Best UK Mortgage Brokers of 2026

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- The top-rated mortgage brokers in the UK include London & Country, Habito, and Trussle.

- For equity release, Age Partnership, Key, and Equity Release Supermarket rank among the best-rated.

- Those with the best customer reviews include John Charcol, Habito, and Trussle.

- London & Country, Trussle, and Habito are known to offer the best rates.

- The most trustworthy, based on customer feedback and industry reputation, include London & Country, John Charcol, and Age Partnership.

Finding the best mortgage brokers doesn’t necessarily mean the best in the market, but the best broker for you and your needs.

In This Article, You Will Discover:

We’ve compiled this list of 5 of the top-ranking mortgage brokers in different specialities to set you on the right path.

5 Best Whole-Of-Market Mortgage Brokers

Whole-of-market mortgage brokers have a bigger scope to find you the best deal in the market as they have access to a wide range of products.

They are usually independent brokers, who are not tied to a specific lender.

Here are the top-ranked whole-of-market mortgage brokers we could find in the UK.

1. VA Mortgages

As a whole-of-market broker, VA Mortgages1 only focus on mortgage needs and associated products such as life insurance, income protection and home insurance.

2. Mortgage Advice Brokerage

Mortgage Advice Brokerage2 is a family-run business with 22 years’ experience in the whole-of-market mortgage field.

3. BlueWing Financials

Whole-of-market mortgage brokers, BlueWing Financials3, has access to more than 130 lenders and a choice of 20,000 deals.

4. L&C Mortgages

As one of the largest whole-of-market mortgage brokers in the UK, L&C Mortgages4 prides itself in its simple four-step process for securing home loans.

5. Needing Advice

According to Needing Advice5 whole-of-market brokers, getting the right outcome for its clients, whether that’s getting a mortgage agreed quickly or whether that’s getting a difficult-to-get agreed mortgage to offer stage, is its main goal.

5 Best Traditional Mortgage Brokers

Traditional mortgage brokers specialise in face-to-face relationships with their clients.

Here are our top-ranked traditional mortgage brokers if you’re looking for a more personal touch.

1. First Mortgage

With branches acrosss Scotland, North East England, Manchester and London, First Mortgage6 advisors are able to consult in person or over the phone.

2. Alexander Hall Mortgages

Alexander Hall Mortgages says its hassle-free mortgage service is tailored to meet your needs.

3. Zing Mortgages

Specialsts in face-to-face consultations, Zing Mortgages will give you the lowdown on all aspects of financing your home purchase.

4. The Mortgage Hut

The Mortgage Hut9 offers both face-to-face and telephonic advice to help you decide the best mortgage option for you.

5. Mortgage Advice Brokerage

Mortgage Advice Brokerage10 believes in the personal touch by getting to know their clients, their financial circumstances, dreams and goals.

5 Best Online Mortgage Brokers

With an online mortgage broker, you can make your initial enquiries through a chatbot, or apply for a mortgage using an online form.

It’s usually only at the stage where you do the paperwork that you’ll come into contact with a human broker.

If you prefer to go the digital route, here are our top five.

1. L&C Mortgages

One of the features of the L&C Mortgages11 service is an online portal which allows you to track your mortgage process 24/7.

2. Habito

Your digital mortgage journey with Habito12 starts from the minute you enter their website and continues till you receive the keys for your new front door.

3. Mojo Mortgages

According to Mojo Mortgages13, 95% of their clients are successful in their mortgage applications.

4. Mortgage Scout

The Mortgage Scout14 website has a host of valuable tools and information to facilitate your mortgage journey.

5. Mortgages Online

Mortgage Online15 uses technology to smooth the mortgage process because they believe online mortgage brokers are the future.

5 Best Fee-Free Mortgage Brokers

Fee-free mortgage brokers earn commission from the mortgage lender you sign your deal with.

In other words, the home buyer doesn’t pay any fees for service to the broker.

Here are our top-ranked fee-free mortgage brokers.

1. L&C Mortgages

L&C Mortgages16 says its fee-free mortgage service comes without hidden costs, just honest advice to secure your mortgage.

2. Habito

Habito17 promises totally free, unbiased mortgage advice, and a simple online process.

3. First Mortgage

Because their service is funded entirely by mortgage lenders, First Mortgage18 says you can bid farewell to advice fees.

4. Fee Free Mortgages

Fee Free Mortgages19 will help you buy your first home or remortgage your current one, completely fee free.

5. Vincent Burch

Independent fee-free mortgage broker, Vincent Burch20 will match your mortgage to your needs and budget.

5 Best Specialist Mortgage Brokers

A specialist mortgage broker has the knowledge and skills to secure mortgages for buyers who are freelancers or self-employed, who want to purchase an unconventional property, or have a bad credit rating.

These are our top-ranked specialist mortgage brokers.

1. John Charcol

Your John Charcol21 mortgage advisor will offer the best product for your individual circumstances.

2. CLS Money

Getting approved for a specialist mortgage can be tricky, so CLS Money22 is there to help you navigate the process.

3. Agentis Financial & Mortgage Solutions

Agentis Financial & Mortgage Solutions23 provides clear, simple and easy-to-understand advice for your particular needs.

4. The Loans Engine

If you’ve had no luck with the high-street lenders, specialist mortgage brokers, The Loans Engine24 may be able to help.

5. Private Finance

With access to several private banks, Private Finance25 can help secure high-value mortgages without the associated complex paperwork and delays.

5 Best Mortgage Brokers for Telephonic Advice

If you’re looking for the best broker who’s only a phone call away, here are our top 5.

1. Drake Mortgages

Drake Mortgages26 understands that applying for a mortgage is a huge financial decision.

Their brokers are waiting for your call.

2. L&C Mortgages

Although it’s moved with the times, L&C Mortgages27 still provides their traditional telephonic service for clients who prefer that route.

3. Mortgage Advice Bureau

With more than 2,000 advisors across the UK, Mortgage Advice Bureau28 offers local, regional and national mortgage advice over the phone or face-to-face.

4. Expert Mortgage Advisor

Expert Mortgage Advisor29 will give you a quote in 60 seconds and then match you with a suitable mortgage advisor.

5. The Mortgage Brokerage

The Mortgage Brokerage30 will take you through the entire mortgage process via phone, video conferencing, secure link, and email.

5 Best Mortgage Brokers for Speedy Applications

With the advent of online mortgage brokers, the turnaround time for a mortgage application has become faster.

Here are our top-ranked mortgage brokers for speedy applications.

1. Online Mortgage Advisor

Online Mortgage Advisor31 promises to get you a mortgage quote and a decision in principle within a matter of minutes.

2. Trinity Financial

Trinity Financial32 has worked on developing valuable contacts throughout the lending industry to provide a quick, quality mortgage service.

3. L&C Mortgages

The L&C Mortgages33 digital journey makes for a faster, seamless application process.

4. Simple Fast Mortgage

It’s all in the name, Simple Fast Mortgage34 is a fully remotely brokerage offering consultations over the telephone, by video call and email.

5. Habito

Habito35 believes that life’s too short for life’s admin, so their end-to-end mortgage service is designed to make things happen fast.

5 Best Mortgage Brokers for a Bad Credit Record

A bad credit record doesn’t necessarily exclude you from getting a mortgage.

Here are our top-ranked mortgage brokers who specialise in buyers with a bad credit record.

1. The Mortgage Hut

The Mortgage Hut36 has helped hundreds of prospective buyers with bad credit to realise their dream of owning a home.

2. Simply Adverse

Specialising in clients with a poor credit record, Simply Adverse37 has the market access to adverse-friendly lenders.

3. CLS Money

CLS Money38 seeks out mortgages for people who have a poor history with credit agreements and have a lower-than-average credit score.

4. Haysto

Haysto39 makes mortgages possible for people with bad credit, or who are self-employed, or have a complex situation.

5. Revolution Finance Brokers

If you’ve been turned down for a mortgage because of your bad credit record, Revolution Finance Brokers40 will find a solution for you.

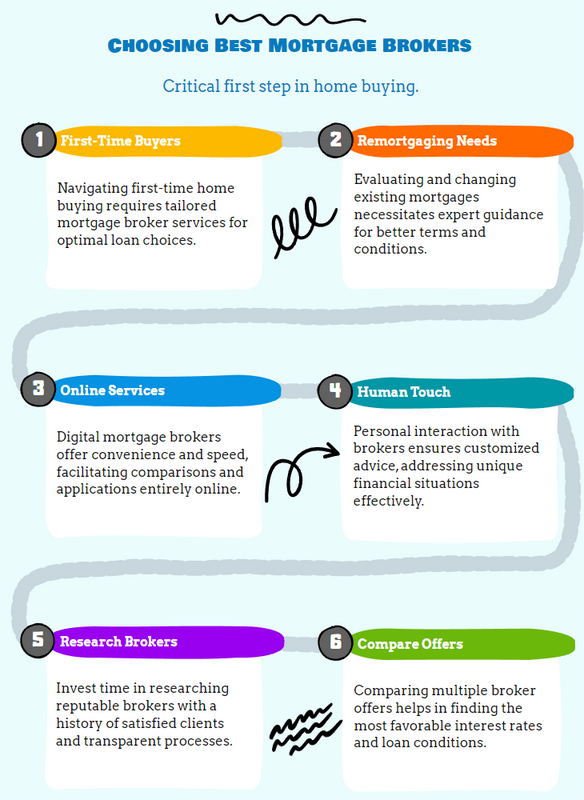

5 Best Mortgage Brokers for First-Time Buyers

If you’re a first-time buyer, you want a mortgage broker who can guide you through the process.

Here are our top-ranked mortgage brokers for first-time buyers.

1. First Mortgage

As the name implies, First Mortgage41 specialises in assisting first-time buyers secure their new home.

2. Just Mortgage Brokers

As a first-time buyer, you probably have a lot of questions, Just Mortgage Brokers42 has the answers and knowledge to secure your loan.

3. Alexander Hall Mortgages

Alexander Hall Mortgages brokers will steer first-time buyers through the mortgage process.

4. CLS Money

Applying for a first-time buyer mortgage is a daunting prospect.

The advisors at CLS Money44 will support you through the process.

5. John Charcol

John Charcol45 has the expertise to guide you through the first steps onto the property ladder.

5 Best Mortgage Brokers for Remortgaging

When it comes time to remortgage, you’ll be looking for someone who can find you the best deal.

These are the highest-ranked mortgage brokers for remortgaging.

1. Just Mortgages

Your Just Mortgage46 broker will review your budget and come up with a suitable remortgaging option for you.

2. Online Mortgage Advisor

If it’s time for you to remortgage, it’s time to call on Online Mortgage Advisor47.

3. L&C Mortgages

The team at L&C Mortgages48 will walk you through your remortgage options.

4. First Mortgage

If you’re thinking of remortgaging, First Mortgage49 will help you on your way.

5. Choice Mortgages UK

There are many reasons why you might choose to remortgage, Choice Mortgages UK50 will find the right solution for you.

Common Questions

How Do I Choose a Mortgage Broker?

Why Should I Use a Mortgage Broker Instead of a Bank?

Should I Talk to More Than 1 Mortgage Broker?

Who Are the Top Rated Mortgage Brokers in the UK?

What Are the Best UK Mortgage Brokers for Equity Release?

Which UK Mortgage Brokers Have the Best Customer Reviews?

Which UK Mortgage Brokers Offer the Best Rates?

Who Are the Most Trustworthy Mortgage Brokers in the UK?

In Conclusion

Whether you’re a first-time buyer or remortgaging, looking for an online service or prefer the human touch, finding the best mortgage brokers for you is the first step in the journey of finding your dream home.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.