Are Halifax a Part of Lloyds Bank? Get Your Answers in 2026?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

Key Takeaways...

- Halifax, as part of Lloyds Bank, offers a range of services including current accounts, savings accounts, mortgages, loans, and equity release schemes.

- They offer similar benefits including access to a wide network of branches and cashpoint machines, digital banking, and a variety of financial products.

- Their role affects customers by offering more accessibility and a broader range of financial products and services.

- Though both are part of the same entity, they may offer slightly different equity release options, with different interest rates and features.

- Reviews are generally positive, with customers praising the wide range of financial products, customer service, and ease of banking online and in-branch.

If you have been looking for a mortgage provider, we are sure you have heard about Halifax, and you may want to know more about it and if it is part of Lloyds Bank.

Halifax was first established in 18521, so it has a long history and has seen it's fair share of banking evolution.

As a result, Halifax is a bank that is more connected than people realise and has become part of the Lloyds Banking Group, which owns many banks.

In This Article, You Will Discover:

Our knowledgeable economic journalists constantly research the financial markets to bring you the latest banking news and the most relevant and accurate information on new trends.

Therefore...

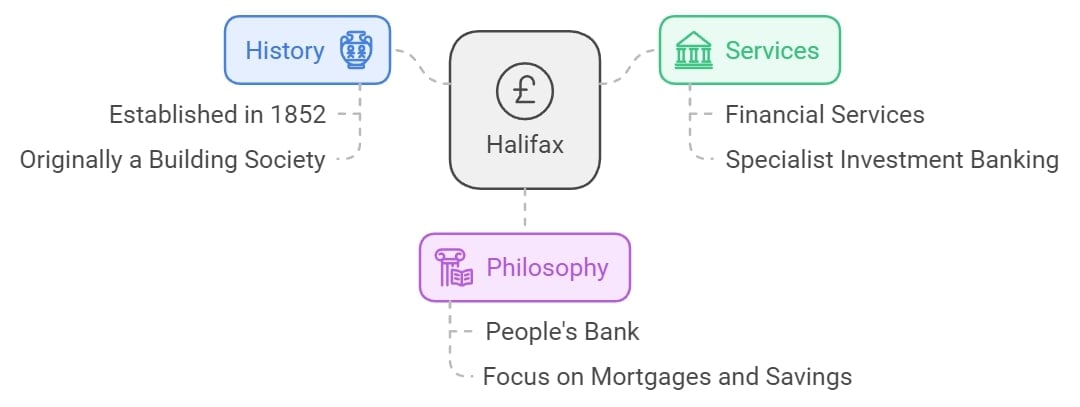

Who Is Halifax?

Halifax is a UK-based financial services provider and specialist investment bank.

It was first established in Halifax in 1852 as Halifax Permanent Benefit Building Society.

Halifax prides itself on being a people’s bank, focusing on helping ordinary people live their daily lives more easily.

Halifax knows that sometimes you need a little extra help in life, and that is why it understands the importance of a mortgage and savings to help you buy a family home.

What Does Halifax Offer?

Halifax offers a range of financial services and investment products, including credit cards and savings accounts.

Halifax’s financial services:

- Bank Accounts

- Overdrafts

- Credit Cards

- ISAs

- Savings Account

- Loans

- Travel Money

Being a people’s bank, Halifax understands the need to provide extra assistance for the future by making use of reliable and safe investment products such as mortgages.

Halifax’s investment products:

- Mortgages

- Investing

- Wealth Management

- Retirement

Who Is Lloyds Bank?

Lloyds Banking Group, commonly known as Lloyds Bank, is based in the United Kingdom and has a 300+ year history, making it an established financial and banking services group.

Lloyds Banking Group Overview

Lloyds Banking Group is a financial services group that focuses on both personal and commercial customers.

It's role is to provide these customers with the best financial assistance possible while contributing to the communities in which they operate.

Strategy

The Lloyds Banking Group's strategy is to help Britain grow by becoming a leader in the UK digital banking space.

It aims to do so by taking advantage of scalable opportunities.

Purpose

The purpose of Lloyds Banking Group is to help Britain prosper; it will achieve this by making finance more inclusive and using it as a way to give back and do good in it's community.

Impact

Lloyds Banking Group has had an impact on various sectors, which include charities and the environment.

More information:

- 93,00 Small businesses2, charities, and start-ups have been assisted.

- £46mln was invested in its community.

- 80,000 First-time homeowners have had mortgages approved.

- The environment has been boosted with over 2mln trees planted.

Brands

Lloyds Banking Group operates under many brand names, including Lloyds Bank and Halifax.

More information:

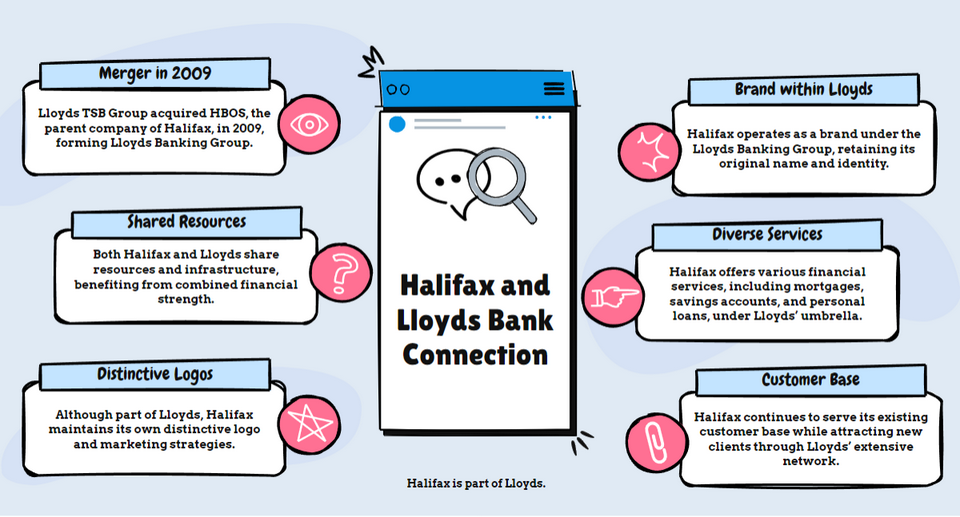

How Is Halifax Connected to Lloyds Bank?

Halifax is connected to Lloyds bank, which is a subsidiary of the Lloyds Banking Group.

In 2001, Halifax merged with Bank of Scotland and became HBOS5 Plc.

Then in 2009, HBOS Plc was purchased by Lloyds TSB to form a new company called Lloyds Banking Group plc.

Lloyds Banking Group has many household names that enable them to serve customers' financial needs through multiple brands, such as Halifax.

Common Questions

Can Lloyds Customers Use Halifax?

What Services Does Halifax Offer as a Part of Lloyds Bank?

Does Halifax Have the Same Benefits as Lloyds Bank?

How Does Halifax's Role Within Lloyds Bank Affect Customers?

Is there a Difference in Equity Release Options Between Halifax and Lloyds Bank?

What are the Reviews of Halifax's Services as a Part of Lloyds Bank?

In Conclusion

Halifax Bank is a people-oriented bank that falls under the umbrella holding of the Lloyds Banking Group, which trades under numerous names.

Lloyds Banking Group owns multiple banking subsidiaries with household brand names, such as Halifax and Lloyds Bank.

Before you decide to use Halifax, which is a part of Lloyds Banking Group, we recommend that you always do your research or talk with your financial advisor6.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.