Just Equity Release Review (2026): Full Analysis

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Just equity release has received varied feedback from customers, with most praising their professional service and clear communication.

- Based on reviews, it is considered reliable due to their high customer satisfaction rates and transparency in dealing with equity release.

- Pros include excellent customer service and competitive rates, while cons include limited product range and slow process times.

- The majority of reviews are positive, commending the company for their professionalism and helpfulness.

- Key points highlighted in reviews usually focus on the company's responsive customer service, clear explanations, and competitive rates.

Just equity release is not merely a brand name but a key player in the complex realm of equity release options.

For many homeowners, understanding this financial tool and it's providers is crucial, especially when planning for later-life financial needs.

In This Article, You Will Discover:

Our team of financial specialists has thoroughly explored the equity release market to offer insights into various providers and their offerings.

This article is intended to shed light on the specific features and attributes of Just equity release, providing homeowners with a clearer understanding of what to expect.

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Just equity release. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Just equity release.

Who Is Just Equity Release?

Just equity release, formerly known as Just Retirement, is a prominent UK-based financial services company specialising in retirement solutions.

With a solid foundation built on expertise and a commitment to helping individuals navigate the complexities of retirement financing, Just equity release has carved a niche for itself in the equity release sector.

History

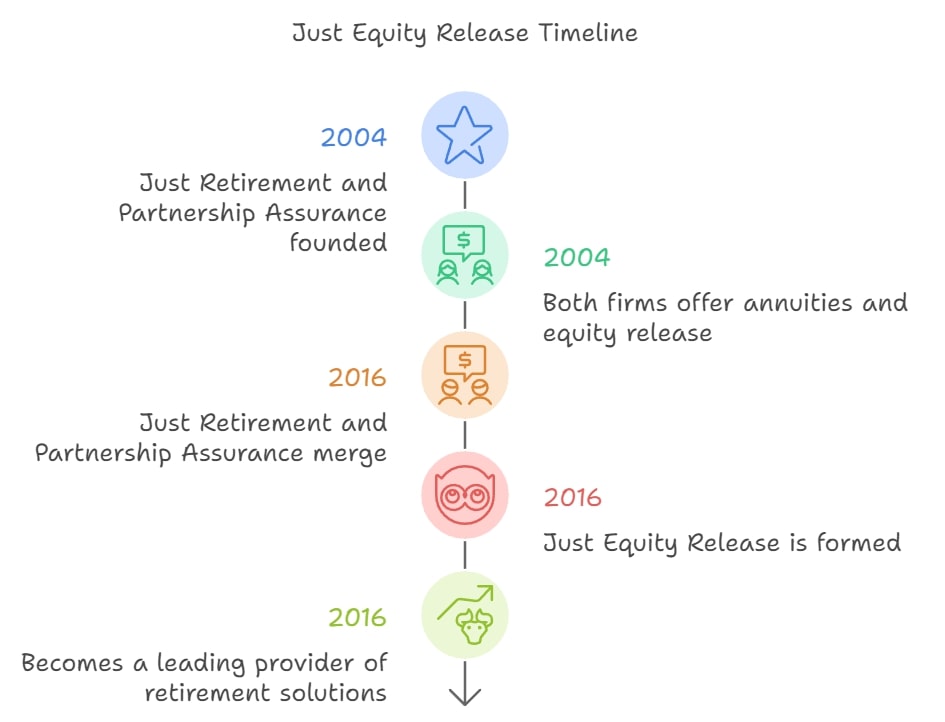

Just equity release was formed in 2016 by the merger of two specialist retirement income providers: Just Retirement and Partnership Assurance.1

Both firms operated since 2004, with strong reputations for offering annuities and equity release to customers with factors affecting life expectancy.

The merger created one of the UK’s leading providers of retirement solutions, with a focus on offering personalised and flexible products that meet the needs of customers in later life.

Current Standing

Just equity release is part of the Just Group plc, which is listed on the London Stock Exchange and is a constituent of the FTSE 250 index.

The company has helped customers release more than £6bln from their properties while managing approximately £23bln in retirement savings.2

Just equity release has won several awards for it's products and services, including the Best Equity Release Provider at the 2021 Moneyfacts Awards.3

It offers a range of retirement solutions, including annuities, drawdown, care plans, and lifetime mortgages.

It's lifetime mortgages cater to diverse customer needs, including borrowing more based on health and lifestyle, making monthly interest payments, or benefiting from a lower rate for energy-efficient properties.

Why Should You Consider Just Equity Release?

You should consider Just equity release for it's exceptional track record and tailor-made solutions.

It could be a good option for you if you are looking for:

- Personalised solutions that consider health and lifestyle factors, potentially increasing borrowing or securing better rates.

- Flexibility in loan amount, timing, and payment structure.

- Security through regulation by the Financial Conduct Authority (FCA)4 and adherence to Equity Release Council5 standards, including the no negative equity guarantee.

- A reputable choice backed by a retirement solutions provider with 15+ years of experience and award-winning service.

Consulting a professional equity release advisor is essential to assess if it is right for you and if Just equity release offers the ideal solutions for your needs and goals.

Does Just Equity Release Offer Equity Release or Lifetime Mortgages?

Yes, Just equity release offers equity release in the form of lifetime mortgages.

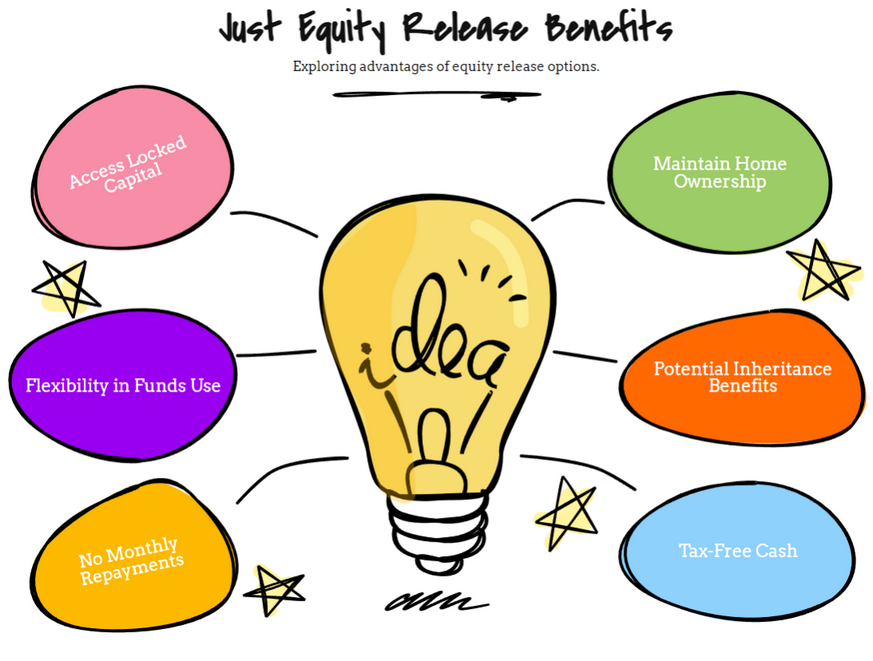

It's range of products is designed to help homeowners access the value tied up in their properties, providing them with financial flexibility and security in retirement.

Just Equity Release Schemes

Just equity release offers a type of equity release called Just For You Lifetime Mortgage.

This is a flexible and personalised product that allows you to borrow more or get a better interest rate based on your health and lifestyle factors.

Your plan can be tailored based on your personal circumstances giving you the option to choose how much you want to borrow, when you want to borrow it, and whether you want to make monthly interest payments or let the interest roll up.

The Just For You Lifetime Mortgage has the following features and benefits:6

- A fixed interest rate for life.

- A cash reserve facility that lets you withdraw money as and when you need it (subject to a minimum withdrawal amount of £2,000).

- The option to make monthly interest payments.

- The option to benefit from a lower interest rate if your property has an Energy Performance Certificate (EPC) rating of B or above.

- The option to make penalty-free repayments based on the terms of the plan

- The minimum age to apply for the Just For You Lifetime Mortgage is 55 and the minimum property value is £70,000. The maximum loan-to-value (LTV) ratio is 75%, which means you can borrow up to 75% of your property value depending on your age and health.

Your individual circumstances will determine the availability of certain features and as such it is important to consult a qualified advisor for guidance.

Just Equity Release Qualification Criteria

To qualify for Just equity release, you must meet the following criteria:

- You are aged 55 or over (if you are applying with someone else, the youngest applicant must be at least 55).

- You own a property in the UK that is your main residence.

- Your property is worth at least £70,000 and is in good condition.

- Your property is of standard construction and meets the lender’s criteria.

- You have little or no mortgage left on your property (if you have an existing mortgage, you must use some or all of the equity release funds to pay it off).

In addition, if you are applying for the enhanced lifetime mortgage, you must also meet the following criteria:

- You do not have health and lifestyle factors that could affect your life expectancy, such as smoking, high blood pressure, diabetes, or a history of certain medical conditions.

- You are willing to answer some questions about your health and lifestyle as part of the application process.

Does Just Equity Release Provide an Equity Release Calculator?

Yes, Just equity release provides an indicative lifetime mortgage calculator on it's website.

The calculator will provide you with an indication of the total amount you could release from your property based on your age, property value, and health and lifestyle factors.

For an independent approximation, why not try our easy-to-use equity release calculator here.

To get a more accurate and personalised quote, you will need to speak to an independent financial adviser who can assess your eligibility and suitability for Just equity release.

What Are Just Equity Release's Equity Release Interest Rates?

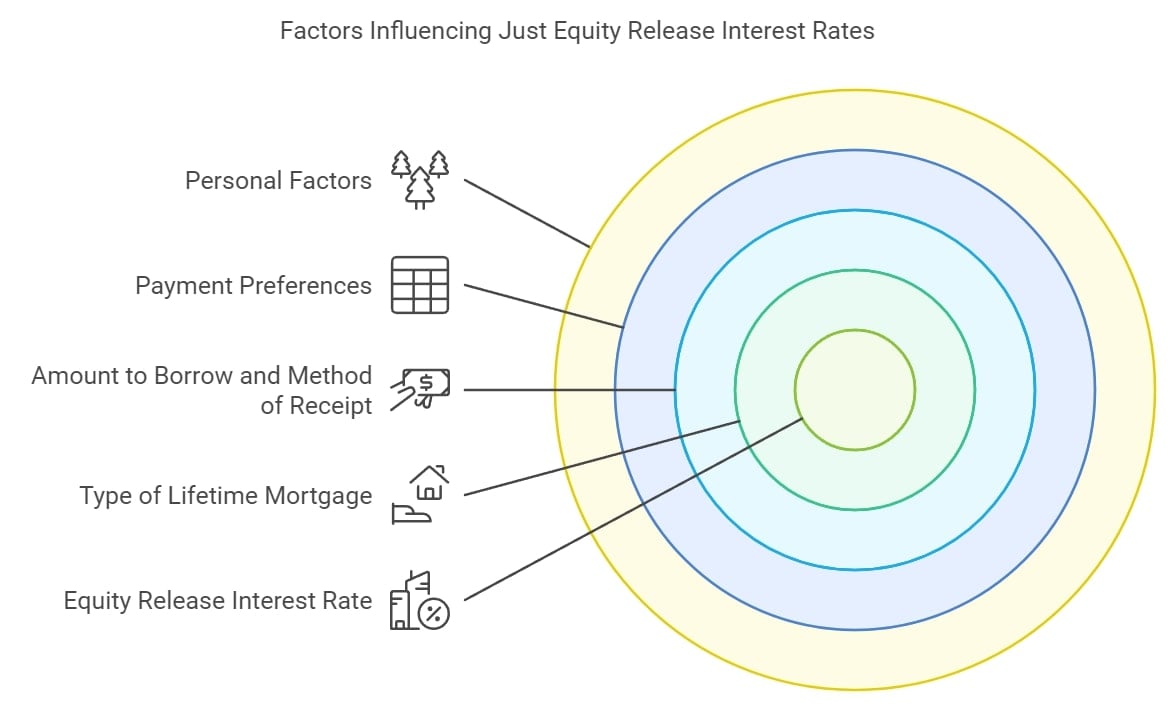

Just equity release’s equity release interest rates are fixed for life, which means they will not change during the term of the loan.

The interest rate you will get depends on several factors, such as:

- The type of lifetime mortgage you choose (standard or enhanced).

- The amount you want to borrow and how you want to receive it (lump sum or drawdown).

- Whether you want to make monthly interest payments or let the interest roll-up.

- Whether you want to receive a cashback amount or not.

- Whether your property has an EPC rating of B or above or not.

- Your age, health, and lifestyle factors.

Current equity release interest rates range between 5.97% to 6.28% AER.*

View the most current rates here.

To find out the exact interest rate you will get from Just equity release, you will need to obtain a personalised quote from an independent financial adviser who can compare different products and providers for you.

* While we regularly review our rates, these may have changed since our last update.

What Are Just Equity Release's Fees?

There may be fees associated with setting up a Just lifetime mortgage.

These could include:

- An application fee

- A valuation fee

- A completion fee

- An early repayment charge, which applies if you repay all or part of the loan before the end of the term.

The total cost of Just equity release's equity release will depend on your personal circumstances and the product you choose.

You should always compare different providers and products and get a personalised illustration before making a decision.

What Are the Pros and Cons of Just Equity Release?

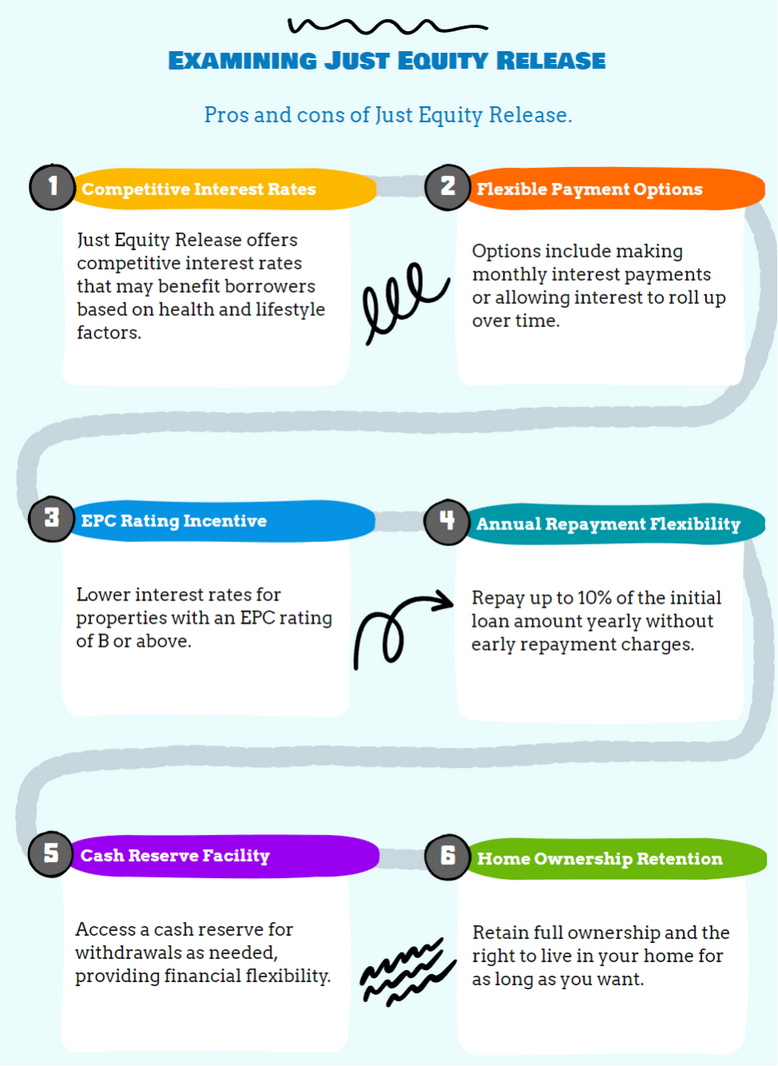

Just equity release is a notable player in the equity release arena and it brings with it several advantages like competitive interest rates and flexible payment options.

However, as with all providers, there are inherent challenges, such as specific eligibility criteria and potential early repayment charges.

A closer look at the pros and cons of Just Equity Release's equity release:

Advantages

Some of the advantages of Just equity release's equity release are:

- You can borrow more or get a better interest rate based on your health and lifestyle factors

- You can choose whether you want to make monthly interest payments or let the interest roll-up

- You can benefit from a lower interest rate if your property has an EPC rating of B or above

- You can repay up to 10% of the initial loan amount each year without any early repayment charges

- You can access a cash reserve facility that lets you withdraw money as and when you need it

- You can retain full ownership of your home and continue to live in it for as long as you wish

- You can benefit from the no negative equity guarantee, which means you will never owe more than the value of your home

Disadvantages

Some of the disadvantages of Just equity release's equity release are:

- You will reduce the amount of inheritance you leave to your family

- You may affect your tax situation

- You could impact your eligibility for state benefits

- You may have to pay higher interest rates than other types of borrowing

- You may have to pay some fees for setting up and maintaining the plan

- You may have to pay an early repayment charge if you repay all or part of the loan before the end of the term (except in certain circumstances)

- You may have to follow some rules and restrictions regarding your property and it's maintenance

What Do Just Equity Release’s Customers Have to Say About It?

Just equity release has received mostly positive feedback from it's customers, who have praised it's products, services, and staff.

Have a look at Just equity release’s latest reviews on Trustpilot.

How to Log a Complaint

If you have a complaint about Just equity release or its equity release products or services, you can contact them in the following ways:

- By phone: You can call them on 01737 233 297 from Monday to Friday, 8:30am to 5:30pm

- By email: You can email them at customerservices@wearejust.co.uk

- By post: You can write to them at Just, Vale House, Roebuck Close, Bancroft Road, Reigate, Surrey, RH2 7RU

Just equity release will try to resolve your complaint as quickly and fairly as possible.

They will acknowledge your complaint within five working days and aim to provide you with a final response within eight weeks.

If you are not satisfied with Just equity release’s response or if they do not resolve your complaint within eight weeks, you can refer your complaint to the Financial Ombudsman Service (FOS).7

How Did We Review the Information on Just Equity Release?

We conducted our review on Just equity release by aggregating information from several sources.

We delved into Just equity release's official website for insights on products, fees, and customer testimonials.

Our research was further enriched by examining customer reviews and information on any accolades or recognition Just equity release has received.

Our team's deep expertise in equity release further bolstered our comprehensive and unbiased analysis.

This is an unaffiliated, independent review of Just equity release.

FCA Details

Trading Names

- Just

- Just Equity Release Limited

- Just Retirement Solutions Limited

FCA Permitted Services

To see an updated list of permitted services you can consult the FCA register.

Regulators

Just equity release is regulated by the following regulators:

- The Financial Conduct Authority (FCA)8

- The Prudential Regulation Authority (PRA)9

- The Equity Release Council (ERC)10

Registration Numbers

- FCA registration number: 232595

- Companies House registration number: 05135289

FCA and Companies House Link

- FCA Link: FCA Link

- Companies House Link: Companies House Link

How to Contact Just Equity Release

If you want to contact Just equity release for any reason, you can do so in the following ways:

- You can call them on 01737 233 288

- You can email them at equity.release@wearejust.co.uk

- You can write to them at Just Equity Release, Vale House, Roebuck Close, Bancroft Road, Reigate, Surrey, RH2 7RU

- You can fill in an online form on their website and they will get back to you as soon as possible

You can also visit their website for more information and guidance on equity release and their products.

Common Questions

Is Just Equity Release a Member of the Equity Release Council?

How Reliable Is Just Equity Release Based on Reviews?

Who Owns Just Equity Release?

How Can I Calculate the Potential Equity Release Amount With Just Equity Release?

What Factors Should I Consider Before Choosing Just Equity Release?

Is Just Equity Release Authorised and Regulated by the Financial Conduct Authority (FCA)?

How Does Just Equity Release Ensure the Security and Privacy of My Personal Information?

Can I Switch From an Existing Equity Release Provider to Just Equity Release?

Can I Release Equity From My Property With Just Equity Release if I Have an Existing Mortgage?

How Long Does the Equity Release Process With Just Equity Release Typically Take?

What Do Customers Say About Just Equity Release?

What Are the Pros and Cons Mentioned in Just Equity Release Reviews?

Are the Just Equity Release Reviews Positive or Negative?

What Are the Key Points Highlighted in Just Equity Release Reviews?

In Conclusion

In the ever-evolving realm of equity release, Just equity release stands out as a notable option for homeowners.

It is crucial to navigate this financial avenue with a thorough understanding and, ideally, expert guidance to prioritise your needs and financial health, and ensure any decision aligns with your long-term goals.

Whether you are new to equity release or considering a switch, Just equity release offers a blend of product features worth your consideration.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.