What Are the Best Lifetime Mortgage Interest Rates in 2026?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

Key Takeaways...

- UK lifetime mortgage rates swing within 5.97% to 6.28%*, shaped by the lender, plan specifics, market trends, and your details.

- Expect heftier rates than regular mortgages, as lenders see more risk here.

- Pick from steady fixed rates or go with the flow using variable options, depending on the lender and the specific plan chosen by you, the borrower.

Did you know that just a 0.5% difference in your lifetime mortgage rate can result in paying tens of thousands more over the life of your loan?

Not only will you have interest and lifetime mortgages explained in this guide, you will also learn about navigating the ins and outs of lifetime mortgage rates, updated for 2026.

In This Article, You Will Discover:

Our mission at SovereignBoss is to equip you with trustworthy, comprehensive insights to help you make informed decisions about your financial future.

With in-depth knowledge of everything from the calculation of interest to the factors affecting your rates, prepare to learn the secrets of finding the best lifetime mortgage rates in the market.

What Is the Average Interest Rate on a Lifetime Mortgage in 2026?

The average rate for a lifetime mortgage in the UK as of 2026, is approximately 5.97% to 6.28%*.1

However, rates can vary significantly based on several factors including the type of plan, your age, and the current market conditions.

*While we regularly review these interest rates, they may have changed since our last review.

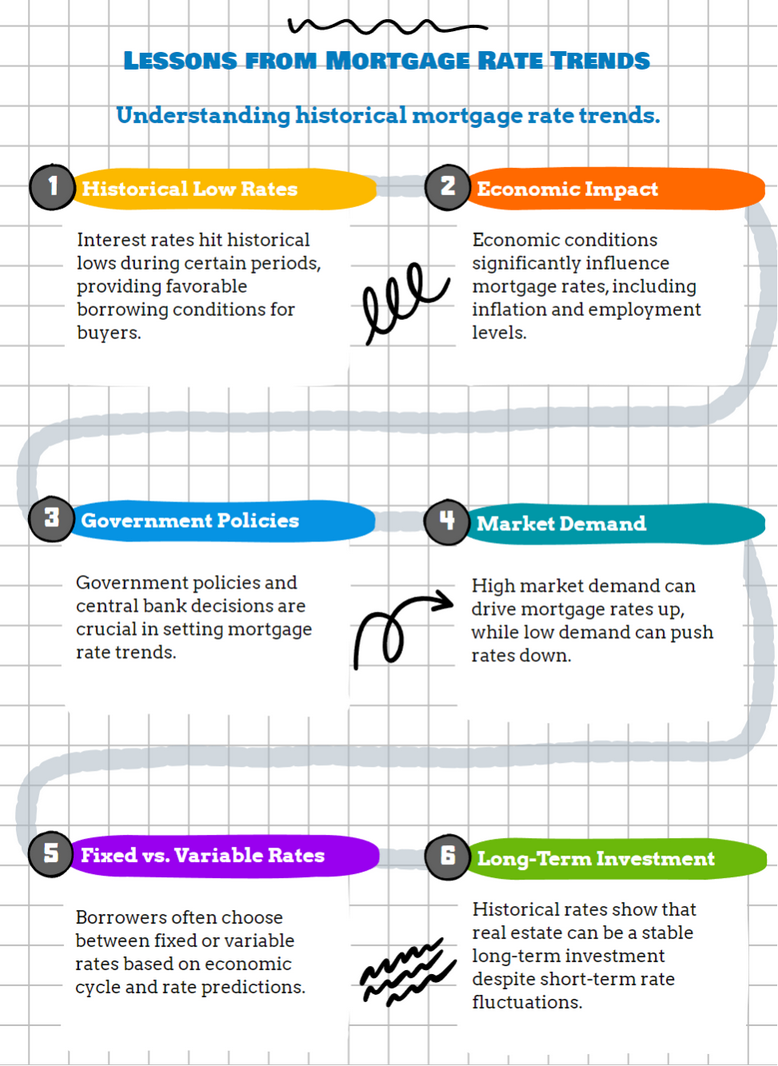

What Have Historical Trends in Lifetime Mortgage Rates Taught Us?

Looking at historical trends, we've learned that lifetime mortgage rates can fluctuate significantly over time, often in response to wider economic changes.

For example, during periods of economic stability and low inflation, rates tend to be lower, making it a more opportune time to consider a lifetime mortgage.

These patterns underscore the importance of timing your decision, as waiting for a more favourable rate environment can significantly impact the cost of borrowing.

How Can You Find and Secure the Best Lifetime Mortgage Rates in 2026?

Securing the best rates involves comparing lenders, considering the timing of your application, and seeking advice from a financial adviser.

How Can You Find the Best Lifetime Mortgage Rates in 2026?

The best lifetime mortgage rates in 2026 depend on various factors, such as your age, property value, health condition, and personal preferences.

Generally, the lower the interest rate, the less you will pay back in the long run.

However:

You should also consider other features of a lifetime mortgage, such as the flexibility to make repayments, the option to draw down more money in the future, and the guarantee that you will never owe more than your home is worth.

Current lifetime mortgage rates range from 5.97% to 6.28%*.2 However, these rates are subject to change and may not be available to everyone.

Therefore, it is advisable to compare different lifetime mortgage deals and seek professional advice before making a decision.

Lifetime Mortgage Rates - Feb 2026

| Plan Provider | Fixed Monthly Interest Rate From | Annual Rate (AER) From | Maximum Loan-To-Value | Maximum Equity Offered |

|---|---|---|---|---|

| Legal & General | 4.33% | 4.50% | 38% | £2mln |

| More2Life | 4.27% | 4.43% | 32% | £1mln |

| Canada Life | 4.37% | 4.60% | 28.8% | £1mln |

| Pure Retirement | 4.22% | 4.30% | 33.5% | £725,000 |

Note: The maximum equity offered is subject to your circumstances and based on the value of your home.

*Last updated in line with the Equity Release Council's Q4 2022 Equity Release Report.3

This maximum is the cap available for higher-valued properties.

What Strategies Can Help You Secure the Best Lifetime Mortgage Rates?

To secure the best rates, start by comparing offers from multiple lenders, as rates can vary widely.

Consider consulting a financial adviser who specializes in equity release to understand the nuances of different plans and identify the most favourable rates.

Additionally, keeping an eye on economic forecasts can help you anticipate movements in interest rates, allowing you to apply at a strategically advantageous time.

How Can You Secure the Best Interest Rate on a Lifetime Mortgage?

Finding the best rate on a lifetime mortgage in 2026 starts by using online resources to compare rates and annual percentage rates (APR) among different providers.

It is also strongly recommended that you consult an independent financial advisor specialising in equity release or an equity release broker for insights and personalised recommendations.

Consulting an equity release broker familiar with the entire market will not only help you find the best interest rates but also the best plan tailored to your financial needs and goals.

What Is a Rate Lock and How Can It Benefit Your Lifetime Mortgage?

A rate lock allows you to fix the interest rate of your lifetime mortgage for a certain period, protecting you against rate increases while your application is processed.

This can be particularly beneficial in a volatile market where rates are expected to rise.

By locking in a rate, you can ensure that you benefit from the current low rates, potentially saving you a significant amount over the life of your mortgage.

How Are Interest Rates Calculated and What Impact Does Compound Interest Have on Lifetime Mortgages?

Interest rates are calculated based on the loan amount and compounded over time, significantly impacting the total amount repayable.

How Do Lenders Calculate Interest on a Lifetime Mortgage?

Interest on a lifetime mortgage is typically calculated using compound interest.

This means interest is levied on both the original borrowed amount and any interest that has accrued from prior periods.

Most lifetime mortgages do not require monthly interest payments; instead, the interest accrues and is added to the total loan amount.

Over time, this can cause the loan amount to grow significantly, especially if interest is compounded frequently, such as annually or monthly.

What's the Difference Between Fixed and Variable Lifetime Mortgage Rates?

Lifetime mortgages usually come with fixed interest rates, which provide the consistency of unchanged costs over the term.

Variable rates can change with market conditions, and while they may start off lower, they have the potential to increase over time.

Fortunately, members of the Equity Release Council who offer variable interest rates are required to set a maximum cap for the loan's entire duration.4

What Is the Difference Between APR and MER?

The annual percentage rate (APR) is a comprehensive measure that includes the interest rate and any mandatory charges or fees.

On the other hand, the monthly equivalent rate (MER) only considers the interest rate, which is compounded monthly.

Comparing APRs is generally more helpful for assessing the total cost.

How Does Compound Interest Affect Lifetime Mortgages? Here Are Examples

The following are examples of the impact caused by interest, based on rates of 5.97% to 6.28%*.

£50,000 Loan on a 4% Annual Interest Rate (AER)

| Year | Loan Amount | 4% Interest AccruedThe interest on a bond or loan that has accumulated since the principal investment, or since the previous coupon payment if there has been one already. | Total Amount Owed |

|---|---|---|---|

| 1 | £50,000 | £2,000 | £52,000 |

| 2 | £52,000 | £2,080 | £54,080 |

| 3 | £54,080 | £2,163 | £56,243 |

| 4 | £56,243 | £2,249 | £58,492 |

| 5 | £58,492 | £2,340 | £60,832 |

| 10 | £71,165 | £2,847 | £74,012 |

| 15 | £86,583 | £3,464 | £90,047 |

| 20 | £105,342 | £4,371 | £109,556 |

5.97% to 6.28%* interest is an average rate, but it is higher than what one might achieve with a traditional mortgage.

Annual interest on a £50,000 loan would be £2,000, but if left unpaid, it will compound.

This is for indicative purposes only.

£50,000 Loan on a 5% Annual Interest Rate (AER)

| Year | Loan Amount | 5% Interest AccruedThe interest on a bond or loan that has accumulated since the principal investment, or since the previous coupon payment if there has been one already. | Total Amount Owed |

|---|---|---|---|

| 1 | £50,000 | £2,500 | £52,500 |

| 2 | £52,500 | £2,625 | £55,125 |

| 3 | £55,125 | £2,756 | £57,881 |

| 4 | £57,881 | £2,894 | £60,775 |

| 5 | £60,775 | £3,039 | £63,814 |

| 10 | £77,766 | £3,878 | £81,444 |

| 15 | £98,996 | £4,950 | £103,946 |

| 20 | £126,347 | £6,317 | £132,664 |

If you are on the younger side and your loan amount is small, you can expect to pay around 5% interest or more.

A year on 5% interest is £2,500, but that is before it compounds.

This is for indicative purposes only.

Exploring Examples of Compound Interest on Lifetime Mortgages

Exploring examples of compound interest on lifetime mortgages will give you a better understanding of how it works.

Imagine you take out a £100,000 lifetime mortgage at 5% interest

With compound interest, you would owe approximately £162,889 in ten years.

With an interest-only mortgage, paying 5% interest annually, you would still owe £100,000, but would have paid £50,000 in interest over ten years.

Or consider a £50,000 loan with a 5% interest rate

The first-year interest would be £2,500, resulting in a total owed of £52,500.

The next year's interest is calculated on this new total, resulting in an interest amount of £2,625.

This compounding effect continues throughout the loan's duration, leading to a significant increase in the final repayment amount.

* These figures are for indicative purposes only.

What Factors Influence Interest Rates on Lifetime Mortgages, and How Can You Compare Them?

Factors influencing rates include the Bank of England base rate, lender risk assessment, and the borrower's age and property value.

What Factors Affect Interest Rates on Lifetime Mortgages?

The interest rate charged on a lifetime mortgage can be affected by your loan-to-value ratio, age, health and lifestyle conditions, marital status and plan features.

Therefore...

Loan-to-Value (LTV)

The loan-to-value ratio reflects the percentage of the home's value that is being borrowed.

Lenders often charge higher interest rates for higher LTVs to offset the increased risk they undertake.

Age

Age significantly influences the interest rate on a lifetime mortgage.

Younger borrowers often face higher rates because they are expected to hold the loan longer, allowing more time for interest to accumulate, presenting a greater risk to lenders.

As borrowers age, lenders may offer lower rates due to the anticipated shorter duration of the loan.

Essentially, the older the borrower, the more favourable the rate might be, as the loan's repayment is expected to be sooner, either due to the borrower's passing or moving into long-term care.

Health and Lifestyle Conditions

Some lifetime mortgage providers offer enhanced terms, including potentially lower interest rates, for individuals who have specific health conditions or lifestyles that may reduce their life expectancy.

Marital Status

The interest rates may also be influenced by marital status.

Providers might consider the life expectancy of both partners in married or civil partnership cases, which can have an impact on the rates offered.

Plan Features

The features of your mortgage plan, like downsizing protection, inheritance protection, or partial repayments can also affect your interest rate.

Economic Factors

Economic factors such as inflation, the Bank of England's base rate, and the overall health of the economy play a crucial role in determining lifetime mortgage interest rates.

For instance, if inflation is high, lenders may increase rates to maintain their profit margins; conversely, in a low-interest-rate environment, you might find more favourable conditions for securing a lifetime mortgage.

Understanding these dynamics can help you anticipate shifts in rates and make informed decisions about when to enter the market.

How Can You Compare Interest Rates Across Different Lifetime Mortgages?

Comparing the range of lifetime mortgage interest rates offers insight into the diverse plans and their respective interest frameworks, empowering you to make well-informed decisions.

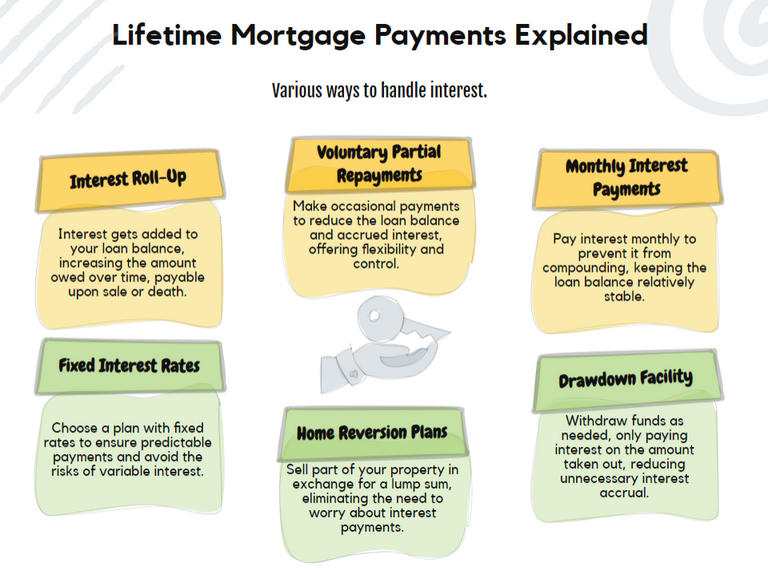

Roll-up Mortgages

In a roll-up lifetime mortgage, the interest on the loan accumulates over time and is added (or "accrued") to the loan balance.

You are not required to make any regular interest payments, instead, the interest compounds, and the total debt can grow quite rapidly.

Both the original loan amount and the accrued interest are repaid when you pass away, sell your home, or move into long-term care.

This option might be considered by those who prefer not to make monthly repayments and understand that the total loan amount will increase because of the compounding interest.

Drawdown Mortgages

Drawdown lifetime mortgages provide more flexibility.

Rather than obtaining a one-time lump sum, you can designate a specific amount to a cash reserve, allowing you to "draw down" funds as required, up to a predetermined limit.

Interest is only charged on the amount that has been drawn down, not on the entire reserve.

This flexibility means that you can manage the growth of the debt by only taking funds when necessary, leading to potentially lower interest costs over time compared to taking a full lump sum at the outset.

This is ideal for individuals who need access to funds over time rather than a lump sum at the beginning.

Flexible or Voluntary Payments

With flexible or voluntary payment lifetime mortgages, you have the option to make payments towards the interest at your discretion.

You can decide whether you want to pay some or all of the interest, and this could be on an ad-hoc or regular basis.

By making these payments, you can mitigate the effects of interest roll-up, making this a more manageable option.

Good news:

As of March 2022, all new lifetime mortgages provided by Equity Release Council members guarantee customers the ability to make voluntary payments without penalties, in accordance with the lender's terms.5

Interest-Only Mortgage Rates

Interest-only lifetime mortgages in the UK allow you to just pay the interest portion of the mortgage each month.

This means that the loan amount itself does not increase because you are effectively preventing the interest from being added to the loan.

This option requires a commitment to making regular monthly payments, so it is best for individuals who have a steady source of retirement income.

At the end of the mortgage term, the original loan amount will still need to be repaid.

How Do Interest Rates Vary Across Different Lifetime Mortgage Plans?

Interest rates can vary significantly across different types of lifetime mortgage plans.

For example, drawdown mortgages might offer slightly higher rates than lump-sum options due to their flexibility; similarly, enhanced mortgages, designed for those with certain health conditions, could come with lower rates as the lender anticipates an earlier repayment.

Understanding these differences is key to choosing the plan that not only meets your financial needs but also offers the best possible rate.

What Are Your Options for Paying Back Interest on a Lifetime Mortgage?

Interest on a lifetime mortgage is repaid when the plan comes to an end, typically when the policyholder passes away or moves into long-term care.

More detail on the process:

When the homeowner either passes away or moves into long-term care, the executor of the estate oversees the sale of the property to repay the lifetime mortgage.

The proceeds from the sale are first used to settle the debt with the lender.

Any remaining funds are then distributed to the heirs as per the deceased's will or, in the absence of a will, according to intestacy laws.

Importantly, under this arrangement, homeowners are not required to make monthly repayments during their lifetime, unless they opt to or have secured an interest-only lifetime mortgage.

Frequently Asked Questions About Lifetime Mortgage Interest Rates

How Do Lifetime Mortgage Interest Rates Compare to Traditional Mortgage Rates?

Is It Possible to Negotiate Lower Interest Rates on a Lifetime Mortgage?

Which Lenders Are Offering Special Lifetime Mortgage Rates in 2026?

What Influences the Interest Rates on Lifetime Mortgages?

Are There Fixed and Variable Lifetime Mortgage Interest Rates?

Can I Switch to a Lower Interest Rate if I Find a Better Offer Later?

Are There Any Government Schemes or Initiatives That Provide Lower Lifetime Mortgage Rates in 2026?

Can I Make Overpayments to Reduce the Interest Costs on My Lifetime Mortgage?

What Are the Current Interest Rates for Lifetime Mortgages in the UK?

Do Lifetime Mortgage Interest Rates Change Over Time?

Conclusion: Navigating Lifetime Mortgage Interest Rates for Your Financial Future

Understanding the nuances of lifetime mortgage rates is key to making informed financial decisions.

Rates can vary based on factors such as the loan amount, your age, health, marital status, and the chosen mortgage type.

While lifetime mortgages offer a means to access cash during retirement, they are not suitable for everyone.

Seeking advice from both a solicitor and a financial advisor ensures you are well-informed of potential scenarios and risks.

Ultimately, a thorough understanding of lifetime mortgage rates lays the foundation for wise financial decision-making.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.