Which Are the Best Equity Release Rate Offers in 2026?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- The beginning of 2026 sees equity release rates dancing between 5.97% to 6.28%, with both fixed and variable rates swayed by market trends and personal details—scoring the best rates depends on these factors.

- Grasping equity release interest, from APR vs. MER, is key to picking your plan.

- Use an interest rate calculator to ballpark your costs, keeping an eye on repayment strategies and how your home's value changes could play out.

If you’re considering a retirement mortgage, understanding equity release interest rates is key, as they can have a significant impact on your financial future, influencing both your borrowing costs and long-term plans.

Curious if you can secure a better deal? This guide breaks down the essentials of equity release interest rates and provides practical tips to help you find the most competitive offers available.

At SovereignBoss, we’ve done the legwork—meticulously researching and compiling the latest rates and offers—so let us guide you toward making informed decisions tailored to your lifestyle and financial goals.

Let's get started...

In This Article, You Will Discover:

What Is Equity Release, and How Do Interest Rates Affect It in the UK?

Equity release in the UK allows homeowners aged 55 and over to unlock property value through lifetime mortgages or home reversion plans; interest rates, often compound, significantly impact the total repayment amount, ultimately affecting inheritance and long-term costs.

Let's take a closer look:

What Is Equity Release in the UK?

Equity release in the UK enables homeowners aged 55 and over to access the value tied up in their property without selling it, and through schemes like lifetime mortgages or home reversion plans, you can unlock tax-free cash while retaining the right to live in your home until you pass away or move into long-term care.

This financial solution is particularly useful for bridging the gap between retirement savings and living expenses, offering flexibility with options for a lump sum or regular payments.

Equity release provides a way to enjoy a more comfortable and secure retirement without the burden of monthly repayments.

How Does Interest on Equity Release Work in the UK?

Interest on equity release in the UK is typically calculated on a compound basis, meaning interest is charged not only on the original loan amount but also on previously accrued interest.

This compounding effect can cause the total debt to grow significantly over time, potentially reducing the inheritance left for your estate.

You have 2 primary options to manage interest:

- Monthly Payments: You can choose to make monthly payments to cover the interest, preventing the loan balance from increasing and keeping the overall debt lower.

- Compound Interest: Alternatively, you can allow the interest to accumulate, which will result in faster growth of the total amount owed.

Many modern equity release plans offer flexibility, allowing you to make occasional payments when it suits your financial situation.1

What Are the Current Equity Release Interest Rates, and How Have They Changed Historically?

The current equity release interest rates range from approximately 5.72% to 7.34% AER in the UK; historically, these rates have fluctuated due to economic conditions, reflecting trends in inflation, lender policies, and market demand.

Here's more information:

What Are the Current Equity Release Interest Rates in the UK?

Current equity release interest rates in the UK typically range between 5.97% to 6.28%, which are higher than standard mortgage rates due to the unique nature of these products.

Unlike traditional mortgages, equity release loans do not require regular repayments, the interest accrues over time, and the loan, along with the accrued interest, is usually repaid when the property is sold or the homeowner passes away or moves into long-term care.

It’s crucial to understand that equity release can impact your eligibility for state benefits and your tax position., which is why consulting with both a solicitor and a financial adviser ensures you make an informed decision tailored to your financial situation and goals.

What Have Been the Historical Trends in Equity Release Interest Rates?

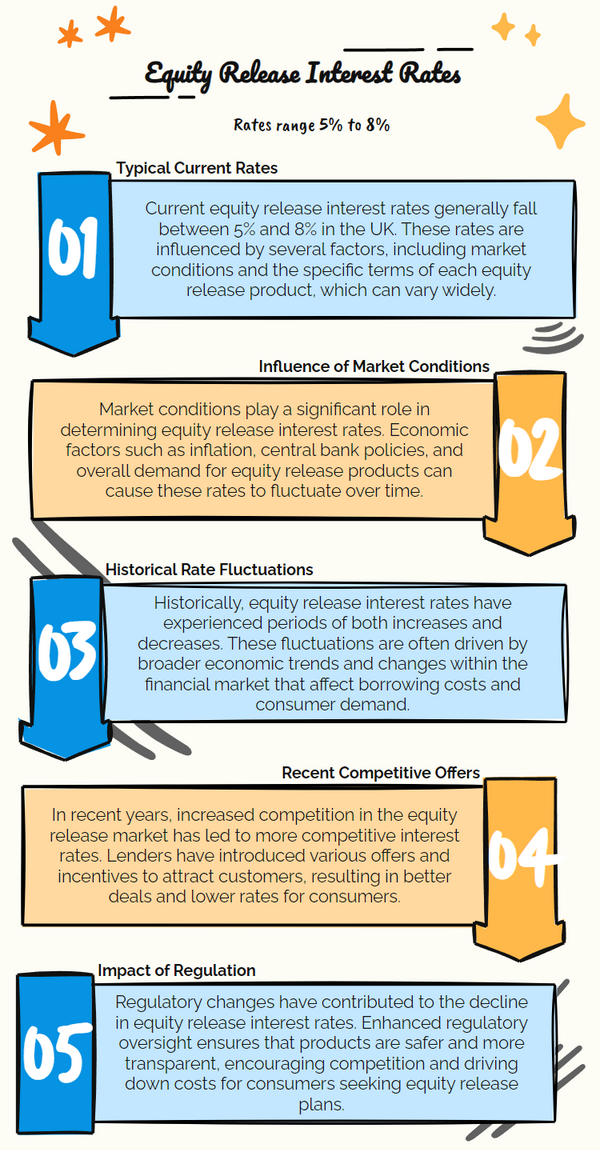

Historical trends in equity release interest rates have seen a significant decline over the years, dropping from double-digit figures in the 1990s to more competitive levels in recent years.

This trend reflects increased competition among providers and improved regulatory standards, making equity release products more appealing to homeowners seeking to access their property’s value during retirement.

Despite this progress, equity release rates remain higher than conventional mortgage rates, and rates can fluctuate based on broader economic conditions, including changes in the Bank of England’s base rate.

Are Equity Release Rates Competitive in 2026 and How Do They Compare?

In 2026, equity release rates are competitive compared to previous years, and while still higher compared to traditional mortgage rates, the equity release market offers a variety of flexible options that make it more appealing for those seeking to unlock home equity.

Here's what you need to know:

Are Equity Release Rates Competitive in 2026?

Equity release rates in 2026 remain competitive compared to previous years, though their appeal depends on factors such as market conditions, product features, and individual circumstances.

Following the economic challenges of late 2022, many providers introduced incentives like lower rates, higher loan-to-value (LTV) ratios, and expanded product ranges to attract customers.2

These adjustments sparked renewed interest in equity release, with signs of increased activity by mid-2023.3

Consequently

To assess the competitiveness of offers in 2026 amid fluctuating interest rates, compare rates typically within the 5.97% to 6.28% range and evaluate terms across providers.

*While we review our figures regularly, they may have changed since this article was last updated.

How Do Current Equity Release Interest Rates Compare in 2026?

In 2026, equity release interest rates remain competitive, reflecting the specialised nature of these products and the protections they offer.

As of early January 2026, the best available equity release rates fell within the range of 5.97% to 6.28% (MER), highlighting the importance of comparing options across providers to secure the most favourable terms.

Here is a summary of the best current figures:

| Provider | Monthly (Rate) The amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. | AER (Annual Equivalent Rate) The percentage of interest on a loan or financial product if compound interest accumulates over a year during which with no payments are made. | APR (Annual Percentage Rate) The number that represents the total yearly cost of borrowing money, expressed as a percentage of the principal loan amount. |

|---|---|---|---|

| Pure Retirement | 5.97% | 6.14% | 6.14% |

| Canada Life | 6.13% | 6.31% | 6.31% |

| Canada Life | 6.16% | 6.34% | 6.34% |

| Aviva | N/A | 6.35% | 6.30% |

| Canada Life | 6.20% | 6.38% | 6.30% |

| Canada Life | 6.24% | 6.42% | 6.38% |

| Just Retirement | 6.25% | 6.43% | 6.42% |

| Just Retirement | 6.25% | 6.43% | 7.20% |

| Canada Life | 6.27% | 6.45% | 7.20% |

| Just Retirement | 6.28% | 6.46% | 6.45% |

Last update: 17 February 2025

Scenario

- 60 Year Old Single Male

- £300k Property Value

- £30k Release

*This rate was accurate upon publication. While we review our figures regularly, they may have changed since this article was last updated.

What Are the Average Interest Rates in the UK in 2026?

The average equity release interest rate is 5.97% to 6.28% (APR)*, according to the Spring Market report released by the ERC.21

*This rate was accurate upon publication. While we review our figures regularly, they may have changed since this article was last updated.

Look at the mechanics of the average interest rates here:

Are Equity Release Interest Rates Fixed?

Yes, most equity release interest rates are fixed, offering homeowners stability and predictability throughout the loan term.

Fixed rates ensure that the interest charged remains constant, providing clarity on the long-term costs; however, some products may feature variable rates, so it’s crucial to review the terms carefully.

Equity Release Council (ERC) members are required to offer fixed rates or, if providing variable rates, to cap them for the entire duration of the loan, with current fixed rates typically falling within the range of 5.97% to 6.28%.4

Fixed vs. Variable: What's Best for Equity Release Rates?

Fixed vs. variable equity release interest can have different outcomes, so what's best totally depends on what works for you.

Fixed rates are generally preferred for equity release, offering stability and predictable costs over time; variable rates, though potentially lower initially, carry the risk of increasing, making them less suitable for long-term financial planning.

Fixed rates provide certainty, which is often crucial for retirees, potentially making them the better choice.

What Is the Difference Between APR and MER in Equity Release?

APR (Annual Percentage Rate) includes all costs of borrowing, giving a comprehensive view of expenses, while MER (Monthly Equivalent Rate) focuses on the monthly interest rate applied.

It does not include any extra charges or fees that may come with the equity release.

Beware, though; while MER rates may seem more affordable, you should use the APR to compare rates for a clearer understanding of the associated costs.

What Are the Average Interest Rates in the UK in 2026?

The average equity release interest rate in the UK is 5.97% to 6.28% (APR)*, according to the Spring Market report released by the ERC.5

*This rate was accurate upon publication. While we review our figures regularly, they may have changed since this article was last updated.

How Can You Find the Lowest Equity Release Interest Rates in 2026?

You can find the lowest equity release interest rates in 2026 by comparing offers from top providers, consulting a financial adviser, using online comparison tools, and ensuring eligibility for plans with competitive loan-to-value ratios and flexible repayment options.

These are things to consider:

Where Can You Find the Lowest Equity Release Interest Rates This Year?

You can find the lowest equity release interest rates this year by exploring offers from leading providers like Aviva, Legal & General, and Pure Retirement, consulting equity release advisers, and using online comparison tools tailored to your needs.

Financial comparison websites are a good starting point, but consulting with a financial adviser can also uncover tailored deals that may not be widely advertised.

Remember, the lowest rate isn't always the best option if it doesn't meet your overall financial strategy.

Which Providers Offer the Best Equity Release Rates in 2026?

In 2026, top providers and companies like Aviva, Legal & General, and more have been competitive and offer the best equity release rates.

Each offers distinct plans that cater to different needs, with some providing lower interest rates for specific conditions or amounts.

It's crucial to compare these providers not just on their rates but also on the flexibility and features of their products to identify the best fit for your financial situation.

What Factors Influence Equity Release Interest Rates and How Can You Secure the Best Rate?

Factors influencing equity release interest rates include the borrower’s age, property value, loan-to-value ratio, market conditions, and the chosen plan type; to secure the best rate, compare providers, opt for flexible plans, and seek advice from a qualified financial adviser.

Look at these factors:

What Factors Influence Equity Release Interest Rates?

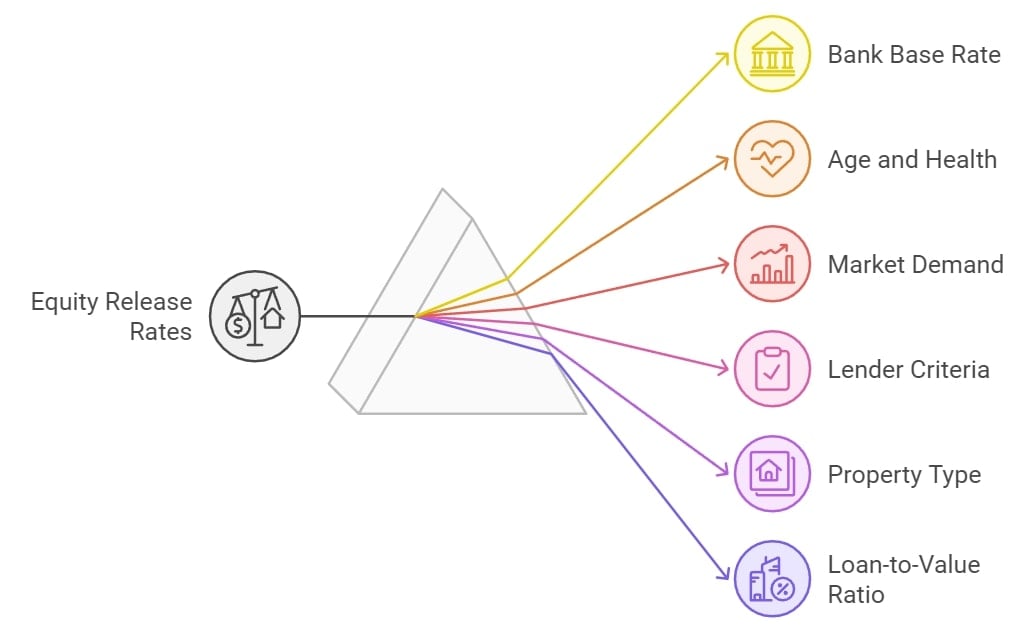

Factors influencing interest in equity release products range from the Bank of England base rate to your age and health.

Other factors include:

- Market demand

- The lender’s criteria

- The type of property

- The loan-to-value (LTV) ratio

The type of scheme you choose can also impact the interest rate.

How Do You Get the Best Equity Release Interest Rates in 2026?

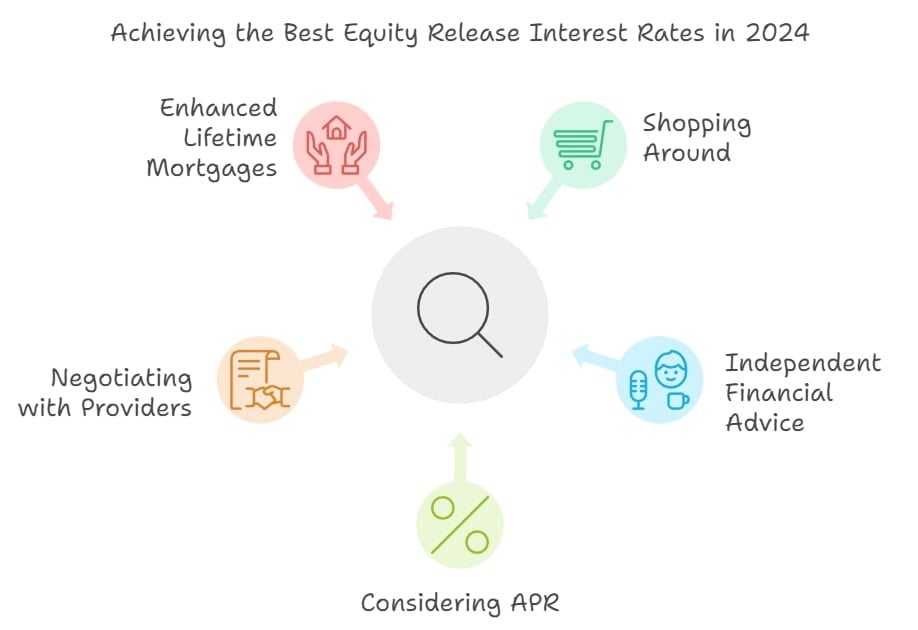

You can get the best equity release interest rate in 2026 by shopping around and seeking independent financial advice.

Also consider the following:

- Look at the APR to understand the total cost.

- Negotiate with providers to see if they can offer more favourable terms.

- Consider an enhanced lifetime mortgage if you have certain health conditions or lifestyle factors that may reduce your life expectancy.

How Do Equity Release Calculators Help in Understanding Interest Rates?

Equity release calculators help in understanding interest rates by providing personalised estimates of loan amounts, interest costs, and repayment projections based on factors like property value, age, and chosen plan, offering clarity for informed decision-making.

Take a look:

Can You Use the Equity Release Interest Rate Calculator?

Yes, you can use an equity release interest rate calculator to get an approximate idea of the potential costs of a scheme.

By entering details like your age, property value, and desired loan amount, the calculator provides an estimate of what you might qualify for; however, remember that this is only an indicative figure, and the exact cost can only be confirmed once you complete the loan application process.

Our free calculator is simple and easy to use, offering a helpful starting point for planning your equity release options. Why not try it today to explore your potential benefits?

How Can a Compound Interest Calculator Clarify the Cost of Equity Release?

A compound interest calculator clarifies the cost of equity release by demonstrating how interest accumulates over time on the loan, helping you understand the long-term financial impact and compare equity release options more effectively.

By entering details such as your loan amount and expected interest rate, the calculator projects the total amount you might owe in the future.

This insight allows you to assess the potential effect on your estate’s value, enabling you to make an informed decision about whether equity release aligns with your financial goals.

Keeping Up With the Latest on Interest Available in 2026

Staying informed about the latest interest rates in 2026 is essential for making sound decisions regarding equity release; additionally, regularly checking financial news, comparison websites, and consulting with financial advisers can help you secure the best rates.

Interest rates can fluctuate due to economic factors, affecting the overall cost of borrowing.

Look at the latest interest news to know:

What Has Changed in Equity Release Interest Rates?

What has changed is that in 2026, the Bank of England hiked its base rate for the 13th time in a row to 5.25%.6

How Do Changes in Equity Release Rates Affect You?

Changes in equity release rates directly impact the overall cost of borrowing, affecting how much you owe over time.

Higher rates can lead to increased interest accumulation, reducing the amount of equity left in your property, while lower rates offer potential savings.

It is normal to wonder about equity release interest rates rising; however, the implication for you is that while the base rate is rising, the fixed interest rate for products has declined since Q4 2026.7

Common Questions

Are Fixed or Variable Interest Rates More Common in Equity Release Products?

Can I Negotiate a Lower Interest Rate on My Equity Release Plan?

How Are Interest Rates for Equity Release Determined in the UK?

How Does the Bank of England Base Rate Affect Equity Release Interest Rates?

Can You Switch to a Different Equity Release Plan With Lower Interest Rates?

Can You Repay Equity Release Interest to Prevent Compounding?

How Does a Change in Property Value Affect My Equity Release Interest Rate?

What Are the Current Equity Release Interest Rates in the UK for 2026?

Can Equity Release Interest Rates Change Over Time in the UK?

How Do Equity Release Interest Rates Impact the Overall Cost?

Are There Ways to Lower Your Equity Release Interest Rates in 2026?

In Conclusion

Mastering the intricacies of equity release interest rates is key to making informed and confident decisions.

Whether you’re considering fixed or variable rates, remember there’s often room for negotiation to tailor a plan that suits your needs.

Given the complexities, seeking guidance from a qualified adviser ensures your chosen option aligns seamlessly with your financial goals, and with the right knowledge and expert support, you can confidently secure a rate that paves the way for a stable and prosperous retirement.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.