Sun Life Equity Release Review (2026): A Complete Evaluation

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- SunLife lets you swap some home value for tax-free cash or a steady income without moving out, but watch out for benefits and inheritance impacts.

- Ideal for seniors needing a financial boost, with the option for partial repayments to manage the loan's growth and interest accumulation over time.

- Feedback shows happy customers thanks to SunLife's transparency on fees and interest rates, though it's important to note that there are niggles about interest and estate effects.

Are you approaching retirement and wondering how to secure the financial freedom you deserve? SunLife equity release might just be the solution you're looking for.

With more and more people across the UK choosing to unlock the value in their homes, funding your retirement has never been more accessible, and you could be one of them.

At SovereignBoss, we've done the hard work for you—our expert team has researched the equity release market inside and out, so you can confidently make an informed decision.

Could SunLife's equity release be the key to your retirement plans? Keep reading to find out...

In This Article, You Will Discover:

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of SunLife. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by SunLife.

Who Is SunLife, and What Equity Release Services Do They Provide?

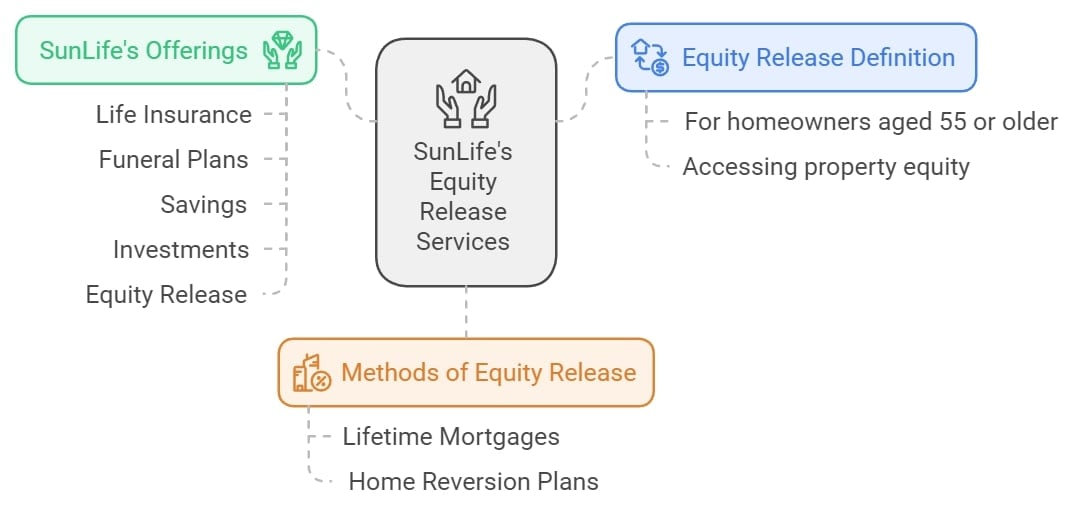

SunLife is a financial services company, offering equity release products to UK homeowners who want to unlock the value of their homes.

Here's what you need to know about SunLife:

What Is Equity Release in the UK?

Equity release is a financial product for homeowners, typically aged 55 or older, enabling them to access the equity in their property without selling it.

Typical schemes include lifetime mortgages and home reversion plans.

Who Is SunLife and What Do They Offer in Equity Release?

SunLife is a UK-based financial services company that offers a range of products and services in equity release, including life insurance, funeral plans, savings, investments, and equity release.1

In 2018, SunLife partnered with Age Partnership, one of the UK’s largest equity release brokers, and in 2022, it partnered with Standard Life Equity Release, a trading name for Key Retirement Solutions Ltd.

SunLife has been in business since 1810 and aims to help people over 50 enjoy a brighter financial future by offering simple, affordable, and flexible solutions.

Why Should You Consider Choosing SunLife for Your Equity Release?

You should consider choosing SunLife for your equity release because of their straightforward equity release solutions, tailored to meet the financial needs of older homeowners.

Take these factors into consideration:

Why Should You Consider SunLife for Your Equity Release?

You should consider SunLife for your equity release because it's a credible financial service provider that has been serving customers for over 200 years, best known for its range of services that are aimed at customers over 50.2

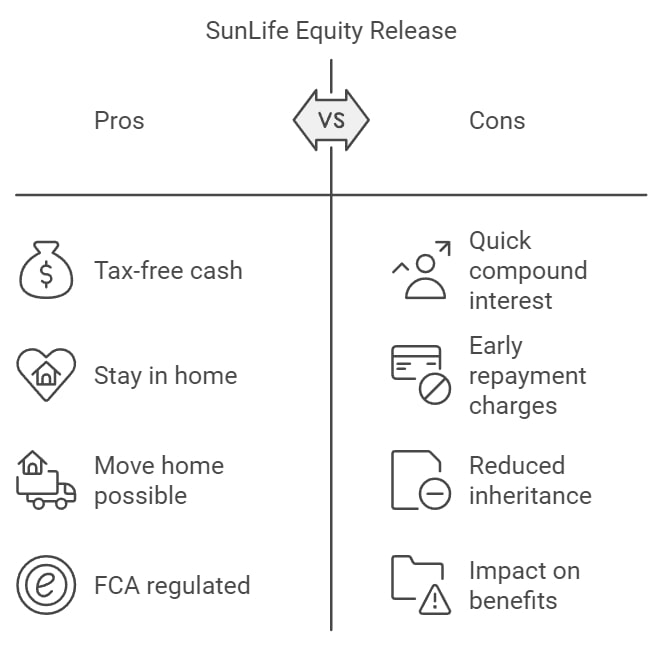

What Are the Pros and Cons of SunLife Equity Release?

The pros and cons of SunLife equity release are that you can access a variety of lifetime mortgage options, but the value of your inheritance will likely be negatively affected.

Let's look closely at these benefits and drawbacks:

Pros

The pros of SunLife equity release include receiving tax-free cash and the assurance that you're dealing with a regulated and accredited company.

These are the pros:

- You unlock tax-free cash.

- You continue to live in your own home until you or your partner if named on your equity release scheme, die or move into a care home.

- You can still move home with an equity release scheme but fees may apply.

- The Financial Conduct Authority (FCA) regulates its equity release schemes.

Cons

The cons of SunLife equity release include its impact on means-tested benefits and rigidity regarding early repayments.

These are the cons:

- Compound interest can roll up quickly.

- There is little flexibility when it comes to early repayments—you will nearly always face an early repayment charge.

- Your family’s inheritance will be reduced.

- Releasing equity may impact your means-tested benefits, now or in the future.

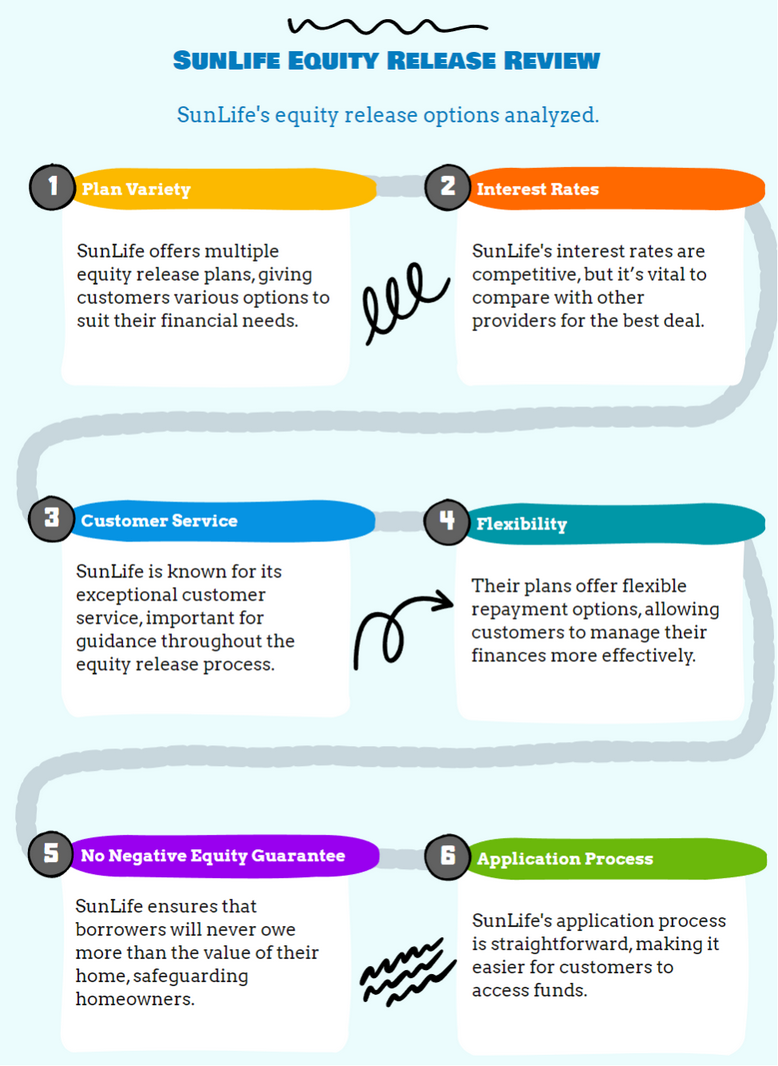

How Does SunLife's Equity Release Offerings Compare to Other Providers?

SunLife's equity release offerings are competitive, focusing on customer-friendly terms, clear communication, and personalised advice.

Here's how SunLife compares:

How Does SunLife Equity Release Compare to Other Providers in Terms of Value and Services?

In terms of value and services, SunLife equity release offers competitive interest rates and a transparent fee structure compared to other providers, which many find to be more advantageous compared to other equity release providers.

Unlike some providers that might offer a one-size-fits-all solution, SunLife focuses on tailoring their services to meet individual financial situations, proving particularly attentive and personalised and ensuring you feel supported throughout the entire process.

What Are the Interest Rates for SunLife Equity Release in 2026?

The interest rates for equity release with SunLife in 2026 depend on various factors such as your age, health, property value, loan amount, and the type of plan you choose.

Depending on your situation, equity release interest rates can range from 5.97% to 6.28%*.

*While we regularly review our rates, these may have changed since our last update.

Can SunLife's Equity Release Calculator Help You Plan Your Finances?

Yes, SunLife's equity release calculator can help you plan your finances, proving to be a useful tool for estimating potential release amounts and aiding in financial planning.

Use these estimates and tools to help you plan:

Does SunLife Have an Equity Release and Lifetime Mortgage Calculator?

Yes, SunLife does have a free online equity release calculator that can help you estimate how much money you could release from your home with a lifetime mortgage, while not requiring any personal details.

All you need to enter is your age and the value of your property, and the calculator will show you the minimum and maximum amount that you could borrow on standard or enhanced terms.

You can also use our equity release calculator below to find approximately the best deal for you!

How Can You Effectively Use the SunLife Equity Release Calculator to Estimate Your Equity Release Amount?

You can effectively use the SunLife equity release calculator to estimate your equity release amount by entering accurate information about your age, property value, and any outstanding mortgage or loans secured against your home.

This tool is invaluable for planning purposes, allowing you to consider how equity release could fit into your financial landscape in retirement.

What Feedback Do Customers Give About SunLife's Equity Release Services?

The feedback that customers give about SunLife's equity release services often show praise for their clear advice, efficient service, and ease of the application process.

Read more about what people have to say:

What Do Customer Reviews Say About SunLife Equity Release?

Customer reviews show that SunLife has a 4.7 rating on Trustpilot, making it a favourable option for releasing equity.

Sunlife won the 2021 Feefo Trusted Service for consistently delivering excellence.

You can view its customer reviews and ratings below:

What Success Stories Do Customers Share About Their Experience with SunLife Equity Release?

Some success stories that customers share with regard to SunLife equity release show that these products have enabled them to live more comfortably in retirement, using the funds to supplement their pension, renovate their homes, or even help family members financially.

These stories often mention the ease and clarity of the process, with SunLife providing detailed guidance every step of the way.

These stories serve as testimonials to the positive impact that SunLife's equity release plans have had on the lives of many, offering both financial relief and the opportunity to enjoy retirement to the fullest.

How Did We Review SunLife's Equity Release Services?

We reviewed SunLife's equity release services by reviewing factors such as customer ratings and cost of service.

We also compared SunLife with other equity release providers in the market to see how it fares in terms of interest rates, fees, features, and flexibility.

These are the criteria:

- The range and quality of its equity release products

- The level and cost of its advice service

- The customer satisfaction and ratings

- The reputation and experience of the company

- The compliance with the Equity Release Council standards

How Does SunLife Handle Equity Release Complaints?

SunLife handles its equity release complaints by encouraging customers to lodge a complaint directly on the website.

The alternative is to use a review site such as Trustpilot or Feefo and leave a review, which will allow the team to quickly reach out to you to assist.

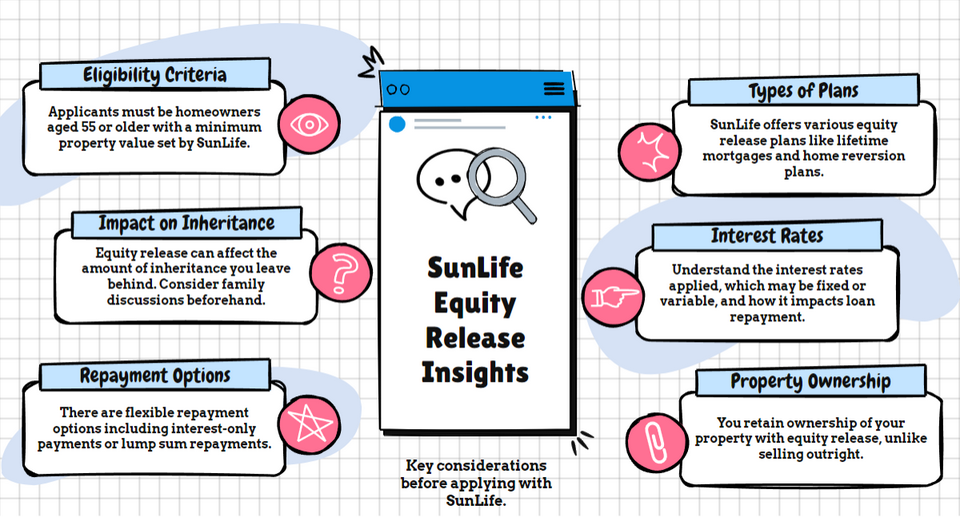

What Should You Know Before Applying for Equity Release with SunLife?

Before applying for SunLife equity release, you should know and understand the impact on inheritance, potential costs, and the importance of seeking independent advice.

Keep these points in mind:

What Are the Long-Term Financial Implications of Choosing SunLife for Equity Release?

The long-term financial implications of choosing SunLife for equity release typically include a reduction in the amount of inheritance you can leave to your family, so always chat with a financial adviser to understand how equity release fits into your overall retirement planning strategy.

SunLife's plans, however, are designed with features to mitigate this impact, such as the option to make voluntary repayments or choose a plan with inheritance protection.

What Are the Qualification Criteria for SunLife Equity Release?

The qualification criteria for SunLife equity release include property types and minimum qualifying ages.

To find out more about qualifying, it is best to consult a professional advisor or broker directly.

These are the factors that form the criteria:

- Minimum Amount of Equity Offered: £10,000 (lifetime mortgage)

- Mortgage: You must have little or no outstanding mortgage on your property

- Minimum Qualifying Age: 55 years

- Property Minimum Value: £70,000

- Property Types: Houses that are detached, semi‑detached, or terraced, bungalows, and flats

- Main Residence: Your property must be in the UK and must be your main residence.

What Is the Step-by-Step Process for Applying for Equity Release with SunLife?

The step-by-step process for applying for equity release with SunLife begins with contacting SunLife for an initial consultation, where they assess your needs and eligibility.

Following this, SunLife provides you with a personalised equity release plan, detailing the amount you can release and the associated costs.

After you decide to proceed, SunLife will guide you through the application paperwork, property valuation, and legal checks, leading up to the final approval and release of funds.

What Are the Fees Associated with SunLife Equity Release?

The fees associated with SunLife equity release include solicitor fees and arrangement fees, though the exact fees may depend on the product you choose and your individual circumstances.

Equity release setup costs, however, are typically between £1,500 and £3,000.3

Common fees include:

- Advice Fees

- Arrangement fees

- Valuation fees

- Solicitor fees

Does SunLife Offer Lifetime Mortgages and Home Reversion Schemes?

No, SunLife only offers lifetime mortgages.

SunLife Limited is officially authorised to introduce the SunLife Equity Release Service.

This service operates under the trading name of Key Advice Solutions Limited, which specialises in advising and organising equity release transactions in the form of lifetime mortgages.

What Are the Range of Services Offered by SunLife?

The range of services offered by SunLife includes home insurance and equity release, offering services targeted at those over 50.

These include:

- Life insurance

- Equity release

- Funeral plans

- Home Insurance

How Can You Get in Touch with SunLife Regarding Equity Release Inquiries?

You can get in touch with SunLife regarding equity release inquiries by going directly through their website, or customer service hotline, or by arranging a consultation with their advisers.

Here's more regarding SunLife's contact info:

SunLife's Financial Conduct Authority (FCA) Registration Details

SunLife's Financial Conduct Authority (FCA) registration details include their registration information and address.

See below:

Regulators

Registration Numbers

- FCA Reg Number: 769427

FCA and Companies House Link

- FCA Link: FCA Link

- Companies House Link: Companies House Link

How to Contact SunLife for Equity Release Inquiries

- +44 1256 841 414

- contactus@sunlife.co.uk

- SunLife 1 Wythall Green Way, Wythall, Birmingham B47 6WG.

Frequently Asked Questions About SunLife Equity Release

Is SunLife Accredited by the Equity Release Council?

Who Owns SunLife?

Does SunLife Offer Jobs?

Where Can You Find SunLife's Offices in the UK?

Does SunLife Offer Equity Release?

Is SunLife Equity Release Safe?

What Are the Pros and Cons of Sun Life Equity Release?

Is Sun Life Equity Release a Good Deal for Seniors?

How Does Sun Life Equity Release Work?

What Are the Customer Reviews for Sun Life Equity Release?

How Can I Apply for Sun Life Equity Release?

Conclusion: Making an Informed Decision About Sun Life Equity Release

SunLife has firmly established itself as a top choice for UK homeowners exploring equity release options.

Its commitment to prioritising customers, combined with its competitive product suite and a strong industry reputation, underscores its position as a leading player in the equity release landscape.

Furthermore, its consistent performance and trustworthiness have further cemented its standing among its peers.

However, as with any significant financial decision, it is always prudent to seek guidance from a financial adviser before delving into SunLife equity release schemes.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.