Key Equity Release Review (2026): Top Tips and Insights

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Key equity release offers benefits like tax-free cash and a no-negative equity guarantee, though it may reduce inheritance and affect state benefits.

- It is regulated by the FCA and a member of the Equity Release Council, ensuring a safe and reliable option.

- Key equity release is known for its excellent customer service, competitive rates, and clear cost structures, though additional fees like legal and advice costs may apply.

If you’re exploring equity release options in 2026, Key equity release is a name that stands out.

As the Financial Reporter’s Best Later Life Broker of 2022, Key has earned its reputation as a trusted provider in the industry1. But does it truly meet the needs of your retirement finances?

At SovereignBoss, we’re dedicated to bringing you the latest, most accurate insights, and our expert team continuously updates content to ensure you have the most relevant information to make an informed decision.

Here’s what we’ve uncovered about Key and whether it could be the right fit for your financial future...

In This Article, You Will Discover:

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Key Later Life Finance. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Key Later Life Finance.

What is Equity Release?

Equity release, a financial solution offered by Key, allows homeowners to access the equity tied up in their property without selling it.

It's a way to tap into the value of your home, typically providing funds through either a lifetime mortgage or a home reversion plan.

This route can be particularly appealing for those looking to supplement their retirement income, fund home improvements, or manage debt, illustrating the flexibility and many potential uses of equity release.

Who is Key?

Key is a UK-based financial services company renowned for its expertise in advising on equity release, later-life mortgages, wills, and lasting powers of attorney, making the concept of equity release more accessible and understandable to older homeowners and retirees.

Why Should You Consider Key Later Life Finance for Equity Release?

Consider Key Later Life Finance for equity release because of its strong reputation for customer service, competitive interest rates, and flexible, tailored plans.

Here are some more reasons to consider:

- Key has over 20 years of experience offering later-life advice and tailored financial products.2

- It promises personalised and honest advice on later-life products.

- Key is a member of the Equity Release Council and is regulated by the Financial Conduct Authority.3

- It has been voted for and won over 80 industry awards over its years of service.

Understanding the Rebranding of Key Equity Release and Lifetime Mortgages

Key Equity Release has recently undergone a significant rebranding, shifting its focus to Key Later Life Finance and highlighting their expanding commitment to offering a wider range of lifetime mortgage solutions and equity release products.

By broadening its service offerings, Key aims to provide even more flexible, transparent, and customer-centric options for those looking to release equity from their homes, along with the new tagline: ‘For the life in later life.’

Will Hale, Chief Executive, spoke on the organisation’s new approach: “Our brand now better reflects the vibrant, diverse, and exciting market we operate in and the range of services we offer.”4

Equity Release Offerings of Key Later Life Finance

Key Later Life Finance offers a range of flexible equity release products, with offerings including lifetime mortgages and other retirement mortgage options.

Additionally, Key Later Life Finance offers advice on its equity release products and retirement mortgage products.

Your equity release options include:

- Lifetime mortgages, including the option of voluntary repayments whenever you have the means; however, monthly payments are not compulsory.

Additional retirement mortgage options include:

- Retirement interest-only mortgages: RIOs require monthly repayments. You can risk foreclosure if you fail to meet these repayments.

- Retirement repayment mortgages: including higher age limits than most mortgages, available to borrowers aged 50+.5

An Overview of Key Later Life Finance Equity Release Schemes

Key Later Life Finance Equity Release Schemes are available as a drawdown or lump sum lifetime mortgage, with personalised features to custom-build your plan to suit your needs.

You can also expect safeguards, including a no negative equity guarantee and downsizing protection after 5 years of signing onto your plan.

These are some factors to consider:

Qualification Criteria

The qualification criteria for Key equity release include the youngest homeowner being 55+, having single or joint ownership, and your property being valued at a minimum of £70,000.

What Are the Costs?

The costs include advice fees and interest, which can either be paid monthly or left to compound.

Fees

Key Later Life Finance has arrangement fees, in addition to an advice fee of £899 which is only due upon completion.

Other fees you can expect to pay include:

- A property valuation

- Solicitors fees

- Arrangement fees

Rates

Key’s lifetime mortgages will typically charge compound interest based on the bank rate.6

A lifetime mortgage's prevailing average interest rate is approximately 5.97% to 6.28%*.

Nevertheless, rates can begin at 5.97% to 6.28%* (AER).

*Please note that these interest rates are subject to periodic updates, and there may have been changes since our previous check.

Does Key Provide an Equity Release Calculator?

Yes, Key does provide an equity release calculator to estimate how much you can access from one of its products.7

Alternatively, you can also use our calculator to estimate how much you could potentially unlock across the regulated market.

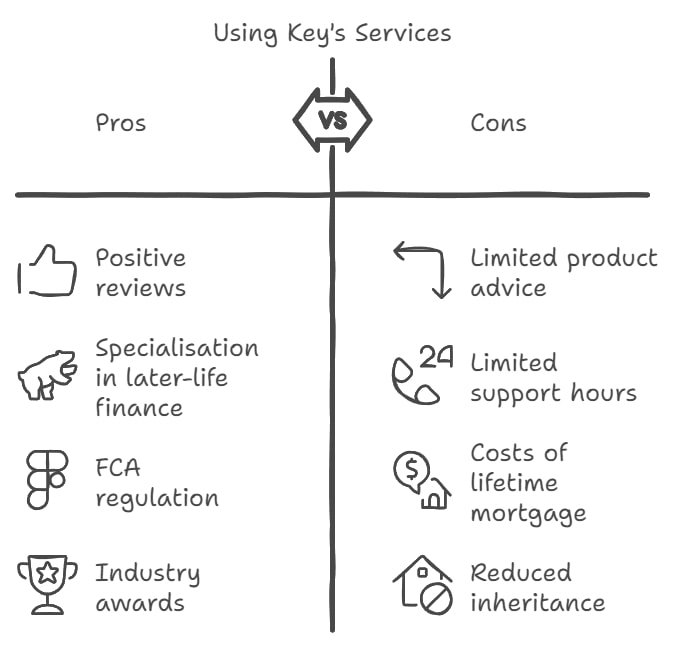

What Are the Pros and Cons?

The pros and cons of Key include that it offers award-winning advice, but it only advises on its own products rather than the broader market.

Here's a more detailed breakdown:

Pros

The pros of Key equity release include the fact that Key is an authorised and regulated company, and specialises specifically in retirement finances.

These are the pros:

- Key has numerous positive customer reviews.

- The company specialises specifically in later-life finance.

- It is authorised and regulated in the UK by the FCA8 and ERC.

- It is recognised as a leading expert, having won multiple industry awards.

Cons

The cons of Key Key equity release include the costs involved, as well as a reduction in inheritance.

These are the cons:

- If you use Key’s advice, you will only be advised on the products Key offers, not the wider regulated industry.

- It does not offer 24/7 support like some lenders. Instead, the firm opens Monday to Thursday, 9 am to 8 pm, Friday until 5:30 pm, Saturday until 5 pm, and is closed on Sunday.

- There are costs involved with opting for a lifetime mortgage.

- Using a lifetime mortgage will reduce the inheritance you leave to your heirs.

Customer Testimonials and Feedback

Customer testimonials and feedback on Key Later Life Finance are extremely positive, with 93% of Trustpilot customers rating the company as excellent.

Let's take a closer look:

Reviews

Of over 17,000 reviews on Trustpilot, 99% of customers provide a rating higher than three stars.

A recent 5-star review states:

“Excellent advice given throughout on the pros and cons of ER. All the various types of mortgages available for ER were explained, with the decision left entirely to me, I was not led or pushed to any type in particular but guided impartially.

I would recommend Key without any hesitation.”

Take a look at Key’s Trustpilot reviews.

Other reviews can be found here:

- Reviews of Key Group on Glassdoor.com

- Key Reviewed on UK.Indeed.com

Complaints

Of the few customer complaints on Trustpilot, Key has responded quickly where necessary and is open to hearing feedback and resolving queries.

How Did We Review Key?

We reviewed Key based on their innovation and technology,

These are the factors we used for the review process:

- Reputation and History – How many years they have been in business, customer reviews, and industry rewards received.

- Financial Strength – Ensuring it is going strong and has adequate funds to meet long-term commitments.

- Product Range – We favour companies offering a variety of equity release schemes with greater product flexibility.

- Interest Rates and Fees – We review competitive rates compared to industry averages and they must be fully transparent about rates and fees without hidden costs.

- Customer Service and Support – When and how it is available, response times, and available online educational resources. As well as online tools, like a calculator.

- Code of Conduct and Compliance – We only consider companies that adhere to recognised industry standards and codes.

- Industry Insights and Peer Reviews – We care about a company’s industry-wide reputation.

- Innovation and Technology – Is there a streamlined, digital application process?

- Client Testimonials – Success stories and the complaints resolution process.

Regulatory Details and Compliance

As previously mentioned, Key is fully regulated and compliant according to the ERC and FCA.

Here are all the details:

Trading Names

Previous and current trading names include:

- Key Retirement Solutions Limited

- Key Later Life Finance

- Standard Life Equity Release

- Mortgage Advice Bureau Later Life

- MAB Later Life

- MAB LL

- Key Partnerships

- The Equity Release Experts

- Key

- Key Equity Release

- Key Retirement

- Key Retirement Solutions Annuity Service

- Key Retirement Solutions Limited

FCA Permitted Services

The FCA permits these services:

- Consumer Credit

- Mortgage and Home Finance

Regulators

It is authorised and regulated in the UK by:

- Financial Conduct Authority (FCA)

Registration Numbers

Key’s registration numbers are:

- FCA Ref Number: 224987

- Companies House Number: 2457440

FCA and Companies House Link

Here are the FCA Link and Companies House links for viewing.

Contact Details

If you would like to contact Key, you can do so through one of the following means:

- Call: +44 800 2943 144

- Physical Address: Baines House, 4 Midgery Court, Fulwood, Preston PR2 9ZH, United Kingdom.

- Email: info@keyadvice.co.uk

Common Questions

What Are the Early Repayment Charges Offered with Key Equity Release?

Is Key Later Life Finance a Member of the Equity Release Council (ERC)?

How Trustworthy is Key Equity Release?

How Can I Work at Key?

How Does Key Equity Release Compare to Other Companies?

What Types of Properties Are Eligible for Equity Release With Key?

How Long Does Key’s Equity Release Process Take?

Does It Offer Any Additional Financial Planning or Guidance Services?

Can I Make Repayments on My Key Plan to Reduce the Overall Cost?

What Are the Pros and Cons of Key Equity Release?

What Are Customers Saying in Key Equity Release Reviews?

Are There Any Hidden Costs in Key Equity Release?

In Conclusion

Key Later Life Finance has firmly established itself as a leading provider in the UK’s equity release market, known for its customer-first approach and commitment to high industry standards.

As a member of the Equity Release Council and regulated by the FCA, Key offers reliable, secure, and flexible solutions for homeowners in later life; whether you’re seeking to release cash for retirement, home improvements, or other financial needs, Key’s tailored lifetime mortgage options provide peace of mind.

If you’re asking who is the best for equity release in your situation, Key Later Life Finance is definitely worth considering—explore your options today to secure a brighter, financially flexible future!

Additional Reading:

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.