10 Investment Considerations: You Need to Know All About in 2026

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Key considerations before making an equity release investment include understanding the product's features, assessing potential risks, considering any possible impacts on your estate and potential tax implications.

- Factoring inflation into your equity release considerations involves considering its potential impact on your investment's value and your future cost of living.

- The tax implications of equity release investments can be complex, potentially including income tax, inheritance tax, and capital gains tax, depending on your individual circumstances.

- Equity release investments can impact your estate by reducing its overall value and potentially affecting any inheritance you may wish to leave to your loved ones.

- Risks involved in equity release investments include potential negative impacts on your estate's value, potential tax implications, and the possibility of higher future interest rates impacting the cost of the loan.

When it comes to investments, there are some very important considerations you'll need to keep in mind.

Investments are a huge decision to make.

That's why we've compiled a list of things you should take into consideration before investing your hard-earned cash.

In This Article, You Will Discover:

#1. Assess Your Needs & Goals

Take a moment to sit and write down in a notebook or on your computer what you need this money for in the future - or how long it will take before you'll be able to use this money again.

#2. Consider an Appropriate MIX of Investments

Many people have a tendency to invest in only one type of investment, like investing exclusively in stocks.

It's important that you diversify your portfolio so that if one part does poorly, the other parts can help balance things out.

#3. Weigh up the Risk vs Reward

It's important to consider how much risk is involved in order to get to your financial goals.

Evaluate and analyse every possible investment opportunity you have and then weigh up what might be best for you!

#4. Consider the Time Span of Your Investment

Usually, people are investing in retirement.

If that's your goal, make sure to take a look at the timeline - and how much risk is involved in order to get there.

#5. Find Your Inner Critic

Be a critic of your investment decision and once you have a well-defined plan for your investment,

Make sure to be open and honest with yourself.

Is the risk worth the potential reward?

Does this investment line up with my goals as well as any other opportunities that might suit me better?

#6. Evaluate Your Comfort Zone in Taking on Risk

When investing, it's not just about the size of your return. It also depends on how much risk is involved in order to get there.

If you're uncomfortable taking risks with your hard-earned money, don't be afraid to invest only what feels comfortable for you.

#7. Maintain a Cash Emergency Fund

It's important to establish a pot of money as an emergency fund1.

This should be enough for you and your family to survive off of, in the event that anything unexpected happens, like being laid off.

#8. Check the Hidden Fees

Look for hidden charges and don't be afraid to ask questions about what you're paying for. Remember, it's your money!

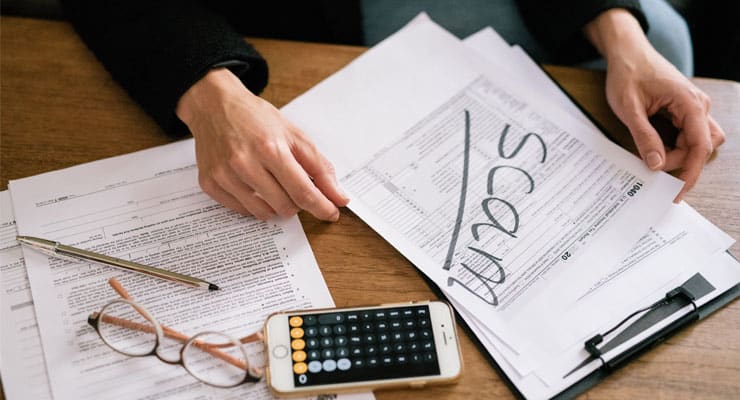

#9. Be Diligent About Fraudsters

Avoid circumstances that can lead to fraud and any situations where you could potentially be a victim of a scam.

For example avoid responding to an unsolicited email or giving out personal information to strangers.

#10. Take Advantage of “Free Money”

The average annual contribution to an employer-sponsored retirement plan2 is $14,000 per year.

That's a lot of free money that you're leaving on the table if your employer matches contributions!

Common Questions

What Are the Key Considerations Before Making an Equity Release Investment?

How Can I Factor Inflation Into My Equity Release Investment Considerations?

What Are the Tax Implications of Equity Release Investments?

How Will Equity Release Investments Impact My Estate?

What Are the Risks Involved in Equity Release Investments?

In Conclusion

The best investment you can make is in yourself, by improving your skills and knowledge.

It'll help elevate your earning potential, which could help with any loans or debt you may have acquired earlier on in life.

Investing time into developing more marketable skills also keeps the option open for taking a different career path if what you are doing now isn't working out as well as planned.

These are among the most important investment considerations you'll need to make.

References

- www.sec.gov/investor/pubs/tenthingstoconsider.htm

- www.moneyadviceservice.org.uk/en/articles/top-tips-for-choosing-investments

- www.reliancesmartmoney.com/Insights/blog/rsm-articles/2020/01/29/ten-things-to-consider-before-you-make-investing-decisions

- www.yours.co.uk/life/money/things-to-consider-before-making-an-investment-decision/

- www.thesimpledollar.com/investing/ten-things-you-need-to-do-before-you-start-investing/