Interest Only Lifetime Mortgage: The Ultimate Guide in 2026

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

Key Takeaways...

- An interest only lifetime mortgage is a type of equity release scheme where you only pay the interest on the loan during your lifetime, and the loan's principal is repaid when your home is sold.

- You can repay by making regular monthly payments to cover the interest, and the loan amount is ultimately repaid from the sale of your property after your death or move into long-term care.

- The pros are predictable monthly payments and a constant loan balance, while the cons include mandatory interest payments and the possibility of not having a home to pass on to heirs.

- You can switch, but it depends on your lender's policies and your personal financial circumstances.

- The eligibility criteria typically includes being over the age of 55, owning a UK-based property of a certain value, and proving you can afford to make the monthly interest payments.

Is an interest-only lifetime mortgage still a financial tool in the UK that promises to provide a safety net in later life?

Find out what it entails and whether it is still relevant in 2026

We have all these questions answered right here.

In This Article, You Will Discover:

Our SovereignBoss team is constantly researching equity release to discover the latest information and compiling it in an easy-to-read format.

Here is a deep dive into the realm of this financial instrument, shedding light on its intricacies, implications, and potential benefits, and discover if it is still an option to consider in 2026.

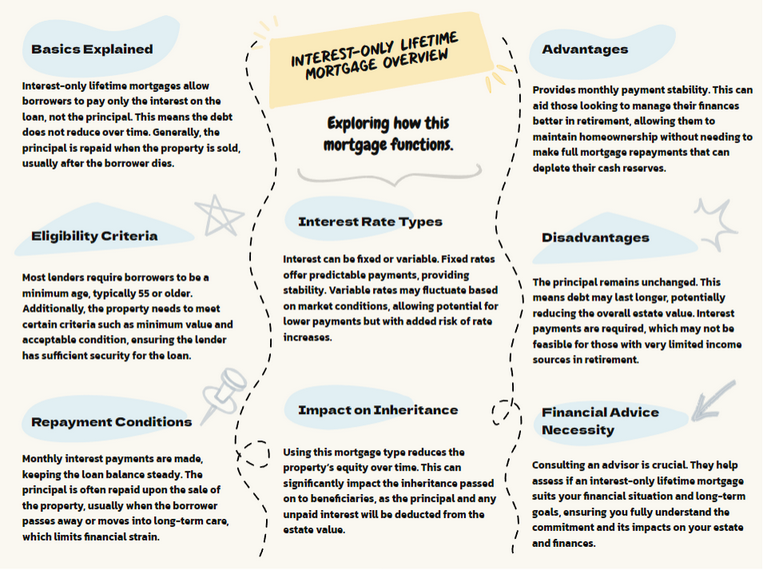

What Is an Interest-Only Lifetime Mortgage?

An interest-only lifetime mortgage was a specialised equity release scheme designed to provide homeowners aged 55 and above with a flexible way to access funds tied up in their property.

Unlike with other equity release products, homeowners are required to repay the monthly interest, meaning that you would not need to worry about it compounding.

How Does an Interest-Only Lifetime Mortgage Work?

An interest-only lifetime mortgage operates uniquely compared to traditional mortgages, where repayment is deferred until the last homeowner passes away or moves to long-term care.

Understanding Eligibility for Interest-Only Lifetime Mortgages

To qualify for an interest-only lifetime mortgage, homeowners must meet specific criteria:

- Age Requirement: Typically aged 55 or older.

- Property Value: Own a property meeting minimum valuation criteria.

- Mortgage Status: Either mortgage-free or with a low outstanding balance.

- Additional Considerations: Lenders also assess property type, location, and health/lifestyle factors to determine suitability.

Evolution in Equity Release Options

Note: The Equity Release Council's recent announcement allows for voluntary monthly interest repayments, changing the landscape of equity release planning.

Pros and Cons of Interest-Only Lifetime Mortgages

Pros:

- Enhanced Retirement Income: Provides additional funds to support retirement lifestyle and unexpected expenses.

- Retain Ownership and Residence: Allows homeowners to live in their homes indefinitely, maintaining comfort and familiarity.

- Flexible Use of Released Equity: Funds can be used for various purposes, from long-term care to personal aspirations.

- No Accumulating Interest: Monthly interest payments prevent interest from compounding.

Cons:

- Impact on Inheritance: Reduces the estate value available for beneficiaries.

- Limited Loan-to-Value (LTV) Ratios: Provides access to only a portion of property wealth.

- Long-Term Commitment: Designed to last until the homeowner's death or long-term care entry, with penalties for early termination.

- Means-Tested Benefits Impact: Potential effects on eligibility for benefits due to increased financial assets.

Reviewing Your Options

If you currently hold an interest-only lifetime mortgage, consider reviewing your plan to assess its suitability against newer, more flexible products.

Consultation and Expert Advice

Consult a qualified equity release advisor or broker to evaluate your current plan, financial circumstances, and available products. They can recommend options that better align with your goals and financial needs across the market.

Navigating the complexities of interest-only lifetime mortgages requires informed decision-making and expert guidance to secure your financial future effectively.

How Are Interest Rates Calculated on an Interest-Only Lifetime Mortgage?

Interest rates on interest-only lifetime mortgages are typically calculated based on the following factors:

- Fixed or variable rates

- Loan-to-value (LTV) ratio

- Market conditions

A closer look at each of these factors...

Fixed or Variable Rates

Lenders mostly offer fixed, but occasionally variable interest rate options for this type of plan.

Fixed rates remain consistent throughout the mortgage term, providing borrowers with predictable repayment amounts.

Variable rates, on the other hand, can fluctuate based on market conditions and may result in varying monthly interest charges.

Variable rates will always be capped with equity release.3

Loan-to-Value (LTV) Ratio

The loan-to-value ratio is determined by factors such as the borrower's age, property value, and health.

A lower LTV ratio, indicating a smaller loan amount concerning the property value, may result in more favourable interest rates.

Market Conditions

Interest rates will also be influenced by broader economic factors and prevailing market conditions.

Changes in the Bank of England's base rate4 or shifts in the mortgage market can impact the interest rates offered by lenders.

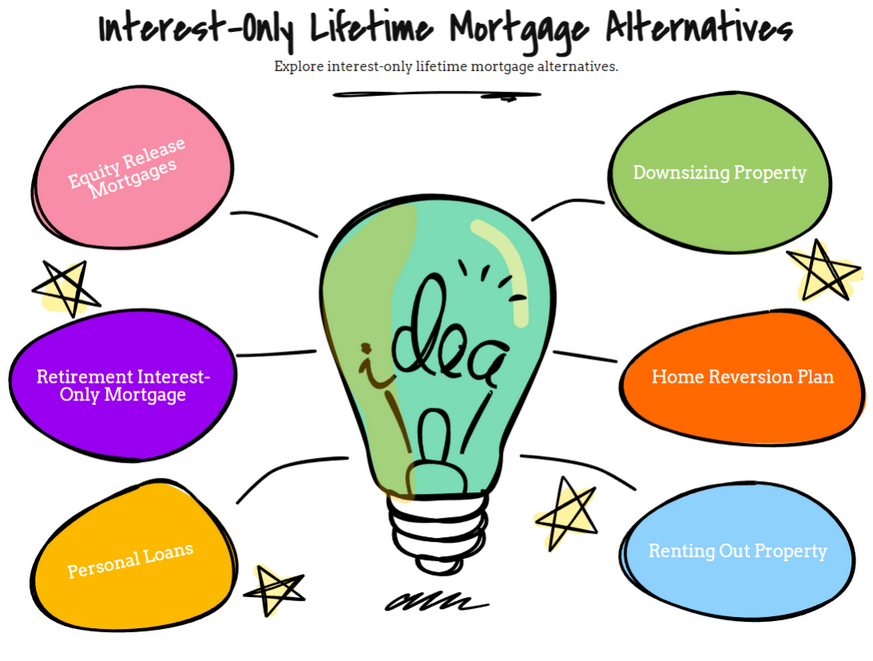

Are There Any Alternatives to an Interest-Only Lifetime Mortgage?

The alternatives to an interest-only lifetime mortgage include other equity release products, downsizing, a retirement interest-only (RIO) mortgage, or budgeting.

Since these mortgages are no longer relevant, you may wish to review your alternatives with a qualified equity financial advisor.

Common Questions

Who Offers Interest-Only Lifetime Mortgages?

Can I Repay an Interest-Only Lifetime Mortgage Early?

What Is an Interest Only Lifetime Mortgage?

How Can I Repay an Interest Only Lifetime Mortgage?

What Are the Pros and Cons of Interest Only Lifetime Mortgages?

Can I Switch from a Regular to an Interest Only Lifetime Mortgage?

What are the Eligibility Criteria for an Interest Only Lifetime Mortgage?

In Conclusion

Interest-only lifetime mortgages have offered a compelling solution for homeowners aged 55 and above to unlock the value of their property while maintaining financial flexibility.

However, as equity release becomes more flexible, lifetime mortgage products all offer the option of monthly repayments.

By carefully considering the benefits, risks, and alternatives, homeowners can make an informed decision about whether an interest-only lifetime mortgage still aligns with their long-term financial goals and aspirations.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.