Canada Life Equity Release Review (2026): Comprehensive Review

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- The pros and cons of Canada Life equity release include the advantage of cash flow enhancement and the risk of depleting your home equity.

- They work by allowing you to tap into your property's value whilst still maintaining your residency, which typically gets repaid when you pass away or move into long-term care.

- Whether it is a good option for you depends on your financial situation, need for cash flow, and comfort with reducing home equity.

- The interest rates vary between 5.97% to 6.28%* based on the specifics of your plan and current market rates, making it essential to understand your agreement.

- While they are transparent with their costs, it's crucial to read your agreement carefully to understand all potential fees such as early repayment charges.

Could Canada Life equity release be the right product for your needs?

Celebrating it's 175th year1 in 2022, Canada Life is certainly a provider to consider.

With so many providers to choose from, the question of what is the best company for equity release is one that requires a lot of research in order to find the answer.

Therefore, we have done the preliminary research for you.

In This Article, You Will Discover:

At SovereignBoss, we have spent countless hours reviewing equity release companies and putting the information in an easy-to-use format.

Therefore:

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Canada Life. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Canada Life.

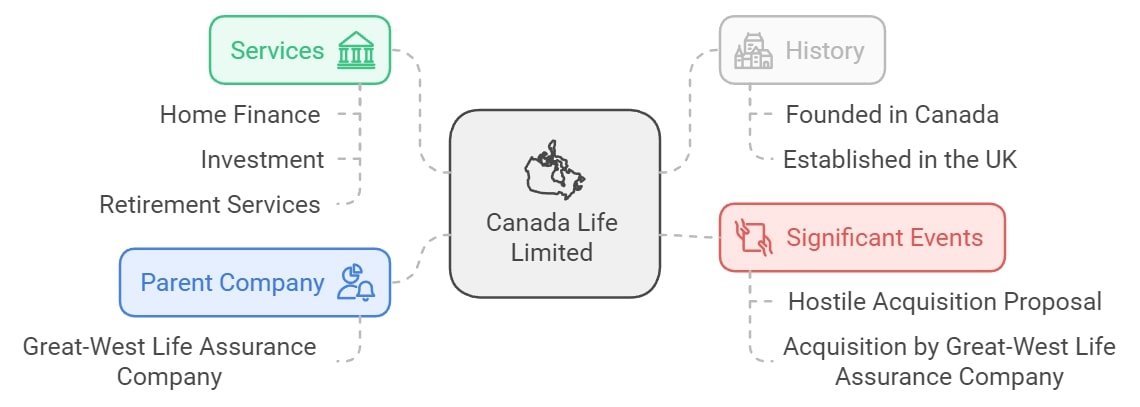

Who Is Canada Life?

Canada Life Limited is a UK subsidiary of Great-West Lifeco and provides home finance, investment, and retirement services to individuals and businesses.

After rejecting a hostile acquisition proposal by rival Manulife, it was bought by The Great-West Life Assurance Company in 2003.2

The firm has been around for more than 170 years in Canada, and has been in the UK since 1903.

Why Should You Consider Canada Life for Releasing Equity?

You should consider it's service as it offers a large array of award-winning products, boasting market-leading expertise and customer support.

It also has products with the option to release cash from your second home.

Additionally:

It is a subsidiary of Great-West Lifeco, which manages assets worth over £987bln.3

Does It Offer Equity Release or Lifetime Mortgages?

Yes, Canada Life offers equity release in the form of a lifetime mortgage with a flexible range of products.

What Lifetime Mortgage Products Does It Offer?

Its lifetime mortgage products are presented in three ranges:

- Capital Select Options

- Lifestyle Select Options

- Second Home Options

More information:

Capital Select Options

With the Capital Select Options,4 you can expect the following features:

- Your advisor can help you choose from Capital Select Super Lite, Capital Select Lite, and Capital Select Gold.

- You can voluntarily repay up to 10% of the loan annually with a minimum payment of £50 each year, starting from when your mortgage is completed.

- You will receive a lump sum, with the added option of a cash facility from which you can withdraw.

- There are no early repayment charges for downsizing after five years of obtaining an equity release loan.

Lifestyle Select Options

Lifestyle Select Options5 provide these features:

- You can choose Lifestyle Select Lite, Lifestyle Select Super Lite, and Lifestyle Select Ultra Lite.

- Select a lump sum option or a lump sum with a drawdown facility.

- These products also allow you to repay up to 10% of the loan each year.

- You can withdraw a minimum of £2,000 from your cash facility. If there is less available, you will need to withdraw the full amount.

Second Home Options

If you like to release money from your second home, you can look into the following features with the company’s Second Home Options.6

- A once-off payment of tax-free cash.

- A free property valuation.

- The option to borrow more at a later stage should you wish to.

- No affordability checks.

- Voluntarily repay up to 10% of the loan annually or let the interest compound.

General Product Features and Benefits

You can expect the following features from all of Canada Life’s products:

- Retained property ownership with no chance of repossession in your lifetime.

- Fixed for life interest rates.

- The option to ringfence a portion of your home as a guaranteed inheritance.

- You can move home and port your plan if the new property qualifies.

- A No Negative Equity Guarantee which ensures that if your property is sold and does not cover the full loan amount, any remaining debt will be written off.

- You can opt for further advances at a minimum of £4,000 with required additional advice.

- There are fixed early repayment charges that fall away after nine years.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount.

Who Qualifies?

You may qualify for a Canada Life lifetime mortgage if you are nearing retirement and live in the UK.

Additional criteria include:

- Being 55 or older.

- You own your home.

- You hold residency in the UK.

- The property is located in England, Wales, or Scotland.

- Your property is your primary residence or, where applicable, your second home.

To determine if you qualify, consult an equity release advisor or broker who can assess the suitability of this borrowing option for your circumstances.

What Are the Costs?

The costs of a lifetime mortgage with Canada Life are indicated on the company's website,7 indicating transparency, which is important for Equity Release Council-regulated lenders.

A breakdown:

Fees

If you opt for a lifetime mortgage with Canada Life, you may be eligible for these fees:

- Valuation fee - Only if you are opting for a further advance. The fee charges are based on your property value.

- Completion fee - The company charges £650 to set up your plan and for standard legal fees.

- Legal fees - In some cases, you may be charged additional legal fees ranging from £30 to £250. You can also opt for the services of a member of the Equity Release Solicitors’ Alliance (ERSA),8 which would incur additional costs.

You can expect additional charges if you take a further advance or in other circumstances.

Rates

Canada Life interest rates will depend on age, property value, and property type.

Rates sit around 5.97% to 6.28% AER*.9

*While we regularly review our rates, these may have changed since our last update.

Does Canada Life Provide an Equity Release Calculator?

Yes, you can use a Canada Life equity release calculator10 to estimate how much cash you can get from your property.

You can also use our free calculator to obtain an initial estimate.

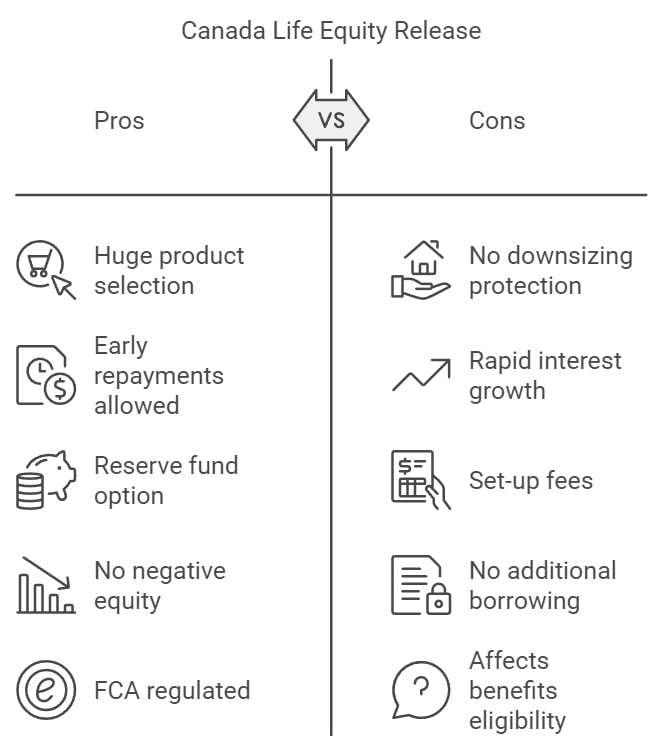

What Are the Pros and Cons?

The pros and cons of using Canada Life include allowing early repayments without incurring any fees; however, depending on your product choice, you may not get downsizing protection.

Advantages

Additional advantages of the company:

- It has a huge product selection.

- You have the option to make early repayments without facing charges.

- You can establish a reserve fund from which you can draw additional cash.

- There is no danger of falling into negative equity.

- All the lifetime mortgages it offers are regulated by the FCA.11

Disadvantages

Disadvantages you may experience:

- Certain plans do not include downsizing protection.

- With any equity release loan, interest can grow rapidly, which means you will leave less to your family when you pass away.

- Equity release may require set-up fees.

- Once you have taken out an equity release plan, no other borrowing can be taken out using your home as security.

- Equity release may affect your eligibility for means-tested benefits.

Equity release may not be suitable for everyone, which is why your adviser will ask you to consider other options before proceeding.

Customer Views:

There are a number of negative reviews, with certain customers mentioning high telephone waiting times.

Additionally:

There are some customers and employees who have praised the company for excellent service.

Reviews

You will find customer reviews on these sites:

Complaints

If you like to complain about the service you have received from Canada Life, the company is open to assisting and advises on a four-step process.12

- Contact their team directly by picking up the phone.

- Have your matter escalated to the appropriate department.

- Get in touch with the Ombudsman Office using this online form.

- If the case is not resolved, contact an external regulator.

How Did We Review the Information on Canada Life?

We reviewed Canada Life based on the following:

- Reputation and History – How many years they have been in business, customer reviews, and industry rewards received.

- Financial Strength – Ensuring it is going strong and has adequate funds to meet long-term commitments.

- Product Range – We favour companies offering a variety of equity release schemes with greater product flexibility.

- Interest Rates and Fees – We review competitive rates compared to industry averages and they must be fully transparent about rates and fees without hidden costs.

- Customer Service and Support – When and how it is available, response times, and available online educational resources. As well as online tools, like a calculator.

- Code of Conduct and Compliance – We only consider companies that adhere to recognised industry standards and codes.

- Industry Insights and Peer Reviews – We care about a company’s industry-wide reputation.

- Innovation and Technology – Is there a streamlined, digital application process?

- Client Testimonials – Success stories and the complaints resolution process.

This is an unaffiliated, independent review of Canada Life.

*As of September 2023.

FCA Details

FCA details include trading names, permitted services, and regulators, as per below.

Trading Names

The firm holds a single trading name: Canada Life Limited.

FCA Permitted Services

It is licensed to offer the following services:

- Banking

- Customer credit

- Insurance

- Investments

- Pensions

Regulators

It is authorised and regulated in the UK by the Financial Conduct Authority,13 and Prudential Regulation Authority.14

Registration Numbers

Registration numbers are as follows:

- FCA Ref Number: 110394

- Companies House Reg Number: 00973271

FCA and Companies House Link

These links are available for you to review:

- FCA Link: FCA Link

- Companies House Link: Companies House Link

Canada Life Contact Details

For more information, get in touch with Canada Life by using these details:

- Call: 0345 606 0708 or +44 1707 651 122

- Email: Customer.Services@canadalife.co.uk

- Location: Canada Life Limited, Canada Life Place, Potters Bar, Hertfordshire EN6 5BA

Common Questions

Can You Repay Your Plan Early?

Is Canada Life Safe and Regulated?

Do Canada Life’s Equity Release Plans Affect Your Inheritance?

Does Canada Life’s Equity Release Scheme Impact Pension Benefits?

Who Owns Canada Life?

Can I Work for the Firm?

Can You Make Additional Borrowings?

How Long Does It Take to Get Canada Life Equity Release?

How Can You Apply?

What Are the Pros and Cons of Canada Life Equity Release?

How Does Canada Life Equity Release Work?

Is Canada Life Equity Release a Good Option for Me?

What Are the Interest Rates for Canada Life Equity Release?

Are There Any Hidden Charges in Canada Life Equity Release?

Conclusion

The company offers homeowners a strategic approach to tap into the value of their properties, enabling them to utilise funds for various purposes, from retirement to home improvements.

As with any financial decision, it is crucial to weigh the pros and cons, consult with financial experts, and understand the potential impact on your inheritance and overall financial health.

Ultimately, for those who see it as a good fit, Canada Life equity release can be a valuable tool in later-life financial planning.

Additional Reading:

Age Partnership Equity Release Calculator

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.