2026 Equity Release Statistics: Key Data Points

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

Key Takeaways...

- The latest trends in the equity release market in the UK show a growing popularity among those aged 65 and over, with a noticeable shift towards flexible products that cater to a wider range of financial needs.

- Equity release rates in the UK have historically seen a downward trend, making these financial products more attractive for older homeowners looking to supplement their income.

- The latest UK trends indicate a steady increase in the number of people aged 65 and over who are opting for these financial products to improve their retirement lifestyle.

- The latest statistics are having a significant impact on the market, with a higher demand for flexible products prompting providers to offer more competitive rates.

- The current average age, according to the latest statistics, is 72 years, reflecting the financial needs of an ageing population.

These equity release statistics will help you determine if lifetime mortgages and home reversion schemes are still something to consider in 2026.

With £4.8bln unlocked in 2021,1 and even more in 2022, will 2023 be another record-breaking year?

In This Article, You Will Discover:

Our SovereignBoss team makes it our mission to keep our finger on the pulse of the latest equity release news.

We are thrilled to present the Equity Release Council’s Q2 2023 equity release statistics.

Therefore:

Was 2022 a Record-Breaking Year for Equity Release?

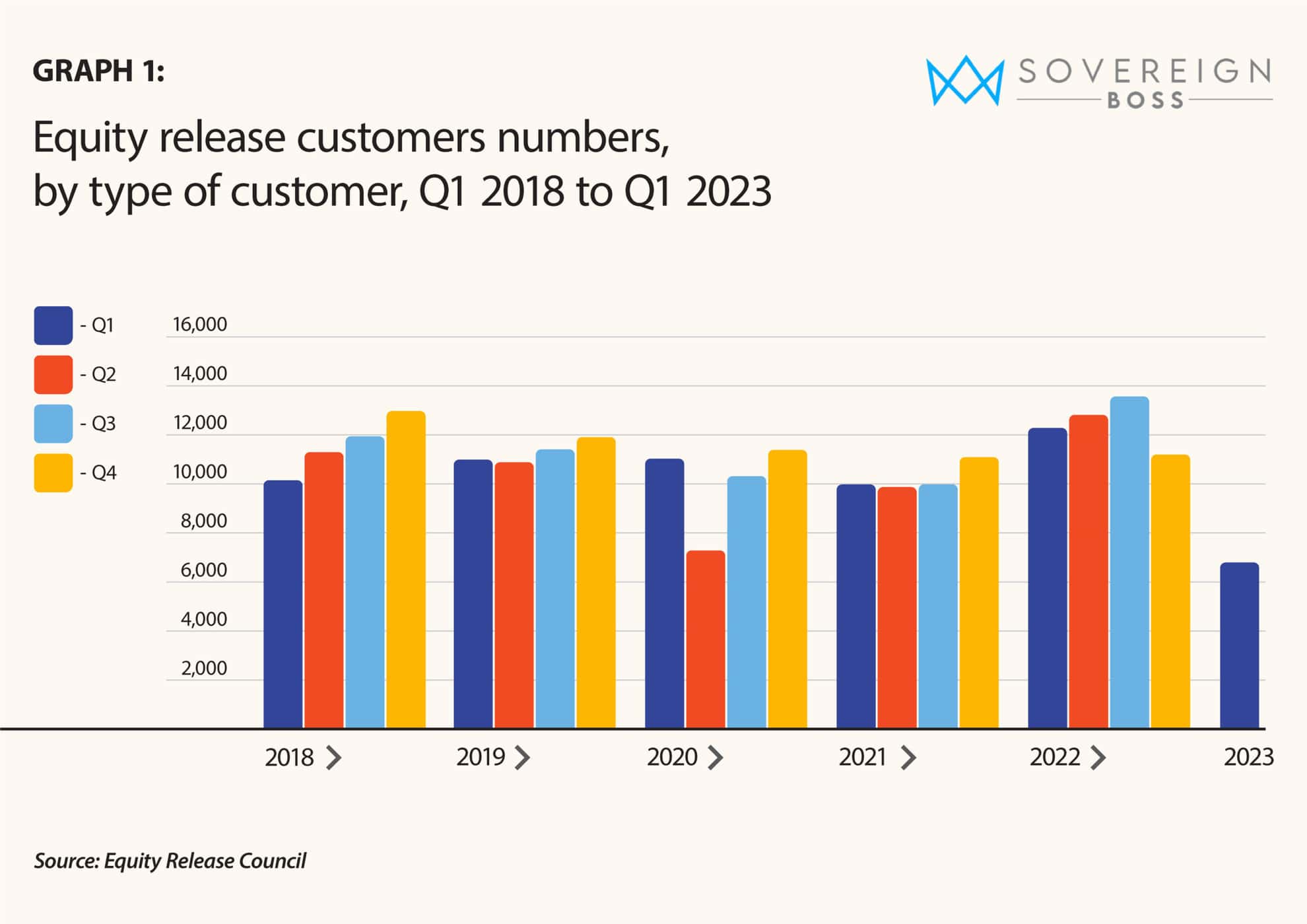

Yes, 2022 was a record-breaking year for the equity release industry, with a total of £6.2bln in equity unlocked by 93,421 new and returning customers.2

However:

There was an evident drop in customer activity after the mini-budget in September that prompted interest rates to rise.

Has this impacted 2023?

What Do the Q2 2023 Equity Release Statistics Reveal?

The Q2 2023 equity release statistics reveal a slight increase in activity towards the end of the quarter, which the Council describes as ‘cautious optimism’.3

The chair of the Equity Release Council, David Burrowes, has advised that the rise in interest rates has negatively impacted the popularity of both traditional and lifetime mortgages, but the gap between the two rates has narrowed.

Both innovation and socio-economic factors maintain demand for equity release.

How Many New Plans Were Unlocked in Q2 2023?

6,682 new equity release plans were unlocked in the second quarter of 2023.

Notably:

- This was 46% less than the same quarter in the previous year.

- A whopping 12,485 new plans were taken out in Q2 2022.

- This figure is 1% lower than Q1 2023.

How Much Property Wealth Was Unlocked in Q2 of 2023?

A total of £664mln in property wealth was unlocked by older homeowners across the UK in Q2 of 2023.

What this means:

- This was 5% lower than reviewed in the Q1 2023 statistics.

- It is the quietest quarter since £571mln was released in Q3 2016.

How Much Equity Has Been Unlocked in 2023 So Far?

Homeowners had unlocked £1,363bln in the first half of 2023, showing a significant overall drop from the 3.13bln in the 1st half of 2022.4

Did Q2 2023 Break Any Records for New Plans Agreed?

No, Q2 of 2023 did not break any records on the new plans agreed.

With a high-interest rate environment in the UK, mixed with the chance of a lower maximum LTV, customers have reduced their borrowing amount.

Which Month of Q2 2023 Was the Most Popular for Equity Release?

June 2023 was the best month for equity release in Q2 2023, indicating a hopeful increase in overall borrowing.

Total new customer numbers were:

- April: 2,004

- May: 2,117

- June: 2,462

This is vastly lower than the average of 200 new customers per day seen in Q2 of 2022.

Which Equity Release Plan Type Was the Most Popular in Q2 2023?

In Q2 of 2023, 52% of homeowners who chose equity release decided on a drawdown lifetime mortgage, with the remaining 48% opting for a lump sum.

Albeit by a small margin, the drawdown remains the most popular equity release type on the UK market.

How Many Further Advances Were Agreed in Q2 2023?

2,529 existing customers took further advances in Q2 of 2023.

Take note:

- This is 15% more than the previous quarter.

- There were 2,193 further advances in Q1 2023.

What Is the Average 1st Withdrawal for New Drawdown Customers?

The average 1st withdrawal of new drawdown customers in Q2 of 2023 was £59,294.

The facts:

- This is down from the £90,646 in Q2 2022.

- Making it 35% less than the average withdrawal in the previous year.

What Is the Average Amount of Equity Released for New Lump Sum Customers in the Quarter?

The average amount of equity released through a lump sum lifetime mortgage was £94.226 in the 2nd quarter of 2023.

Take note:

- This is a 29% year-on-year drop.

- It is the lowest number seen since Q2 of 2019, which was £93,712.

Has Industry Trajectory Been in Line With Predictions?

Whether the equity release industry trajectory has been in line with predictions is neither a 'yes' nor a 'no' answer.

Whilst the industry was booming, the mini-budget5 and increased interest rates have made a huge impact on the number of people opting for equity release and the amount homeowners are choosing to release.

Despite this, equity release is still active due to it providing a fair amount of flexibility and the chance to access cash in a difficult economic time.

What Is the Equity Release Council’s New Product Standard?

The newest Equity Release Council’s product standard indicates that all new equity release products must come with the option to make penalty-free loans and interest repayments.

This was announced by the Council in March 2022 as yet another way to make equity release a more flexible option for older homeowners.6

The amount allowed is determined by each specific lender.

How Was This Data Compiled?

This data was compiled by analysing statistics released quarterly by the Equity Release Council.

Common Questions

What Are the Latest Trends in the Equity Release Market?

What Are the Latest Equity Release Statistics in the UK?

How Are the Latest Equity Release Statistics Affecting the Market?

How Have Equity Release Rates Changed Over the Years?

What Is the Current Average Age for Equity Release According to Latest Statistics?

The 2025 equity release statistics paint a picture of challenge and resilience in the UK market.

Despite the increase in interest rates and general mortgage rates, equity release remains a viable option for many.

Whilst there has been a downturn in market trends, it has not deterred the industry altogether.

The impact of the wider economic situation on the UK financial industry has been substantial, yet the equity release sector continues to demonstrate adaptability.

It is a reminder that, in turbulent times, an informed approach is paramount.

As we move forward, keeping abreast of the latest equity release statistics will be vital for consumers and professionals alike, ensuring that decisions are made with a clear understanding of the complex financial landscape.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.