Liverpool Victoria (LV) Equity Release Review (2026): Expert Review

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- The Liverpool Victoria equity release plan offers benefits such as tax-free cash and a no-negative equity guarantee, but also includes potential downsides like a reduced inheritance and high early repayment charges.

- The scheme allows homeowners aged 55 and over to release a portion of their home's value as a lump sum or in regular payments, which is repaid when the home is sold.

- With a no-negative equity guarantee and regulation from the Financial Conduct Authority, the scheme is designed to be safe and secure for homeowners.

- Interest rates can vary between 5.97% to 6.28%*, but are typically competitive, and are fixed for the life of the loan to help with financial planning.

- The scheme has clear costs, with any potential additional fees, such as valuation or legal fees, outlined upfront.

Are you planning for your retirement and wondering how Liverpool Victoria (LV) equity release can help?

With equity release increasing in popularity,1 there is a wide selection of providers and plans to choose from.

This does not make the decision process any easier, in fact, it can make it more confusing.

In This Article, You Will Discover:

Our specialist equity release team has spent hours combing the market to find the most relevant and accurate information on Liverpool Victoria.

Therefore:

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Liverpool Victoria. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Liverpool Victoria.

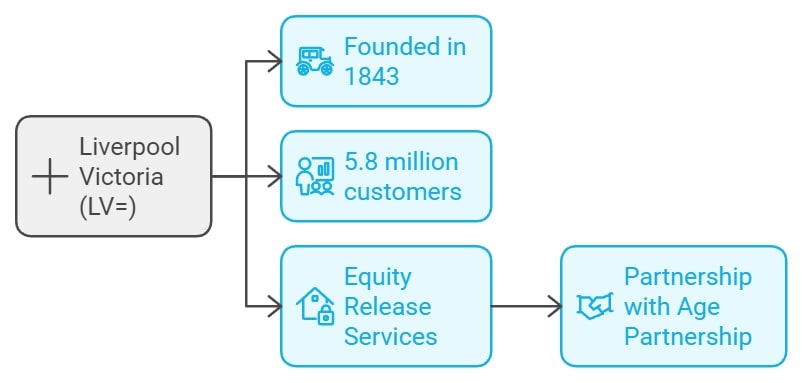

Who Is Liverpool Victoria?

Liverpool Victoria (known as LV=) is a provider of insurance and retirement-related services.

Founded in 1843, it now boasts more than 5.8mln customers.2

Liverpool Victoria has been offering equity release for more than two decades.

Currently, Liverpool Victoria’s equity release is offered in partnership with another industry giant, Age Partnership.3

Why Consider Liverpool Victoria?

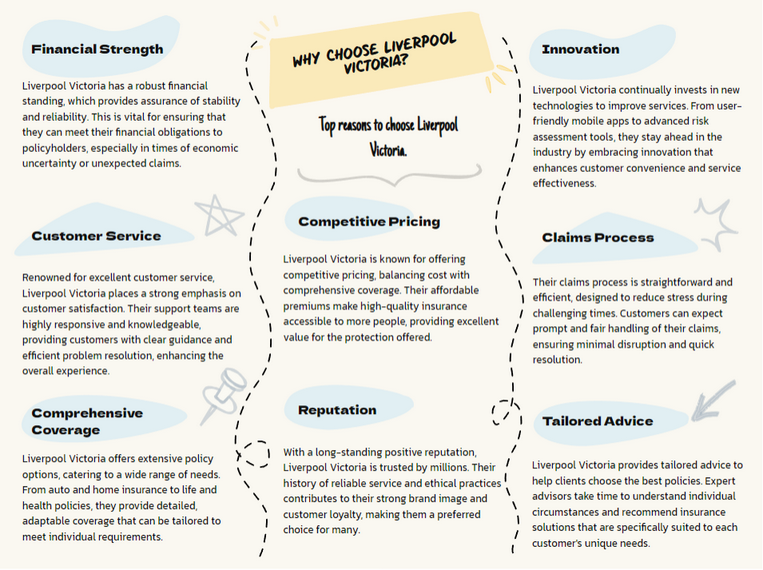

You may consider Liverpool Victoria because it is an award-winning and leading financial services provider in the UK.

It works in conjunction with Age Partnership to provide equity release plans.

What Services Do Liverpool Victoria Offer?

Liverpool Victoria offers the following categories of services:

- Home Insurance

- Pensions and retirement

- Car insurance

- Life insurance

Does Liverpool Victoria Offer Equity Release or Lifetime Mortgages?

Yes, Liverpool Victoria does offer equity release provided by Simply Lifetime Mortgages Limited, an appointed representative of Age Partnership.

Liverpool Victoria’s Equity Release Schemes

Liverpool Victoria’s equity release schemes include the lifetime mortgage lump sum and the lifetime mortgage drawdown.4

Liverpool Victoria’s Equity Release Scheme Features

More information:

Lifetime Mortgage Lump Sum

- You release a lump sum.

- No monthly repayments required.

- Equity and interest accrued are payable when the property is sold.

Lifetime Mortgage Drawdown

- You can release cash as and when needed.

- Interest is only payable on the cash that you release.

- This is widely viewed as the more cost-effective option.

What Are Liverpool Victoria’s Fees?

Liverpool Victoria offers the first consultation or initial advice at no cost.

However, should you decide to proceed with equity release, an advice fee of £1,795 would need to be paid.5

Does Liverpool Victoria Have An Equity Release Calculator?

Yes, there is an LV equity release calculator.

You can also use ours below to see approximately how much capital you could unlock from your property.

Liverpool Victoria Customer Reviews and Ratings

Liverpool Victoria has received mostly positive customer reviews online.

Customer reviews:

- LV Reviews for UK.TrustPilot.com

- Customer reviews of LV are available on Reviews.co.uk

- LV Reviewed on ReviewCentre.com

How Did We Review the Information On Liverpool Victoria?

We reviewed Liverpool Victoria based on the following:

- Reputation and History – How many years they have been in business, customer reviews, and industry rewards received.

- Financial Strength – Ensuring it is going strong and has adequate funds to meet long-term commitments.

- Product Range – We favour companies offering a variety of equity release schemes with greater product flexibility.

- Interest Rates and Fees – We review competitive rates compared to industry averages and they must be fully transparent about rates and fees without hidden costs.

- Customer Service and Support – When and how it is available, response times, and available online educational resources. As well as online tools, like a calculator.

- Code of Conduct and Compliance – We only consider companies that adhere to recognised industry standards and codes.

- Industry Insights and Peer Reviews – We care about a company’s industry-wide reputation.

- Innovation and Technology – Is there a streamlined, digital application process?

- Client Testimonials – Success stories and the complaints resolution process.

This is an unaffiliated, independent review of Liverpool Victoria.

Liverpool Victoria Complaints

Liverpool Victoria complaints can be directed via email, call, or by writing the company.

It’s complaints contact details are:

Phone: 0800 028 8974

Address: Box 2, LV=, County Gates, Bournemouth, Dorset, BH1 2NF.

Alternatively, you can air your grievances on any of the popular review sites, such as Trustpilot6 and Feefo, for it's attention.

Liverpool Victoria Pros and Cons

The advantages of Liverpool Victoria include equity release plans offered through an industry leader, Age Partnership.

The disadvantages include a reduced inheritance when releasing equity.

Liverpool Victoria Pros

- Equity release plans are offered in partnership with a reputable company, Age Partnership.

- No requirements for monthly repayments.

- Inheritance protection.

- You retain ownership of your home.

Liverpool Victoria Cons

- Relatively high advice fee at a percentage of the equity you unlock.

- Cumulative compound interest can add up to quite a large sum.

- Equity release will impact the amount of inheritance you can leave.

- Equity release may impact your means-tested benefits, now or in the future.

Learn More About Liverpool Victoria

Founded originally in 1843, LV= is a major provider of insurance and retirement solutions.

Age Partnership is the provider of LV= Equity Release schemes.

It is able to compare equity release schemes with a range of UK lenders and offer independent advice and preferential rates between 5.97% to 6.28%* that may not be available elsewhere.

The firm aims to assist advisers in helping their clients achieve their financial goals and retire with confidence.

LV=’s lifetime mortgages are tailored to the needs of the customer and provide a flexible approach to long-term financial planning.

It's online portal provides you with 24 / 7 access.

Liverpool Victoria FCA Details

FCA Address

County Gates, Bournemouth, Dorset, BH1 2NF, UK.

Trading Names

- Liverpool Victoria Financial Services Limited

- Great Deal

- LV=

- LV

- L.V.F.A.S.

- LVFAS

- F.A.S.

- FAS

- Financial Advice Services

- Liverpool Victoria

FCA Permitted Services

- Banking

- Insurance

- Pensions

- Investments

Regulators

Registration Numbers

- FCA Ref Number: 110035

- Companies House Number: 12383237

FCA and Companies House Link

- FCA Link: FCA Link

- Companies House Link: Companies House Link

Liverpool Victoria Contact Number

Liverpool Victoria’s contact number is:

0800 028 8974.

Common Questions

Is Liverpool Victoria a Member of the Equity Release Council?

Who Owns Liverpool Victoria?

Where Can I Find Liverpool Victoria Jobs?

Where is Liverpool Victoria Located?

Does Liverpool Victoria Offer Equity Release?

Is the Liverpool Victoria Equity Release Scheme Safe and Secure?

What Are the Pros and Cons of the Liverpool Victoria Equity Release Plan?

How Does the Liverpool Victoria Equity Release Scheme Work?

What Are the Interest Rates for the Liverpool Victoria Equity Release Plan?

Are There Any Hidden Fees in the Liverpool Victoria Equity Release Scheme?

Conclusion

Deciding whether to take out an equity release plan or not is a challenge in itself, never mind trying to choose a provider.

Liverpool Victoria is a well-established financial services provider with a proven track record in the equity release industry.

Working with Age Partnership to provide equity release services has only strengthened it's position in the market.

If you have decided that equity release is for you, then you may consider Liverpool Victoria to help you with some of the best equity release mortgages available for you.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.