Equity Release Calculator 2026: Discover Your Potential

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

- Get a quick cash estimate that shows what you could unlock from your home in 2026 with an equity release calculator, based on property value and age—no personal details required.

- Pros? It's a speedy way to see what you might get, helping shape your financial strategy. Cons? It misses tailor-made advice from an expert and might skip some details affecting your final cash-out.

- It might be worth looking into several calculators from various providers to compare estimates, as calculations and assumptions can vary.

Finding out how much you can qualify for on equity release may seem like a complicated science, but it does not have to be with our easy-to-use equity release calculator.

More than 13,000 new customers released equity in Q3 of 2022,1 and their journey likely started by getting an estimate of the amount of cash they would be able to access.

In This Article, You Will Discover:

Our expert team at SovereignBoss dedicates its time to bringing you the latest information on the equity release market.

Find out how our equity release calculator works and see if this is the first step in your journey to release equity.

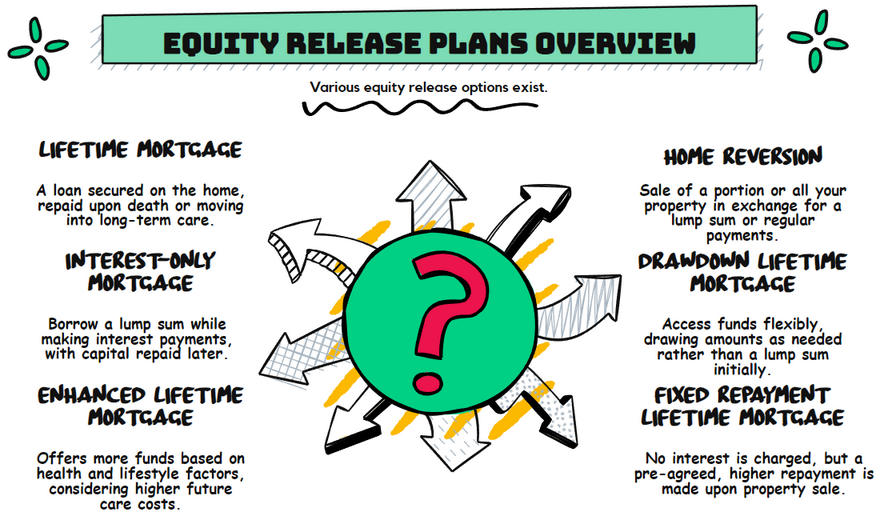

What Types of Equity Release Plans and Options Are Available?

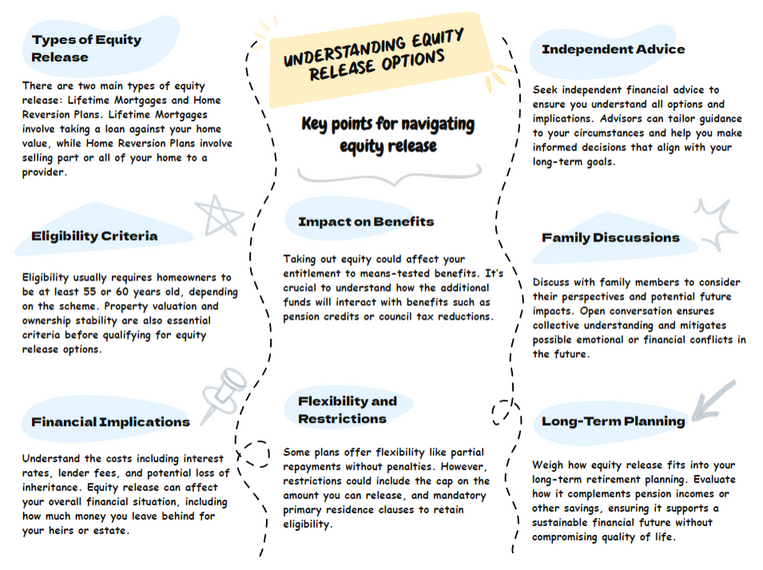

In the UK, there are two main types of equity release plans: lifetime mortgages and home reversion plans.

Each offers different features that can significantly impact the amount you can unlock from your property, with your choice depending on your personal circumstances and financial goals.

Understanding Equity Release in the UK

Equity release is a financial option for homeowners, especially those aged 55 and older, to unlock a portion of the equity tied up in their property.

This is typically done through schemes like lifetime mortgages or home reversion plans.

Homeowners can receive a lump sum or regular payments, with the borrowed amount and any accrued interest usually repaid when the homeowner passes away or moves into long-term care.

While equity release can provide additional income or funds for various purposes, it's crucial to carefully consider the implications.

Lifetime Mortgage

The most common type of equity release, a lifetime mortgage, allows you to take out a loan secured against your home while retaining ownership.

The loan, along with any accumulated interest, is repaid from the proceeds when your home is sold, usually upon your death or when you move into long-term care.

Learn More: What is a Lifetime Mortgage?

Home Reversion Plan

With a home reversion plan, you sell all or part of your property to a reversion company in exchange for a lump sum or regular payments.

This option lets you access funds without monthly repayments, but you give up a portion of your property's ownership.

You can continue living in your home rent-free until you pass away or move into long-term care.

Read On: What is a Home Reversion Plan?

Equity Release Calculator

An equity release calculator is an online tool that estimates how much cash you can release from your property based on the information you provide.

What is an Equity Release Calculator?

An equity release calculator is an online tool that determines the amount of cash you can access from your home by taking out a lifetime mortgage.

By entering a few details into the calculator, you will be presented with the estimated minimum and maximum amounts you could borrow.

If you have ever wondered, "How much is my house worth?" then this is the tool for you.

However, there is a difference between an equity release calculator versus a mortgage calculator, as equity release involves taking money out of the equity of your home, while a mortgage involves purchasing a new home.

It may also assist you with figuring out "How much do I pay back on equity release?" as it gives you the interest rate you may qualify for.

This is useful when planning how your estate will be handled after you pass away or move to long-term care.

Using Our Equity Release Calculator

Our free equity release calculator is straightforward and user-friendly; to get started, simply go to the calculator section at the top of our website.

Here, you'll first need to enter your age, which is a critical factor in determining how much equity you can potentially release from your home.

After filling in all the required fields, click the ‘Calculate’ button—the calculator will then process your information and quickly provide an estimate of the equity you could release.

How exactly are these estimates calculated?

Equity release estimates are calculated by multiplying your Loan To Value (LTV)2 percent by the value of your property.

Additionally, the age of the youngest homeowner determines the LTV percentage you qualify for.

For example, if the youngest homeowner is 55, you may qualify for an LTV of 55%, whereas at 75, the percentage could rise to 41%*.

*These figures are for reference purposes only.

How do deferment rates come in? Deferment rates are explained in a nutshell - they are a valuation tool used to determine the total value of your estate, as well as the amount of equity in it, in comparison to the value of your property when you move into permanent care or pass away.

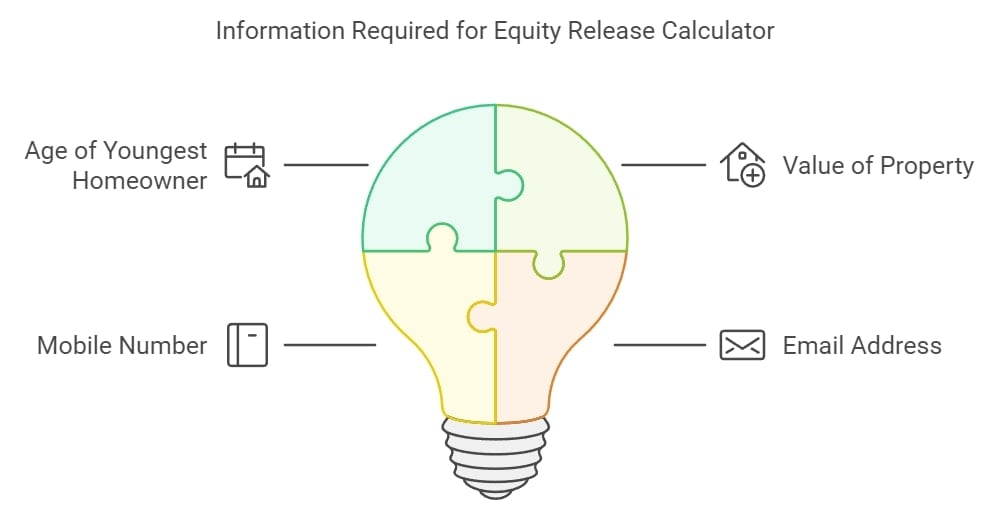

What Information Do You Need to Include?

You may wonder about our equity release calculator and the information you need to include, but don't fret - no personal information is required to get a valuable estimate.

To use the calculator, you will have to enter the following information:

- The age of the youngest homeowner

- The value of your property

- Your mobile number

- Your email address

What Are the Key Benefits of Using an Equity Release Calculator?

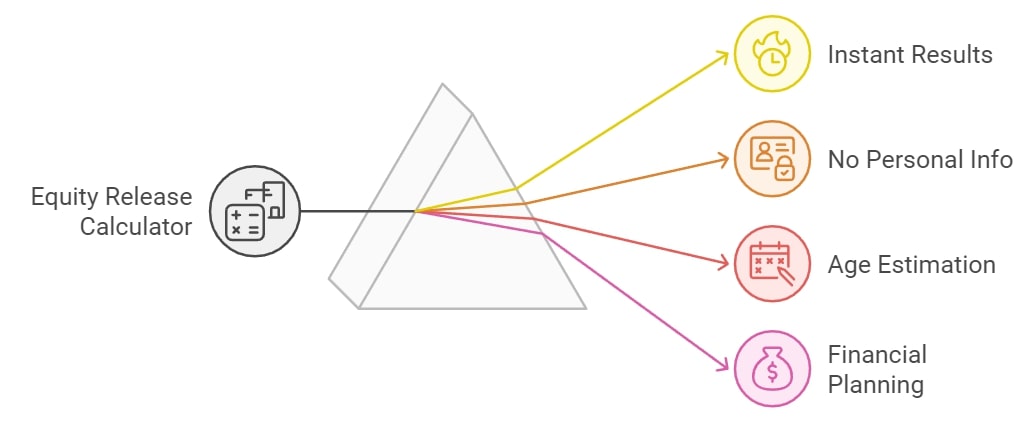

Using a calculator helps gauge potential loan amounts, offering a quick, no-obligation insight into equity release options and their feasibility.

What Are the Main Benefits of Using an Equity Release Calculator?

Using an equity release calculator provides key benefits, such as estimating available equity, planning financial outcomes, and aiding in informed decision-making about releasing home equity.

Consider these benefits:

- You do not need to pay to use an equity release calculator.

- You do not need to submit any personal information or documentation.

- You will get your results instantly.

- You can estimate how much you could release at different ages.

- You can determine whether equity release will provide you with the amount you hoped for before taking any official steps.

How Can an Equity Release Interest Rate Calculator Help in Making Financial Decisions?

An equity release interest rate calculator is instrumental in illustrating how the interest on your plan could accumulate over time, affecting the total amount you owe.

By inputting different rates, you can see potential future balances, helping you to choose a plan with an interest rate that aligns with your financial strategy and risk tolerance.

This insight is invaluable in planning for the long-term impact on your estate's value and your beneficiaries.

How Much Equity Can You Release?

The amount of equity you can release depends on your age, property value, and the specific terms of the equity release plan you choose.

These results are in no way meant to replace an official consultation with a qualified equity release adviser or broker, but they can help you begin to answer the question and move forward with your financial planning.

An adviser or broker would be in the best position to examine your circumstances and financial goals and recommend suitable equity release plans and providers.

What Factors Affect the Maximum Equity Release Amount in a Calculator?

Factors affecting the maximum equity release amount in a calculator include the homeowner's age, property value, and health, which influence the loan's size and terms.

Factors Affecting Your Calculation

Equity release calculators use a variety of inputs to assess your eligibility and the potential benefits you might receive, with the main factor being your age, as younger applicants typically access lower percentages of home equity compared to older homeowners.

Consider these factors:

- The age of the youngest homeowner

- Your health

- Lender fees

- The location of your home

- Whether you are taking a joint or a single equity release plan

- The type of property you own

The value and type of your property are also crucial; higher-valued properties in good condition may increase the amount you can release; additionally, your health status can influence calculations, with poorer health potentially leading to greater available funds under enhanced equity release schemes.

Each of these factors helps tailor the equity release solution that best fits your situation, ensuring that the estimate is as accurate as possible given your personal circumstances.

Typical Results Explained

When you input your details into an equity release calculator, the typical results might include the maximum lump sum available, the type of equity release products you qualify for, and an estimate of interest rates.

For example, a homeowner aged 70 with a property valued at £300,000 might find they can release up to 30% of their home’s value, equating to £90,000; this amount can be received as a lump sum or in smaller, regular amounts.

The results will also often explain the implications of your choice on interest accumulation and how it affects the equity remaining in your home, helping you plan financially and considering both your current needs and future implications for your estate and beneficiaries.

What Are the Financial Consequences of Equity Release?

Equity release can have multiple financial consequences, including the accumulation of interest, potential effects on inheritance, and impacts on eligibility for means-tested benefits.

Interest Rates and Repayment

Grasping the details of interest rates and repayment options is essential for managing the long-term costs associated with equity release plans like lifetime mortgages.

Typically, these plans feature a fixed interest rate from the start of the agreement; interest is compounded, which means it accrues on both the initial loan amount and any previously accumulated interest.

This compounding effect can significantly increase the debt over time, especially if the loan remains unpaid until the homeowner passes away or enters long-term care.

Repayment usually occurs through the sale of the property, and the growing debt can consume a significant portion of the property’s value if not carefully managed.

Exploring Inheritance and Benefits Eligibility

Equity release can also influence your inheritance plans and means-tested benefits eligibility.

The total amount borrowed plus accrued interest is often repaid by selling the property when the homeowner dies or moves into care, potentially reducing the estate's value left to heirs.

Additionally, the cash received from releasing equity may alter your financial standing, affecting your qualification for benefits like pension credit, income support, or council tax support.

It is advisable to seek financial advice to fully understand how equity release might affect their personal finances and to develop strategies to lessen these impacts, ensuring informed decision-making throughout the process.

What Should You Know About Navigating Equity Release Options?

When navigating equity release options, understanding practical examples by age, seeking expert financial guidance, and utilising advanced calculator features are essential for informed decision-making.

Practical Examples of Equity Release Amounts by Age

Understanding how much equity you can release from your home at different stages of life can help you plan your finances more effectively, and here, we illustrate how potential release amounts can vary significantly with age using a property valued at £250,000 as a consistent example.

For a homeowner at age 55, the equity release might typically be up to 20% of the property’s value, amounting to £50,000—this could be suitable for covering large expenses such as home renovations or providing a financial cushion for early retirement plans.

As the homeowner ages, the percentage of available equity generally increases due to the reduced expected remaining lifetime.

By age 70, the release could rise to approximately 30%, offering £75,000, which might be directed towards funding retirement lifestyles or healthcare needs.

At age 85, the potential release could peak at around 45%, translating to £112,500, often used for more substantial costs like long-term care or financially assisting family members.

Each scenario presents a unique opportunity to leverage home equity to meet personal and family financial goals across different life stages.

Expert Financial Guidance

Understanding the intricacies of equity release necessitates expert financial guidance, which can yield personalised recommendations tailored to your financial situation and long-term objectives.

These professionals evaluate your current financial health, clarify different equity release products, and guide you through how these options might impact your estate and retirement planning.

Expert financial advice is vital to ensure compliance with legal standards, maximise available options, avoid expensive errors, and align your chosen plan with your future needs and family considerations.

Advanced Equity Release Calculator Features

Modern equity release calculators are often equipped with additional sophisticated features that provide a comprehensive view of potential equity release scenarios.

These calculators allow for customisable inputs such as age, property value, and property type, enabling precise adjustments to fit your specific circumstances.

They might also feature scenario analysis tools that can project the effects of changing interest rates or property values over time or estimate the future balance of the loan, factoring in different rates of compound interest and helping users understand the long-term financial implications of their equity release choices.

Navigating Legal and Regulatory Aspects of Equity Release

The Financial Conduct Authority (FCA), which strictly regulates equity release, makes sure that all transactions adhere to high legal standards for consumer protection.

This regulation requires that all equity release schemes, including lifetime mortgages and home reversion plans, maintain transparent communication and provide responsible financial advice.

Members of the Equity Release Council are also subject to a code of conduct that includes crucial safeguards like the no-negative-equity guarantee, which guarantees to protect borrowers by ensuring they never owe more than the value of their home, regardless of how property values fluctuate.

Before finalising any equity release plan, obtaining legal advice is compulsory to ensure all parties fully understand the terms and consequences of the agreement, reinforce consumer protections, and promote confidence in equity release as a secure method for accessing property equity.

Common Questions

How Accurate Is a Free Equity Release Calculator UK?

How Reliable Are Equity Release Calculators for Financial Planning in the UK?

Where Can I Find a Free Online Equity Release Calculator?

What Are the Limitations of Using an Equity Release Calculator Without Providing Personal Details?

Can Equity Release Calculators Estimate the Impact on Inheritance and Means-Tested Benefits?

What Are the Features of a Buy-to-Let Equity Release Calculator?

What is the Typical Interest Rate on Equity Release?

What Percentage Can You Get on Equity Release?

How Do Equity Release Calculators Estimate the Cost of Equity Release?

How Much Will I Pay Back According to an Equity Release Repayment Calculator?

In Conclusion

When looking into equity release, a good place to start is to find out how much tax-free cash you could get your hands on.

Your estimate will likely reveal whether the amount is what you expected and whether it is an option you would like to pursue.

If it is a viable option, you will want to analyse your personal circumstances and financial goals with an industry expert.

They will then be able to recommend the schemes and providers best suited to your needs.

Whilst an equity release calculator is a fabulous tool, it is not a replacement for the in-depth information and advice a qualified equity release advisor or broker can give you.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.