2026 Home Reversion Calculator: How Much Equity Can You Access?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Key Takeaways...

- A home reversion calculator in the UK uses the age of the youngest homeowner and the estimated value of your property to calculate the percentage of your home's value that you could sell for a tax-free cash lump sum.

- It provides an equity release estimate by determining the percentage of your home's value you can sell whilst retaining the right to live there rent-free.

- To use, you need your property's estimated value and the age of the youngest homeowner.

- While it provides a useful estimate, accuracy depends on the quality of the input data and market variations, so it is best used as an initial guide.

- A reliable calculator can be found on various equity release comparison websites, financial advisory sites, and providers' own websites, such as SovereignBoss.

Do you want to discover approximately how much equity you can unlock in just ten seconds with our home reversion calculator?

Along with having your estimate emailed to you, you will also get an obligation-free call from an adviser from Age Partnership, one of the leading home reversion scheme providers in the UK.

In This Article, You Will Discover:

Let our expert team guide you through how a home reversion calculator can help you estimate the potential amount you could release.

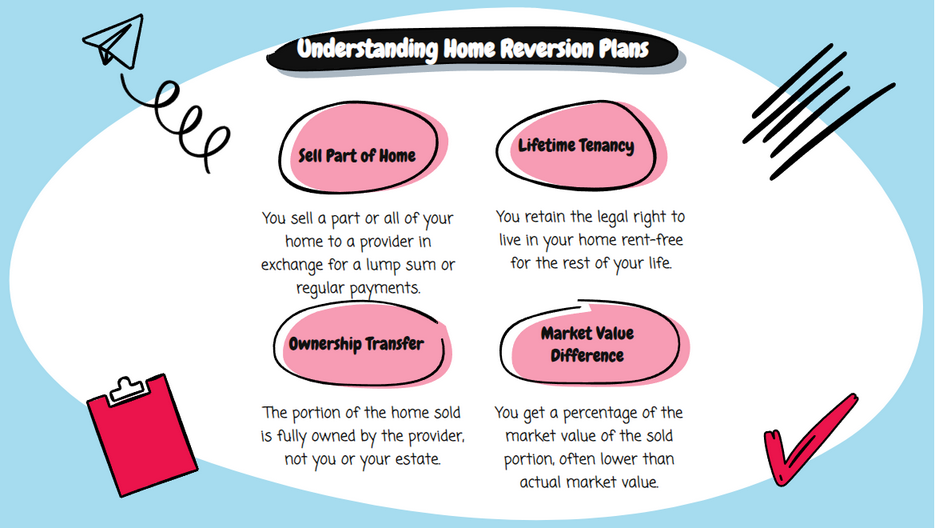

What is a Home Reversion Plan?

A home reversion scheme is a type of equity release plan available in the UK for homeowners aged 65 or over.1

This type of equity release plan enables you to sell all or a part of your property, below market value, to an equity release provider in exchange for a tax-free lump sum, regular access to a cash facility, or both.

You retain the right to live in your home rent-free (in most cases) until you pass away, move into long-term care, or sell your home.

Understanding the Calculation Process of Home Reversion

Understanding the calculation process of a home reversion is crucial for homeowners considering this option, as it impacts the amount you receive and the equity left in your home.

Home reversion calculators estimate the amount you may be able to release from your home.

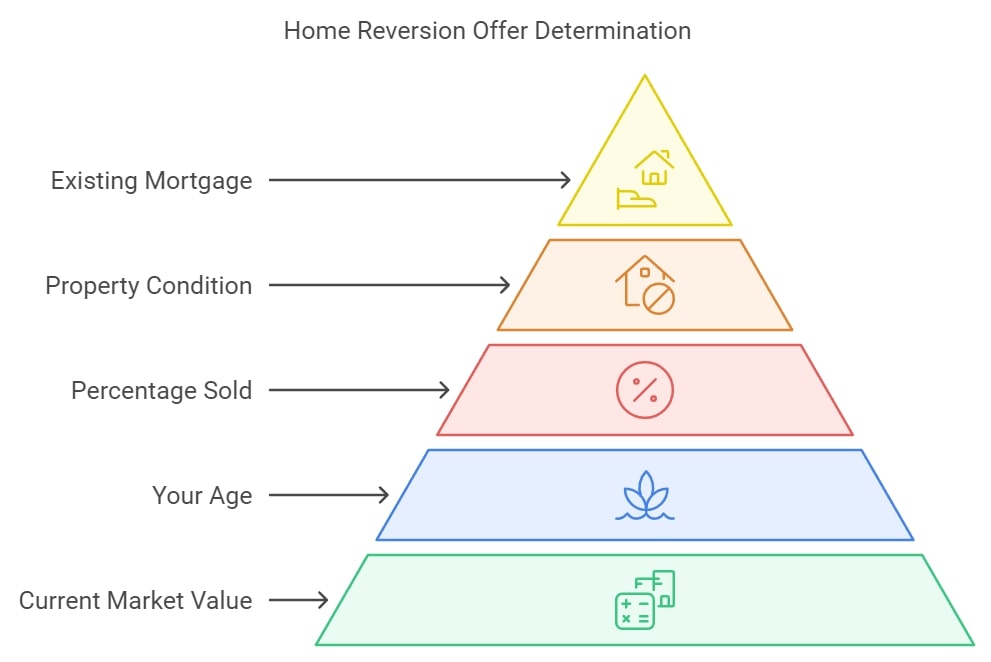

How Does a Home Reversion Company Determine It's Offer?

A home reversion company determines it's offer based on several factors including the current market value of your property, your age, and the percentage of your home you wish to sell.

Understanding these factors is crucial in assessing the offer made by the company and determining if home reversion is a suitable option for you.

A closer look at these factors:

- Current Market Value: The first step is to assess the current market value of your property. This usually involves a professional valuation to determine the property's worth.

- Your Age: The older you are, the higher the percentage of your home's value you may be able to release. This is because your life expectancy is a significant factor in the calculation.

- Percentage of Property Sold: The amount of money you wish to receive is directly related to the percentage of your home you are willing to sell. Selling a larger portion of your property will result in a higher offer.

- Property Condition: The state and location of your property will also affect the company’s offer. A well-maintained property in a desirable location will likely fetch a better offer.

- Existing Mortgage: Whether you have an existing mortgage on the property is another typical equity release criterion. Having an existing mortgage may affect the amount you can release through home reversion.

The company will then make an offer based on these factors, typically a percentage of the market value of the portion of the property being sold.

It is important to note that the offer will usually be below the market value because the company will factor in potential future property value changes and associated risks.

Step-By-Step Guide to Using a Home Reversion Calculator

Our step-by-step guide to using a home reversion calculator will walk you through the process.

Navigating the world of home reversion can be complex, but using a home reversion calculator can make it simpler.

This handy tool requires just a few key pieces of information: the age of the youngest applicant, the value of your property, and a few other essential details.

In just ten seconds, you can receive an estimate directly in your inbox.

Key Information Required

To use a home reversion calculator, you will be required to input the following:

- The estimated value of your estate (which, according to the FCA and ERC, must be at least £70,000)2

- The age of the youngest owner (which must be over 65)

- Your postcode (which must be in the UK)

- The percentage of your estate’s equity that you want to release (which can be from 25% to 100% of the property)3

- Whether you are applying individually or in joint names

Ensuring you have this information on hand will facilitate a smooth and efficient calculation process.

Interpreting the Results

Interpreting the results is crucial for making an informed decision.

Once you have input all the required information into the home reversion calculator, you will receive an estimate of the lump sum amount you could potentially receive.

Remember, the results from the home reversion calculator are just an estimate and the actual offer may vary.

It is always advisable to consult a financial advisor or a home reversion specialist for personalised advice before making a decision.

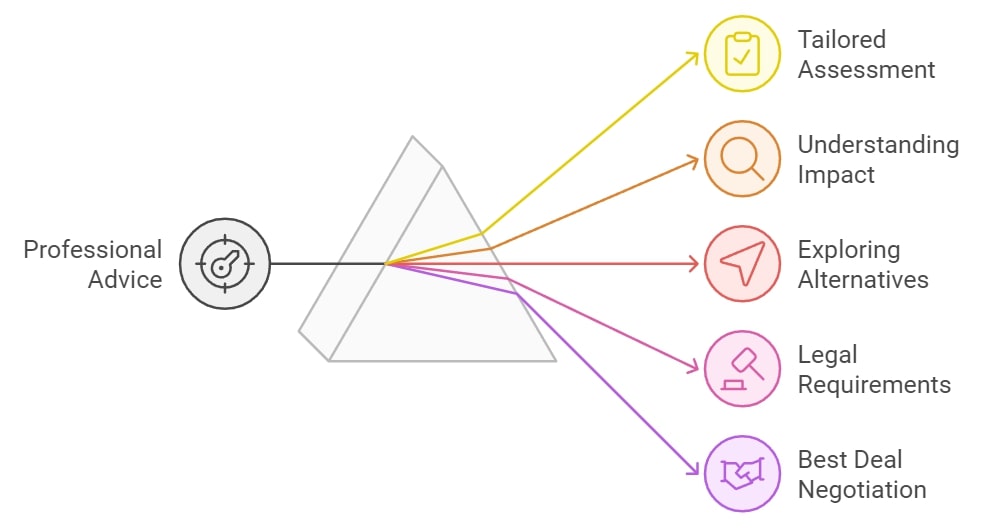

The Importance of Professional Advice

When considering home reversion or any other form of equity release, seeking professional advice is crucial.

Some reasons why professional advice is so important:

- Personalised Assessment: Professionals can provide a tailored assessment of your financial situation and help determine if home reversion is suitable for you.

- Understanding the Impact: Experts can help you understand the implications of home reversion on your estate, inheritance tax, and means-tested benefits.

- Exploring Alternatives: There are various ways to release equity from your home, and an advisor can help you explore all available options and recommend the best one for your situation.

- Legal and Regulatory Requirements: Professionals can help you navigate the legal and regulatory requirements associated with home reversion.

- Negotiating the Best Deal: An advisor can help negotiate the best possible terms with the home reversion company.

Since home reversion is a significant decision with long-term implications, it is always advisable to seek professional advice before proceeding.

Where to Find a Reliable Home Reversion Calculator

A reliable home reversion calculator can typically be found on the websites of reputable financial institutions, home reversion companies, or equity release advisory services.

Additionally, organisations such as the Equity Release Council or comparison websites may also provide access to reliable calculators.

It is always advisable to use calculators provided by companies authorised and regulated by the Financial Conduct Authority (FCA)4 and then consult a professional advisor for personalised advice.

Estimating Your Potential Reversion Amount With Our Free Home Reversion Calculator

Try our obligation-free calculator below to obtain an estimate of how much equity you may be able to release with a home reversion plan.

Simply enter the required details, and you will instantly receive a preliminary estimate, serving as a crucial first step in determining whether a home reversion plan aligns with your unique financial circumstances.

How Will You Receive Your Money With a Home Reversion?

After approval of a home reversion plan, you have the flexibility to choose your preferred method of payment:

Options available to you are:

- A tax-free lump sum

- Regular access to a cash facility

- A combination of both

Additionally, you can choose to reserve a portion of your home's value for future use.

It is important to discuss and agree upon these options with your provider before finalising the home reversion plan.

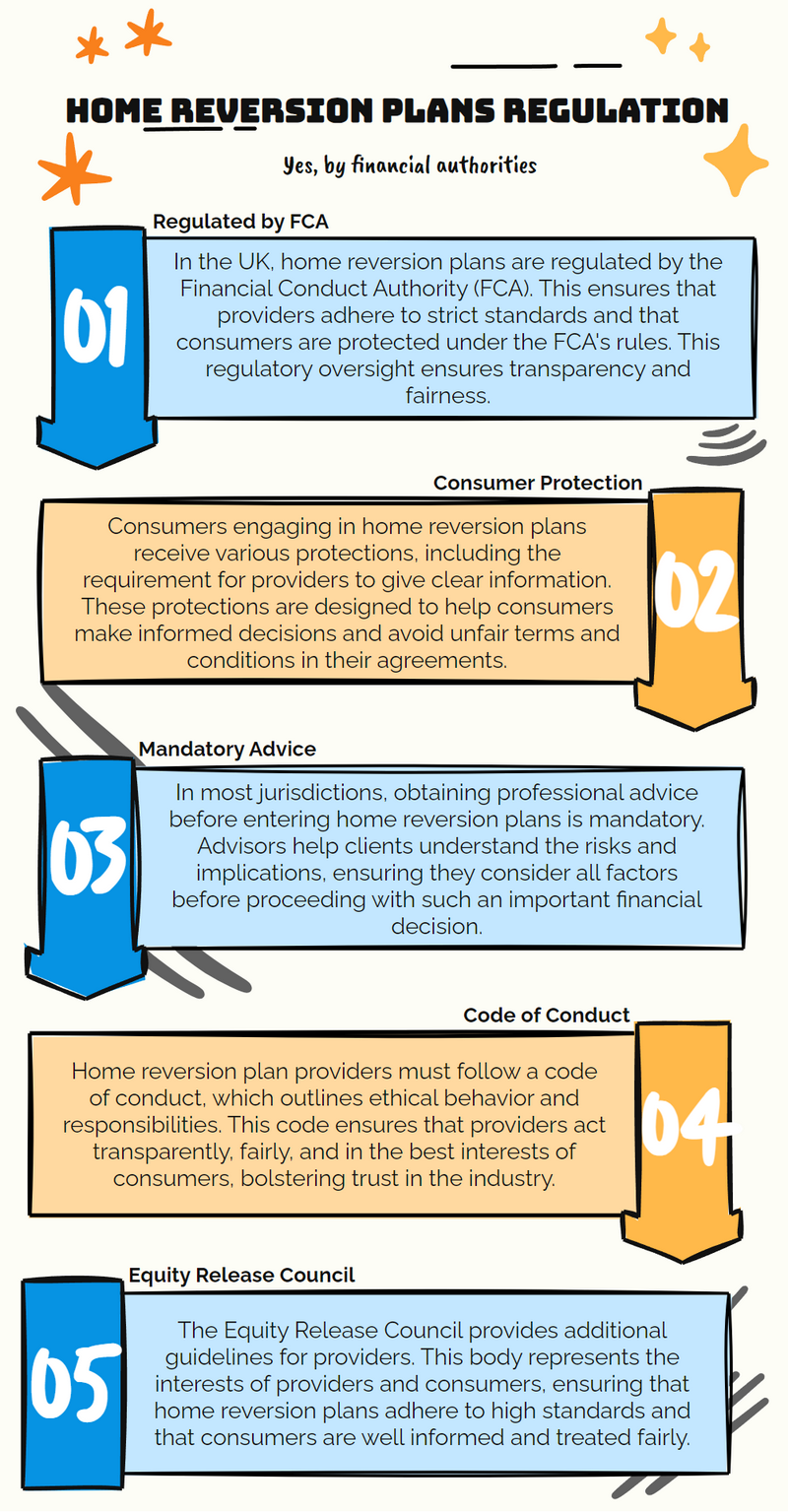

Are Home Reversion Plans Regulated?

Yes, home reversion plans in the UK are regulated by the FCA, ensuring they meet certain standards, and that you, as a consumer, are protected.

Companies offering these plans must adhere to stringent regulations and are required to provide clear and fair information, devoid of any misleading elements.

The Equity Release Council (ERC) also plays a pivotal role in supervising the equity release market, thereby ensuring additional safeguards and establishing standardised practices across the industry.

Common Questions

How Does a Home Reversion Calculator Work in the UK?

Can a Home Reversion Calculator Provide an Estimate for Equity Release?

What Happens if My Circumstances Change After Using a Home Reversion Calculator?

Are the Results of a Home Reversion Calculator Legally Binding?

Is There a Restriction on Using the Capital From a Home Reversion Plan?

Do You Pay Interest on a Home Reversion Plan?

What Information Do I Need for a Home Reversion Calculator?

How Accurate Is a Home Reversion Calculator?

Where Can I Find a Reliable Home Reversion Calculator Online?

In Conclusion

A home reversion calculator serves as a convenient and accessible resource, offering an initial glimpse into your equity release options.

Keep in mind however, that the estimates generated are merely indicative and do not constitute a legal obligation.

It is always recommended to choose a company regulated in the UK by the Financial Conduct Authority (FCA) when contemplating such a pivotal financial decision.

To kickstart your journey, try our FREE home reversion calculator right here for an approximation!

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?