How Does Equity Release Work in 2026? Discover More

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

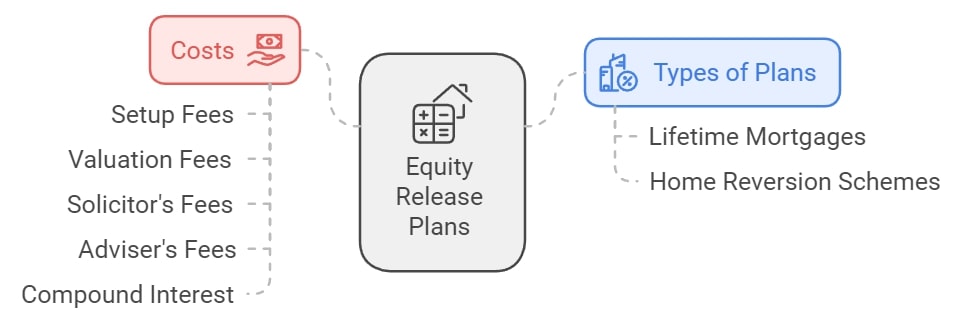

- Equity release lets homeowners tap into their property's value through lifetime mortgages or home reversion plans, and to qualify, you need to be over a certain age, own valuable property, and meet lender-specific rules.

- You can get a loan based on your home's value or sell a part, with payback due when you pass away or sell the house.

- Costs to take into account include interest rates in the 5.97% to 6.28%* range, setup fees, and possibly advice fees, all of which depend on your home value and age.

Did you know that, according to statistics, UK homeowners unlocked over £6.2 billion in property wealth in 2022?1 Unsurprisingly, many are asking, What is equity release, and how can it benefit me?”

If you’re retired or planning your later-life finances, now is the perfect time to explore whether equity release could be the right solution for you. By unlocking the value of your home, this financial option offers flexibility and security to meet your unique needs.

At SovereignBoss, we’ve immersed ourselves in the latest developments in later-life finance to provide you with clear, reliable insights.

Ready to learn how equity release works and if it fits your retirement goals?

Let’s get started...

In This Article, You Will Discover:

What Is Equity Release and How Does It Work in the UK?

Equity release in the UK enables homeowners aged 55 and above to unlock the financial value of their property without selling it, and it works by offering tax-free cash while allowing the homeowner to remain in their home until they pass away or move into long-term care.

Let's take a look:

What Is Equity Release?

Equity release is a financial solution enabling homeowners aged 55 and over to unlock the value of their property without selling it, offering either a lump sum or a flexible drawdown facility—depending on the homeowner’s needs and the property’s value.

Repayment is usually deferred until the property is sold, which occurs after the homeowner passes away or transitions into long-term care.

Here's a little more about the mechanics of equity release:

How It Works

Equity release works by allowing homeowners to unlock the value of their property either through a loan secured against their home or by selling a portion of it.

It provides access to funds in the form of a lump sum or a drawdown facility, based on the property’s value.

Repayment is deferred until the homeowner passes away or moves into long-term care, making it a practical way to benefit from the wealth tied up in their home during their lifetime.

Costs to Consider

Equity release comes with certain costs to consider, such as interest rates, setup fees, and advice fees.

These expenses vary based on your age, property value, and the specific plan you choose, with interest rates that typically fall within a range of 5.97% to 6.28% accumulating over time.

Understanding these costs is crucial to making an informed decision about releasing equity from your home.

Why Now?

In 2022, UK homeowners accessed over £6.2 billion through equity release, highlighting its growing popularity as a financial solution.

With increasing interest in unlocking property wealth, understanding how equity release works can help you decide if it aligns with your retirement planning goals and financial needs.

Why Trust Us?

At SovereignBoss, we stay updated on the latest developments in later-life finance.

We’re here to help you understand your options and decide if equity release fits your needs.

Breaking Down Equity Release in the UK

Equity release allows you to access some of the cash tied up in your home without moving out.

There are typically 2 main ways to do this:

- Lifetime Mortgage: You borrow money against your home's value, with the loan secured by your property. Interest accrues over time, but repayment isn’t required until you pass away or move into long-term care.

- Home Reversion Plan: You sell part or all of your home to a provider in exchange for a lump sum or regular payments. While you continue living in your home, the provider owns a portion of it.

In both cases, you can choose to receive the money as a one-off payment, through regular withdrawals, or a combination of both.

You maintain the right to live in your home until the end of the agreement, ensuring financial flexibility while staying in your home.

A Brief History of Equity Release in the UK

Equity release in the UK traces its origins to the first recorded case in 1971.2

Initially, the industry faced criticism due to poor regulation and unfair practices; however, the establishment of SHIP (Safe Home Income Plans), now the Equity Release Council (ERC), in 1991, alongside stricter Financial Conduct Authority (FCA) regulations, transformed the sector.3

Today, it is a trusted financial solution, providing retirees with greater flexibility and security.

What Types of Equity Release Plans Are Available and What Are Their Costs?

The types of equity release plans available include lifetime mortgages and home reversion plans, with costs that typically include setup fees, interest rates, and reduced inheritance due to accrued interest or home ownership transfer.

Here's a closer look:

What Are the Different Types of Equity Release Plans in the UK?

The different types of equity release plans in the UK are, as mentioned, lifetime mortgages and home reversion plans.

Both options provide access to property equity, but they function differently.

Some providers, however, offer flexible products allowing you to tailor plans to your individual needs.

What Are the Costs Associated With Equity Release Schemes?

The costs associated with equity release schemes include setup fees, valuation fees, solicitor’s fees, and adviser’s fees, typically totalling between £1,500 and £3,000.4

Additionally, compound interest on lifetime mortgages can significantly increase repayment amounts.

However, since 31 March 2021, homeowners can voluntarily repay part of the loan and interest annually, reducing long-term costs.5

How Much Equity Can You Release From Your Property?

The amount of equity you can release from your property depends on various factors like your age, the property's value, and your health condition.

Typically, the older you are, the more equity you can release, with amounts typically ranging from 20% to approximately 60% of the property's value.

What is a Lifetime Mortgage?

A lifetime mortgage is a type of loan secured against your home—this loan including any accumulated interest, is repaid when you pass away or move into long-term care.

With a lifetime mortgage, you retain full ownership of your home and have the flexibility to make repayments or allow the interest to roll up over time.

What Is a Home Reversion Scheme in Equity Release?

A home reversion scheme in equity release allows you to sell part or all of your property to a provider in exchange for a lump sum or regular payments.

You retain the right to live in your home rent-free for the rest of your life, but ownership of the sold portion transfers to the provider.

When the property is sold after your death or move into long-term care, the provider receives their share of the proceeds, including any increase in property value.

What Is the Most Popular Type of Equity Release Scheme?

The most popular type of equity release scheme is the lifetime mortgage, due to their flexibility and the fact that the homeowner retains full ownership of the property.

Lifetime mortgage plans make up over 99% of all products selected by UK homeowners, with home reversions selected by less than 1%.6

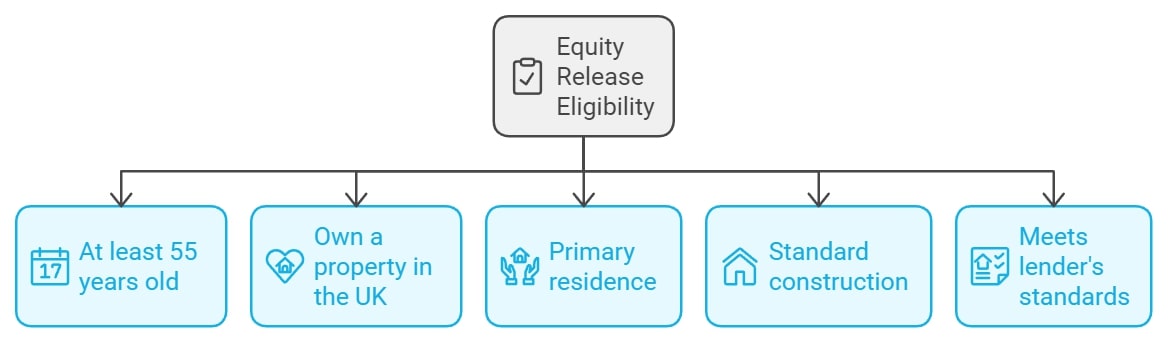

Who Is Eligible for Equity Release and What Are the Requirements?

Equity release is available to UK homeowners aged 55 or older who own a qualifying property, and eligibility requires the property to be your primary residence and typically valued at £70,000 or more.

Specific requirements depend on the provider and product, ensuring the plan meets your individual needs.

This is what you need to know:

What Criteria Must Be Met for Equity Release in the UK?

The criteria that must be met for equity release include being 55 years old or older and the property being your primary residence.

Essential equity release criteria include the following:

- At least 55 years old (usually 65 for a home reversion scheme).

- Own a property in the UK.

- The property must be your primary residence.

- The property must be of standard construction and meet certain standards set by the lender.

Can Individuals Under 55 Access Equity Release Options?

Individuals under 55 cannot usually access standard equity release products, as these are designed for homeowners aged 55 and above; however, alternatives such as secured loans or remortgaging may provide similar financial solutions.

For those in joint ownership, equity release may still be an option if one partner meets the age requirement, or waiting until reaching the minimum age may be necessary.

Consulting a financial adviser is essential to explore available alternatives and ensure the best solution for your circumstances.

What Is the Maximum Loan to Value in Equity Release Mortgages?

The maximum loan-to-value (LTV) in equity release mortgages typically ranges from 20% to 60%, depending on factors like your age, property value, and the specific product.

Older homeowners generally qualify for higher LTV ratios.

What Is the Minimum Borrowing Amount for an Equity Release Loan in the UK?

The minimum borrowing for an equity release loan in the UK can vary by provider, but typically starts at around £10,000.

It may be £15,000 with other lenders.

The minimum you can usually withdraw from your drawdown cash facility is £5,000.

Will I Be Eligible for Tax With Equity Release in the UK?

No, you will not be eligible for equity release tax.

Funds released are tax-free, but how you use the money could be subject to tax.

How Are Interest Rates Determined for Equity Release Mortgages?

Interest rates for equity release mortgages are determined by factors such as the loan-to-value (LTV) ratio, the homeowner's age, property value, and market conditions.

Providers also consider product-specific features, such as fixed rates or flexible repayment options, when setting rates.

Take a look:

What Are the Current Interest Rates for Equity Release Loans?

The current equity release interest rates have increased, and many clients can expect rates between 5.97% to 6.28%*.

*We regularly review our rates, but these may have changed since our last update.

How Are Interest Rates Calculated for Equity Release Mortgages?

Interest rates for equity release mortgages are calculated as either fixed or variable, depending on the specific product and provider.

These rates are typically compounded, meaning interest accrues not only on the initial loan amount but also on previously added interest, which can significantly increase the total owed over time.

However, many plans allow you to repay the interest monthly, preventing it from compounding and reducing the overall cost of borrowing.

What Are the Main Uses of Equity Release Loans in the UK?

The main uses of equity release loans in the UK include supplementing retirement income, funding home improvements, and consolidating debts.

More of the main equity release uses include:

- Supplementing retirement income

- Paying off existing debts

- Home improvements

- Helping family members (such as a deposit for a house)

- Financing lifestyle expenses such as travel

It provides financial flexibility in retirement, but careful consideration is needed due to potential impacts on inheritance and entitlements to means-tested benefits.

Are There Restrictions on Using Money Released From Equity Release?

Generally, there are no restrictions on how you can use the money released from equity release—as long as it is legal.

From home improvements and holidays to clearing debt or helping family, the choice is yours.

However, it is advised to use the funds responsibly due to the long-term financial implications.

What Is the Application Process for an Equity Release Plan?

The application process for an equity release plan involves consulting a qualified financial adviser, assessing eligibility, obtaining a property valuation, selecting a suitable plan, completing the application with a solicitor's assistance, and finalising the agreement with the lender.

It typically takes up to 12 weeks but may vary depending on the provider and individual circumstances.

Are There Fast-Track Equity Release Options Available for Quick Access to Funds?

Yes, certain equity release providers offer fast-track options designed for quicker access to funds, often within a few weeks.

These options typically involve simplified application processes and expedited property valuations, making them ideal for those needing immediate financial support or funds for urgent expenses.

To determine availability, it’s essential to consult your provider and understand any additional costs or criteria associated with fast-track services.

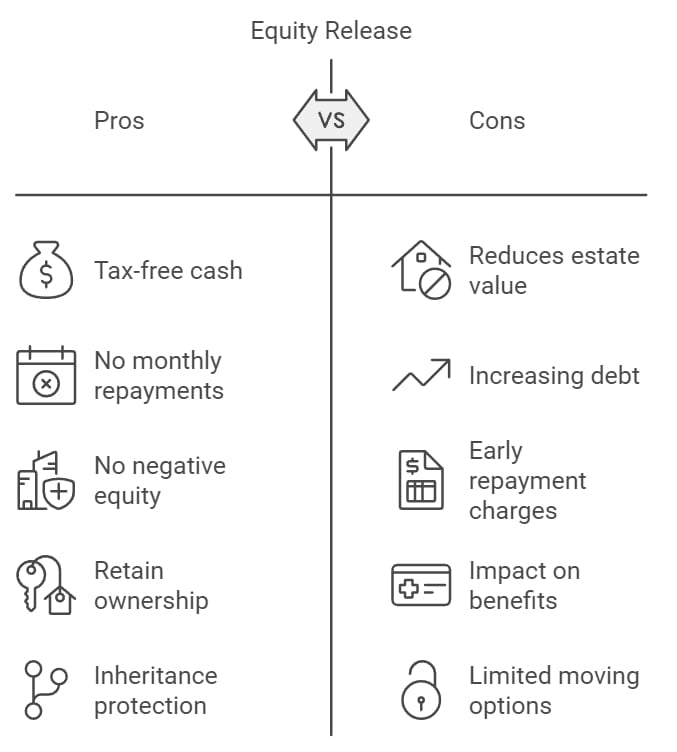

What Are the Advantages and Disadvantages of Opting for Equity Release?

The advantages of opting for equity release include accessing tax-free cash and supplementing retirement income; however, disadvantages involve accruing interest and potentially affecting eligibility for means-tested benefits.

Let's look at the pros and cons:

What Are the Pros and Cons of Equity Release in the UK?

The pros and cons of equity release include access to tax-free cash, but it potentially will reduce your estate value.

We have broken down these details further:

Advantages

- Access to tax-free cash

- No monthly repayments required

- No negative equity guarantee

- Retain full property ownership (with lifetime mortgages)

- Potential inheritance protection

Disadvantages

- Reduces your estate value

- Compound interest can significantly increase the debt

- Possible early repayment charges

- Potential impact on means-tested benefits

- Limited moving options

Is Equity Release a Good Idea for You?

Whether equity release is a good idea for you depends on your financial needs, goals, and circumstances.

Equity release can be a good idea if you need additional retirement funds, want to stay in your home, and are comfortable with reducing your estate’s value.

Always remember that professional advice is essential.

How Does Equity Release Impact Your Financial Planning and What Are the Alternatives?

Equity release impacts your financial planning by providing immediate tax-free funds while reducing your home’s equity, potentially affecting inheritance and means-tested benefits; alternatives include downsizing, personal loans, or even family financial support, depending on your goals.

Check out the impacts and alternatives:

How Safe Is Equity Release for Over 55s in the UK?

Equity release is generally safe for over 55s in the UK when using providers regulated by the FCA; safeguards like the no negative equity guarantee ensure you will never owe more than the value of your property, providing financial security.

Most equity release providers are also members of the ERC, which enforces strict standards to protect consumers including requiring legal advice and ensuring transparency, making equity release a secure option when carefully evaluated with professional guidance.

How Does Equity Release Affect Your Pension Income and Retirement Planning?

Equity release can enhance your pension income by providing additional funds; however, its impact on retirement planning must be carefully considered to ensure it aligns with your long-term financial goals and does not jeopardise future security.

Seeking advice from a financial adviser is essential to integrate equity release into a comprehensive retirement strategy.

This ensures the funds complement your pension income and provide financial stability without compromising your overall plans.

What are the Alternatives to Equity Release?

The alternatives to equity release include downsizing, using personal savings or investments, seeking family financial support, or even exploring government grants or benefits.

Alternatives to equity release include:

- Downsizing to a smaller property

- Taking in a lodger

- Seeking help from family

- Saving more into a pension

- Investing in other financial products

- Releasing funds from other assets

Each has its advantages and disadvantages, and professional advice is recommended to make an informed decision.

Which Companies Provide Equity Release Schemes in the UK?

The companies that provide equity release schemes in the UK include Aviva and Legal & General, offering flexible lifetime mortgages and home reversion plans tailored to homeowners' financial needs.

Key providers include:

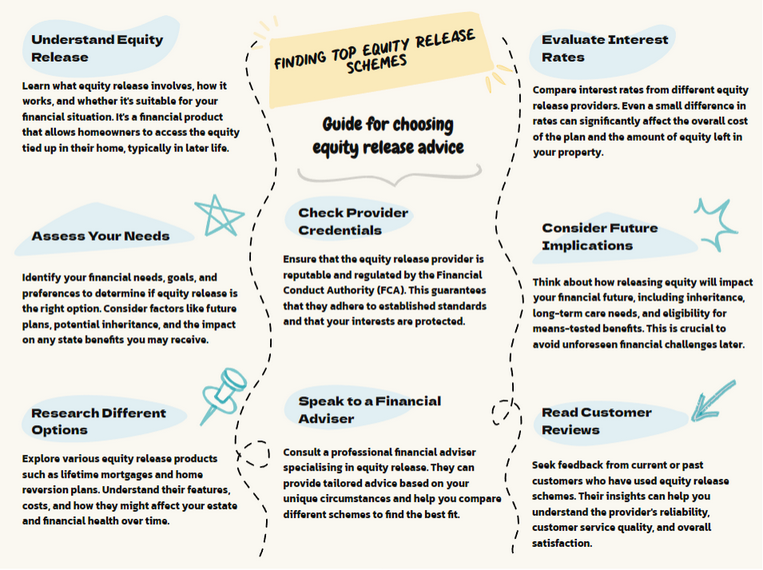

How Can You Find the Best Equity Release Scheme and Get Professional Advice?

You can find the best equity release scheme by comparing offers from multiple providers and seeking professional advice from an independent financial adviser or equity release specialist to ensure you choose a plan that suits your financial goals and needs.

Here's what you need to do:

How Can You Choose the Best Equity Release Scheme for Over 55s?

You can choose the best scheme by understanding your financial needs, seeking professional advice, and comparing plans from multiple providers.

Consider interest rates between 5.97% to 6.28%*, flexibility, the reputation of the provider, and any additional features like inheritance protection or downsizing protection.

* While we regularly review our rates, these may have changed due to changing market conditions since our last update.

Where Can I Get Professional Equity Release Advice in the UK?

You can get professional equity release advice in the UK from independent financial advisers or brokers specialising in these products.

This ensures they are qualified, have a wide knowledge of the market, and adhere to regulations set by the FCA and preferably the ERC as well.

How Can You Compare UK Equity Release Schemes and Find the Best Deals?

You can compare UK equity release schemes and find the best deals by evaluating interest rates, loan-to-value ratios, flexibility, fees, and provider reputation.

You can also use comparison tools, consult independent financial advisers, and explore multiple providers to find the best deals tailored to your financial needs—these are some of the best ways to find deals suited to you.

Comparing equity release schemes involves looking at:

- Interest rates

- Setup fees

- Flexibility of the product

- Customer service of the provider

Can Equity Release Be Accessed Anywhere in the UK, Including Northern Ireland?

Equity release can be accessed anywhere across the UK, including Northern Ireland; however, availability may vary depending on the provider, so it's essential to check with individual lenders to ensure they offer products in your specific location.

Each provider will have its own criteria, which may influence the availability and amount of equity you can release.

Are There Equity Release Companies I Should Avoid in the UK?

Yes, there are equity release companies to avoid, especially if they are unregulated or non-mainstream.

Also, be sure to avoid any lenders who are willing to give you the money right away because the process should typically take a few weeks when carried out correctly—it is not an instant loan.

Where Can You Get an Equity Release Quote?

You can get an equity release quote online from most providers or through an adviser or broker.

Remember, these quotes are generally illustrative and your actual amount may vary depending on the provider's assessment and your circumstances.

How Does an Equity Release Calculator Work?

An equity release calculator works by estimating the amount you could release from your home through inputting the age of the youngest homeowner and an estimate of your property value.

It is a useful tool for understanding potential borrowings, but, once again, a full assessment with an adviser is needed for an accurate quote.

Note that by using our calculator, you can get a free initial consultation with Age Partnership.

How Does a Compound Interest Calculator Aid in Equity Release Planning?

A compound interest calculator aids in equity release planning by illustrating how interest accumulates over time on your loan, helping you assess the long-term financial impact, compare different equity release products, and make well-informed decisions.

By entering details such as the loan amount, interest rate, and repayment duration, the calculator estimates the total amount owed in the future.

This clarity ensures you understand the costs involved and can determine whether equity release aligns with your long-term financial objectives.

Essential Jargon for Understanding Equity Release

The essential jargon for understanding equity release includes terms like lifetime mortgage, loan-to-value ratio, compound interest, no negative equity guarantee, and home reversion, which clarify the key features and mechanics of equity release schemes.

We have compiled a list of essential equity release jargon to help you navigate the A to Z of these versatile retirement mortgages.

What is the Latest News on Equity Release in the UK?

The latest equity release news is that the Equity Release Council has launched new post-completion guidance that is designed to help a remaining homeowner or family member understand how these products work.

This is a great communication tool to avoid complications during the completion process.

You can find it on the ERC’s website.7

Common Questions About Equity Release Answered

How Can I Get the Best Equity Release Deal?

Can I Repay My Equity Release Plan Early?

What Happens to My Equity Release if I Need Long-Term Care?

Can I Move House After Taking Out an Equity Release Plan?

Can I Release Equity From a Buy-To-Let Property?

How Could Rising Interest Rates Impact Me?

Can I Remortgage My Existing Equity Loan?

How Do I Know I am Getting the True Market Value of My Property?

Is Equity Release More Expensive Than a Regular Mortgage?

Will My Credit Score Impact My Eligibility?

Can I Include an Additional Borrower in My Plan in the Future?

What Happens if My Equity Release Lender Stops Trading?

Where Can I Get an Equity Release Guide?

In Conclusion: Is Equity Release Right for You?

Equity release offers retirees the opportunity to unlock the value of their home and gain greater financial flexibility; however, it’s a decision that requires careful thought and expert advice.

As you consider your options, take the time to fully understand what equity release is and how it fits into your retirement goals. Remember that equity release is a long-term commitment that can have substantial impacts for your estate and future financial planning.

With the right guidance, you can make a choice that brings you financial peace of mind and supports your future aspirations.

* While we regularly review our rates, these may have changed due to changing market conditions since our last update.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?