Reputation and History – How many years they have been in business, customer reviews, and industry rewards received.

- Financial Strength – Ensuring it is going strong and has adequate funds to meet long-term commitments.

- Product Range – We favour companies offering a variety of equity release schemes with greater product flexibility.

- Interest Rates and Fees – We review competitive rates compared to industry averages and they must be fully transparent about rates and fees without hidden costs.

- Customer Service and Support – When and how it is available, response times, and available online educational resources. As well as online tools, like a calculator.

- Code of Conduct and Compliance – We only consider companies that adhere to recognised industry standards and codes.

- Industry Insights and Peer Reviews – We care about a company’s industry-wide reputation.

- Innovation and Technology – Is there a streamlined, digital application process?

- Client Testimonials – Success stories and the complaints resolution process.

Please note that this analysis is conducted by an unaffiliated, independent third-party.

Frequently Asked Questions About Aviva Equity Release

What Are the Interest Rates for Aviva's Equity Release Scheme?

How Much Can You Release With Aviva's Equity Release Plan?

How Does Aviva Equity Release Affect My Inheritance and Taxation?

How Does Aviva's Equity Release Scheme Compare to Others?

How Can I Make Changes or Repayments to My Aviva Equity Release Plan?

How Long Does the Equity Release Process With Aviva Typically Take?

Does Aviva Allow Early Equity Release Repayments Without Any Penalties?

Is Aviva a Member of the Equity Release Council?

How Does Aviva Ensure the Security and Privacy of My Personal Information?

How Can I Get a Job at Aviva?

What Is Aviva’s History With Mergers and Acquisitions?

What Are the Pros and Cons of Aviva's Equity Release Scheme?

Can I Trust Aviva's Equity Release Scheme?

How Does Aviva's Equity Release Scheme Work?

Conclusion: Making an Informed Decision About Aviva Equity Release

Aviva's equity release products stand as a testament to the company's commitment to providing flexible and customer-centric solutions, with its robust security measures and experienced financial experts further adding to the appeal.

With adherence to the Equity Release Council's guidelines, product flexibility, and an efficient process, it is a strong choice to consider.

If you are wondering about the best equity release companies in the UK, it may be worth perusing what Aviva has to offer to see if they fit the description for your particular needs.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.