2026 Alternatives to Equity Release: Top Options

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Downsizing your home, taking out a personal loan, or using retirement savings are some of the best alternatives to equity release.

- You can access your property wealth without equity release by renting out part of your property, remortgaging, or selling and downsizing.

- Alternatives such as a retirement interest-only mortgage or using savings may be cheaper than equity release.

- Options like downsizing or remortgaging can potentially mitigate the risks associated with equity release.

- Equity release alternatives can offer better control over your property and savings, but may also require larger immediate payments or lead to a reduction in your living space.

Equity release is becoming a more and more popular option for UK retirees, but have you considered equity release alternatives?

With over £6.2bln in equity having been released in the UK in 2022,1 it is clear that it has become a viable mainstream option.

However, releasing equity is a big decision, as this type of loan is meant to be a lifetime commitment.

Before you consult a financial advisor to have equity release explained, it may be wise to consider whether any other options are open to you.

In This Article, You Will Discover:

At SovereignBoss, our expert team has delved into the details of how UK homeowners are planning for retirement.

We have studied statistics compiled by local financial advisors and combed the industry to discover the top 12 other options for retirees in 2026.

If you like to learn more about these, we have summarised them for you here.

Take a look RIGHT NOW!

What Is Equity Release?

Equity release schemes, allow property owners to draw upon their home's value.

This option is particularly beneficial for those looking to supplement retirement income or cover unexpected costs.

By choosing equity release, homeowners enjoy the dual benefits of accessing funds and staying in their beloved home.

It's a solution that balances financial needs with emotional attachments to one's home.

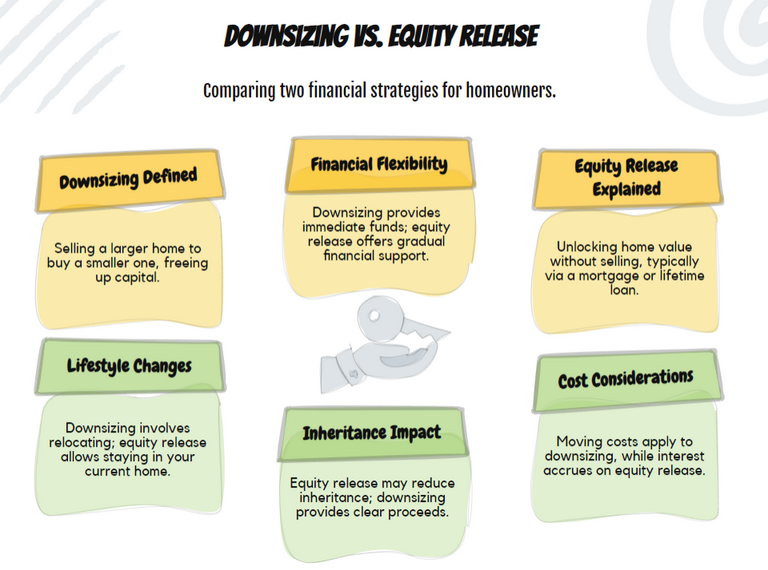

Is Downsizing a Better Option Than Equity Release?

Downsizing and equity release are both viable methods of accessing the value tied up in your home.

The best option depends on your financial situation, lifestyle preferences, and long-term planning.

While you can remain in your property if you opt for equity release, you will not access its full value as you will when you sell up and move to a smaller home.

Risks

Risks of downsizing to consider:

- The property market may fluctuate, potentially reducing the sale price of your home.

- The costs involved in selling, buying, and moving can be substantial and should be factored into your financial planning.

- Emotional distress is a significant factor, as leaving a home with sentimental value can be challenging.

Benefits

You may experience these benefits from downsizing:

- It provides a lump sum to supplement retirement income or cover other expenses.

- It can lead to reduced living costs, such as lower utility bills and less need for maintenance.

- You can benefit from your full property value.

Can a Credit Card Be an Alternative to Equity Release?

A credit card can be an alternative to equity release, albeit imperfect.

It can help to cover immediate or unexpected expenses. Still, it is generally not recommended for large, long-term financial needs due to high interest rates and the result of long-term costs.2

Risks

Consider these risks before opting for a credit card:

- High Interest: Credit cards typically carry high interest rates, especially if only minimum payments are made. This can result in substantial long-term debt.

- Impact on Credit Score: Using a high percentage of your credit limit or missing payments can negatively affect your credit score.

- Unsustainable Debt: Relying on credit cards for significant expenses or income can lead to unsustainable debt and financial instability.

Benefits

Credit cards can offer the following benefits:

- Flexibility: Credit cards offer flexibility for spending and can be used to cover immediate or emergency expenses.

- Rewards and Benefits: Some credit cards offer rewards and benefits like cashback or travel points.

- Short-term Solution: Credit cards can be an effective solution for smaller, short-term needs.

Is a Retirement Interest-Only Mortgage a Viable Choice?

A Retirement Interest-Only (RIO) mortgage can be a viable alternative to equity release for some individuals.

It allows the borrower to only pay the interest on the loan each month, with the capital being repaid when the house is sold.

This typically happens when the borrower dies, moves into long-term care, or decides to sell the property.

Risks

The expectant risks of a Retirement Interest-Only Mortgage:

- Dependence on Property Sale: The loan repayment relies on the future sale of your home. Any decrease in property value could affect your ability to repay the loan. Unlike equity release, RIOs do not always have a no negative equity guarantee.3

- Affordability Checks: Lenders will check that you can afford the monthly interest payments. If your income decreases, you might struggle to meet these payments.

- Loss of Home: You must keep up with the interest payments to avoid losing your home.

Benefits

You may find these benefits when exploring an RIO mortgage:

- Lower Monthly Payments: The costs are generally lower than a regular mortgage because you are only required to make monthly interest payments.

- Stay in Your Home: You can continue living in your home while making the interest payments.

- No Fixed Term: There is no set end date for the mortgage. It runs until you sell your home, move into care, or pass away.

Should I Consider Remortgaging Instead of Equity Release?

Remortgaging can be a viable alternative to equity release, especially if you have a significant amount of equity in your property and a good credit history.

It involves taking out a new mortgage to pay off the existing one, potentially at a lower interest rate or over a longer term to reduce monthly payments.

Risks

Risks you will need to assess when considering remortgaging:

- Charges: There may be substantial fees involved in remortgaging, including arrangement, valuation, and legal fees, as well as any penalties for paying off your existing mortgage early.

- Affordability Checks: Lenders will carry out affordability checks. If your circumstances have changed (e.g., you have retired), you might not qualify for a new mortgage.

- Risk of Repossession: As with any mortgage, your home may be at risk if you can not keep up with the repayments.

Benefits

However, there are benefits of remortgaging, which are:

- Potential for Lower Interest Rates: You could potentially secure a lower interest rate than your existing mortgage or an equity release plan, reducing the overall cost of borrowing.

- Overpayments: Unlike most equity release schemes, with some mortgage products, you can make overpayments without early repayment charges, which can help you clear your debt more quickly.4

- More Flexibility: Remortgaging can give you more flexibility than an equity release scheme, as you might be able to borrow more money if needed.

Are Personal Loans a Good Alternative to Equity Release?

Personal loans can serve as an alternative to equity release, depending on your financial situation and the amount of money you need.

They are unsecured loans, meaning you do not have to use your home as collateral.

However

The amount you can borrow is generally less than with equity release, and repayment begins immediately.

Risks

Personal loans come with their risks, like:

- High Interest Rates: The interest rates for personal loans can be higher than for mortgages or equity release, especially if you have a lower credit score.

- Monthly Repayments: Unlike equity release, you will need to start making repayments immediately, which could strain your budget.

- Impact on Credit Score: If you fail to make the repayments, it can negatively impact your credit score.

Benefits

You can also benefit from personal loans in the following ways:

- No Risk to Home: Since personal loans are unsecured, your home is not at risk if you can not make the repayments.

- Fixed Repayments: Personal loans usually offer fixed interest rates, meaning your repayments will be the same every month, making budgeting easier.

- Faster Access to Funds: Getting a personal loan can be faster than setting up an equity release scheme, providing quicker access to funds.

Can I Utilise My Savings and Investments Instead of Equity Release?

Absolutely, using your savings and investments can be an effective alternative to equity release.

This method allows you to utilise the accumulated wealth over the years.

Your advisor will likely suggest you use existing equity instead of borrowing against your estate, but each case differs.

Risks

The risks of using savings and investments are:

- Potential for Depletion: If your savings or investments are your primary source of income, you may deplete them over time. Ensure they are not needed in later life.

- Market Volatility: Investments are subject to market risks. Their value can go down and up, impacting the amount of money you have available.

- Loss of Future Growth: Using your savings and investments now could mean missing out on potential future growth or interest.

Benefits

The benefits of using your existing wealth are:

- No Need for Debt: Using your savings or investments means you do not have to borrow money or put your home at risk.

- Flexibility: Savings and investments typically offer more flexibility, as you can choose how much money to use and when.

- Potential Tax Advantages: Depending on the type of investments and their tax treatment, you can withdraw funds tax-efficiently.

Should I Rent Out a Room in My House as an Alternative?

Renting out a room in your house can be an effective alternative to equity release, particularly if you have spare rooms and are comfortable sharing your home.

It can provide a steady income stream without needing to borrow money or tap into your savings.

You can receive up to £7,500 in tax-free cash annually by taking part in the UK Rent-a-Room Scheme.5

Additionally

You can register your home with Airbnb,6 a popular site used by tourists and locals looking for accommodation.

Risks

The risks you might endure through renting out a room are:

- Loss of Privacy: Renting out a part of your home means sharing your living space with others, which could impact your privacy.

- Responsibility as a Landlord: You will have responsibilities as a landlord, including maintaining the property and ensuring it is safe and habitable.

- Potential for Vacancies: There may be periods when the room is not rented, resulting in inconsistent income.

Benefits

There are benefits of renting out a room, like:

- Regular Income: Renting out a room can provide a regular monthly income without needing to borrow or draw down on savings.

- Tax Benefits: Under the UK government's Rent a Room Scheme, you can earn a certain amount tax-free yearly from letting out furnished rooms in your home.

- Social Interaction: For some, having a tenant can provide companionship and a sense of security.

Can I Seek Assistance From My Family Instead of Equity Release?

Yes, financial support from family members can be an alternative to equity release for some older homeowners.

But

You will need to clarify if it is a gift or a loan and ensure it will not strain your loved ones financially.

Risks

The risks of asking family for potential support are:

- Potential Family Conflict: Financial matters can bring about disagreements or tension, particularly if the repayment terms are unclear or if the lending family member later experiences financial hardship.

- Inequality Among Siblings: Providing financial aid to one family member might cause contention among other siblings or descendants.

- Financial Strain on Family Members: Depending on their own financial situation, providing financial help may put undue pressure on family members.

Benefits

You can consider these benefits of borrowing from family:

- Flexibility: Family agreements might provide more flexibility than formal financial agreements, potentially with less rigid repayment terms.

- Avoiding Formal Debt: Financial assistance from family might help to avoid entering into debt with a financial institution.

- Maintaining Home Ownership: If family members can provide support, there may not be a need to release equity from your home, thus preserving its full value for future needs or inheritance.

Are Local Authority Grants Worth Considering as Alternatives?

Yes, local authority grants can be worthwhile alternatives to equity release.

These are often available to help with specific needs, such as home adaptations for accessibility or energy efficiency improvements.

Additionally, you can look into various means-tested benefits.

Grants are usually available for those with low income and can include:

Additionally

Turn2Us grants search11 is a comprehensive database of grants and contact details.

Risks

There could be risks with opting for a local authority grant or loan like:

- Eligibility Criteria: These grants and loans often have strict criteria, meaning not everyone will qualify.

- Limited Funds: There might be a limited amount of funding available, which could run out, or the amount you receive might not cover your full needs.

- Potential Charges: In some cases, local authority loans can be secured against your property, which may require repayment when you sell your home.

Benefits

There are definitely benefits from these grants and loans, including:

- No Repayment Required (Grants): If you qualify for a grant, you do not need to repay the money, making this an excellent option for those on a limited budget.

- Targeted Support: These grants or loans are often designed to help with specific needs, such as improving home energy efficiency or making accessibility modifications.

- Lower Interest Rates (Loans): Local authority loans often have lower interest rates compared to commercial loans or credit cards.

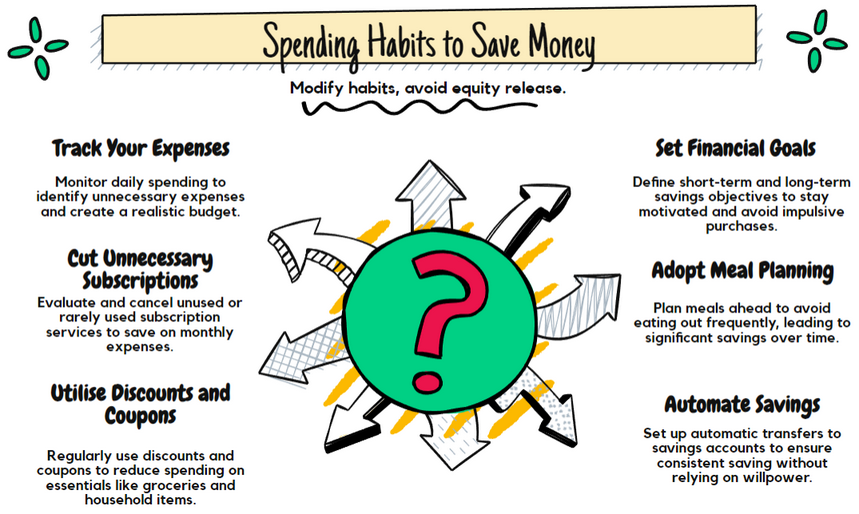

How Can I Adjust My Spending Habits to Save Money Instead of Choosing Equity Release?

Altering your spending habits can be a practical way to save money and possibly avoid the need for equity release.

This approach may involve reviewing your budget, identifying unnecessary expenditures, and making conscious decisions to save more.

Risks

There are some risks of adjusting your budget, including:

- Lifestyle Changes: Cutting back on spending can require lifestyle changes, which may be difficult to adjust.

- Emergencies: If your budget is tight, any unexpected costs could lead to financial strain.

- May Not Be Sufficient: Depending on your financial needs, savings from adjusted spending may not be enough.

Benefits

There are definitely benefits from budgeting more effectively, like:

- Avoiding Debt: You avoid taking on new debt or releasing equity from your home, preserving it for future use or inheritance.

- Improving Financial Awareness: Regularly reviewing and managing your budget can improve financial control and understanding.

- The Potential for Savings Growth: Money saved can be put into a savings account or invested to grow over time potentially.

Should I Sell Assets as an Alternative to Equity Release?

Deciding between selling assets or opting for equity release hinges on your financial goals and personal circumstances.

Selling assets offers immediate liquidity without accruing debt or interest.

However, it means parting with valuable or sentimental possessions.

That being said

You may have treasures like art, coins, or vintage furniture lying around the house that could be worth a penny or 2.

Risks

Keep these risks in mind:

- Loss of Asset - Once sold, you no longer benefit from potential future appreciation in its value.

- Sentimental Value - Parting with assets, especially those with emotional significance, can be challenging.

- Liquidation Costs - There may be costs associated with selling the asset, such as broker fees or auction charges.

Benefits

However, there is also great benefits like:

- Immediate Liquidity - Gain instant access to funds for immediate needs or opportunities.

- No Debt Accrual - Generate capital without taking on new debt or interest obligations.

- No Maintenance Costs - Eliminate any ongoing costs or responsibilities associated with the asset's upkeep.

Is Getting a Part-Time Job a Better Option Than Equity Release?

Whether getting a part-time job is a better option than equity release largely depends on individual circumstances.

A part-time job provides an additional income stream, allowing you to maintain your home equity and provide more social and cognitive stimulation.

However

It also comes with risks such as job instability, potential physical and mental demands, and possible impact on benefits.

Risks

Choosing to secure a part-time job instead of opting for equity release has several potential benefits:

- Increased Income: It can provide an additional income stream, which can be used to cover living expenses without tapping into home equity.

- Preservation of Home Equity: Rather than reducing the equity in your home, employment allows you to maintain this asset intact, potentially leaving a more substantial inheritance.

- Social and Cognitive Benefits: Engaging in part-time work can offer social interaction and mental stimulation, which can be particularly beneficial for retirees.

Benefits

However, this option also has potential drawbacks to consider:

- Job Stability: Part-time work often comes with less job security than full-time employment, which might lead to uncertainty.

- Physical Demand: Depending on the individual's health and the nature of the work, a part-time job can be physically or mentally taxing, particularly for older adults.

- Impact on Benefits: Additional income from part-time work might affect eligibility for certain means-tested benefits and could also have implications on tax liabilities.

Common Questions

Is Selling a Second Property a Feasible Alternative to Equity Release?

Can Equity Release Alternatives Provide Tax Advantages?

How Do I Know if I Should Consider an Alternative to Equity Release?

Can I Switch From Equity Release to One of the Alternatives?

Are There Any Financial or Tax Implications to Consider When Exploring Equity Release Alternatives?

How Do I Compare the Different Alternatives to Find the Best Option for Me?

Can I Still Access Funds for Long-Term Care With the Alternative Options?

What Are the Best Alternatives to Equity Release?

How Can I Access My Property Wealth Without Equity Release?

Are There Cheaper Alternatives to Equity Release?

Can I Avoid the Risks of Equity Release with Other Options?

What are the Pros and Cons of Alternatives to Equity Release?

In conclusion

While equity release can effectively tap into the wealth tied up in your property, it is not for everyone.

Alternatives such as extending your mortgage term, selling a second property, or finding a part-time job can also offer viable pathways, each with its own set of benefits and drawbacks.

It is important to consider all your options carefully and seek professional financial advice tailored to your personal circumstances and long-term goals.

Remember, the best approach is not one-size-fits-all but is determined by individual needs, financial circumstances, and future plans.

When exploring your options, always keep in mind that equity release alternatives may offer additional flexibility or benefits tailored to your unique situation.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.