Equity Release Costs in 2025: What You Need to Know

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- The cost of equity release in the UK varies, but often includes an arrangement fee of up to £3,000 and legal and advisor fees, adding up to around 1.5% to 2.5% of the total value.

- The average costs often range between £1,500 to £3,000, but this can rise depending on the value of your property and the complexity of your financial situation.

- While most costs are upfront and transparent, there might be hidden costs such as early repayment charges and increased interest rates over time.

- Some benefits, like certain government grants or allowances, might be used to offset the costs, but this depends on individual circumstances.

- Reducing costs can be achieved by shopping around for the best deals, avoiding unnecessary add-ons, or choosing a drawdown scheme to reduce interest charges.

These are the equity release costs you MUST know about, or you may end up wasting money!

It can be an expensive process, but it does not necessarily need to be.

Appropriate advice may assist in effective financial planning and enable you to join the 93,421 new and returning customers who have withdrawn wealth from their properties in 2022.1

In This Article, You Will Discover:

Our team has carried out a comparative analysis of the expenses involved across a range of advisers, plan providers, and solicitors, to weigh up the average and determine what fair equity release expenditure should be.

We have done the research for you, so all you need to do is read.

Let’s find out now!

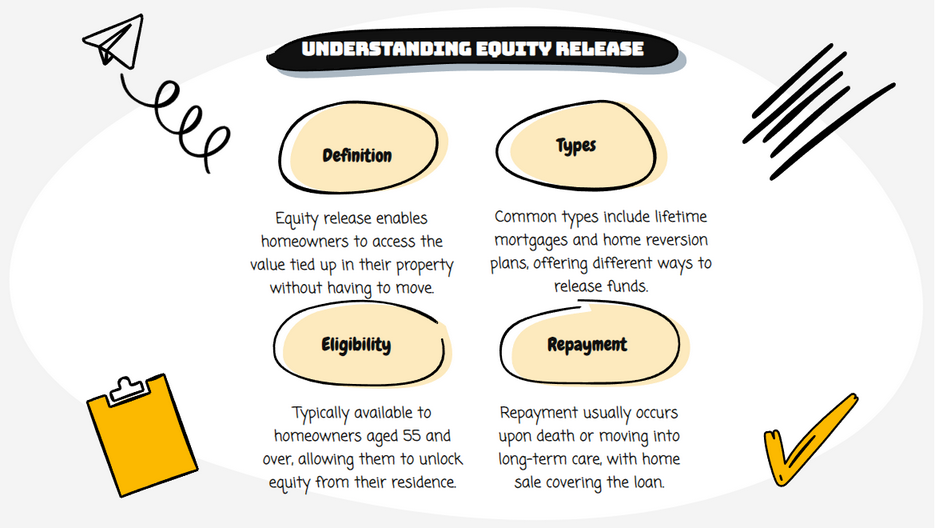

What Is Equity Release?

Homeowners can utilize equity release to draw on their home's value, providing a financial boost without the need to downsize.

The beauty of this approach lies in its ability to offer financial relief while homeowners continue to enjoy their property.

It's a considerate option for leveraging home equity, tailored to fit the homeowner's lifestyle, especially through equity release loans available in the UK.

What is the Total Cost of Equity Release in 2025?

The total cost of equity release in the UK can vary depending on several factors, including property value, loan amount, interest rates, fees, and the duration of the plan.

On average, the total cost typically falls within the range of £1,500 to £3,000, plus compound interest.5

Currently, equity release rates are between 5.97% to 6.28%*

* While we regularly review our rates, these may have changed due to changing market conditions since our last update.

However

It is important to note that this is a general estimate, and actual amounts may differ based on individual circumstances and the specific product chosen.

Seeking advice from a qualified financial adviser or broker is crucial to obtain a more accurate assessment of the total cost tailored to your situation.

What Are the Equity Release Set-up Costs?

Equity release set-up costs in the UK typically include fees such as those for the application, valuation, and the hiring of a solicitor and advisor.

These can vary depending on the provider and the specific product chosen.

It is essential to carefully consider the total amount involved before proceeding with a plan to ensure it aligns with your financial goals and circumstances.

What Fees Will You Pay With Equity Release?

The fees you will usually pay include:

- Advice fees

- Valuation fees

- Arrangement fees

- Solicitor’s fees

- Consultation costs

Some lenders and brokers may incorporate some of these into the overall fees you will pay or provide certain services for free.

Here is a breakdown of each of these fees.

Advice Fees

When seeking advice on UK equity release, it is common to pay advisory fees to ensure you receive professional guidance tailored to your needs.

Expect this

The average cost for advice fees ranges from 1% to 2% of the total amount released.2

Fees can vary among advisers, so it is wise to explore different options and consider the value of the advice provided before making a decision.

Valuation Fees

Valuation fees vary depending on the property's location, size, and value.

In the UK, a valuation determines the value of your property, which helps determine the maximum amount you can release.

Some lenders may offer a free valuation.

Arrangement Fees

In the UK, arrangement fees charged by providers will typically range from £500 to £1,000.3

It is important to carefully review the details of any arrangement fees associated with a plan and determine what these fees cover.

Solicitors' Fees

Solicitors’ fees can be expected since a solicitor will handle the legal aspects of an equity release transaction.

You could pay between £600 to £1,500, depending on the complexity of the case and the solicitor's hourly rate.4

Remember to request a clear breakdown of the total involved when choosing your solicitor.

Consultation Fees

When considering equity release in the UK, initial consultations are generally offered for free.

These consultations provide an opportunity to discuss your needs, explore options, and gain a better understanding.

Once you decide to proceed with a plan, advisory fees, and other associated costs, as mentioned earlier, may apply.

It is always recommended to confirm the specific terms and numbers with the adviser or provider during the consultation process.

Understanding Additional or Hidden Costs

When considering equity release loans in the UK, it is important to be aware of potential additional or hidden costs.

These can include early repayment charges, surveyor fees for property inspections, insurance premiums, and potential impact on means-tested benefits.

With so many variables at play, it is imperative that you consult a qualified equity release advisor or broker with experience across the entire market.

They will be able to highlight all of the potential fees you may encounter throughout the entire process.

When Should You Pay Your Fees?

Equity release fees are typically paid at different stages of the process.

Valuation fees and application fees are usually paid upfront when applying for a plan.

Solicitor fees are paid during the legal process, usually upon completion of the plan.

Adviser fees are often deducted from the released amount.

It is important to understand the specific payment schedule and arrangements for fees with your chosen provider, as they may vary.

Your financial adviser or broker can guide you through the fee payment process and help you plan accordingly.

What Factors Can Influence the Total Cost?

The factors that influence the total cost of equity release include:

- Age: Older individuals may be eligible for higher loan-to-value ratios, potentially allowing them to release more equity compared to younger individuals.

- Health and lifestyle: Individuals with certain health conditions or lifestyle choices may qualify for enhanced plans, potentially offering higher loan amounts or more favorable terms.

- Property type and value: Higher-valued properties may allow for a larger amount, while certain property types, such as leasehold or non-standard construction, may have stricter eligibility criteria or higher fees.

- Loan-to-value ratio: Higher LTV ratio may result in a lower interest rate, potentially reducing the overall cost of the plan.

- Interest Rates: Higher interest rates will increase the cost of your loan.

- Providers' fees and terms: Variations in fees, interest rates, early repayment charges, and other terms can significantly affect the overall cost and financial implications of a plan.

How Can You Minimise These?

You can minimise these by considering the following options:

- Get Advice: Consult an independent financial advisor or broker.

- Compare Providers and Plans: Find the best option for you and your family.

- Make Partial Repayments: Equity release partial repayments have the benefit of reducing your compound interest.

- Switch Plans: If interest rates drop or if you can find a plan with better features. Additionally, look if your current plan does not offer voluntary payments like the plans available today.

Understanding Early Repayment Charges (ERCs)

Early Repayment Charges (ERCs) are fees that may be imposed when repaying an equity release or lifetime mortgage earlier than the agreed-upon term.

These charges are designed to compensate lenders for the potential loss of interest income due to premature repayment.

ERCs can vary depending on the terms of the mortgage, and they are typically calculated as a percentage of the outstanding loan balance.

Is there equity release with no early repayment charges? It can depend on the circumstances and the lender, so be sure to peruse the agreement carefully.

How to Use an Equity Release Calculator Effectively

For the best equity release calculator results, start by gathering accurate information about your property's value and your age .

Input these details along with any outstanding mortgage balance into the calculator.

Common Questions

Can These Payments be Included in the Loan Amount?

Can Equity Release Costs Impact the Inheritance I Leave Behind?

Are There Any Tax Implications Related to These Costs?

Will My Costs Vary Based on My Property Value?

Are There Any Specific Fees Associated With Different Types of Equity Release Products?

What Factors Should I Consider When Comparing Equity Release Schemes and Their Costs in 2025?

Can You Negotiate or Reduce the Total Cost of Equity Release in 2025?

Are There Any Government Schemes or Incentives to Assist With Product Costs in 2025?

How Much Does Equity Release Cost in the UK?

What Are the Average Costs of Equity Release?

Are There Any Hidden Costs in Equity Release?

Can Equity Release Costs Be Offset by any Benefits?

How Can I Reduce Equity Release Costs?

In Conclusion

Understanding the various components and implications of these figures is essential when considering this financial option.

By carefully examining the fees, charges, and potential impacts on inheritance, you can make informed decisions that align with your goals and circumstances.

Seeking guidance from reputable advisors and comparing offerings from different providers can help ensure that equity release costs are carefully evaluated and managed throughout the process.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.