2026 Equity Release Council: What You Need to Know

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- The Equity Release Council (ERC) upholds ethics in the equity release world, ensuring fair play and homeowner protection with rules and standards that aim to keep the industry straight, covering everything from big principles to product details.

- Advisers, lawyers, and providers are required to stick to the ERC's guidelines, which include strict checks and rule enforcement, making them reliable go-tos for equity release.

- At the forefront of consumer protection, the ERC offers insights and stats, and helps tackle industry issues and your questions.

Established in 1991, the Equity Release Council (ERC) plays a vital role in overseeing the UK’s equity release market, ensuring that homeowners can access their property's value safely and with confidence.

But here’s the big question—Is equity release truly safe in 2026?

With a history tarnished by scandal and financial pitfalls, equity release has often been viewed with scepticism, but times have changed, and today’s market is very different.

At SovereignBoss, we’ve dedicated hours to researching top plan providers, digging deep into the pivotal role of the ERC, and compiling everything you need to know into this comprehensive guide.

Ready to uncover how the ERC is protecting homeowners? Keep reading to find out...

In This Article, You Will Discover:

Who Makes Up the Equity Release Council, and What Are Their Core Functions?

The Equity Release Council is made up of industry professionals who oversee equity release schemes, with their core functions being setting the standards and protections that safeguard consumers' interests.

Here's what you need to know:

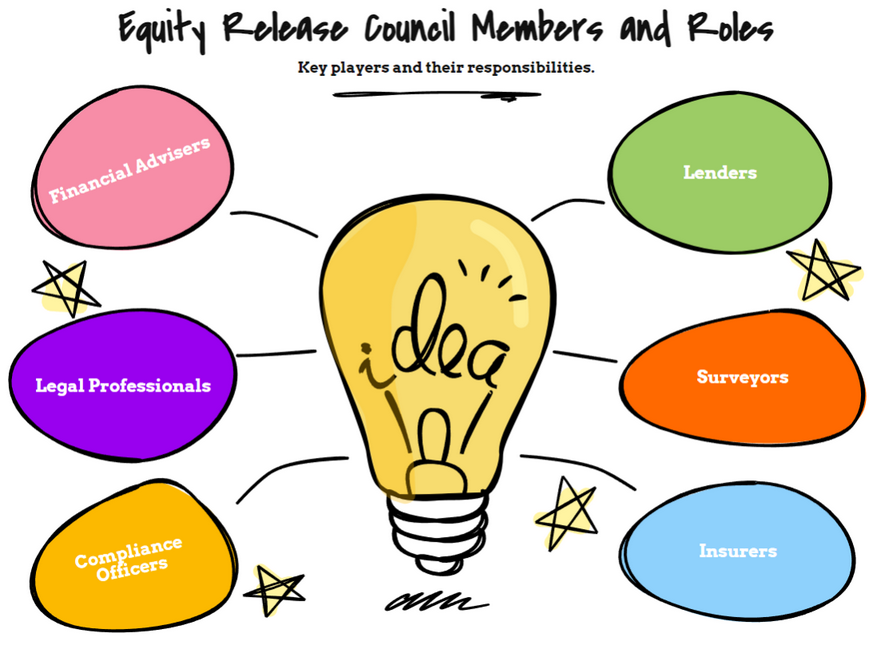

What is the Composition of the Equity Release Council?

The composition of the Equity Release Council consists of a range of organisations involved in the equity release market, including equity release providers offering related financial products, financial advisers who guide consumers, legal professionals who manage the legal aspects, and surveyors who assess property values.

The Equity Release Council is a trade association in the United Kingdom and was formerly known as SHIP (Safe Home Income Plans) until it was rebranded in 2012.

The Council acts as a self-regulatory body for the equity release industry, and members also include firms that provide support services, ensuring that the equity release sector operates with high standards of consumer protection, transparency, and regulatory compliance.

What Are the Primary Functions of the Equity Release Council (ERC)?

The primary functions of the Equity Release Council (ERC) include serving as the governing body for the equity release sector, focusing on consumer protection, industry standards, and ethical practices.

Overall, the ERC is there to regulate legitimate UK equity release companies and protect the interest of the homeowner.

4 of the main ERC’s1 responsibilities include:

- Offering you all the information you may require on equity release and its products.

- Protecting any consumers using equity release, and those who are considering releasing equity from their home.

- Raising awareness on how it may be an ideal option after retirement.

- Representing more than 180 member firms and more than 500 people in the industry, from experienced financial advisers and lenders to representatives and surveyors.

How Does the Equity Release Council's Code of Conduct Benefit Consumers?

The Equity Release Council's Code of Conduct benefits consumers by ensuring they are protected through strict standards and ethical guidelines, enhancing transparency and fairness in equity release transactions.

Here's how the ERC protects and guides:

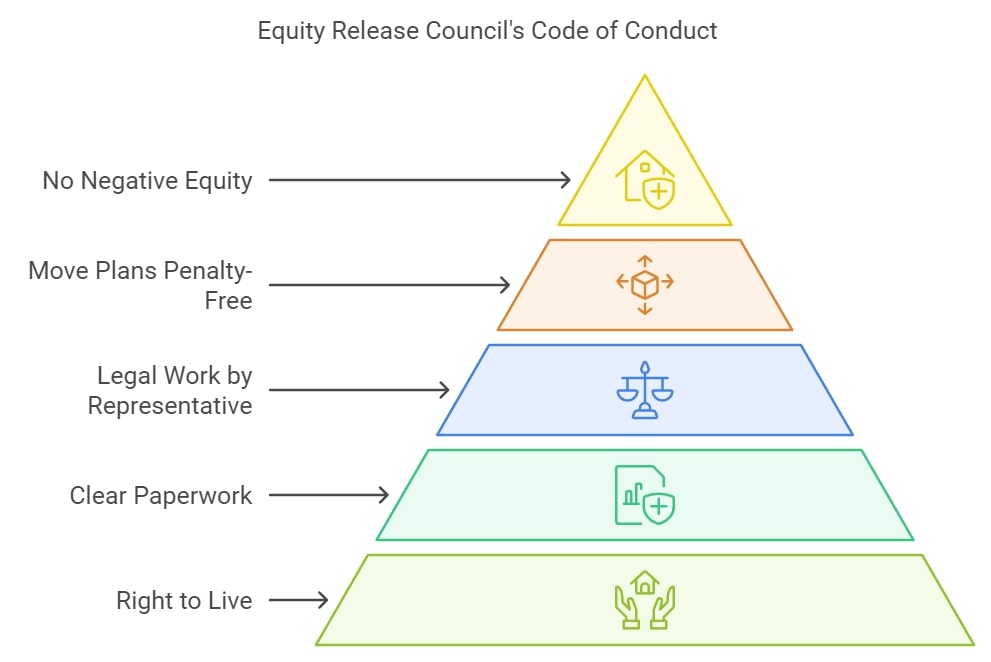

What is the Equity Release Council's Code of Conduct?

The Equity Release Council's Code of Conduct is a framework that provides ethical practices, ensuring safe and fair equity release schemes for homeowners.

Take a closer look at the code of conduct:

- The borrower has the right to live in their home until they pass away.2

- The borrower will be given clear and concisely written paperwork, which will include transparent details about setup costs and how changes in house values may affect the plan.

- The consumer’s preferred representative steers any legal work—the borrower and their solicitor

3 will sign a certificate confirming the plan’s certification and that all the risks and jargon are understood. - The client can move their plan to a different property without facing penalties.

- The equity release certificate will detail the cost to the client’s assets and estate.

- Plans carry no negative equity guarantees.

How Does the Equity Release Council Protect Consumers Through Its Code of Conduct?

The Equity Release Council protects its consumers through the Code of Conduct by ensuring safety and fair treatment when considering equity release, guaranteeing the right to remain in your home for life and imposing a no-negative-equity guarantee so you never owe more than your home's worth.

This code mandates clear, comprehensive advice from advisers, ensuring you're fully informed before making any decisions.

What Standards and Safeguards Are Established by the Equity Release Council?

The Equity Release Council establishes rigorous standards and safeguards that include transparent terms and the right to remain in one's home, to protect consumers engaging in equity release.

Check out the standards and guidelines:

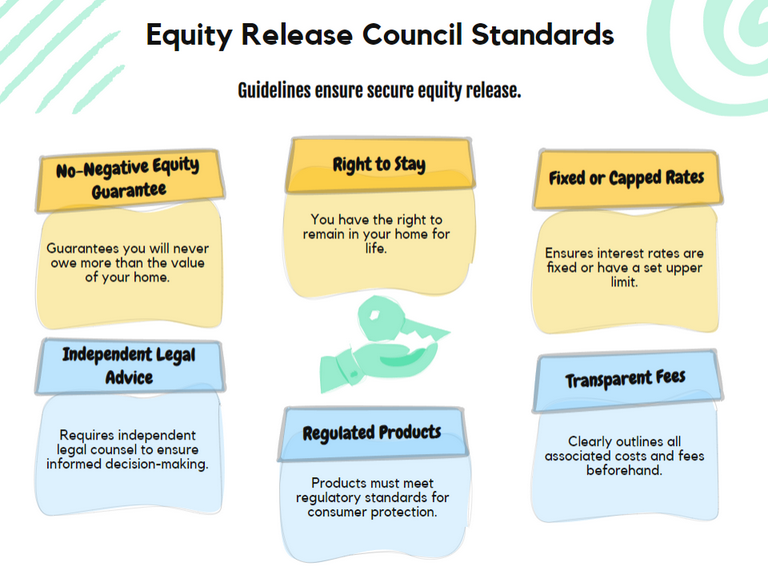

What Standards Are Set by the Equity Release Council?

The standards set by the Equity Release Council focus on consumer protection, transparency, and ethical practices within the equity release market, guaranteeing that customers are offered products and services that adhere to the best practices of the sector.

This ensures that customers are properly informed and fully protected, enforcing compliance with industry regulations and promoting responsible lending practices.

Take a closer look at the safeguards:

What Are the Key Safeguards Established by the Equity Release Council?

The key safeguards established by the Equity Release Council include no negative equity guarantees and the right to stay in one's home, ensuring a secure equity release process for homeowners.

Other safeguards include independent legal advice for each borrower and comprehensive financial assessments to ensure that equity release is suitable for the individual’s circumstances.

These measures are designed to protect you from the risks of debt accumulation and ensure your equity release plan is a safe, viable option for accessing your home's value.

What Are the Equity Release Council's Overarching Principles?

The Equity Release Council's overarching principles focus on transparency, fairness, and security, aiming to protect consumers through strict standards for all equity release schemes.

The overarching principles ensure that members:

- Promote public confidence in equity release through their actions.

- Maintain customers' best interests throughout the process by acting in good faith and treating them fairly.

- Identify and manage conflicts of interest promptly and fairly.4

- Assist customers at every point of contact during the product's lifecycle to achieve the desired results.

What Customer Outcomes Does the Equity Release Council Require?

The Equity Release Council mandates outcomes ensuring customers receive clear information, fair treatment, and comprehensive protection throughout their equity release journey.

Furthermore, the ERC requires that members:

- Offer customers the best-suited products and services at a fair price based on their needs.

- Support customers at any point of contact who are vulnerable, whether physically, mentally, or financially.

- Provide customers with reassurance that they can remain in their own homes for as long as they like or move to another property that meets their needs, as long as they follow contract terms.

- Ensure that customers are aware of their rights and responsibilities at every stage of the customer relationship.

What Are the Product Standards Enforced by the Equity Release Council?

The product standards enforced by the Equity Release Council include fixed interest rates, penalty-free payments, and the no negative equity guarantee.

If a product does not meet ALL of these standards, then documentation must be provided explaining why certain standards have not been met and what the implications are.

The ERC product standards are:

- Lifetime mortgage interest rates must be fixed or, if variable5, there must be a fixed upper limit for the loan term.

- Customers have the right to remain in their homes for the rest of their lives or until they move into long-term care, but the property must remain their main residence.

- Customers will be allowed to move to an alternative property provided it meets the provider’s requirements and it still provides acceptable security for the loan.

- The product must include a “no negative equity guarantee”—this ensures that neither the customer nor the estate will be liable to cover any shortfall following the sale of the house.

- All customers will have the right to make penalty-free payments on their loan, subject to certain criteria.

Despite the ERC’s Safeguards, What Are Pitfalls to Consider?

Despite the ERC's safeguards, the pitfalls to consider include reduced inheritance and potential early repayment fees—your adviser or broker will go through these in great detail to determine whether equity release is an option you should be considering.

These pitfalls include:

- Reducing the inheritance you could leave to your beneficiaries.

- You could be liable to pay early repayment fees if you decide to pay off your loan early.

- It could disqualify you from receiving means-tested state benefits.

- It can be an expensive form of borrowing.

Which Organisations Are Affiliated With the Equity Release Council?

The organisations that are affiliated with the Equity Release Council equity release providers such as major financial institutions and specialist lenders, independent financial advisers (IFAs) and advisory firms, surveyors, valuers, and compliance organisations.

Here are these organisations in more detail:

Who Are the Advisers Associated With the Equity Release Council?

The advisers associated with the Equity Release Council are independent financial advisers (IFAs) who specialise in providing advice on equity release products.

The Financial Conduct Authority (FCA) requires customers to seek financial advice before releasing equity from their homes, and this advice can be given either face-to-face or over the phone.6

Which Solicitors Are Members of the Equity Release Council?

Solicitors who are members of the Equity Release Council are legal professionals or firms that provide independent legal advice to clients considering equity release products.

These solicitors are specifically trained to ensure that consumers fully understand the legal implications of entering into an equity release agreement, including their rights and responsibilities.

Why Is It Important to Choose Equity Release Council-Affiliated Solicitors for Your Equity Release?

It's important to choose Equity Release Council-affiliated solicitors as you will get peace of mind that you're receiving expert, ethical advice aligned with the highest industry standards.

Their adherence to the Council’s standards also means you benefit from safeguards which protect your financial interests.

What Providers Are Part of the Equity Release Council?

Providers that are part of the Equity Release Council are companies that offer equity release plans, typically in the form of lifetime mortgages and home reversion plans.

Providers that hold an ERC membership are required to comply with the ERC’s strict product standards.

Who Are the Associates and Affiliates of the Equity Release Council?

The associates and affiliates of the Equity Release Council include numerous organisations that support the equity release market but may not directly offer products or services to consumers.

These typically include surveying and valuation firms, compliance and regulatory bodies, consumer protection organisations, technology providers, and training and educational institutions.

While these associates and affiliates may not directly provide equity release products, their involvement helps ensure that the sector operates responsibly, efficiently, and in the best interest of consumers.

Who Is Responsible for Governing the Equity Release Council?

The Equity Release Council is governed by a Board of Directors, which is responsible for overseeing its strategic direction and ensuring the implementation of its policies and standards.

The Board is typically made up of senior representatives from member organisations, including equity release providers, financial advisers, and other stakeholders within the sector.

The governance structure also includes various committees that focus on specific areas, such as product standards, compliance, and consumer protection.

How Can Companies Join the Equity Release Council, and How Is Compliance Ensured?

Companies can join the Equity Release Council by meeting strict compliance criteria, and compliance is ensured by always seeing that they uphold the highest industry standards for ethical equity release practices.

Take a look at the process:

What Is the Process for a Company to Become a Member of the Equity Release Council?

The process for a company to become a member of the Equity Release Council involves a company completing the application process and paying the necessary fees.

The company will also be required to prove their systems will adhere to the ‘Statement of Principles’, and ‘Required Consumer Outcomes’ and be able to follow the ‘Rules and Guidance’.

How Does the Equity Release Council Ensure Compliance With Its Policies?

The Equity Release Council ensures compliance with its policies through regular audits, adherence to a strict code of conduct, and sanctions for non-compliance.

On the anniversary of their admission as members, the ERC requires all members to complete and submit an Annual Certificate of Compliance with the rules and guidance.

What is the Frequency of Member Reviews by the Equity Release Council?

The frequency of member reviews by the Equity Release Council is typically annual, and members are often required to submit a certificate of compliance with their annual membership fees.

How Are Complaints Managed and Resolved by the Equity Release Council?

Complaints are managed and resolved by the Equity Release Council through a structured process, offering mediation between members and consumers to ensure fair and prompt resolutions.

These are the processes for complaints and feedback:

How Are Complaints About Companies Handled by the Equity Release Council?

Complaints about companies are handled by the Equity Release Council by giving the provider a chance to respond and rectify any wrongdoing through their own internal procedures.

Should this not obtain an acceptable result, the ERC will intervene and conduct its investigations to determine whether the case should be escalated to relevant governing bodies.

How Can You File a Complaint Through the Equity Release Council, and What Process Follows?

You can file a complaint through the Equity Release Council by first contacting the member firm directly and following their complaints process; the process that follows involves the ERC investigating the complaint, engaging with the member firm, and potentially taking action if any breaches are identified.

If the issue remains unresolved, you can escalate the complaint to the ERC, which will review the case and ensure that the firm adheres to the council's Code of Conduct.

What Enforcement Actions Can the Equity Release Council Undertake?

The Equity Release Council can undertake several enforcement actions, including issuing warnings or sanctions to member firms that fail to comply with its Code of Conduct.

In more serious cases, the council can suspend or expel members, barring them from representing the ERC, ensuring that member firms maintain high ethical behaviour and transparency in the equity release market.

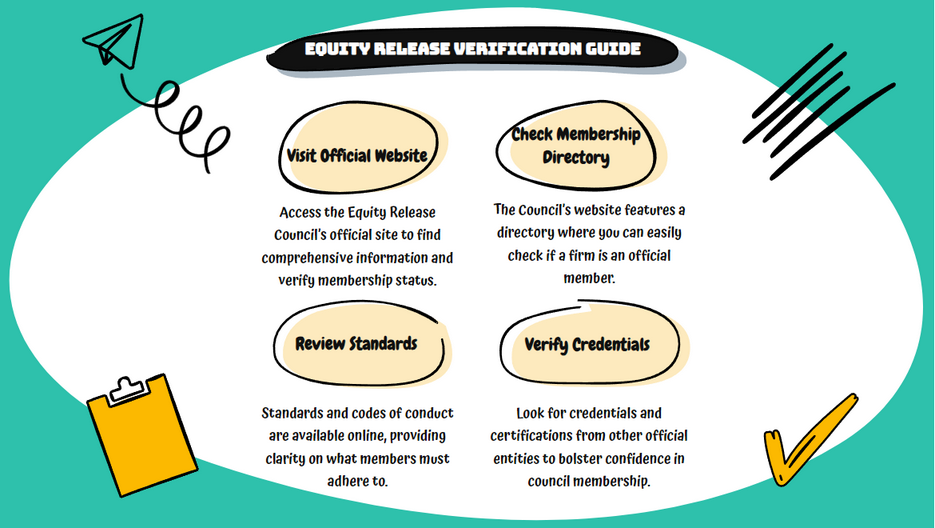

How Can You Verify Membership and Find More Information on Equity Release Council Standards?

You can verify membership and find more information on Equity Release Council standards by consulting the ERC's official website, which provides comprehensive resources and member directories.

Always ensure verification by knowing this info:

How Can You Verify If an Adviser or Provider Is a Member of the Equity Release Council?

You can verify if an adviser or provider is a member if they appear on the ERC’s website.

Find a Member here.

Where Can Consumers Find Detailed Information and Assistance on the Equity Release Council’s Website?

Consumers can find detailed information and assistance on the Equity Release Council’s website in sections such as "Consumer Information," which provides guides, FAQs, and explanations of equity release products.

For specific queries or more personalised assistance, the site provides contact details for direct support from the council, ensuring you can easily access the information and help you need.

Where Can You Find Statistics Related to the Equity Release Council?

You can find statistics related to the Equity Release Council on their website, where they publish annual reports, market analyses, and research papers.

According to recent equity release statisticss, £6.2bln7 was unlocked in 2022.

Frequently Asked Questions About the Equity Release Council

What Should You Expect From Your Interactions With the Equity Release Council?

Can the Equity Release Council Assist in Recovering Money From a Non-Compliant Company?

What Is the Process for Appointing Board Members to the Equity Release Council?

How Does the Equity Release Council Influence Equity Release in the UK?

In What Ways Has the Equity Release Council Benefited Consumers?

What Measures Does the Equity Release Council Take to Protect Consumer Interests?

How Can You Access Reports and Data From the Equity Release Council?

Who Are Equity Release Council Solicitors?

What Steps Are Required for Accreditation by the Equity Release Council?

What Are the Best Ways to Contact the Equity Release Council for Inquiries?

Final Thoughts on the Role and Impact of the Equity Release Council

Navigating your finances and planning for retirement can feel overwhelming, but the good news is, you don't have to do it alone.

The Equity Release Council (ERC) plays a crucial role in ensuring that, if you decide to release equity from your home, you’re protected from excessive interest costs and unnecessary financial pitfalls—both for you and your heirs.

In 2026, it’s more important than ever to choose a regulated, trusted provider who adheres to the ERC’s strict standards, ensuring your equity release is safe and potentially life-changing.

Ready to take the next step? Start by consulting your financial adviser or broker and explore the possibilities with an ERC-approved provider, and to see how much equity you could release, try our handy equity release calculator—your first step toward a secure and informed financial future!

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.