Reverse Mortgage Calculator: How Much Can You Release in 2026?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

- A reverse mortgage calculator in the UK computes the amount of equity you can release from your property based on factors like your age, property value, and existing mortgage balance.

- You'll need to provide your age, the value of your property, and any outstanding mortgage balance you might have.

- Trusted websites such as the Equity Release Council or reputable equity release plan providers typically offer reliable calculators online.

- While it provides a useful estimate, it's not 100% accurate as it doesn't consider personal factors like health or lifestyle, which can influence the amount you can borrow.

- It can give you an estimate of your potential equity release based on specific details about your age and property value.

Did you know that as of 2026, 1 in 6 UK retirees are still paying off their home mortgages?1

At SovereignBoss, we understand your need for reliable and comprehensive information.

We have spent considerable time researching and simplifying complex data about reverse mortgages, with the aim to provide reliable advice.

We strive to help individuals understand the workings of a reverse mortgage, its calculators, and its potential suitability for pensioners.

In This Article, You Will Discover:

We will walk you through the ins and outs of reverse mortgages, guide you in using a reverse mortgage calculator, and help you understand its applicability for pensioners, ensuring that you are well-equipped to ascertain your eligibility for a reverse mortgage.

Let us help you make strategic decisions for a financially secure retirement.

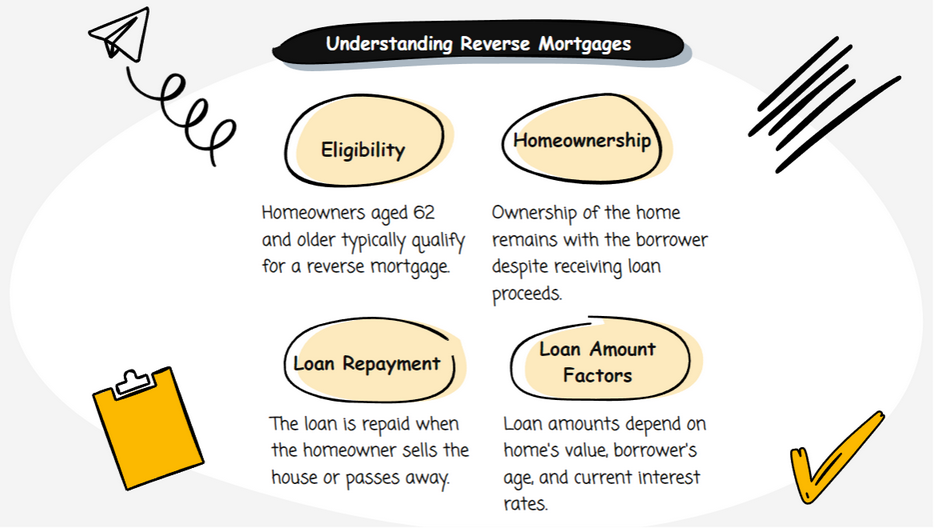

What Is a Reverse Mortgage?

A reverse mortgage, also known as a lifetime mortgage in the UK, is a loan available to homeowners aged 55 or older, allowing them to convert a part of their home equity into tax-free cash.

Unlike a conventional mortgage, there are no monthly repayments.

Instead, the loan amount, along with accrued interest, is repaid when the homeowner passes away or moves into long-term care.

How Do Reverse Mortgages Work?

Reverse mortgages work by enabling the homeowner to borrow against their home's equity.

The amount they can borrow depends on several factors such as their age, the value of their property, and the lender's policies.

The money received can be used for any purpose, such as supplementing pension income, funding home improvements, or covering healthcare costs.

Over time, interest accumulates on the loan, but the debt does not need to be repaid until the house is sold or the borrower passes away.

This enables homeowners to continue living in their homes while benefiting from their property's value.

How Do You Use a Reverse Mortgage Calculator?

To use a reverse mortgage calculator, simply input your age, the estimated value of your property, and any existing mortgage balance.

It is a helpful online tool that allows you to estimate the amount of money you could potentially borrow against your home's equity.

Once the information has been entered, the calculator will provide an approximate figure of how much you may be able to borrow.

Remember, this is just an estimate and actual amounts will depend on the specific terms offered by lenders.

Why not try our free instant reverse mortgage calculator today?

Is a Reverse Mortgage for Pensioners?

Absolutely. Reverse mortgages, or lifetime mortgages, are specifically designed for pensioners aged 55 and above who own their property.

They provide a valuable financial tool that allows pensioners to tap into the wealth tied up in their homes without having to sell or move out.

However, it is important to consider that the loan, plus interest, will reduce the value of your estate and may affect your entitlement to means-tested benefits.

It is always recommended to consult with an independent financial advisor or equity release professional when considering this option.

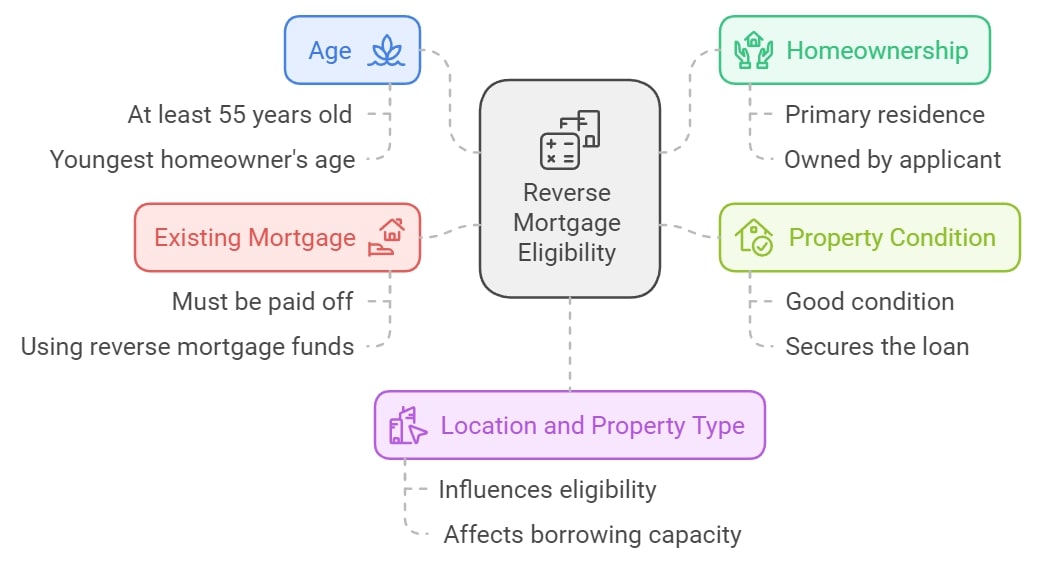

Do You Qualify for a Reverse Mortgage?

Qualifying for a reverse mortgage in the UK primarily depends on your age, homeownership status, and your property's condition.

More details:

- Age: You must be at least 55 years old. If the property is jointly owned, the age of the youngest homeowner is considered.

- Homeownership: The property, which should be your primary residence in the UK, must be owned by you.

- Property Condition: Your property should be in a good condition as it is used to secure the loan.

Additional criteria may include:

- Existing Mortgage: Any existing mortgage on your property must be paid off, possibly using the funds from the reverse mortgage.

- Location and Property Type: Your property’s location and type could influence your eligibility and borrowing capacity.

Remember, before opting for a reverse mortgage, seek advice from a financial advisor to understand the costs, features, and risks involved, as it reduces your estate's value and can affect your eligibility for means-tested benefits.

Common Questions

How Does a Reverse Mortgage Calculator Work in the UK?

How Much Money Do You Get From a Reverse Mortgage?

What Is the Downside of a Reverse Mortgage?

What Percentage of Equity Can You Get on a Reverse Mortgage?

Where Can I Find a Reliable Reverse Mortgage Calculator Online?

Are All Homes Eligible for a Reverse Mortgage or Are There Exceptions?

Is There a Difference Between a Reverse Mortgage and Equity Release?

How Do Interest Rates Impact the Reverse Mortgage Amount?

What Information is Needed for a UK Reverse Mortgage Calculator?

How Accurate is a Reverse Mortgage Calculator?

Can a Reverse Mortgage Calculator Help Me Understand My Potential Equity Release?

In Conclusion

A reverse mortgage can be an effective financial tool for homeowners aged 55 and over, providing you with the means to unlock the equity tied up in your home.

A reverse mortgage calculator particularly, can be invaluable in helping you estimate the amount you could potentially release, allowing you to plan your finances more effectively.

As with any significant financial decision, it is crucial to consider all the implications, including the potential impact on your estate and any means-tested benefits.

Always consult with a financial advisor who can guide you based on your personal circumstances and goals.

If you are considering this route to supplement your retirement income, make the most of a reverse mortgage calculator and speak to an expert today to explore your options.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?