Later-Life Mortgages: The Ultimate Guide in 2026

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Later-life mortgages offer a tax-free cash boost, let you stay in your home, and come with flexible payback plans—all while providing financial support for major expenses, such as home renovations or healthcare costs.

- Ensure that you're up to speed on the rules for keeping your home in tip-top shape, in order to meet loan terms.

- Thinking of switching from a regular mortgage? Your age, home's worth, and what you still owe can make it happen.

Are you part of the 17% of UK retirees who have little or no savings1 and are considering later-life mortgages? If so, that means you may be looking for a solution to supplement your income.

If you are a homeowner, then perhaps, a later-life mortgage could be the answer you have been looking for.

However, with so many providers on the market, it is not always easy to decide who to turn to.

In This Article, You Will Discover:

Our expert team at SovereignBoss has analysed the regulated plans on the market to bring you the newest information available in 2026.

Therefore:

What Is a Later-Life Mortgage?

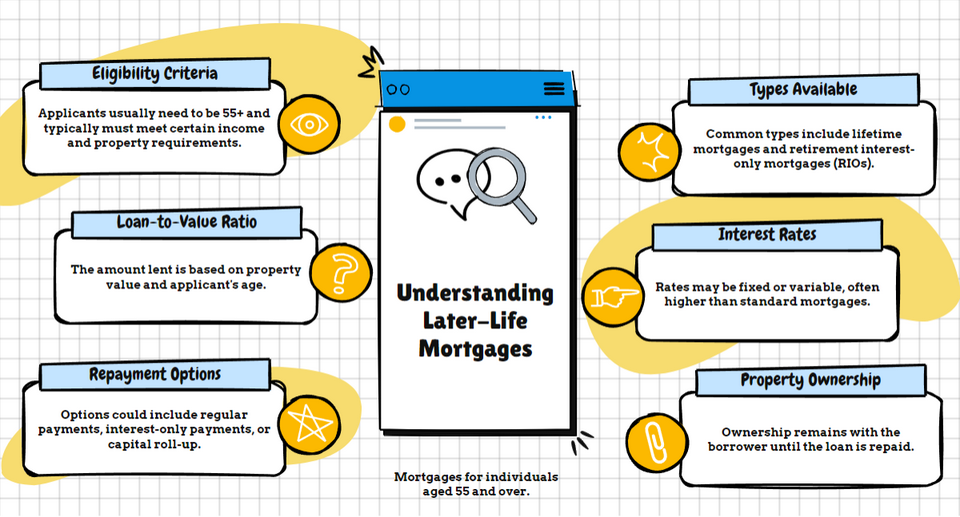

A later-life mortgage is an umbrella term for options that allow you to secure a loan in your senior years against the value of your home.

A lifetime mortgage and equity release are later-life mortgages, and there are some clear differences between them.

Another new product is a retirement interest-only (RIO) mortgage.

There are a variety of retirement mortgages available, each with its own set of terms, but they all assist you in funding your retirement.

You have the option to make monthly payments to pay off the debt, or just cover the interest portion.2

Why Might I Need a Mortgage in Retirement?

You might need a retirement mortgage if you discover that you may not have enough money to live the life you desire in retirement.

It is not uncommon for individuals to own property, but not live comfortably because of a lack of pension income or insufficient savings.

At What Age Can I Apply for Later-Life or Retirement Mortgages?

You can apply for a later-life or retirement mortgage if you are approaching or have already reached retirement age.

Typically, they are available for homeowners from the age of 55 whose property is their primary residence.

In recent years, many banks and building societies have increased the upper age limit for a later-life mortgage.

Others have not set one at all!

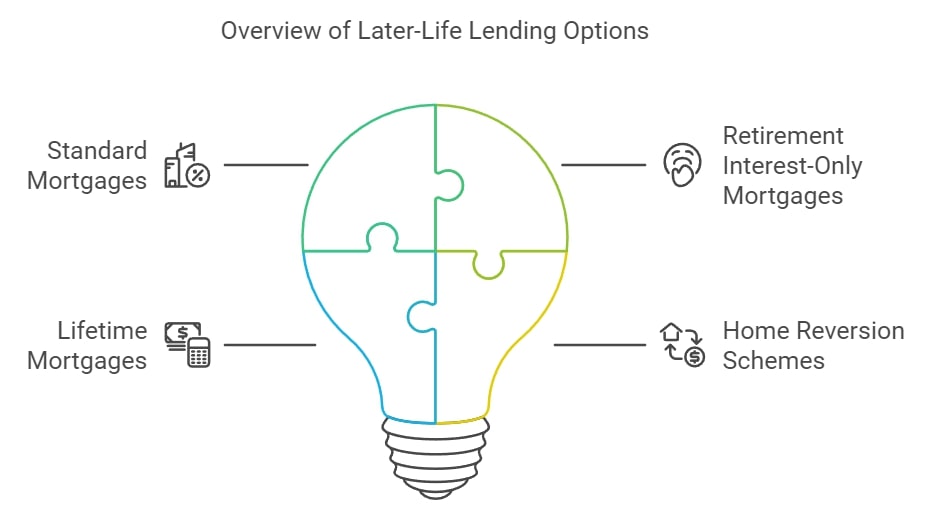

What are the Later-Life Lending Options?

The later-life lending options are standard mortgages, retirement interest-only mortgages, lifetime mortgages, and home reversion schemes.

Standard Mortgage Features:

- Take comfort in the fact that your fixed-term mortgage will be paid off at the end of the term.

- You may pay off part of the loan each month so that it is completely paid off by the end of the term, or you can just repay the interest portion in your lifetime, and then repay the amount you borrowed after the agreed term.

- If you apply for a mortgage, the lender will want to know if you can afford to make the monthly repayments from your income or pension for the whole term.

Retirement Interest-Only (RIO) Features:

- You are only required to pay back the interest and not the loan itself. By repaying the interest monthly, the amount you owe never increases.

- Since you are only paying back the interest, the amount you owe with a retirement interest-only mortgage will generally be lower than your typical mortgage.

- There is no limit to how long you can leave your mortgage outstanding however, if you pass away or enter long-term care, the loan must be repaid - typically from selling your home.

Equity Release – Lifetime Mortgage Features:

- Despite releasing equity, you will still retain 100% ownership of your home.

- The cash is tax-free.3 You may use the money as you wish, whether it is to assist friends and family, go on a dream holiday, or even make home improvements.

- If you have mortgage payments outstanding, you will need to use some of the equity released to settle this.

- You will not need to pay back the loan during your lifetime, and you may either pay the interest each month or let it roll up.

- The loan (and interest) is then repaid, usually from the sale of your home, when you pass away or move into long-term care.

Equity Release—Home Reversion Plan Features:

- You sell all or a portion of your home and receive a lump sum or access to a cash facility.

- You receive tax-free cash.

- You may live in your house rent-free if you take advantage of this offer, but you will still need to maintain it.

- When your home is sold when you pass away or enter long-term care, the lender will take their cut and the balance will go to your heirs.

Which Is the Best Retirement Mortgage?

The best retirement mortgage options will depend on your personal circumstances.

A lifetime mortgage is the most common, and you can leave a greater inheritance with a retirement interest-only mortgage.

Your best bet is to get in touch with a leading financial advisor or mortgage broker to assess your individual circumstances.

You should also base your decision on how much capital you require on your age, income, and property value.

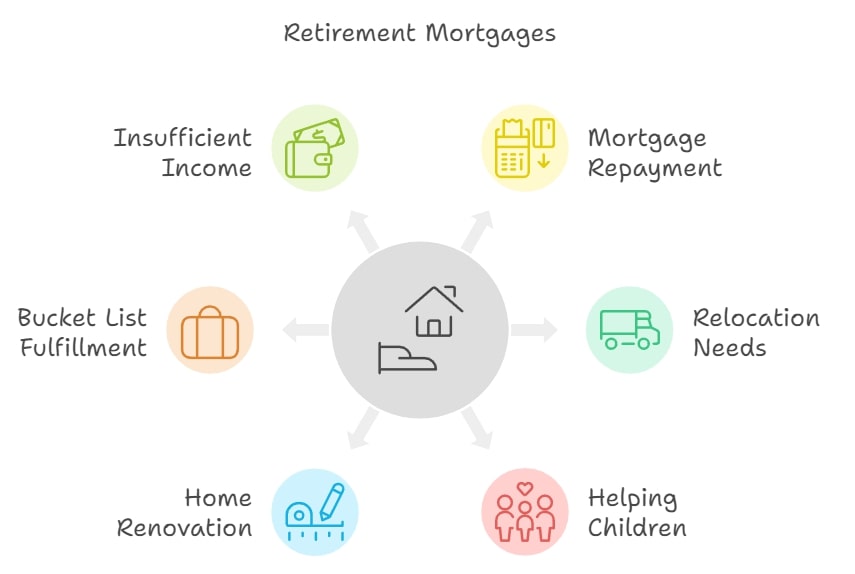

Who Are Retirement Mortgages For?

Retirement mortgages are designed for UK retirees who want or need to use the cash in their home, whether it is to supplement retirement income, help children, or desperately pay off a mortgage or debt.

If you find yourself in any of the following situations, you may require a retirement mortgage:

- You desperately need to repay your mortgage.

- You are relocating to a bungalow, retirement community, or closer to your children for help.

- You want to help your children purchase their first home or leave an early inheritance.

- You want or need to renovate your home.

- You have a bucket list that needs fulfilling, whether it is buying a new car or taking that dream trip.

- You do not have sufficient income to get you through retirement.

Will I Be Able to Get a Mortgage When I’m Over 50?

It may be difficult to get a mortgage at over 50 because lenders consider that your income will soon be dropping as you approach retirement.

However, you can qualify for equity release and later-life mortgages when you are aged 55 and older.

How Does a Later Life Mortgage Differ From a Regular Mortgage?

The difference between a retirement mortgage and a regular mortgage is that a later-life mortgage is used to unlock cash.

Homeowners, on the other hand, typically take out a regular mortgage to purchase a home.

The most important aspects are similar.

The bank will want to ensure that the property has enough value to cover the amount it is lending and might require proof of income, if applicable.

However, the goal of a standard mortgage is to repay more of it to own the property outright.

With a later-life mortgage, you will usually use the equity from your property, which is then paid off when you pass away or move into long-term care.

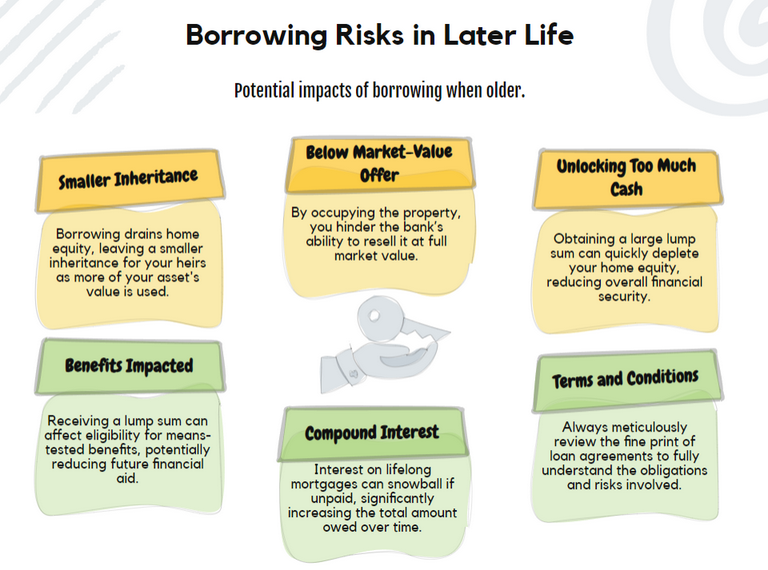

What Are the Risks of Borrowing in Later Life?

The risks of borrowing in later life include the fact that you will leave a smaller inheritance for your heirs.

You also risk unlocking too much cash in one go, ultimately draining all your home equity.

Furthermore:

- Below Market-Value Offer - Since you will continue to live there, you are effectively tying up the bank’s new asset for a while.

- Reduced Inheritance - You will be using the cash tied into your asset, therefore, you will leave less to your loved ones.

- Benefits Impacted - A lump sum might impact any means-tested benefits now or in the future.

- Terms and Conditions - It is vital to verify the fine print of the agreement.

- Compound Interest - If you do not pay off the interest on a lifelong mortgage, it will accrue over time.

- Monthly Payments - If required, you must ensure you have the means to repay all monthly payments.

You must listen to suggestions given by a professional financial advisor and select a product that is right for you.

They will also help you determine if equity release is a good idea. It would also be beneficial to talk to your friends and family first.

How Do I Apply for a Mortgage in Later Life?

You can apply for a later-life mortgage by getting in touch with a leading financial advisor or one of the leading equity release companies.

Before meeting with the advisor, it helps to have your personal and financial information on hand.

These typically include your income figures from any pensions or other savings, outstanding debt, as well as insurance coverage.

What Documentation Is Needed for a Retirement Mortgage?

The documents you need for equity release and a retirement mortgage will depend on the plan you select and your employment status.

These may include:

- P60s

- Means-tested benefits forecast

- Occupational scheme pension forecasts

- Business trading accounts

- Pension letter

- Three months' bank statements

- SA302s

Take note:

If you are opting for a mortgage for retired people that require repayments, you will need to go through affordability checks.

Following the mortgage market regulator’s (MMR) review of the sector in April 20144, it is now up to the lender to show affordability in such cases.

Therefore, careful inspections will be made.

In such circumstances, lenders typically demand that you provide such documentation before retirement:

- Employer and self-employed: P60s will be required if you work, as well as a means-tested benefits forecast and any occupational scheme pension forecast (to verify future income in retirement).

- If you operate a business, most stockbroking firms will ask for three years’ worth of trading accounts before opening an account. You may also need to submit SA302s and a pension forecast.

If you are already receiving a pension, lenders may request the following documents:

- A copy of your last Department of Work and Pensions (DWP) State Pension letter.

- Your last three months’ bank statements as proof of receipt of pension income.

Some lenders may accept investment income and drawdown funds as an acceptable source of income for your mortgage application, although not all do.

What Are the Alternatives to Borrowing in Later Life?

The alternatives to equity release in later life include digging into your savings, downsizing your home, seeking support from friends or family, and looking into local grants or means-tested benefits that you are eligible for.

Your financial advisor should talk you through the most common equity release alternatives before you make your final decision.

Mortgage Calculator

Are you wondering how much cash you could be eligible to unlock through the various later life mortgages?

We have the most accurate mortgage calculators in the UK for you to try.

Just fill in a few details, and our expert team will email you with an estimate of the maximum amount of equity that you could be eligible to borrow.

Common Questions

What Are the Eligibility Criteria for Later Life Mortgages?

How Do Later Life Mortgages Work in the UK?

What Are the Advantages of Later Life Mortgages?

Are There Any Risks Associated With Later Life Mortgages?

Can You Switch to a Later Life Mortgage from a Standard Mortgage?

In Conclusion

While we all imagine a financially stress-free retirement, it is easier said than done.

In today’s world, it is becoming more and more expensive to equip yourself for the financial challenges that come with retirement.

If you are heading towards retirement and you do not know how you will cope financially, later-life mortgages may be an ideal way to enjoy your golden years.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.