Is an Interest-Only Mortgage a Smart Choice in 2026?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Interest-only mortgages mean you're just paying the interest bit, leaving the loan's main chunk untouched; the loan itself doesn't budge unless you chip in extra.

- Pros? Your bills are smaller to start. Cons? You've got to repay the full loan amount when time's up, whether that's through refinancing, selling up, or dipping into your savings—possibly costing more in the long haul.

- Borrowers are advised to review their repayment plan regularly to ensure it remains feasible, adjusting as needed to stay on track.

Did you know that over 700,000 UK homeowners currently have interest-only mortgages?1 A surprising statistic raises questions about why many opt for this unique mortgage structure.

At SovereignBoss, we’re here to simplify the complexities of finance, giving you clear, actionable insights.

From understanding how interest-only mortgages work to exploring qualification criteria and repayment strategies, we aim to empower you to make confident, informed decisions.

Let’s dive into the essentials of interest-only mortgages and uncover whether this option fits your financial future...

In This Article, You Will Discover:

What Is an Interest-Only Mortgage and How Does It Work in the UK?

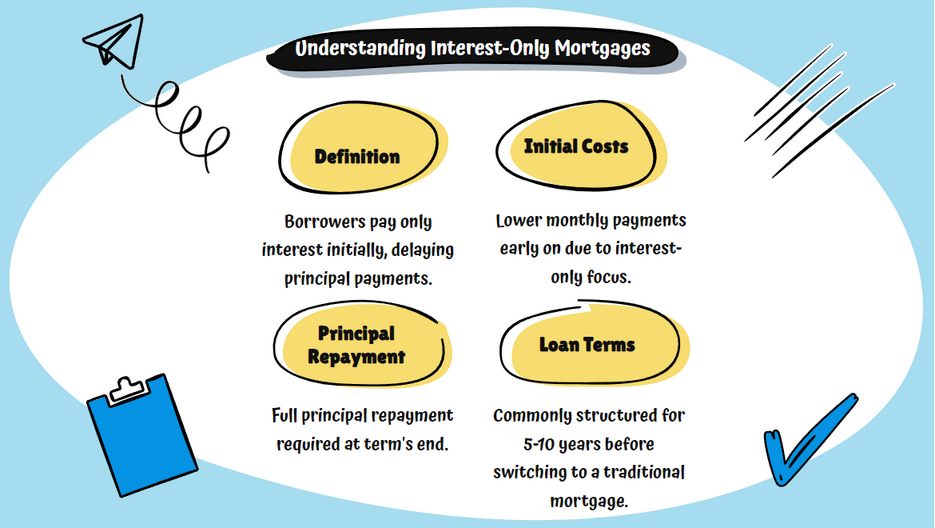

An interest-only mortgage in the UK is a loan where borrowers pay only the interest each month, and it works by deferring the repayment of the principal loan amount until the end of the term, typically through savings, investments, or property sales.

Let's take a closer look:

What’s an Interest-Only Mortgage in the UK?

An interest-only mortgage in the UK is a type of loan where you pay only the interest on the borrowed amount during the loan term, with the principal remaining unpaid until the end of the mortgage period, at which point it must be repaid in full.

This option can complement equity release strategies for homeowners over 55, allowing them to manage their finances more flexibly during retirement.

For instance, it offers a way to reduce monthly outgoings while maintaining property ownership, potentially pairing well with equity release to unlock additional funds without selling the home.

Understanding how interest-only mortgages and equity release work, along with how they can complement traditional mortgage products, is crucial for creating a comprehensive retirement plan that aligns with your financial goals.

How Do Interest-Only Mortgages Work in the UK?

Interest-only mortgages work by allowing borrowers to pay just the interest on the loan each month, leaving the principal balance to be repaid in full at the end of the mortgage term

The capital remains unchanged and is only repaid when the mortgage term concludes.

This means that your monthly repayments will be lower than with a repayment mortgage, but the overall cost may be higher.

How Can You Qualify for an Interest-Only Mortgage in the UK?

To qualify for an interest-only mortgage in the UK, you typically need a substantial deposit, a reasonable credit score, and a solid repayment plan to demonstrate how you'll pay off the principal at the end of the term.

Here's what you need to know:

What Financial Stability Is Needed for an Interest-Only Mortgage?

For an interest-only mortgage, financial stability includes having a reliable income, a strong credit history, and a clear repayment plan for the loan’s principal.

Lenders may also require evidence of savings, investments, or other assets to ensure long-term financial security.

What Deposit Is Required for an Interest-Only Mortgage?

The deposit required for an interest-only mortgage is typically higher than for repayment mortgages, often ranging from 25% to 50% of the property’s value, depending on the lender and the borrower’s financial profile.2

This is because interest-only mortgages are seen as higher risk and a larger deposit reduces the lender's risk.

What Repayment Plan Is Needed for an Interest-Only Mortgage?

For an interest-only mortgage, a repayment plan that could involve savings, investments, selling the property, or other financial assets to cover the outstanding balance is needed.

This plan details how you intend to repay the full loan amount at the end of the term.

How Much Equity Do You Need in Your Home for an Interest-Only Mortgage?

For an interest-only mortgage, lenders typically require significant equity in your home, often around 25% to 50%, to reduce their risk and ensure you have a strong financial position.

If you’re remortgaging, the lender will also consider the amount of equity you have in your home.

At What Age Can You Get an Interest-Only Mortgage in the UK?

In the UK, you can generally get an interest-only mortgage from the age of 18; still, many lenders focus on borrowers aged 55 and above, particularly for retirement-focused products like Retirement Interest-Only (RIO) mortgages.

As every lender has specific criteria, it's important to do your homework and speak with several lenders to understand their requirements.

Consider consulting a financial adviser, as they can help determine if an interest-only mortgage aligns with your financial situation and long-term goals.

Are Interest-Only Mortgages an Option for First-Time Buyers in the UK?

Interest-only mortgages can be an option for first-time buyers in the UK, though they come with stricter criteria compared to standard mortgages, as lenders typically require a higher deposit and a solid plan for repaying the loan's capital at the end of the term.

It's crucial for first-time buyers to carefully consider their long-term financial stability and repayment strategy before opting for this mortgage type.

How Do Buy-to-Let and Residential Interest-Only Mortgages Differ?

Buy-to-let and residential interest-only mortgages differ in purpose and criteria; buy-to-let mortgages are designed for investment properties and rely on rental income for approval, while residential mortgages are for personal homes, focusing on the borrower’s income and repayment plan.

Take a look at the differences:

How Do Buy-to-Let Interest-Only Mortgages Work for Property Investors?

Buy-to-let interest-only mortgages work for property investors by allowing them to pay only the interest on the loan each month, resulting in lower repayments than capital repayment mortgages.

This structure is ideal for those seeking to maximise cash flow from rental income, as it helps maintain liquidity while managing property portfolios.

At the end of the mortgage term, the loan's principal must be repaid, usually by selling the property, refinancing, or using other financial resources.

What Repayment Strategies Are Acceptable for Interest-Only Mortgages?

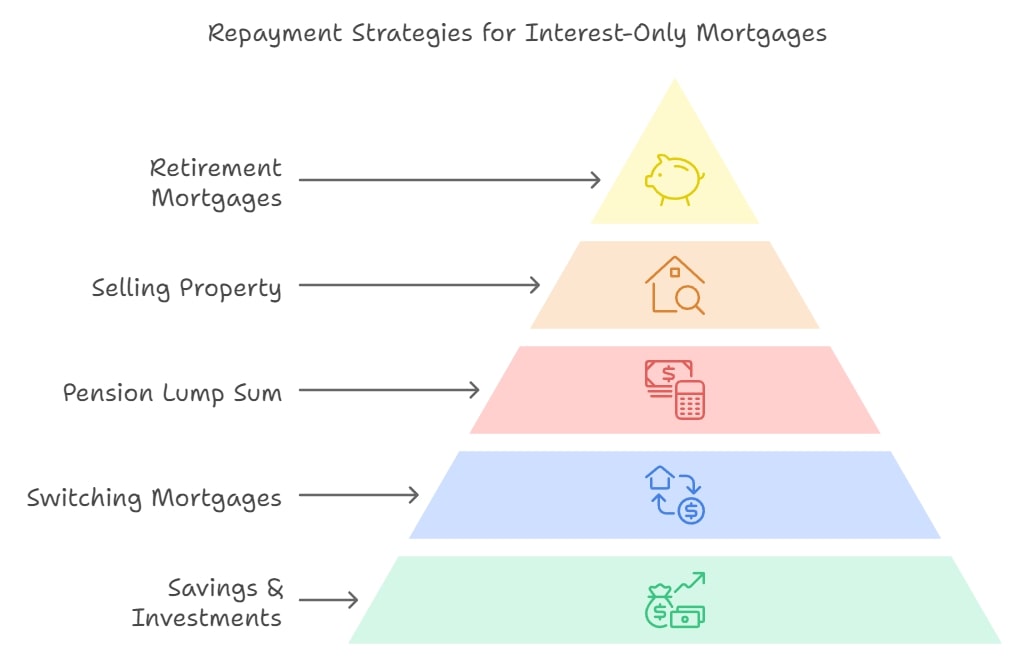

Acceptable repayment strategies for interest-only mortgages include methods using savings, investments, or pensions, with lenders typically requiring proof of a viable plan.

Here's more detail on some of the most common repayment strategies:

- Using Savings & Investments: Consistently setting aside money in a savings or investment account over the term of the mortgage is one approach. By the end of the term, the goal is to have accumulated enough to pay off the loan. The challenge is ensuring sufficient savings or investment growth, bearing in mind the risks associated with investments.

- Switching to a Repayment Mortgage: Another option is switching from an interest-only mortgage to a repayment mortgage during the term. This allows you to gradually pay off the loan amount along with interest, providing peace of mind that the mortgage will be fully repaid by the end of the term.

- Using a Tax-Free Lump Sum from Your Pension: At age 55, you can usually access a tax-free lump sum from your pension, which can be used to repay the loan. However, balancing the need to pay off the mortgage with ensuring sufficient retirement funds is crucial.

- Selling Your Property: Some homeowners plan to sell their property to repay the loan. This strategy relies on property values increasing over time. However, it involves risk, as property prices can fluctuate.

- Retirement Interest-Only Mortgages (RIOs): These are tailored for older borrowers, often retirees. The loan is typically repaid upon a specific life event, such as selling the home, moving into long-term care, or passing away.

When selecting a repayment strategy, it’s essential to consider your personal circumstances, financial goals, and risk tolerance, as each strategy has its pros and cons.

What Are Your Borrowing Limits and Repayment Options with Interest-Only Mortgages?

Borrowing limits for interest-only mortgages are typically lower than for repayment mortgages, often capped at 50–75% of the property value, with repayment options including using savings, investments, selling the property, or switching to a repayment mortgage at the end of the term.

Borrowing limits are based on your income, deposit, and property value.

Here's more information on borrowing limits:

How Much Can You Borrow with an Interest-Only Mortgage in the UK?

The amount you can borrow on an interest-only mortgage depends on your income, credit history, and the lender’s criteria.

However, it's essential to ensure that you have a feasible plan to repay the capital at the end of the term.

What Is the Minimum Value for Repayment Strategies on Interest-Only Mortgages?

The minimum value for your repayment strategy often depends on your lender's specific policies.

Some lenders may indeed stipulate a minimum value for your repayment plan to ensure you can repay the capital by the end of the term.

This underscores the importance of clarifying these details with your lender at the outset and periodically reviewing your strategy to ensure it stays on track.

What Options Do You Have at the End of an Interest-Only Mortgage Term?

The end of your mortgage term marks the time when you need to repay the loan amount. If you're unable to repay the capital at this point, you still have options.

These might include selling the property to cover the loan amount, remortgaging to secure a new loan against the property, or discussing with your lender the possibility of extending the term.

How Can You Find the Best Interest Rates for an Interest-Only Mortgage in 2026?

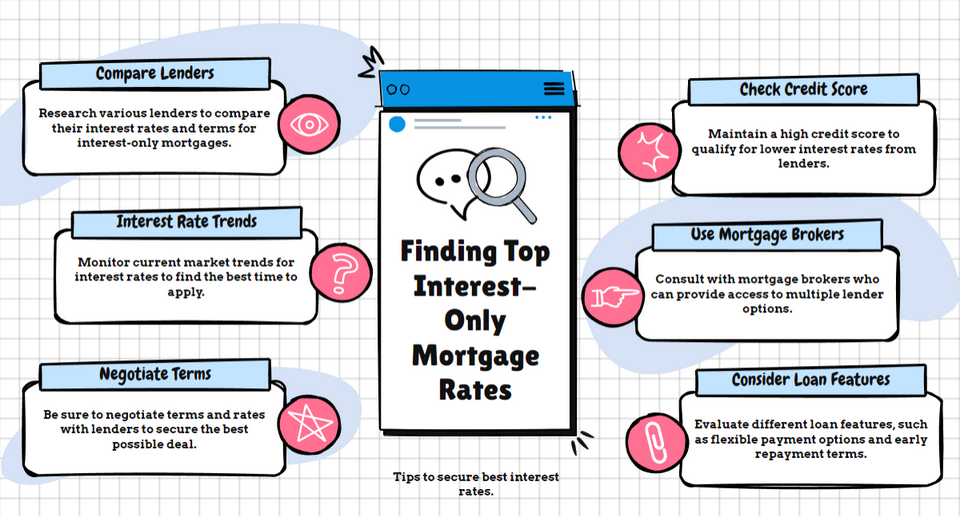

You can find the best interest rates for an interest-only mortgage in 2026 by comparing offers from multiple lenders, checking loan-to-value requirements, consulting mortgage brokers, and evaluating your credit score to access competitive deals.

Here's exactly what you have to do:

What Are the Current Interest Rates for Interest-Only Mortgages in the UK?

While interest rates for interest-only mortgages are typically competitive with those of standard repayment mortgages, remember that with an interest-only mortgage, your monthly payments are only covering the interest, not reducing the actual loan amount.

As a result, while your monthly payments might seem lower, the total amount you pay back over the term could end up being more.

It's essential to consider these elements, and potentially seek advice from a mortgage advisor, before making a decision.

Where Can You Find the Best Interest-Only Mortgage Rates in 2026?

To find the best interest-only mortgage rates in 2026, start by comparing offers from multiple lenders online.

Financial comparison websites are a good place to begin, but don't overlook the value of consulting with a mortgage advisor.

Advisors can offer tailored advice and access to exclusive deals not available on the open market, potentially leading you to more favourable rates.

How Can You Effectively Manage an Interest-Only Mortgage?

You can effectively manage an interest-only mortgage by regularly reviewing your repayment plan, setting aside funds to repay the principal, exploring investment growth opportunities, and consulting financial advisers to stay on track with your long-term financial goals.

Think about the following:

How Do You Apply for an Interest-Only Mortgage?

To apply for an interest-only mortgage, you must assess your eligibility, choose a lender, prepare proof of income and repayment strategy, submit a formal application, and work with a solicitor to finalise the agreement upon approval.

Here's an expanded breakdown of the process:

How Should You Research Interest-Only Mortgages?

Before applying, you'll need to research different mortgage providers to compare interest rates, terms, and the specific criteria they have for applicants.

It can be helpful to use an online mortgage comparison tool for this, or to consult with a financial advisor.

What Does an Initial Consultation for an Interest-Only Mortgage Involve?

An initial consultation for an interest-only mortgage involves discussing your financial situation with a lender or broker to assess your borrowing potential—this can be conducted over the phone, online, or in person, depending on your preference.

During the consultation, the lender will provide an estimate of how much you could borrow and outline the interest rates and terms available to you.

This step helps you understand your options and lays the foundation for selecting the right mortgage product for your needs.

What Steps Are Involved in Applying for an Interest-Only Mortgage?

If you decide to proceed, the steps involved in applying for an interest-only mortgage include assessing your eligibility, selecting a lender, providing evidence of a repayment plan, submitting your application, undergoing a property valuation, and finalising the loan agreement with a solicitor.

This will require you to provide detailed personal and financial information, including your income, expenses, debts, and credit history.

What Repayment Strategy Is Required for an Interest-Only Mortgage?

An interest-only mortgage requires a clear repayment strategy to demonstrate how you will repay the loan balance at the end of the term.

This strategy could involve using savings, investments, or other assets to cover the amount owed; alternatively, you might plan to sell the property to settle the loan.

Lenders typically require detailed evidence of your chosen approach to ensure the strategy is viable and aligns with your financial circumstances, making this a critical part of the application process.

What Documentation Is Needed for an Interest-Only Mortgage Application?

An interest-only mortgage application requires specific documentation to support your financial profile and repayment strategy, which typically includes payslips to verify income, bank statements to assess financial stability, proof of identity, and evidence of your repayment plan, such as investment portfolios or savings accounts.

These documents help lenders evaluate your ability to meet the loan terms and repay the balance at the end of the mortgage term.

How Is Your Application for an Interest-Only Mortgage Assessed?

Your application for an interest-only mortgage is assessed through a detailed review of your financial profile.

After submitting your documents, the lender evaluates your income, expenditure, and repayment strategy; additionally, a credit check is also conducted to determine your creditworthiness and ability to meet the interest payment obligations.

What Role Does Property Valuation Play in Interest-Only Mortgage Applications?

Property valuation is a crucial step in an interest-only mortgage application; once your financial assessment is complete, the lender arranges a valuation to confirm that the property’s value is sufficient to secure the loan.

This ensures the lender’s risk is mitigated and that the loan amount aligns with the property’s market worth.

A successful valuation is essential for the application to proceed, as it validates the property’s role as collateral for the mortgage.

What Can You Expect From an Interest-Only Mortgage Offer?

An interest-only mortgage offer outlines the loan amount, term, interest rate, and key terms and conditions agreed upon by the lender.

This formal document is issued after your application, repayment strategy, and property valuation are approved.

Interest-only mortgages can be more complex than standard options due to the requirement for a clear repayment plan.

What Do You Do If You're Struggling with Your Interest-Only Mortgage Repayment Plan?

If you’re struggling with your interest-only mortgage repayment plan, the first step is to contact your lender as soon as possible, as they may offer solutions such as extending the mortgage term, giving you additional time to build up your repayment funds, or switching to a repayment mortgage.

Taking early action and seeking professional advice can help you explore these options and find a manageable solution.

How Can You Extend the Term of Your Interest-Only Mortgage?

Extending the term of your interest-only mortgage requires approval from your lender.

You'll need to provide a valid reason for the extension, such as changes in your financial circumstances or the need for more time to arrange the repayment of the capital.

It's essential to approach your lender well in advance of your term ending to discuss your options and any potential impacts on your interest rates and overall loan costs.

What Are the Pros and Cons of Interest-Only Mortgages in the UK?

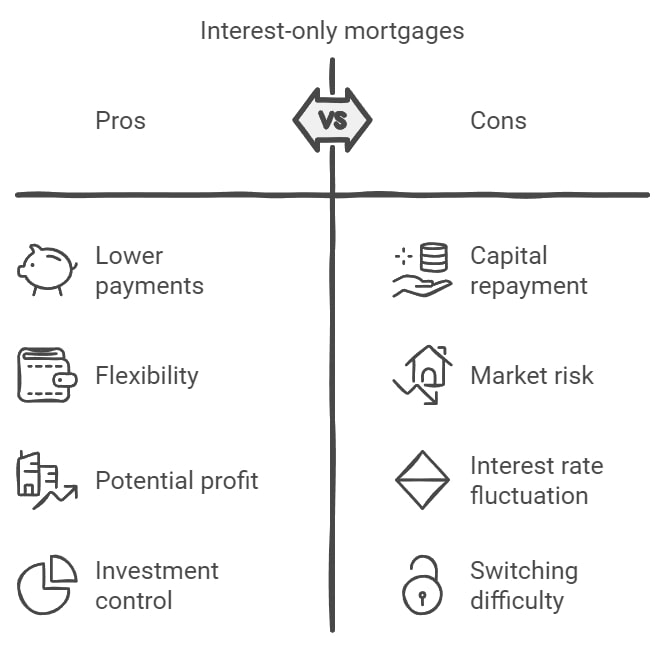

Interest-only mortgages have both advantages and drawbacks.

The Pros

- Lower Monthly Payments: Since you're only paying the interest on the loan during the term, your monthly payments can be considerably lower than with a standard repayment mortgage.

- Flexibility: Interest-only mortgages can offer more flexibility in terms of cash flow. The lower monthly payments might free up funds for other purposes like investing, improving your property, or covering other life expenses.

- Potential for Property Value Increase: If your property appreciates significantly during the term, you could sell it for a profit, even after repaying the mortgage.

- More Control Over Investments: If you're financially disciplined, you could potentially invest the money you're saving on lower monthly payments and earn a higher return than your mortgage interest rate, providing funds to repay the capital.

The Cons

- Capital Repayment: At the end of the term, you're required to repay the full loan amount, which can be a hefty lump sum. It's vital to have a reliable repayment strategy in place to cover this.

- Risk of Property Market Downturn: If your repayment plan involves selling your home and property prices fall, you might not be able to cover the full loan amount.

- Fluctuating Interest Rates: If you have a variable interest rate, your monthly payments could increase, affecting your ability to save or invest for the final repayment.

- Difficulty in Switching: If property prices fall, you may have less equity in your home, making it harder to switch to a repayment mortgage or remortgage with a different lender.

As you can see, interest-only mortgages come with certain advantages that could be beneficial for some borrowers, but they also have significant drawbacks and risks that need to be carefully considered.

Seeking independent financial advice is essential when considering this type of mortgage.

How Much Can You Afford to Borrow on an Interest-Only Mortgage?

How much you can afford to borrow on an interest-only mortgage depends on factors such as your income, regular expenses, and your ability to establish a clear repayment strategy.

Lenders also assess your credit history and overall financial stability to determine your borrowing capacity.

It’s essential to consider more than just approval; you need to ensure the repayments are manageable and that you have a plan for repaying the full loan amount at the end of the term.

What Should You Consider Before Applying for an Interest-Only Mortgage?

Before applying for an interest-only mortgage, consider your ability to repay the principal at the end of the term, the higher deposit requirements, your long-term financial plan, and whether the lender’s terms align with your repayment strategy.

Further, consider these factors:

How Can You Use a Mortgage Repayment Calculator for Interest-Only Loans?

You can use a mortgage repayment calculator for for an interest-only loan to help you estimate monthly payments; by entering your loan amount, term, and interest rate, the calculator quickly provides an estimate of your monthly interest payments, giving you a clear picture of the financial commitment.

While these tools are helpful for initial planning, it’s important to remember they are for estimation purposes only.

Use them as a starting point to explore your options and consult a financial adviser for a more accurate and tailored understanding of your repayment strategy.

Should You Seek Professional Advice Before Applying for an Interest-Only Mortgage?

While it's not compulsory, you should seek professional advice before applying for an interest-only mortgage to ensure the loan aligns with your finances, repayment strategy, and long-term plans, as well as to understand the risks and responsibilities involved.

What Are the Alternatives to Interest-Only Mortgages?

Alternatives to interest-only mortgages include repayment mortgages, where you pay both the capital and interest monthly, gradually reducing the loan balance over time.

For older borrowers, retirement interest-only mortgages offer a tailored option, allowing you to pay only the interest while keeping the capital repayment linked to specific life events.

Equity release schemes are another alternative for those aged 55 and over, enabling homeowners to access funds tied up in their property without immediate repayment obligations.

How Can You Choose the Best Interest-Only Mortgage in the UK?

You can choose the best interest-only mortgage in the UK by comparing interest rates across lenders while also evaluating factors like the lender's reputation, customer service, and repayment flexibility.

Different lenders often have varying requirements for repayment plans, making it crucial to review terms carefully.

Seeking professional financial advice is highly recommended to ensure you fully understand your options to select the mortgage that aligns with your financial situation and long-term goals, enabling you to make a confident decision.

Common Questions About Interest-Only Mortgages in the UK

How Can I Find Out What Interest-Only Mortgage I Can Afford?

What Should My Salary Be to Get an Interest-Only Mortgage?

Can I Make a Joint Application for an Interest-Only Mortgage?

Will Bad Credit Prevent Me From Getting an Interest-Only Mortgage?

What Are the Advantages and Disadvantages of an Interest Only Mortgage?

Can I Get an Interest Only Mortgage if I’m Over 65?

Can I Pay Interest-Only on My Mortgage as a Second Home?

Can I Pay off an Interest-Only Mortgage Early?

What’s the Difference Between Interest-Only and Capital Repayment Mortgages?

Can I Change My Interest-Only Mortgage to Capital Repayment?

What’s the Impact of Interest Rates on Your Interest-Only Mortgage Repayments?

Are There Special Requirements for Self-Employed Individuals Applying for Interest-Only Mortgages?

What Are the Tax Implications of an Interest-Only Mortgage?

How Do I Make Repayments for an Interest Only Mortgage?

What Happens at the End of an Interest Only Mortgage Term?

In Conclusion: Is an Interest-Only Mortgage the Right Choice for You in 2026?

Deciding whether interest-only mortgages are the right choice for you depends on how well they align with your financial goals and circumstances.

By fully understanding the commitment and planning a clear repayment strategy, you can make this option work to your advantage.

As you move forward, seeking advice from an FCA-registered advisor or broker can provide the clarity and confidence needed to navigate this decision, and with the right guidance, an interest-only mortgage could be a step toward achieving your financial aspirations.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.