Lifetime Mortgage Calculator 2026: Calculate Your Potential Equity

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Key Takeaways...

- A lifetime mortgage calculator gives you a quick peek at the maximum loan you might get based on your home's worth and your age, and these calculators can be found on trusted financial sites and equity release providers' web pages.

- While they're pretty on point, remember, it's an estimate—actual amounts can shift with health, lifestyle, or other details.

- Some calculators allow you to input additional criteria, such as health and lifestyle factors, for a more tailored estimate, but nothing beats a detailed discussion with an adviser who can provide personalised recommendations.

Ready to see how much equity you could release? Our FREE lifetime mortgage calculator is here to give you an accurate estimate of the funds you may be able to unlock from your home!

With £664 million released in Q2 20231, it’s clear that equity release is becoming an increasingly popular solution for homeowners looking to boost their retirement funds, and understanding how much you can borrow is a crucial first step in the equity release journey.

As industry experts, we’ve integrated the latest lifetime mortgage insights and technology to ensure you have the most reliable tool at your fingertips.

Explore how the calculator works, what factors it takes into account, and how it can set you on the path to a more secure financial future.

Take the first step towards unlocking your home’s potential...

In This Article, You Will Discover:

What Factors Does a Lifetime Mortgage Calculator Consider in 2026?

A lifetime mortgage calculator considers several key factors to determine how much equity you could potentially release; these typically include your age, the value of your property, any outstanding mortgage balance, and the type of property you own.

In 2026, some calculators may also take into account interest rates, health conditions, and lifestyle factors, as these can influence the loan amount.

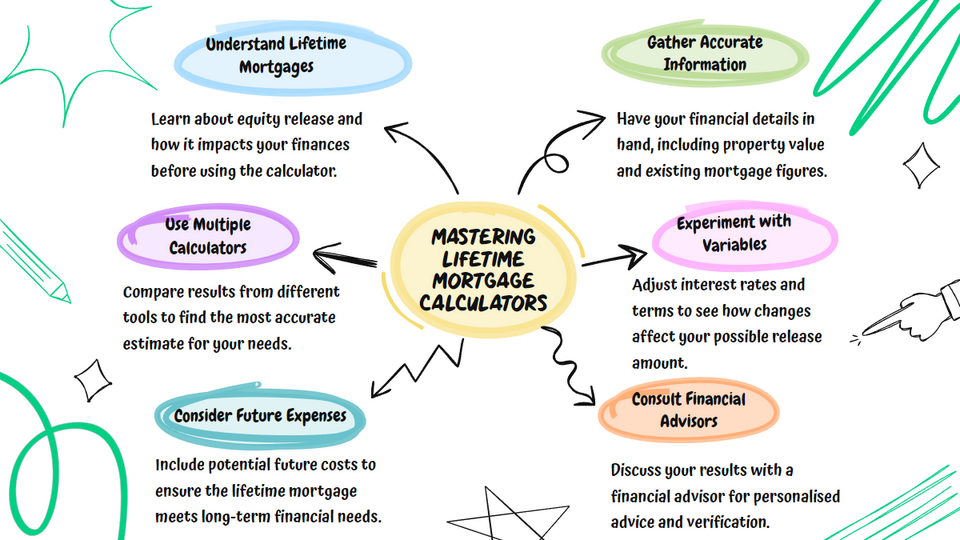

How Can You Use a Lifetime Mortgage Calculator Effectively?

You can use a lifetime mortgage calculator effectively by providing the few key details required to estimate how much you could release from your property.

Here's how to get the best outcome:

Essential Details to Input

As mentioned, essential details to input typically include your age and property value.

This is the process:

- Age: Enter the age of the youngest homeowner, as it influences the loan amount.

- Property Value: Input the current market value of your property or your best estimate.

- Contact Information: Provide your email address to receive detailed results.

- Calculate: Click the calculate button to view estimated loan amounts and potential interest rates.

Free Consultation Bonus!

Get a free consultation bonus on us—using our calculator qualifies you for a complimentary consultation with an expert from Age Partnership!

Note: While the initial consultation is free, opting for an equity release plan may incur charges.

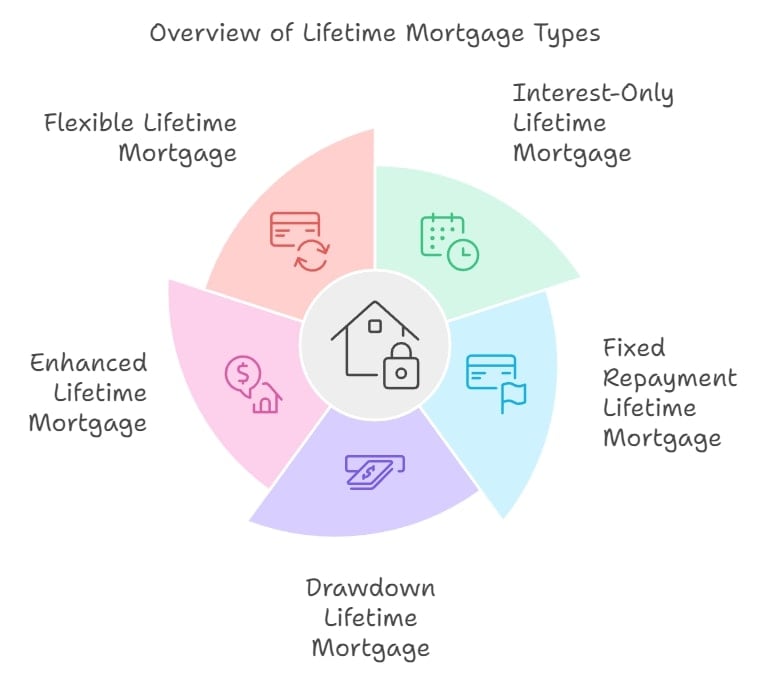

Understanding Different Lifetime Mortgage Types and Calculator Types

Lifetime mortgage types are defined by the specific features they offer, such as interest-only lifetime mortgages or enhanced lifetime mortgages based on health; similarly, lifetime mortgage calculators are defined by the factors they consider, including your age, property value, mortgage balance, and interest rates.

Some calculators also factor in health conditions to offer more accurate estimates.

The different lifetime mortgage types are:

- Interest-Only Lifetime Mortgage: You pay the interest each month, keeping the loan balance the same, with the loan repaid when the property is sold.

- Fixed Repayment Lifetime Mortgage: Repay a fixed higher amount than borrowed upon sale of the property, with no monthly interest payments.

- Drawdown Lifetime Mortgage: Withdraw money as needed, paying interest only on the amount withdrawn, which can reduce overall costs.

- Enhanced Lifetime Mortgage: Offers more favourable terms or a larger amount based on health conditions or lifestyle factors.

- Flexible Lifetime Mortgage: Allows for voluntary payments to manage the loan balance, with options for partial repayments without penalty.

Additionally, the different calculator types serve distinct purposes.

These are as follows:

- Standard: Estimates the total lump sum you could release.

- Drawdown: Shows initial funds available with a reserve for future use.

- Interest-Only: Calculates borrowing potential with monthly interest payments to avoid increasing the loan amount.

How to Analyse Calculator Results for Effective Planning

Analysing calculator results for effective planning means carefully reviewing the estimated amount you can release, considering how the loan amount aligns with your financial goals, and factoring in future interest rates and the potential impact on inheritance.

Additionally, look at the repayment terms and any fees or charges that may apply to assess whether the result meets your needs and make adjustments.

These are the steps to take:

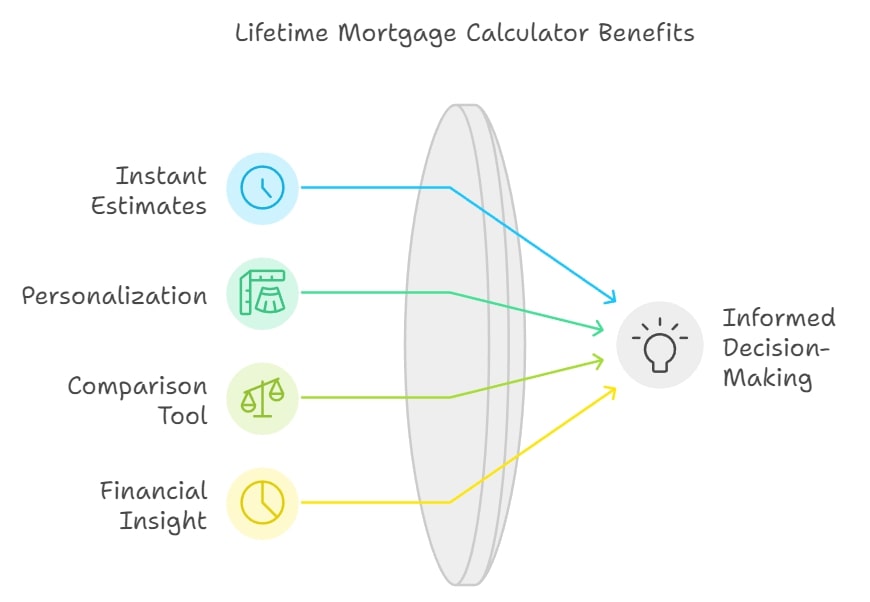

Benefits of Using a Lifetime Mortgage Calculator

The benefits of using a lifetime mortgage calculator include financial insights and immediate estimates.

Mastering your lifetime mortgage calculator empowers you to make informed decisions about your financial future.

Consider these advantages:

- Instant Estimates: Quickly assess potential loan amounts.

- Personalisation: Results tailored to your age and property value.

- Comparison Tool: Easily compare different scenarios and loan options.

- Financial Insight: Plan ahead by exploring various loan terms and their implications.

How Should You Interpret the Results From a Lifetime Mortgage Calculator for Your Financial Planning?

Interpret the results from a lifetime mortgage calculator as a preliminary guide for financial planning, not a definitive answer, and always seek advice for a tailored approach.

These calculated outcomes help you understand the potential size of a loan, but consider this alongside your long-term financial goals and the impact on your estate's value, providing clarity on how equity release fits into your overall retirement planning.

Why Should You Use a Lifetime Mortgage Calculator Before Applying for Equity Release?

You should use a lifetime mortgage calculator before applying for equity release to provide yourself with a quick, hassle-free way to estimate the amount of equity you could release from your home, which is valuable in deciding if you should proceed with a more detailed consultation.

It’s a crucial step in financial planning, helping you understand whether equity release could meet your needs without committing to anything.

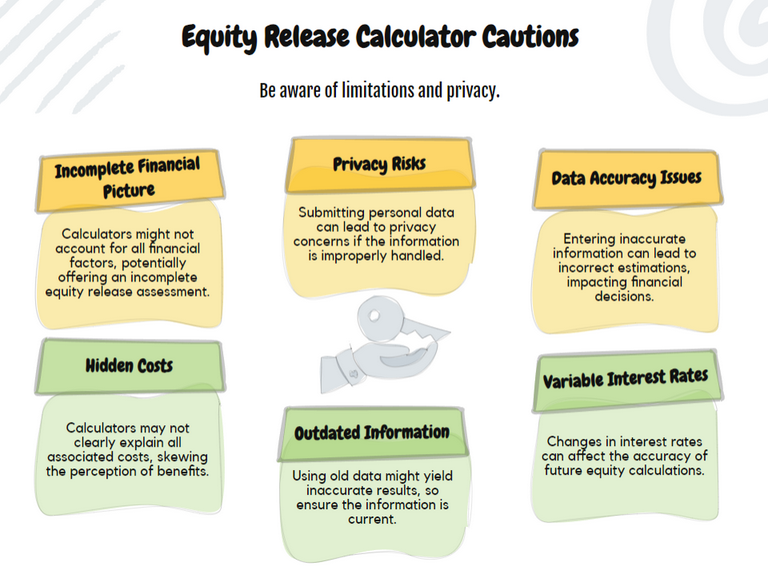

What Limitations and Privacy Concerns Should You Be Mindful of With Equity Release Calculators?

Limitations and privacy concerns you should be mindful of with equity release calculators are typically their ability to only provide estimates based on the data you enter, which may not account for all variables such as health conditions or specific property features.

It's important to remember that these calculators can sometimes offer inaccurate results or miss out on more tailored mortgage options.

Privacy concerns with equity release calculators are defined by the personal information they require, such as your age, property value, and financial details—ensure the calculator is secure, complies with data protection regulations, and handles your information responsibly.

Consider these factors:

How Exactly Do Lifetime Mortgage Calculators Determine Your Potential Equity Release Amount?

Lifetime mortgage calculators determine your potential equity release amount by using information like your age, property value, and, in some cases, health details to estimate your potential equity release amount.

The older you are and the more your property is worth, the more you're typically able to borrow.

These calculators give you a preliminary idea, helping to shape your expectations before you consult with a financial adviser.

What Limitations Should You Be Aware of With an Equity Release Calculator?

The limitations you should be aware of with an equity release calculator include that it potentially is not able to capture all financial nuances or offer a personalised assessment, acting more as a broad initial guide.

These may include:

- Estimates only: Calculators provide rough estimates, not exact figures.

- Market fluctuations: They cannot predict future property values or interest rates.

- Other costs: They may not consider all associated costs, such as legal fees or advice fees.

- Individual circumstances: Calculators cannot factor in unique personal situations or eligibility criteria.

What Privacy Measures Should You Look For When Using Online Equity Release Calculators?

Privacy measures to look for when using online equity release calculators include SSL encryption to secure your data, and always verify that it complies with data protection regulations like GDPR.

Look for clear privacy policies that explain how your information will be used, stored, and protected, ensure the website is secure (look for “https” in the URL), and avoid calculators that require excessive personal details.

Opting for calculators on reputable sites, such as those of well-known financial institutions or advisory services, can also offer additional peace of mind.

Frequently Asked Questions About Lifetime Mortgage Calculators

How Does a Lifetime Mortgage Calculator Work?

Where Can I Find a Reliable Lifetime Mortgage Calculator?

What Information Is Required to Use a Lifetime Mortgage Calculator?

How Accurate Are Lifetime Mortgage Calculators?

Can a Lifetime Mortgage Calculator Help Me Determine My Equity Release?

Concluding Thoughts on Using Lifetime Mortgage Calculators

Lifetime mortgage calculators are an invaluable tool for retirees considering equity release, providing instant, personalised estimates that can help you kickstart your financial planning and borrowing potential.

It's crucial, however, to recognise their limitations—they offer a starting point, but they should never be the sole factor in your decision-making process.

To make the best choice for your future, always seek independent financial advice for a more thorough assessment tailored to your specific needs; combine the insights from a lifetime mortgage calculator with expert guidance, and you’ll be equipped to make confident decisions that set you on the path to a secure financial future.

Start exploring your options today, and take control of your equity release journey with the right knowledge and support.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?