2026 Lifetime Mortgages: Top 5 Picks

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Key Takeaways...

- UK lifetime mortgages let you borrow against your home's value and settle the debt when you're no longer around or move to care; additionally, you never owe more than your home's worth, thanks to the "no negative equity" safety net.

- The older you are, the more cash you might unlock from your home, with interest rates that can be fixed or capped so that there are no nasty surprises with how much you owe.

- Stick to the deal and adhere to the terms of your agreement, and your home stays yours—no worries.

- Are you considering alternative options to a lifetime mortgage? Look into home reversion, downsizing safeguards, or interest-only mortgages for retirees.

A lifetime mortgage is the most popular form of equity release1, but is it for good reason?

With products more flexible than ever, and over 600 plans available2, it is an option that more and more retirees are looking into.

Our team of equity release experts has mapped out everything you need to know about lifetime mortgage in 2026.

Therefore...

What Is a Lifetime Mortgage, and How Does It Function?

A lifetime mortgage is a loan secured against your home, repaid from the property's sale when you pass away or move into long-term care.

This type of equity release scheme is designed for homeowners aged 55 or over, allowing you to unlock the value tied up in your property without needing to move out.

Key Features of a Lifetime Mortgage

- Maintain Ownership: You keep ownership of your home and can live in it until you pass away or move into long-term care.

- Flexible Repayment: Interest compounds over time, but you can choose to repay a portion of the loan and monthly interest.

- Repayment: The loan is repaid when the property is sold, typically upon death or a move into care.

Who Qualifies for a Lifetime Mortgage in the UK?

To qualify for a lifetime mortgage:

- Age Requirement: You must be 55 or older, though some providers may set a minimum age of 60 or 65.

- Mortgage Status: Your existing mortgage must be fully repaid or have a small outstanding balance that can be covered by the equity released.

- Property Criteria: The property must be your main residence in the UK, typically valued at a minimum of £70,000 and made of standard construction.

Additional Eligibility Requirements

Some providers may have specific criteria based on:

- The type and condition of the property.

- The location of the property.

- Any outstanding mortgage or secured loans.

A lifetime mortgage offers a flexible way to unlock the value in your home while still living in it, making it a popular choice for many older homeowners in the UK.

What Types of Lifetime Mortgages Are Available, and Who Can Access Enhanced Options?

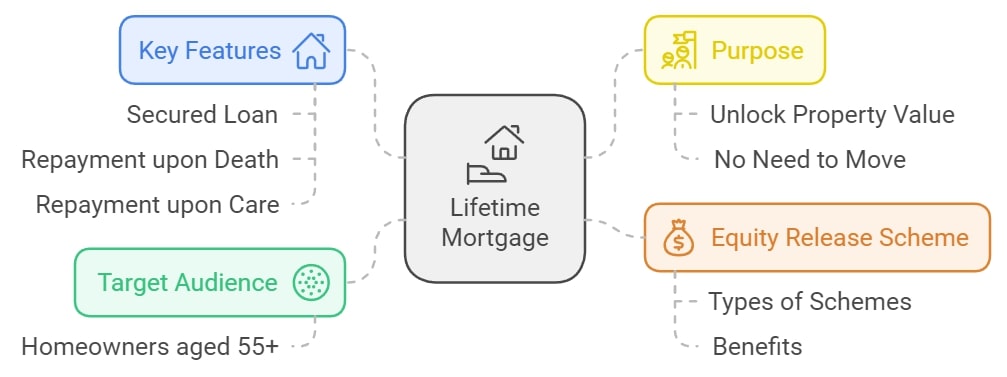

Available types include drawdown, lump sum, and interest-payment options, with enhanced options for those with certain health conditions.

What Are the Different Types of Lifetime Mortgages Available?

There are two main types of lifetime mortgages: lump-sum mortgages and drawdown mortgages.

More important information about each of these types:

- Lump-Sum Mortgages: This category of lifetime mortgage is characterised by a single, large loan secured against your property. It may be suitable for people who need a significant sum of money for a specific purpose, like repaying an existing mortgage or making significant home improvements.

- Drawdown Mortgages: With a drawdown lifetime mortgage, homeowners have the flexibility to release the equity in smaller amounts, as and when needed. This can be a more cost-effective approach as interest is only charged on the amount drawn down, not on the entire facility available.

There are also two different kinds of interest-payment lifetime mortgages; an interest-only lifetime mortgage where the homeowner is required to make regular interest payments and a voluntary repayment lifetime mortgage where the homeowner can make ad hoc interest and capital repayments.

Please note that the optional payment lifetime mortgage is a Legal & General product permitting the homeowner to make voluntary interest payments.

There is also the option of an enhanced lifetime mortgage designed for homeowners with certain health conditions or lifestyle factors.

What Are Enhanced Lifetime Mortgages and Who Qualifies for Them?

Enhanced lifetime mortgages are designed for those with certain health conditions or lifestyles that may affect life expectancy, and if you qualify, you might access more favorable terms, such as a higher loan amount or a lower interest rate.

This is because the lender anticipates the loan will be repaid sooner than with a standard plan.

Qualifying conditions can range from chronic illnesses to lifestyle factors like smoking; if you think you might qualify, it's worth discussing this with your lender or advisor.

Enhanced plans can offer a significant financial advantage, giving you access to more of your home's equity when you need it most.

How Can Homeowners Utilise Funds from a Lifetime Mortgage and What Costs Are Involved?

Homeowners can use funds for any purpose, with costs involving interest rates, arrangement fees, and potential early repayment charges.

How Can You Use Money From a Lifetime Mortgage?

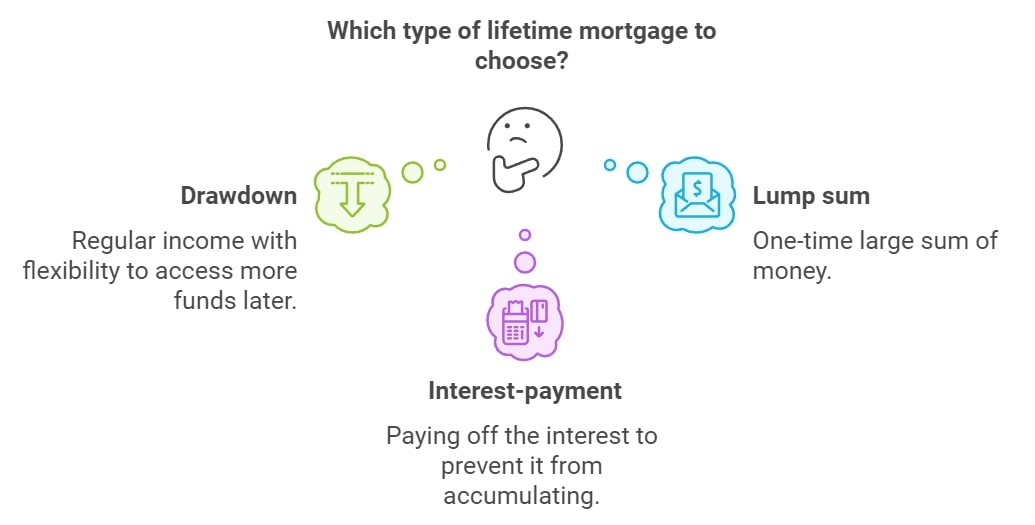

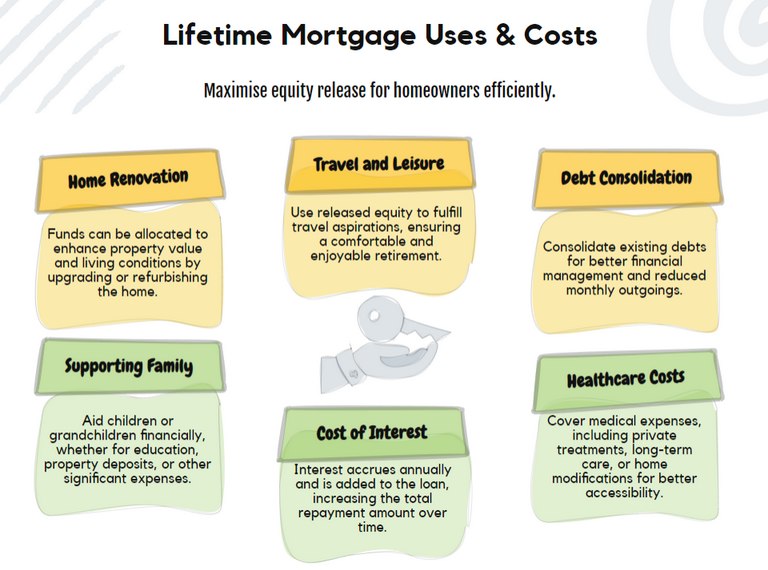

Funds obtained from a lifetime mortgage can be used for a range of purposes.

Some people use it to supplement their retirement income, pay off existing debts, assist with daily living expenses, or make home improvements.

Others may choose to use it for lifestyle purposes, such as travelling or helping younger family members with a deposit for their first home.

The key thing to remember is that it should be used responsibly, considering the long-term impact of equity release on your finances and inheritance.

What Costs Are Involved in Taking Out a Lifetime Mortgage?

There are several costs involved in taking out a lifetime mortgage, including set-up fees, valuation fees, solicitor's fees, and advisor's fees.

Of course:

There are also interest charges to consider.

Some lifetime mortgages also have early repayment charges, should you wish to repay the loan ahead of schedule.

These costs should be highlighted by your equity release advisor or broker.

What Are the Financial Implications of Choosing a Lifetime Mortgage?

Financial implications include the impact on inheritance, potential effect on benefits, and the accumulation of interest over time.

What Will Lifetime Mortgage Interest Rates Be in 2026?

As of 2026, lifetime mortgage interest rates are averaging approximately 5.97% to 6.28%*.

View the most recent rates here.

*While we regularly review our rates, they may have changed since our last review.

How Does Interest Compound on a Lifetime Mortgage, and What Does It Mean for You?

Interest on a lifetime mortgage compounds, meaning it's added to the loan balance, and future interest is calculated on the increased amount.

This can significantly increase the amount you owe over time; however, choosing a plan that allows for interest payments can help control the balance.

With compounding, the loan amount can grow quickly, leaving less for your heirs, though it enables you to access equity without monthly repayments, offering financial flexibility in retirement.

How Do Repayment Options for Lifetime Mortgages Work?

You have several choices when it comes to repaying a lifetime mortgage; one option is to make no repayments until the home is sold, typically when you move into long-term care or pass away.

Alternatively, some plans allow you to pay the interest monthly, preventing it from compounding.

Interest-only payments can help maintain the debt at a constant level. If your plan permits, you can also make partial repayments of the loan amount without facing an early repayment charge.

This flexibility helps manage the loan balance and potentially leaves more equity in your home for your heirs.

What Is a Loan to Value Ratio in Lifetime Mortgages, and How Does It Affect How Much You Can Borrow?

The loan-to-value (LTV) ratio in a lifetime mortgage determines how much you can borrow against your home's value.

It varies by age; the older you are, the higher the percentage you can borrow. This is because lenders factor in your life expectancy when deciding the loan amount.

A higher LTV means you can release more equity, but it also means more interest may accumulate over the loan's life.

Understanding your LTV ratio helps gauge how much you can borrow and the potential impact on your home's equity over time.

What Are the Tax Implications of Taking Out a Lifetime Mortgage?

Taking out a lifetime mortgage might not directly affect your taxes, but it could have implications for inheritance tax.

Since the loan reduces the value of your estate, there may be less inheritance tax to pay; however, it's crucial to consider how this could impact any means-tested benefits you receive.

Remember, the money you release is tax-free, but how you use it could have tax implications; for example, investing the funds might generate taxable income or gains.

Always consult with a financial advisor to understand the tax nuances related to your specific situation.

How Do You Evaluate the Safety and Viability of a Lifetime Mortgage?

Evaluating safety involves considering the provider's reputation, Equity Release Council membership, and the no negative equity guarantee.

What Are the Pros and Cons of Taking Out a Lifetime Mortgage?

The pros and cons of a lifetime mortgage include you will access tax-free cash, but reduce the value of your estate.

More information...

Advantages

Potential benefits of lifetime mortgages include:

- Flexibility: The funds can be used for a wide variety of purposes.

- Ownership: You retain the right to live in your home for the rest of your life.

- No Monthly Payments: There are typically no required monthly payments, as the loan is repaid when you pass away or move into long-term care.

Disadvantages

Disadvantages of a lifetime mortgage that one may encounter include but are not limited to:

- Reduced Inheritance: The value of the estate you leave behind can be significantly reduced.

- Accruing Interest: The amount you owe can increase rapidly due to the compound interest.

- Early Repayment Charges: There can be substantial charges for paying the loan back early.

How Safe Are Lifetime Mortgages for Homeowners?

Lifetime mortgages are considered safe because they are regulated by the Financial Conduct Authority (FCA) in the UK.4

Also:

It is always suggested to use a provider who is a member of the Equity Release Council, as they must adhere to a strict set of standards designed to protect consumers.5

However:

As with any financial product, there are risks involved, and it is crucial to seek independent financial advice before proceeding.

How Can You Determine if a Lifetime Mortgage Is Right for You?

A lifetime mortgage may be right for you if you need extra money and are comfortable with reducing the value of your estate or inheritance.

When it comes to a lifetime mortgage and heirs, it is a good idea to discuss it with your family as it can affect them.

It is important to consider all other options, such as downsizing, before proceeding.

Your advisor will guide you in deciding whether a lifetime mortgage is the best option based on your circumstances and financial goals.

How Can You Get Started with a Lifetime Mortgage?

Starting with a lifetime mortgage requires consulting a financial adviser, considering your long-term needs, and comparing offers from accredited lenders.

Where Can I Find a Lifetime Mortgage Calculator?

There are multiple online lifetime mortgage calculators available that can give you an estimate of potential borrowing amounts.

However, these calculators should only be used as a guide, as the actual amount will depend on individual circumstances and lender criteria.

What Steps Are Involved in Taking Out a Lifetime Mortgage?

To take out a lifetime mortgage, you should start by seeking independent financial advice.

Consider exploring various options to find the most suitable individual to provide you with equity release advice.

An advisor can assist you in exploring various options and comprehending potential implications.

If you decide to proceed, they will guide you through the application process, which includes property valuation and legal processes.

How Much Money Can You Borrow Through a Lifetime Mortgage?

The amount you can borrow with a lifetime mortgage depends on several factors, including your age, the value of your property, and the specific terms of the lifetime mortgage provider.

Typically, you can borrow between 20% and 60% of the value of your property.6

Frequently Asked Questions About Lifetime Mortgages

What Is a Lifetime Mortgage in the UK?

Will a Lifetime Mortgage Affect Your Inheritance?

Is It Possible to Switch Your Lifetime Mortgage to a Different Provider?

How Does the Equity Release Council Influence Lifetime Mortgages?

Can a Lifetime Mortgage Impact Your Credit Score?

What Occurs With a Lifetime Mortgage When a Borrower Enters Care?

How Can a Lifetime Mortgage Affect Your Pension Credit or Universal Credit?

Is It Possible to Obtain a Lifetime Mortgage With an Existing Mortgage?

How Does a Lifetime Mortgage Work?

What Is the Most Popular Type of Lifetime Mortgage?

Can I Get Out of My Lifetime Mortgage?

Can I Buy a House With My Lifetime Mortgage?

What Are Some Expert Tips for Shopping for the Best Lifetime Mortgage Rates in the UK?

How Can My Medical History Affect My Lifetime Mortgage?

What Are the Pros and Cons of a Lifetime Mortgage?

Is There a Risk of Losing Your Home With a Lifetime Mortgage?

Are There Alternatives to a Lifetime Mortgage?

Conclusion: Is a Lifetime Mortgage the Right Choice for You?

A lifetime mortgage offers the opportunity to access the equity in your home without the need for monthly repayments while still maintaining residence and full ownership.

To make informed decisions, it is vital to fully comprehend the terms, costs, and potential impact on your estate and inheritance.

Seeking independent financial advice is essential to explore the array of available options and discover a lifetime mortgage product that aligns with your unique needs and circumstances.

Keep in mind that a lifetime mortgage represents a long-term commitment and should integrate into your lifelong financial plans.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?