Equity Release Companies to Avoid in 2026: Look Out For These Signs

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- No UK equity release firm is universally blacklisted, but digging into their history, rates, and reviews (along with detailed testimonials) is absolutely key.

- Watch out for firms with steep interest, dodgy service, or vague fine print, with red flags that include nasty rates, bad reviews, or missing the Equity Release Council's thumbs-up.

- Seek out clear exit strategies, including penalties for early repayment, to avoid future financial strain and potential scams.

In 2022, UK consumers lost a combined £1.2bln to scams1, so protecting your finances should be high on your list of priorities.

Equity release can be a safe financial solution when dealing with reputable lenders, which is why it's always best to ensure you know which equity release companies to avoid so you avoid ruining your retirement.

This article is based on careful research by SovereignBoss’s team of financial experts; having analysed numerous reports and regulatory documents to compile the most accurate and useful information, we've narrowed down the top providers to avoid as well as their red flags.

In addition, we have looked into the regulations required to be a registered equity release lender and how can ensure your potential lender is legitimate.

Let's dive right in...

In This Article, You Will Discover:

What Is Equity Release, and Which Companies Should Be Avoided in 2026?

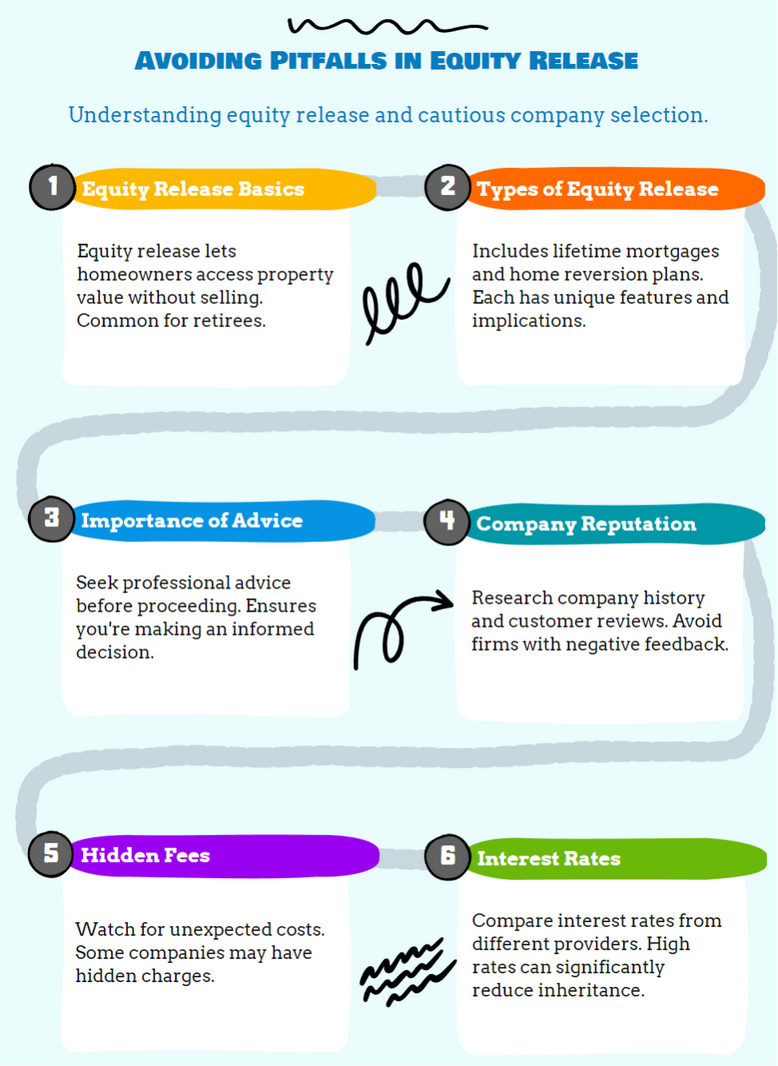

Equity release is a product that allows homeowners to access their property's value as cash, and companies lacking transparency or regulatory compliance should be avoided in 2026.

Let's look into this further:

What Exactly Is Equity Release in the UK?

Equity release is a financial product for homeowners, typically aged 55 or older, that allows them to access the value or equity tied up in their property without selling it.

Common equity release plans include lifetime mortgages and home reversion plans.

Which Equity Release Companies Are Best Avoided in 2026?

The equity release companies that are best avoided in 2026 include any companies that boast various red flags, including unethical practices and poor customer interactions.

These include:

- A history of poor customer reviews (although it is important to remember that this is not always the most reliable metric, as people are more likely to take to online forums to list complaints than to offer praise)

- Unethical practices

- A lack of transparency

- A lack of regulation by the Financial Conduct Authority (FCA)

- A lack of membership of the Equity Release Council (ERC)

What Are the Major Red Flags When Choosing an Equity Release Company?

The major red flags when choosing an equity release company include high-pressure sales tactics, unclear fees, and lack of accreditation with reputable industry bodies.

Here's what you need to look out for:

What Red Flags Should You Look For to Avoid Certain Equity Release Companies?

The red flags you should look out for to avoid certain equity release companies include highly distressing potential outcomes, like the possibility of losing your home or high early repayment charges.

These red flags include the following:

- Lack of regulatory compliance or accreditation

- Bad reputation or poor track record

- High early repayment charges or hidden fees

- The absence of a no negative equity guarantee or downsizing protection clause, which are typically standard in reputable equity release schemes as they protect consumers

- Inability to make voluntary interest or partial repayments

- High-pressure sales tactics or misleading advertising

- No assessment of your personal circumstances or financial goals

- No right to move or transfer your plan

Why Is Lack of Regulatory Compliance a Red Flag in Equity Release Companies?

A lack of regulatory compliance is a red flag in equity release companies as it shows a lack of accreditation and may indicate a higher risk of unethical behaviour, poor customer service, or inadequate consumer protection.

Bodies such as the Financial Conduct Authority (FCA) and the Equity Release Council (ERC) exist to protect consumers and guide ethical practices that are required from these companies.

Here's why regulatory compliance is important:

How Does the Financial Conduct Authority (FCA) Regulate Equity Release Companies?

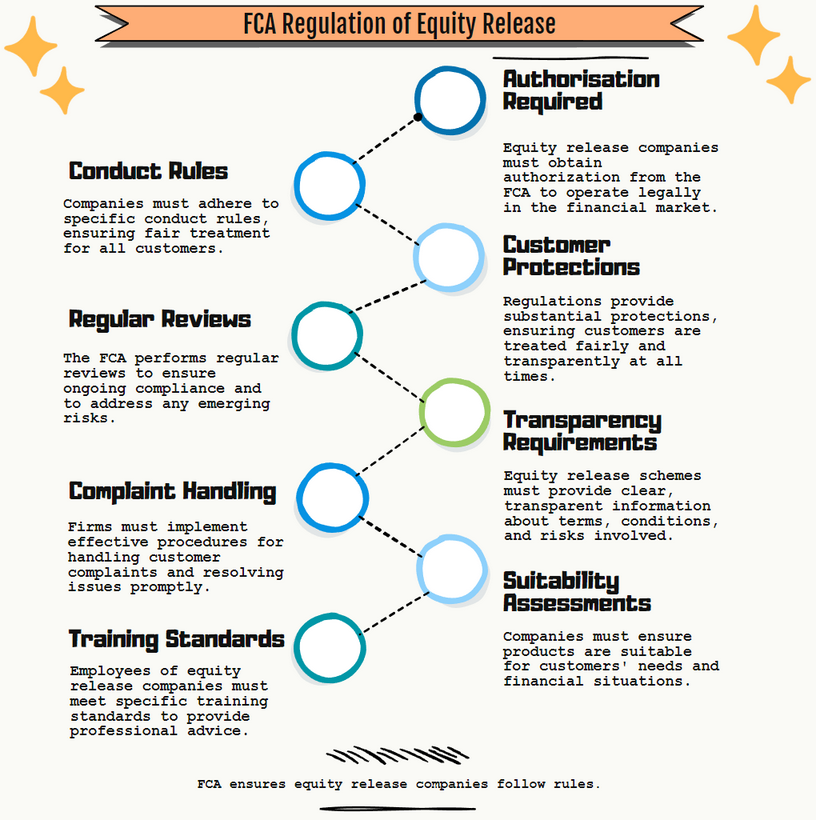

The Financial Conduct Authority (FCA) regulated equity release companies by protecting customers in the financial sector, including those considering or using equity release products.

While the FCA plays a vital role, consumers must also remember to actively protect their interests through understanding terms, seeking advice, and making informed choices.

The FCA safeguards customers through these various measures:

- Regulating providers and brokers to ensure they operate transparently and fairly, adhering to rules and principles.

- Licensing financial firms; companies must meet criteria to obtain and keep their licence, demonstrating competence.

- Conducting regular reviews of the practices and financials of regulated firms.

- Taking action against rule violations, including fines or revoking authorisation.

- Providing resources to encourage informed decision-making on financial products.

- Mediating unresolved consumer-provider disputes through the Financial Ombudsman Service.

- Upholding standards to ensure clear information, suitable advice, and fair complaints handling.

- Promoting competition to ensure a variety of equity release options for consumers.

What Role Does the Equity Release Council (ERC) Play in Protecting Consumers?

The Equity Release Council (ERC) plays an immensely crucial role in protecting consumers; it's a self-regulatory body for the equity release sector in the UK that aims to ensure that all members adhere to high standards of conduct and practice.

Consumers must also actively understand their financial decisions for optimal protection and do their best to conduct thorough research and choose a company with recognised accreditation.

The ERC safeguards customers through the following measures:

- Members must adhere to guidelines that surpass regulatory requirements for additional consumer protection.

- Specific equity release product standards, like the No Negative Equity Guarantee, ensure customers' financial security.2

- Qualified financial advice is mandatory, ensuring informed decisions on equity release products.

- Comprehensive and timely information is provided to help customers make informed choices.

- The Member Code of Conduct enforces fair treatment, honest marketing, and high-quality advice.

- Customers can seek recourse if ERC standards are breached, leading to potential disciplinary action.

- Education on equity release products and rights empowers customers to make informed decisions.

Why Should You Avoid Equity Release Companies with Bad Reputations?

You should avoid equity release companies with bad reputations due to their massive red flags that could apply financial pressure, including higher interest rates, lack of consumer protections, or rigid terms.

Always conduct extensive research and consider the experiences of others before engaging with any equity release company.

Avoid companies with:

- Overwhelmingly negative reviews

- Unresolved complaints

- A history of unethical practices

Why Are Certain Contract Terms and Sales Tactics Red Flags?

Certain contract terms and sales tactics are red flags as they are typically high-pressure and dodgy, limiting flexibility or imposing high exit fees and aggressive sales tactics, and indicating a company's potential lack of customer focus.

Always think about the following:

Why Are High Early Repayment Charges a Reason to Avoid Some Equity Release Companies?

High early repayment charges are a reason to avoid some equity release companies as they can significantly (and negatively) impact your finances if you decide to repay your equity release loan early or if unexpected fees arise during the process.

Remember to keep an eye out for a clear and transparent fee structure.

Why Is the Absence of a No Negative Equity Guarantee a Deal Breaker?

The absence of a no negative equity guarantee is a deal breaker because it ensures that you (or your beneficiaries) will never owe more than the value of your property, even if your home sells for less than the value of your equity release debt.3

The absence of this or a downsizing protection clause are serious red flags, especially from the perspective of looking to protect your financial interests.

As a rule, mandated by the ERC, all its members offer a no negative equity guarantee; additionally, a downsizing protection clause also allows you to move to a smaller property and repay the loan without incurring significant penalties (if you cannot port your lifetime mortgage to your new home).4

How Do High-Pressure Sales Tactics Signify Equity Release Companies to Avoid?

High-pressure sales tactics signify equity release companies to avoid because equity release is a product that requires careful consideration—seniors pressured into making a decision may end up making poor choices that may directly impact their financial health, leaving them vulnerable to negative outcomes.

What Are the Signs of a Lack of Customisation and Flexibility in Equity Release Plans?

The signs of a lack of customisation and flexibility in equity release plans are typically indicated by rigid plan options that don't consider individual financial circumstances or future changes.

Consider these signs:

Why Should You Avoid Companies Without Voluntary Payment Options?

You should avoid companies without voluntary payment options as they suggest rigidity and unmet ERC guidelines; flexibility allows you to manage your loan effectively and potentially reduce the overall interest charges.

In March 2022, the ERC implemented a product standard stating that lenders must have the option to make voluntary loans and interest repayments on all new lifetime mortgages.5

Why Is Lack of Personal Assessment a Warning Sign in Choosing Equity Release Companies?

A lack of personal assessment is a warning sign in choosing equity release companies as ensuring that a product is understood and tailored to your personal situation is key.

Prioritise equity release providers that tailor their services to meet your unique requirements.

A reputable provider will take the time to:

- Understand your needs

- Explain the implications of equity release

- Explore alternative options before recommending a specific plan

Why Should You Avoid Equity Release Companies That Don't Allow Plan Transfers?

You should avoid equity release companies that don't allow plan transfers because they're restricting your mobility or making it difficult to transfer plans.

You should always have the right to port your plan to a suitable property should your circumstances change.

How Can You Protect Yourself From Fraudulent Equity Release Practices?

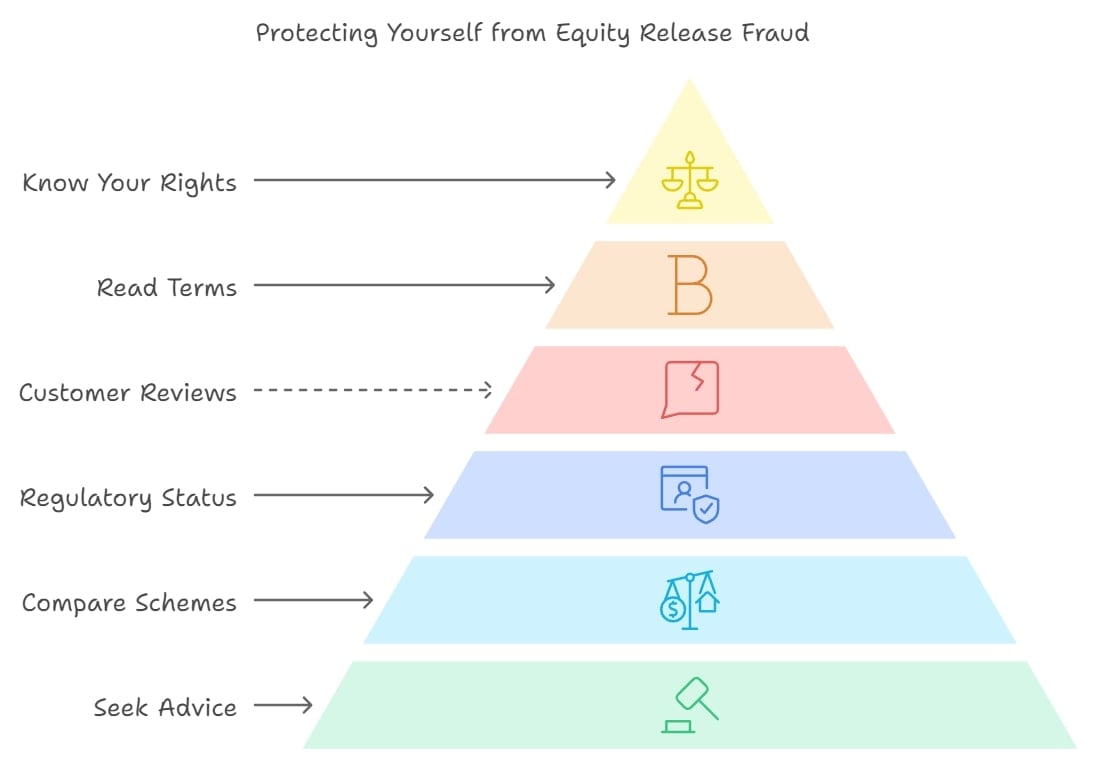

You can protect yourself from fraudulent equity release practices by conducting thorough research, seeking independent legal and financial advice, and choosing companies accredited by the ERC.

Here's more on these safety tips:

How Are Equity Release Leads Generated and What Does It Mean for You?

Equity release leads are often generated through online platforms, advertisements, and partnerships with financial advisers; for you, this means that you'll likely be targeted with promotional offers and advice.

While some of these opportunities can be beneficial, it's essential to approach them with caution—always research and consult with a trusted advisor before making any decisions.

How Can You Protect Yourself From Fraud in the Equity Release Market?

You can protect yourself from fraud in the equity release market by seeking the right advice and fully understanding your loan's terms and conditions.

Consider the following steps to make confident decisions:

- Seek independent legal advice and consult a qualified equity release broker or adviser.

- Compare different equity release schemes and providers to find the most suitable option for you.

- Check the company’s regulatory status and accreditation to ensure you are fully covered.

- Read customer reviews and testimonials to see what others have to say about their experience with the company.

- Read and understand the terms and conditions of your equity release loan before signing on the dotted line.

- Know your rights and responsibilities as an equity release customer to ensure you experience a smooth process.

Which Equity Release Advisers Should You Avoid and Why?

You should avoid equity release advisers who are not authorised or regulated, or pressure you to make decisions; this is because they could lead you into making terrible financial decisions and prioritising their interests over yours as the consumer and client.

The role of the adviser is to help you understand the different types of plans available, compare the pros and cons of each one, make recommendations based on your circumstances, and guide you through the application process.

Some red flags to look out for:

- Advisors not authorised and regulated in the UK by the Financial Conduct Authority (FCA)

- Pressure to make quick decisions

- Discouraging family involvement

- Not exploring alternatives to equity release

- Charging upfront fees

How to Identify Equity Release Solicitors to Avoid

You can identify equity release solicitors to avoid by noting whether or not they're registered with and approved by the ERC and FCA, or if they have an overwhelming number or poor customer reviews and feedback.

Solicitors are suppose to help you with the legal aspects of equity release and its implications, such as checking the contract, verifying the ownership and value of your property, and ensuring that your rights and interests are protected.

Unreliable solicitors may compromise your interests by:

- Not being approved by the FCA, which means they are not subject to the same rules and standards that apply to equity release advisors and lenders.

- Not being independent and impartial, but rather working for or being influenced by the advisor or the lender, who may have a vested interest in the outcome of the deal.

- Not having expertise and knowledge in equity release, meaning they may not be able to provide you with accurate and comprehensive advice that suits your specific needs.

Are There Specific Equity Release Schemes and Interest Rates You Should Avoid?

Yes, there are specific equity release schemes and interest rates you should avoid; avoid plans with unclear interest rates, compound interest that significantly reduces inheritance, and those not offering a no negative equity guarantee.

Be careful and stay alert here:

What Types of Equity Release Schemes Should Be Avoided?

Equity release schemes that should be avoided include those that are unregulated, unclear, and exorbitant in their interest rates.

In addition to this, the 2 types of plans, lifetime mortgages and home reversion plans, both have advantages and disadvantages, depending on your circumstances and goals.

However, some experts advise against home reversion plans due to their nature and drawbacks.

Here are some reasons why you may want to avoid home reversion plans:

- They involve selling part or all of your home to a company in exchange for money. This means you lose ownership and control of your property, and will not get the full market value for it.

- They reduce the value of your estate and the inheritance you leave behind, as you will have less or no equity left in your home when you pass away or move into long-term care.

- These plans are less flexible and more restrictive than lifetime mortgages, as you may not be able to move to another property, make changes to your home, or end the plan early without paying a penalty.

Is It Advisable to Avoid Variable Interest Rates in Equity Release?

Whether it's advisable to avoid variable interest rates in equity release ultimately depends on your circumstances and strategy; interest rates can be fixed or variable—fixed, remaining constant throughout the plan, or variable, fluctuating based on market conditions.

Consulting a financial adviser is recommended to tailor the interest rate choice to individual needs and financial goals.

Key considerations in this decision include:

- Comfort with Uncertainty: Fixed rates suit those preferring predictable costs, while variable rates appeal to those comfortable with risk and potential market benefits.

- Financial Flexibility: Fixed rates are preferable for tight budgets, whereas variable rates might suit those with resources to manage potential increases.

Common Questions About Avoiding Certain Equity Release Companies

What Makes Certain Equity Release Companies Worth Avoiding?

Can I Negotiate Better Terms and Conditions With My Equity Release Company?

What Should I Do if I Have Concerns About My Chosen Equity Release Company?

How Can I Complain or Seek Compensation If I Am a Victim of Fraud or Misconduct by an Equity Release Company?

Which Are the Equity Release Companies to Avoid in the UK?

How Can I Spot Equity Release Companies That I Should Avoid?

Are There Any Notorious Equity Release Companies to Avoid?

Why Are Some Equity Release Companies Considered to Be Avoidable?

In Conclusion: Navigating Equity Release Companies to Avoid for a Safe Financial Future

Being aware of the potential pitfalls and red flags associated with equity release is crucial to protecting yourself as a consumer.

By avoiding equity release companies that exhibit poor track records, lack regulatory compliance, employ high-pressure sales tactics, or have hidden fees, you can take steps to safeguard your financial well-being.

While it is crucial to avoid companies that exhibit poor practices, it's equally important to identify and choose companies with a positive track record, transparent practices, and customer-centric services.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.