Legal and General Equity Release Review (2026): What You Need to Know

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Legal & General, with years in the game and known for their seasoned know-how, solid rates, no-negative equity guarantee, and adaptable plans, is a go-to for homeowners over 65 diving into equity release.

- Their rates, sitting within 5.97% to 6.28%*, stack up well against the competition, tailored to your situation and your home's worth.

- Positive customer feedback shines a light on their pro service, clear dealings, variety of plans, and top-notch support.

Legal & General equity release is a popular choice among UK retirees looking to unlock the value of their homes; in 2022 alone, over £6.29 billion was released from home equity, helping seniors achieve their financial goals.1

Will you be part of the 2026 Legal & General success stories?

At SovereignBoss, our expert research team has thoroughly reviewed the latest equity release options and compiled everything you need to know in one easy-to-use guide.

Dive in and discover if Legal & General is right for your retirement plans...

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Legal & General. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Legal & General.

Who Is Legal & General, and What Equity Release Options Do They Offer?

Legal & General is a financial services giant in the UK known for its extensive range of products, offering equity release options that include lifetime mortgages, pension plans, annuities, life insurance, and investment management.

Let's have a look:

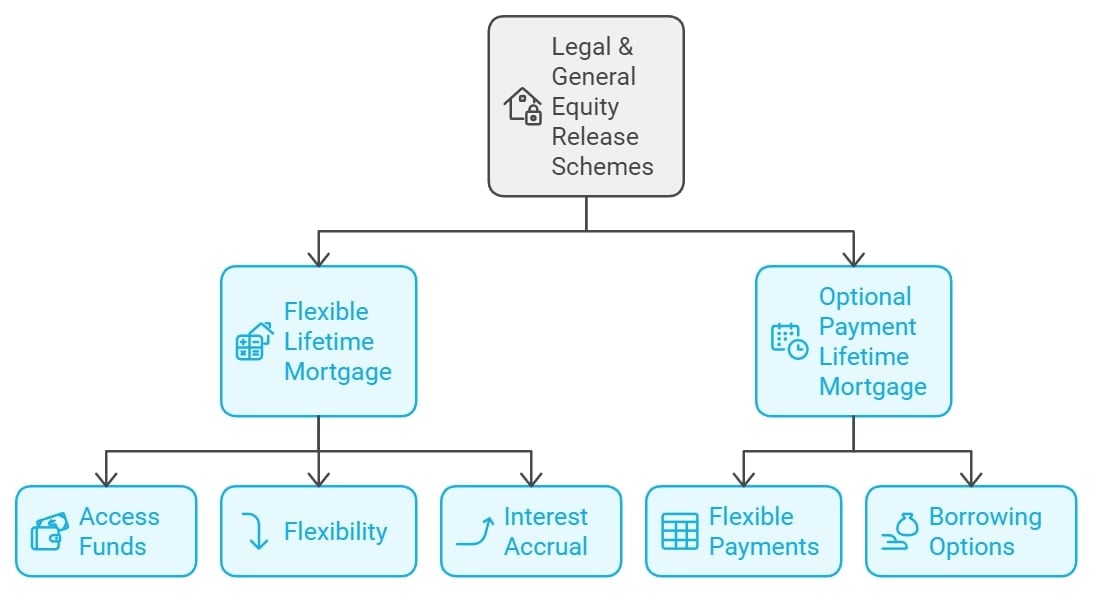

Overview of Legal & General’s Equity Release Schemes

Legal & General offers a range of equity release schemes with products that are designed to suit various financial needs, providing access to home equity while ensuring protections such as the no negative equity guarantee.

Accrued interest is calculated on the principal loan plus any unpaid interest.

Legal & General offers 2 main types of equity release schemes: the Flexible Lifetime Mortgage and the Optional Payment Lifetime Mortgage.

Let's take a look at these options:

Flexible Lifetime Mortgage

Legal & General’s Flexible Lifetime Mortgage offers flexibility with drawdown options and fixed interest rates, making it adaptable to changing financial needs.

Here's a breakdown of the plan:

- Accessing Funds: Borrow a tax-free amount against the value of your home without needing to make any repayments during your lifetime.

- Flexibility: Choose to receive the money as a lump sum or in smaller amounts as needed.

- Interest Accrual: Be aware that interest accrues over time, causing the amount you owe to increase rapidly.

Optional Payment Lifetime Mortgage

Legal & General’s Optional Payment Lifetime Mortgage allows homeowners to access equity while offering the flexibility to make monthly interest payments, typically reducing the total amount owed.

Here's an overview of this plan:

- Flexible Payments: Option to make monthly interest payments to manage your loan balance.

- Borrowing Options: Similar flexibility in accessing your funds.

Features of Legal & General's Optional Payment Lifetime Mortgage

The Optional Payment Lifetime Mortgage offers features that enable you to borrow a tax-free amount of money against the value of your home as one lump sum or smaller amounts over some time.

It works in much the same way as the Flexible Lifetime Mortgage, with the difference of allowing you to make monthly interest repayments which will reduce the final amount owed.

How Can Homeowners Benefit From Legal & General's Equity Release and Lifetime Mortgage Options?

Homeowners can benefit from Legal & General's equity release and lifetime mortgage options by accessing tax-free cash from their property's value while retaining homeownership.

These products offer flexibility, such as making interest payments or drawing down funds as needed, helping to manage costs and tailor the plan to individual financial needs.

Further benefits include the ability to supplement retirement income, fund home improvements, or provide financial help to family members, allowing homeowners to choose the option that best suits their financial situation and goals.

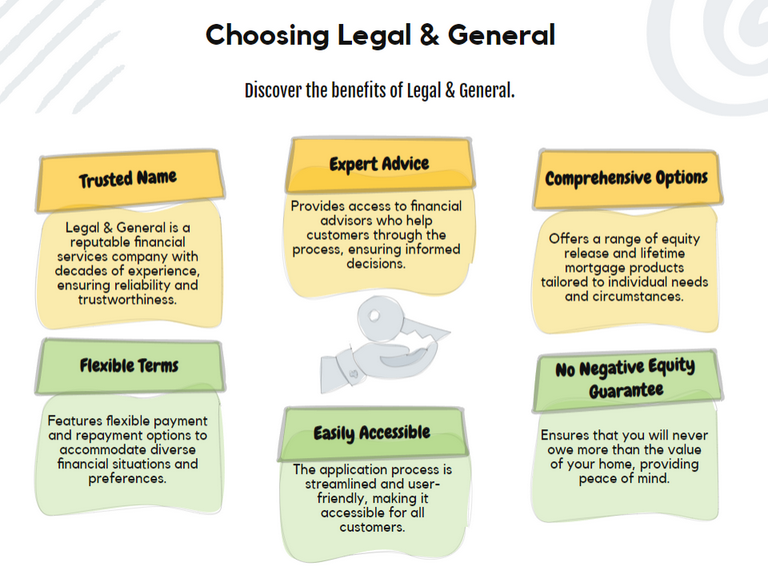

Why Consider Legal & General for Your Equity Release or Lifetime Mortgage?

Consider Legal & General for your equity release or lifetime mortgage because of their comprehensive equity release solutions, strong financial stability, and commitment to customer care.

Keep the following in mind:

Why Should You Consider Legal & General for Equity Release or Lifetime Mortgages?

You should consider Legal & General because it is one of the leading equity release companies in the UK and has a proven track record.

The company has nearly 200 years of financial service experience, has expanded to the US, and is one of Europe’s largest insurance and asset management groups with over £1.8tln in assets.2

It is also an award-winning company.

Some of Legal & General's awards include:3

- Mortgage Finance Gazette Awards 2022 – Best Lifetime Mortgage Lender

- Mortgage Solutions Award 2022 – Best Overall Provider of Lifetime Mortgages

- Mortgage Strategy Awards 2021 – Best Equity Release / Lifetime Lender

- Your Mortgage Awards 2021 – Best Later Life Lender

- The Mortgage Awards 2020 – Later Lifetime Lender of the Year

- Mortgage Strategy Awards 2020 – Best Equity Release Provider / Lifetime Lender

What Are the Pros and Cons of Legal & General?

The pros and cons of Legal & General include gaining access to tax-free cash; however, this could reduce the value of your estate.

Here's a closer look at these in detail:

Pros

Some of the pros include optional repayment and security through an ERC-accredited entity.

The pros include:

- Flexibility in terms of how you receive your money.

- Optional repayments.

- Inheritance protection.

- It is a member of the Equity Release Council (ERC).4

- It is authorised and regulated in the UK by the Financial Conduct Authority (FCA) and Prudential Regulatory Authority (PRA).

Cons

Some of the cons include potential early repayment charges and a reduction in inheritance.

The cons include:

- Possible early repayment charges for early settlement of your loan.

- Equity release may affect your means-tested benefits, now or in the future.

- The interest owed compounds quickly, meaning the value of your estate can rapidly diminish.

- Releasing equity reduces the inheritance you leave behind.

How Can Legal & General's Equity Release Calculator Help You Plan Your Finances?

Legal & General's equity release calculator can help you plan your finances by providing a straightforward way to estimate how much you could release, aiding in financial planning.

Think about the following:

Does Legal & General Have an Equity Release Calculator?

Yes, Legal & General does have an equity release calculator you can use.

You can also use our equity release calculator to see approximately how much home equity you could unlock.

How Does the Legal & General Equity Release Calculator Assist in Financial Planning for Homeowners?

The Legal & General Equity Release Calculator assists homeowners in financial planning by estimating how much equity they can release and projecting potential costs.

This tool aids in financial planning by providing clear insights into future repayments and how equity release can fit into their overall financial strategy, taking into account your age, property value, and mortgage balance.

It provides a personalised estimate of how much equity you can release from your property, helping you to make informed decisions about whether equity release is right for you.

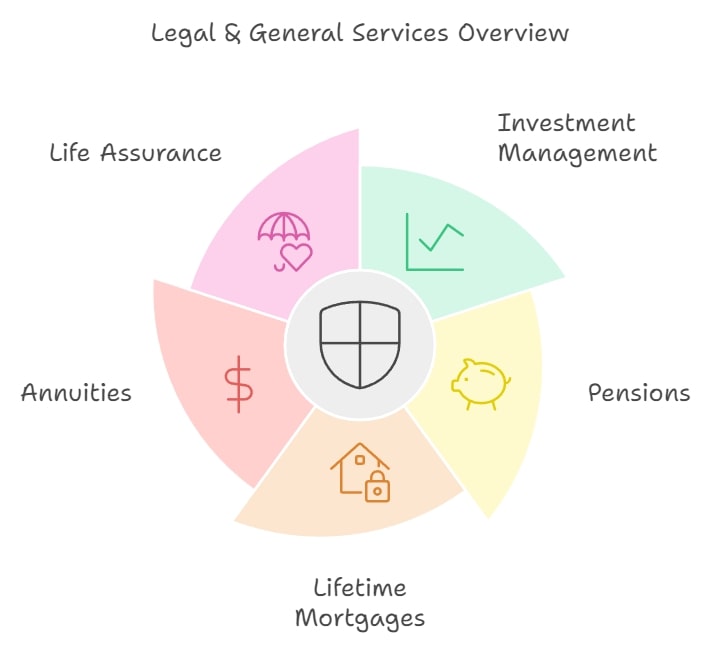

What Services Does Legal & General Offer?

Legal & General offers services such as lifetime mortgages, investment management, and more.

A complete list of the services it offers:

- Investment management

- Pensions

- Lifetime mortgages

- Annuities

- Life assurance

What Criteria and Fees Are Associated With Legal & General Equity Release?

Legal & General equity release requires homeowners to be 55 or older, with a property value of at least £70,000, and associated fees include valuation, legal, and arrangement fees, which vary based on the specific plan chosen.

Here's what you need to look out for:

What Are the Qualification Criteria for Legal & General Equity Release?

The qualification criteria for a Legal & General equity release plan are centred around your personal credentials and property details.

Here's a closer look:

- Minimum Equity Offered: £10,000

- Minimum Age: 55 years

- Maximum Age: 90 years (but exceptions are possible)

- Property value from: £70,000 (Flexible Violet is not available for £70,000–£99,999 properties). £100,000 for flats, maisonettes, ex-council, ex-housing association, and ex-MOD.

- Property Maximum Value: £2mln

- Property Location: England, Wales, or mainland Scotland.

- Property Types: Freehold and Leasehold (remaining term plus the age of the youngest borrower at completion must be at least 175 years)

To find out if you qualify, it is best to consult an equity release advisor or broker for a detailed overview.

What Are Legal & General's Fees?

Legal & General’s fees include arrangement fees, solicitor fees, and interest rates.5

Currently, equity release rates are between 5.97% to 6.28%*

*While we regularly review our rates, these may have changed since our last update.

More information:

Arrangement Fees

An arrangement fee or application fee is typically charged at £599 on certain products, whilst on others, there is no charge.

On completion, you will also be charged £30 for transferring funds to your solicitor.

These costs are not payable until your mortgage is finalised, and the funds are released.

Solicitor Fees

Once you are satisfied with your lifetime mortgage plan, the next step is to appoint a solicitor who specialises in equity release to act on your behalf.

These fees vary considerably but are typically around £650.

It is worth looking for competitive rates as they vary across the market.

Interest Rates

The interest rates charged on your loan are fixed for the whole term and compounded over time.

This means that any accrued unpaid interest is compounded into the loan monthly, causing the loan to progressively increase throughout its entire duration.

Your circumstances will determine your actual interest rate.

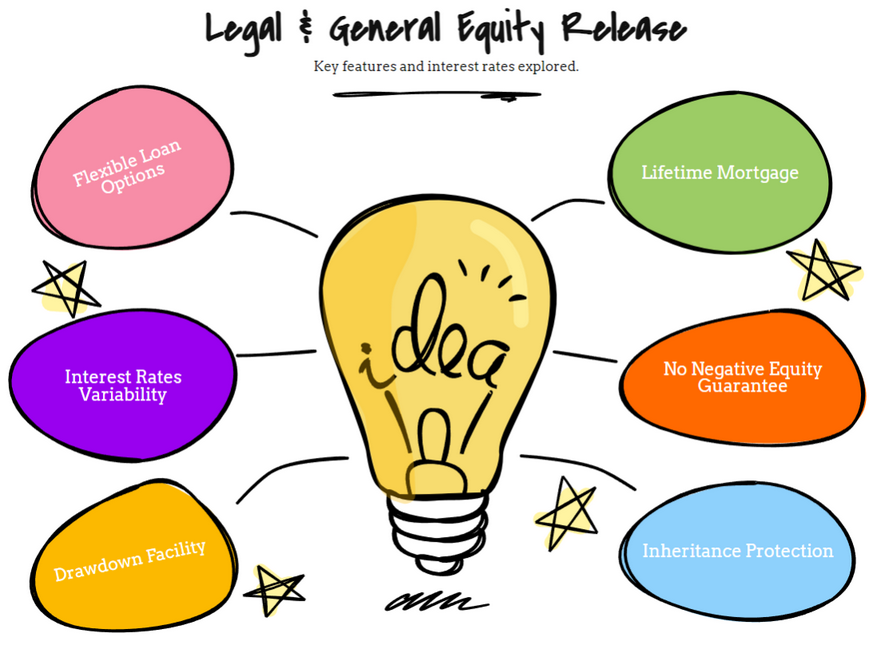

What Are the Key Features and Interest Rates of Legal & General's Equity Release Schemes?

The key features and interest rates of Legal & General's equity release schemes include flexible options like drawdown and lump sum plans with fixed interest rates; key features include voluntary repayment options and the no negative equity guarantee.

Check out key features and core info below:

What Are the Key Features of Legal & General’s Equity Release Schemes?

Legal & General’s equity release schemes reflect key features that include no negative equity guarantees, the option of inheritance protection, and depending on the plan you choose, the option to make interest-only payments every month.

What Are the Interest Rates for Legal & General Equity Release?

Legal & General equity release interest rates vary depending on the plan you choose, though equity release interest rates currently range from 5.97% to 6.28%*.

*While we regularly review rates, these may have changed since our last review.

How Do Legal & General's Equity Release Interest Rates Compare to the 2026 Market Average?

Legal & General's equity release interest rates, generally between 5% and 8%, align closely with the 2026 market average; their competitive rates, coupled with flexible product features, make them a strong contender in the equity release market.

Legal & General strives to offer competitive rates that align with or even beat the market average, ensuring you receive a fair deal.

Their rates are designed to meet the diverse financial needs of homeowners looking to release equity from their property, providing a balance between affordability and value.

Core Information About Legal & General Equity Release

Legal & General is the UK’s largest provider of individual life assurance products and ranks among the top twenty asset managers globally.

Founded in 1836, the company has evolved into one of Europe’s leading insurance and asset management firms, with a robust equity release business.6

Legal & General works with corporations, pension fund trustees, and advisers to deliver stable pension incomes, and for individual consumers, the company offers a range of products designed to provide financial stability in later years, including annuities and lifetime mortgages.

Specialising in various financial products, Legal & General’s offerings include:

- Investments

- Retirement solutions

- Life cover

- Insurance

- Mortgages

- Equity Release

These comprehensive services make Legal & General a trusted partner for those seeking financial security throughout their lives.

How Does Legal & General Support Its Equity Release Customers?

Legal & General supports equity release customers with expert advice, clear communication, and access to additional resources for informed decision-making.

Here's more on their support process:

What Are Legal & General's Customer Reviews and Ratings?

Legal & General's customer reviews and ratings generally highlight satisfaction with their equity release products, praising the clarity of their terms and flexibility of options; however, some customers have noted that the application process can be time-consuming.

Overall, they maintain a positive reputation in the industry.

You can view Legal & General's customer reviews and ratings below:

- Legal & General Reviews are available on UK.TrustPilot.com

- Reviews of Legal & General on Reviews.io

- Legal & General Reviewed for SmartMoneyPeople.com

Handling of Customer Complaints by Legal & General Equity Release

Legal & General complaints can be lodged by email, letter, or phone.

For any equity release-related complaints, you can contact the retirement department at the contact details below:

- Email: customerservices@landghomefinance.com

- Letter: Legal & General Home Finance, PO BOX 17225, Solihull B91 9US.

- Phone: 03330 048 444 Option 2, Option 1, 9am to 5pm, Monday to Friday. Phone calls may be monitored and recorded.

What Is the Methodology Behind Our Review of Legal & General Equity Release?

The methodology behind our review of Legal & General is based on factors such as customer service, product range, and reputation.

Here are the following factors:

- Reputation and History – How many years they have been in business, customer reviews, and industry rewards received.

- Financial Strength – Ensuring it is going strong and has adequate funds to meet long-term commitments.

- Product Range – We favour companies offering a variety of equity release schemes with greater product flexibility.

- Interest Rates and Fees – We review competitive rates compared to industry averages and they must be fully transparent about rates and fees without hidden costs.

- Customer Service and Support – When and how it is available, response times, and available online educational resources. As well as online tools, like a calculator.

- Code of Conduct and Compliance – We only consider companies that adhere to recognised industry standards and codes.

- Industry Insights and Peer Reviews – We care about a company’s industry-wide reputation.

- Innovation and Technology – Is there a streamlined, digital application process?

- Client Testimonials – Success stories and the complaints resolution process.

Note that this is an unaffiliated, independent review of Legal & General.

How Can You Contact Legal & General for Equity Release Inquiries and What Regulatory Standards Do They Adhere To?

You can contact Legal & General for equity release inquiries via their website, phone, or by speaking to an authorised financial adviser; they adhere to strict regulatory standards set by the Financial Conduct Authority (FCA) and are members of the Equity Release Council.

Continue reading to find out more:

How Can You Contact Legal & General for Equity Release Inquiries?

- +44 033 3004 8444

- enquiries@landghomefinance.com

- 4th Floor, Chadwick House, Warwick Road, Solihull, West Midlands B91 2AA

What Are the Regulatory Compliance and Details of Legal & General?

Trading Names

Legal and General Assurance Society Limited

FCA Permitted Services

- Banking

- Insurance

- Consumer Credit

- Pensions

- Investments

Regulators

Registration Numbers

- FCA Ref Number: 303418

- Companies House Number: 04896447

FCA and Companies House Links

- FCA Link: FCA Link

- Companies House Link: Companies House Link

Is Legal & General Accredited by the Equity Release Council, and What Does This Mean for Customers?

Yes, Legal & General is accredited by the Equity Release Council. This accreditation means that Legal & General adheres to a strict set of standards and principles designed to protect customers.

These include a no negative equity guarantee, the right to remain in your home for life, and clear, transparent advice and information.

This accreditation provides peace of mind for customers, ensuring they are dealing with a reputable provider committed to fair and safe equity release practices.

Frequently Asked Questions About Legal & General Equity Release

Is Legal & General Accredited by the Equity Release Council?

What Are Legal & General's Interest Rates?

Who Owns Legal & General?

Are There Jobs Available at Legal & General?

Where Is Legal & General Located?

Is Legal & General's Equity Release Safe?

How Reliable Is Legal & General Equity Release?

How Does Legal & General Equity Release Compare to Other Providers?

What Are the Rates for Legal & General Equity Release?

What Are Customers Saying in Their Legal & General Equity Release Reviews?

Conclusion: Making an Informed Decision on Legal & General Equity Release

If you are looking to unlock funds for your senior years, then Legal & General is a viable option to consider.

Boasting more than 200 years of experience, you can rest assured that you will be dealing with a knowledgeable and reputable team.

Before releasing equity with Legal & General or any other provider, it is best to consult a financial advisor to see if it is the right option for you.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.