Santander Equity Release Review (2026): Is It the Best Choice?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Santander assists with equity release by evaluating eligibility before connecting customers to Legal & General, a leading provider in the UK equity release market.

- While it does not offer equity release products directly, its referral agreement with Legal & General enables access to a variety of later-life mortgage solutions.

- Santander provides a free initial assessment for equity release eligibility, offering a smooth transition to comprehensive advice and products from Legal & General without upfront fees.

- Through its collaboration with Legal & General, Santander ensures customers receive tailored advice and access to products adhering to Equity Release Council standards, including the no-negative-equity guarantee.

- Despite Santander's facilitation, individuals should seek independent advice to ensure their equity release choice matches their personal financial plans.

Could Santander equity release be an option for you?

High Street banks are not renowned for their later-life mortgages offerings, so it pays to be aware of what is available to you.

If you are thinking of approaching Santander to discuss an equity release loan, the good news is that the bank may be able to assist thanks to its partnership with what could be regarded as one of the top equity release companies in the UK, Legal & General.

In This Article, You Will Discover:

At SovereignBoss, our research team has spent countless hours reviewing equity release information and putting it all together in an easy-to-read format.

Our content undergoes thorough verification and quality checks to ensure our readers have access to relevant, useful information.

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Santander. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Santander.

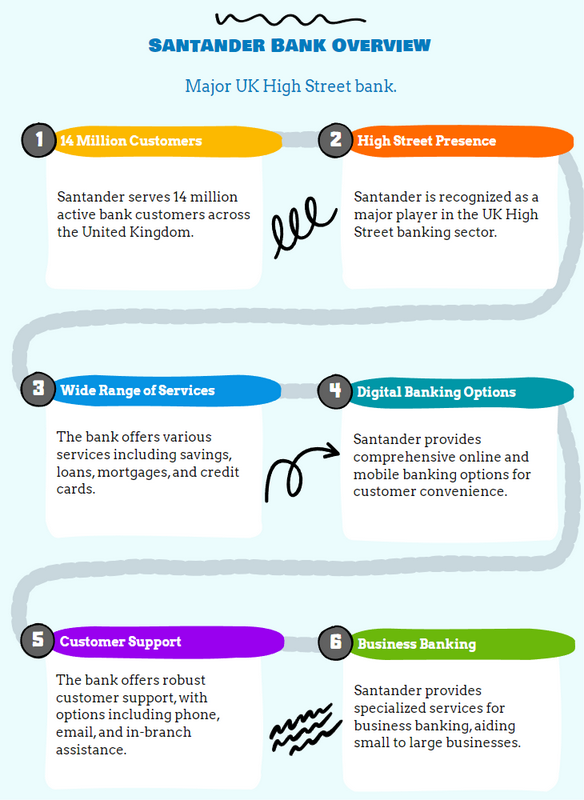

Who Is Santander?

Santander is one of the UK's major High Street banks and serves 14mln active customers.1

Why You May Consider Santander

You may consider Santander because it is an established financial provider and it is authorised and regulated in the UK by the Financial Conduct Authority (FCA)2 and Prudential Regulatory Authority (PRA).

More information:

- Santander evaluates equity release eligibility for its clients before connecting them with Legal & General for further services.

- This collaboration enables clients to explore lifetime mortgages and Retirement Interest-Only (RIO) mortgages, leveraging Legal & General's expertise.3

- Legal & General's a member of the Equity Release Council and received the 2021 Moneyfacts Best Equity Release Provider award.4

Does Santander Offer Equity Release or Lifetime Mortgages?

Santander does not offer equity release directly, but the bank does refer clients to Legal & General, with which it has an agreement regarding later-life mortgages.5

In 2021, Santander extended it's agreement with Legal & General Home Finance for another five years.6

This agreement allows Santander's Interest-Only mortgage clients to access lifetime mortgages when their Interest-Only plans come to an end and provides the bank's clients with a way to release equity from their homes.7

Does Santander Have an Equity Release Calculator?

No, Santander does not offer an equity release calculator as it does not provide these loans directly.

You can, however, access the equity release calculator available on the Legal & General website.8

You can also try our free calculator below for an approximation.

What Are the Advantages of Starting the Equity Release Process With Santander?

Starting the equity release process with Santander offers several advantages.

These include:

- Guidance: Santander provides initial guidance and eligibility assessment for equity release, ensuring clients understand their options and eligibility before proceeding.

- Access to Trusted Partners: Santander connects clients with Legal & General, a reputable provider with award-winning equity release products, ensuring quality and reliability.

- Safeguards: Through Legal & General, clients access products compliant with the Equity Release Council's standards,9 including the no-negative-equity guarantee for added security.

- Variety of Products: The partnership offers a range of equity release options, including lifetime and Retirement Interest-Only (RIO) mortgages, allowing for tailored financial solutions.

- Convenience: For Santander customers, the process is streamlined, leveraging the existing relationship for easier access and potentially quicker processing.

Overall, Santander's role in the equity release process is to provide a seamless and secure pathway for clients to access quality equity release products through a trusted partner.

Of course, it is essential to consider the cons as well as the pros when thinking about taking out equity release.

What Are the Disadvantages of Initiating the Equity Release Process Through Santander?

Initiating the equity release process through Santander could present a few potential disadvantages.

These may include:

- Limited Choices: Clients might face restricted options, potentially missing out on better-suited products due to the focus on a single partner.

- Single Provider Reliance: This dependency could hinder the ability to explore a wider range of products and deals.

- Increased Complexity: The referral process might complicate the equity release journey, adding steps for the client.

- Advice Gaps: Santander's initial screening and referral process may not cover all financial advice needs, possibly necessitating further independent consultation.

It is vital for clients to thoroughly research and weigh all options and implications before proceeding with any provider, including Santander, to ensure their equity release choice aligns with their financial goals and circumstances.

What Are Santander’s Fees for Equity Release Eligibility Checks?

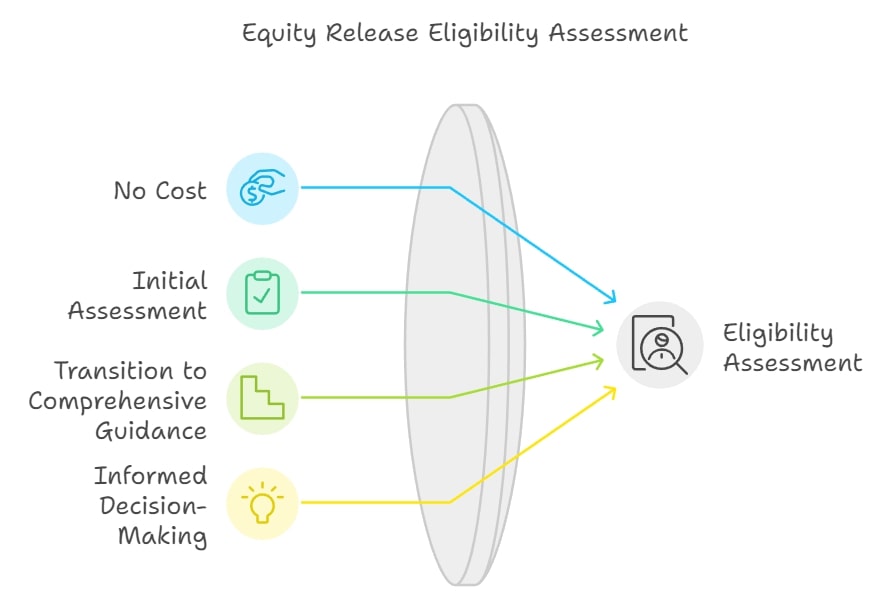

Santander generally provides an initial eligibility assessment for equity release at no cost, which is aimed at assessing whether you are a suitable candidate for more detailed advice from Legal & General.

This complimentary service is designed to help potential clients understand their eligibility without incurring any upfront fees, facilitating a smoother transition to comprehensive guidance and potentially suitable equity release products offered by Legal & General.

This approach allows individuals to explore their options confidently and make informed decisions about their financial future with minimal initial financial commitment.

Santander Customer Reviews

Santander customer reviews may help you find out more about other clients' experiences with the bank.

Take a look at these review sites:

How Did We Review the Information on Santander and Its Role in Equity Release?

To review the information on Santander and its role in equity release, we meticulously examined official resources from Santander, including their website and press releases, to understand their services and partnership with Legal & General.

Additionally, we considered industry analyses and customer feedback to gauge service effectiveness and satisfaction.

SovereignBoss is an unaffiliated, independent, third-party reviewer.

Our review of Santander is wholly autonomous.

Santander Complaints

If you are unhappy with your experience and would like to make a complaint, the best way to do this would be to reach out directly on the company website's Support page.10

An alternative may be to use a review site such as Trustpilot11 or Feefo12 and leave a review, and the bank may reach out to you to assist.

Learn More About Santander

Santander is a major retail and commercial bank in the UK and is a wholly-owned subsidiary of Spanish multinational financial services company Banco Santander.

The bank entered the UK market in 2004 when Banco Santander acquired Abbey National.13

Santander now boasts 14mln clients, of whom 7mln are digital.14

Regulatory Details

Santander's regulated by the Financial Conduct Authority (FCA)15 and authorised by the Prudential Regulation Authority (PRA).16

Current Trading Names

- Santander Corporate and Commercial

- Santander Business

- Cahoot

Previous Trading Names

- Santander Corporate and Investment Banking

- Santander Corporate

- Santander Global Corporate Banking

- Santander Corporate and Commercial Bank (SCCB)

- Bradford and Bingley

- Abbey National Plc

FCA-Permitted Services

- Insurance

- Investments

- Mortgages and Home Finance

- Consumer Credit

- Pensions

- Banking

Registration Numbers and Links

Santander's Contact Number and Address

- 0800 068 6064

- consumerservice@santander.co.uk

- 2 Triton Square, Regent's Place, London NW1 3AN.

Frequently Asked Questions About Santander and Equity Release

Is Santander a Member of the Equity Release Council?

Who Owns Santander?

Can I Apply for a Job at Santander?

Where Is Santander Located?

Is Santander Safe?

Final Thoughts on Santander's Role in Equity Release

Exploring equity release options for retirement with Santander presents a reassuring route for individuals looking to enhance their financial flexibility.

By joining forces with Legal & General, Santander unlocks a suite of specialised mortgage solutions and professional guidance aimed at catering to various retirement planning needs.

This alliance is dedicated to offering personalised advice, simplifying the process for customers to grasp their choices and how these align with their unique financial objectives.

The guidance and knowledge offered through the Santander equity release collaboration play a crucial role in helping secure your financial stability and prosperity during retirement.

The features mentioned and the amounts raised are subject to the lender’s criteria and terms and conditions. Lenders may take into account age and health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.