Equity Release Pros and Cons 2025: Is It Right for You?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

Key Takeaways...

- Equity release allows access to home equity as tax-free cash, yet may reduce the value of your estate and increase overall debt.

- For seniors, it can provide financial freedom in retirement, but it is crucial to evaluate its long-term impact on estate value and personal finances.

- It can supplement your retirement income, but it may affect eligibility for means-tested benefits and requires careful financial planning.

- The financial implications of equity release include a potential increase in debt, effects on your estate's value, and possible tax considerations.

- It carries risks like a decrease in property value, rising interest rates, and the potential for negative equity over time.

Considering the pros and cons of equity release is crucial for homeowners seeking to unlock their property's value.

In the quest for financial stability, more and more people are turning to equity release schemes with a record-breaking £6.2bln unlocked in 2022.1

As we investigate this powerful but intricate tool, we must discuss the promises it offers and the potential traps it hides.

In This Article, You Will Discover:

Our research team at SovereignBoss is dedicated to helping you understand everything there is to know about equity release to help you determine if it is right for you.

Therefore...

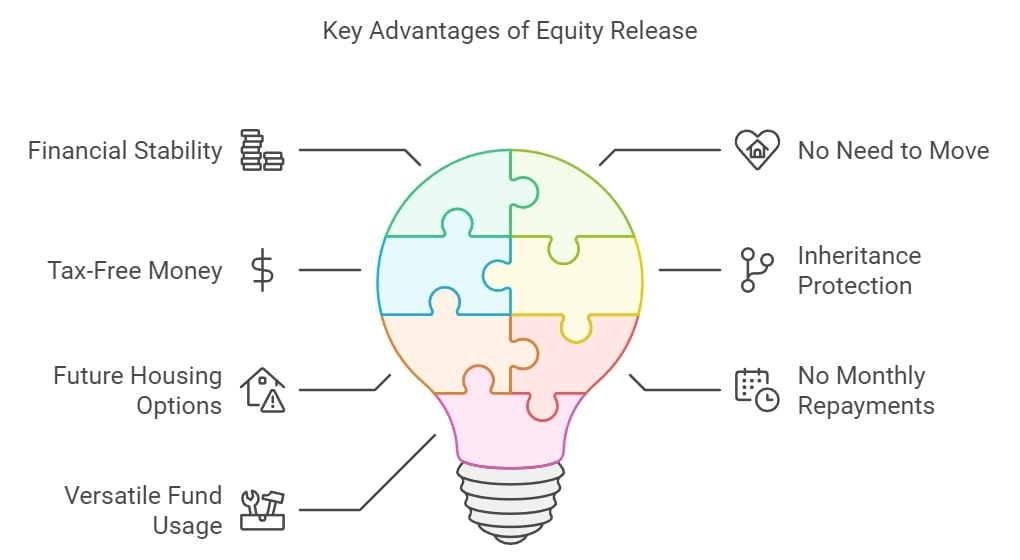

Advantages of Equity Release

The benefits of equity release include tax-free cash, the option to remain living on your property for life, inheritance protection, the option to move home, no monthly repayments, and access to money you can use in any way needed.

We have broken down each of these options.

Pro #1. Gaining Financial Stability through Access to Cash

With £12,800 annually2 being the minimum required for a single retiree to live comfortably in the UK, gaining financial stability through access to cash can change one’s life.

One of the biggest pros of equity release is the opportunity to tap into the wealth tied up in your property, whilst still living in it or retaining ownership.

Equity release can provide a significant boost to your retirement income if you are 55 or older, allowing you to maintain a comfortable standard of living or address unforeseen expenses.

Always...

Receive information from your financial advisor or broker to determine if equity release is the best solution for your needs.

Pro #2. Not Needing to Move

One of the key benefits of equity release is that you can withdraw your property value, but have security to live in it until you pass away or move to long-term care.

This is particularly beneficial if you are sentimentally attached to your home and do not wish to downsize or relocate to unlock its value.

Pro #3. Benefitting from Tax-Free Money

The cash you release from your home is tax-free, whether you opt for a lump sum or a drawdown facility.

Why?

This is because it is seen as a loan and not a form of regular income.

If you invest the money, there may be tax implications, so consider this with your every move and financial decision you make.

Pro #4. Providing Security via Inheritance Protection

Inheritance protection is designed for you to ring-fence some of the property value so it can not be used to pay off the loan or compound interest.

Instead this protected amount will be passed on to your beneficiaries or as stipulated in your will.

This feature is available with certain equity release plans, where you can protect a portion of your home's value as an inheritance.

Let your advisor or broker know if this is something you require.

Pro #5. Providing Future Housing Options

Equity release does not necessarily mean you can never move house, so if life changes, you could be supported.

Many schemes allow for 'portability,' meaning the equity release plan can be transferred to a new property (subject to provider approval).

Pro #6. Enjoying Flexibility with No Monthly Repayments

Equity release schemes have flexible payment options since there is no obligation to repay the loan or compounded interest until you pass away or move into long-term care.

In the past...

Some plans let you pay off a portion of the loan annually and sometimes the monthly interest.

As of March 20223, all new plans provided by Equity Release Council members must allow for voluntary monthly interest repayments and annual repayments of up to 10% of the loan (lender-dependent).

This allows for stress-free financial flexibility, with no need to worry about meeting monthly commitments.

Pro #7. The Versatility of Using Released Funds

The funds from equity release can be used in any way required to suit your lifestyle and needs, provided that it is legal.

This could include:

- Home improvements

- Supplementing retirement income

- Paying for care costs

- Going on a dream holiday

However, as with any financial decision, it is important to carefully consider the potential downsides and speak with a specialist financial advisor or broker.

The decision to release equity from your home should not be taken lightly.

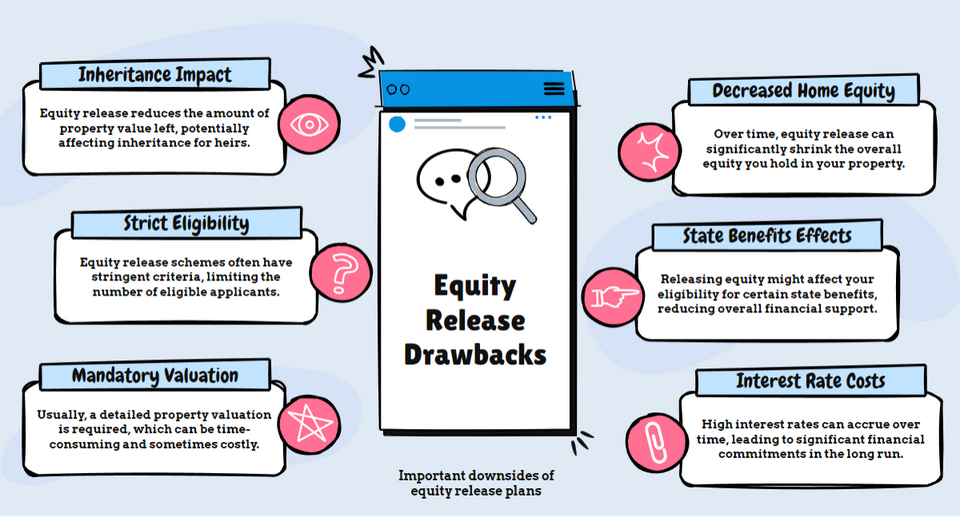

Equity Release Pitfalls

Like all financial products, equity release also has disadvantages, including reducing your inheritance, reduced equity, limited eligibility, an impact on your state benefits, the need for a property valuation, expensive interest rates, and the possibility of early repayment charges.

Here is a detailed breakdown of each...

Con #1. Affecting Legacy by Reducing Inheritance

While equity release can provide immediate financial relief, it will reduce the inheritance you leave to your estate.

With the average house price at £285,000 in March 2023,4 it is very possible that your house is your greatest asset.

Even with ringfencing a portion of your estate, your kids will not benefit from the full value.

Con #2. Reduced Equity

Equity release can have a long-term impact on your financial options as it reduces the equity in your property and diminishes the portion of your home that you fully own over time.

Therefore...

Ensure you are opting for equity release at the right time.

Con #3. Limited Eligibility Criteria

Not everyone can apply for an equity release scheme because it is only available for homeowners aged 55 and above.

Other equity release criteria include your property value, type, and location.

Eligibility criteria for different equity products vary amongst providers and as such it is imperative to run through your options with an equity release expert.

Con #4. Effects on State Benefits

Taking out an equity release will likely impact your entitlement to means-tested state benefits.

This can include benefits like Pension Credits or Housing Benefits.

You must always carefully assess the potential implications on your overall financial situation before opting for an equity release plan.

Con #5. Requirements for Property Valuation

You will be required to have a professional property valuation conducted by a surveyor to determine if you qualify for equity release.

Not all property types are eligible for equity release and in general, a minimum property value of £70,000 is required.

Con #6. Financial Implications of Interest Rates

Interest rates on equity release can be higher than traditional mortgages and are compounded if left unpaid.

Currently, equity release rates are between 5.97% to 6.28%*

* While we regularly review our rates, these may have changed due to changing market conditions since our last update.

If the equity release scheme runs for many years, the total debt can potentially exceed the value of your home, known as 'negative equity'.

Fortunately, the Equity Release Council’s no negative equity guarantee5 ensures that lenders are obligated to write off any negative equity incurred when the loan agreement is terminated, providing added protection for borrowers.

In other words, you and your estate will never owe more than what your property is sold for - provided it is sold for the best possible price.

Con #7. Early Repayment Charges

You may incur early repayment charges if you need to end the loan earlier than agreed.

Equity release schemes are designed to last for the rest of your life, but you never know what may happen in the future.

Early repayment charges generally taper off after some years, however, this varies among providers.

Common Questions

How Can Equity Release Affect My Retirement?

Is Equity Release a Good Idea for Seniors?

What Are the Pros and Cons of Equity Release?

Can I Lose My Home With Equity Release?

What Happens If I Pass Away After Taking Out Equity Release?

How Does Equity Release Work in the UK?

How Does Equity Release Compare to Selling My Property Outright?

How Does the Absence of Monthly Repayments in Equity Release Schemes Affect My Standard of Living?

Can Equity Release Offer More Financial Flexibility Compared to Other Borrowing Options?

Can Equity Release Limit My Options to Move to Another Property in the Future?

Will Equity Release Affect My Ability to Take Out Future Loans?

Are There Risks Involved in Equity Release?

What Are the Financial Implications of Equity Release?

In Conclusion

Equity release can be an effective way to unlock the value tied up in your home, providing a tax-free source of income that can significantly ease financial stress during retirement.

However, it is not a decision to be taken lightly, with the potential to impact your estate's value, affect eligibility for state benefits, and limit future borrowing options.

Professional financial advice is crucial to navigate these considerations and ensure this financial move aligns with your specific circumstances and long-term plans.

Ultimately, understanding the equity release pros and cons thoroughly is the key to making an informed decision that truly benefits your financial future, and answers the question "is equity release a good idea" when it comes to your specific circumstances and needs.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.