Lloyds Equity Release Review (2026): Top Takeaways

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Lloyds Bank offers various financial products for over 55s, including lifetime mortgages.

- Consider exploring Lloyds Bank's lifetime mortgage options as an alternative to equity release.

- Lloyds Bank may provide retirement interest-only mortgages suitable for those over 55.

- Explore Lloyds Bank's range of retirement lending options tailored to your financial needs.

- Investigate Lloyds Bank's later life lending solutions as alternatives to equity release.

Does Lloyds offer equity release?

This may be a question you are asking yourself if you are considering equity release in 2026.

Lloyds is a household name when it comes to financial services, but that does not necessarily mean it is an equity release company.

In This Article, You Will Discover:

Our expert team has spent countless hours researching the equity release market. We are able to bring you the latest and most accurate information on Lloyds and releasing equity.

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Lloyds. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Lloyds.

What Is Equity Release?

An equity release mortgage involves borrowing a sum of money against the value of your property, with the understanding that the loan and interest will not be repaid until a significant event, such as the homeowner’s passing or a move into permanent care.

This arrangement allows homeowners to access funds without the burden of monthly repayments, with the full amount settled later, typically through the sale of the home.

Who Is Lloyds?

Lloyds is a UK-based financial services provider founded in 1765.1

It's services include personal finance and equity release through Scottish Widows Bank.2 Scottish Widows Bank is a subsidiary of the Lloyds Banking Group.

Lloyds Bank is widely considered as one of the “Big Four”3 clearing banks in the UK.

Why Consider Lloyds?

You should consider Lloyds for your financial needs because it is a trusted provider with a proven track record in the industry.

Lloyds is able to offer you an equity release solution through Scottish Widows Bank, a subsidiary of the Lloyds Banking Group.

You can also rest assured of the safety of Lloyds' financial services due to it being authorised and regulated in the UK by the Financial Conduct Authority (FCA) and Prudential Regulatory Authority (PRA).

What Services Does Lloyds Offer?

Lloyds offers banking and wealth management services that include equity release and other retirement products and services.

More services offered by Lloyds:

- Current accounts

- Credit cards

- Savings accounts

- ISAs

- Investment products and services

- Home Insurance

- Wealth management

- Retirement products and services

- Mortgages

- Loans

Does Lloyds Offer Equity Release or Lifetime Mortgages?

No, Lloyds does not offer equity release directly.

However, it can connect you with Scottish Widows Bank which offers equity release. Scottish Widows Bank is a subsidiary of the Lloyds Banking Group.

Does Lloyds Have An Equity Release Calculator?

No, Lloyds does not have an equity release calculator.

You can also use our equity release calculator below to see approximately how much equity you could unlock from your home.

What Are Lloyds’ Interest Rates?

Lloyds' interest rates vary depending on the product or service you are considering.

Equity release interest rates are currently in the region of 5.97% to 6.28%*.

If you are curious about the latest equity release rates, you can view them here..

*While we regularly review our rates, these may have changed since our last update.

What Are Lloyds' Fees?

Lloyds fees associated with it's mortgages include product fees and valuation fees.

Additional charges that you may incur include:

- Valuation fees

- Product fees

- Account fees

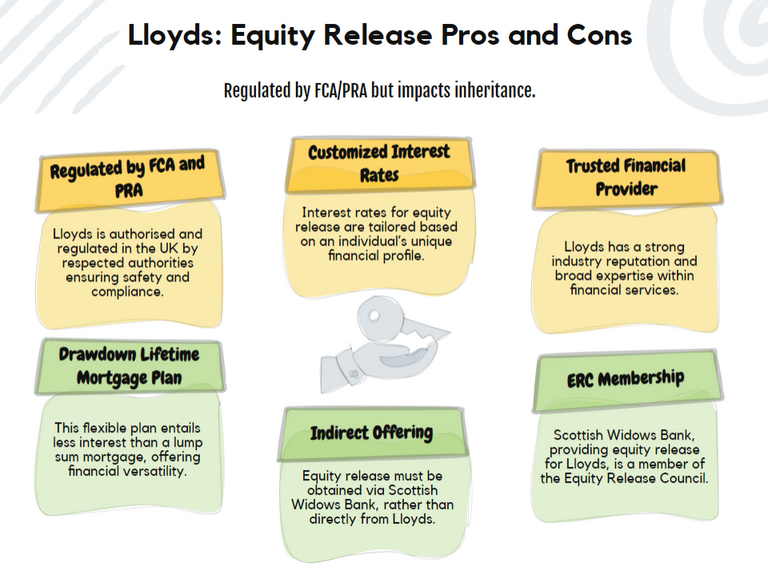

What Are The Advantages and Disadvantages of Lloyds?

The advantages and disadvantages of Lloyds include that it is authorised and regulated in the UK by the FCA and PRA; however, any equity release product will reduce the inheritance you leave to your heirs.

More information.

Lloyds Pros

The pros of Lloyds include that it is a regulated entity.

More information:

- Lloyds is authorised and regulated in the UK by the FCA and PRA.

- It is a trusted financial services provider with extensive industry experience.

- The interest rate you receive on equity release is not standard; it is based on your personal profile.

- There is a drawdown lifetime mortgage plan available which is flexible and incurs less interest than a lump sum lifetime mortgage.

- Scottish Widows Bank, the equity release provider for Lloyds, is an Equity Release Council (ERC) member.

Lloyds Cons

- You need to deal with Scottish Widows Bank to obtain equity release from Lloyds, so it is not a direct offering from Lloyds.

- Your inheritance will reduce when you make use of a lifetime mortgage.

- You may have to pay early repayment charges if you settle your loan prematurely.

- Equity Release may not be suitable for everyone, which is why your advisor will ask you to consider other options before proceeding.

- You may want to discuss the option of equity release with your loved ones, to make them aware that it is something you are considering.

Lloyds Bank Customer Reviews and Ratings

Lloyds has received mixed customer reviews on popular review sites.

What it's customers have to say below:

- Lloyds Bank Reviews on UK.TrustPilot.com

- Reviews of Lloyds Bank on Reviews.io

- Lloyds Bank Reviewed on SmartMoneyPeople.com

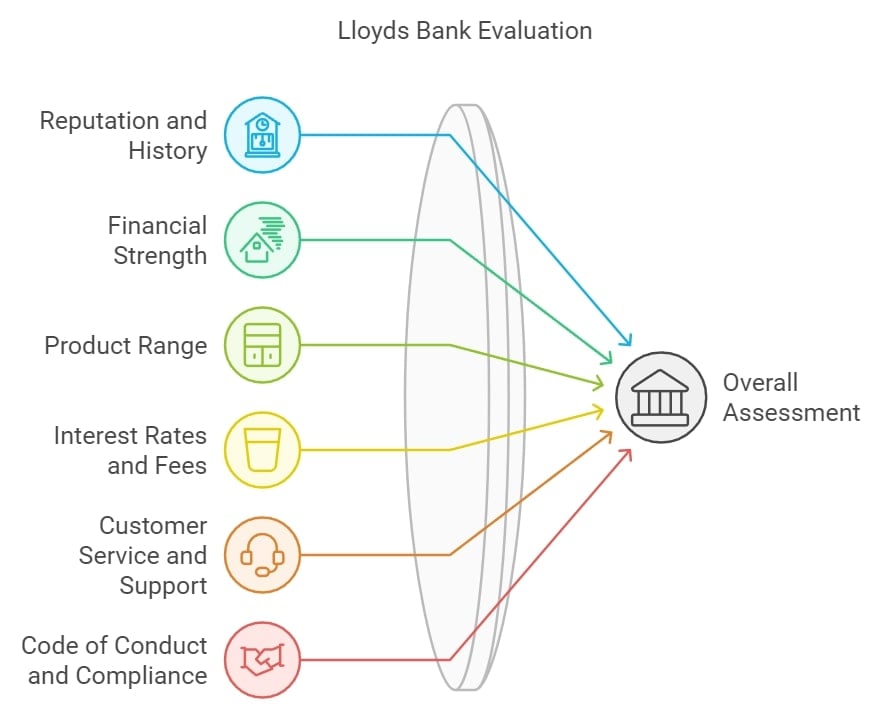

How Did We Review the Information on Lloyds?

We reviewed Lloyds Bank based on the following:

- Reputation and History – How many years they have been in business, customer reviews, and industry rewards received.

- Financial Strength – Ensuring it is going strong and has adequate funds to meet long-term commitments.

- Product Range – We favour companies offering a variety of equity release schemes with greater product flexibility.

- Interest Rates and Fees – We review competitive rates compared to industry averages and they must be fully transparent about rates and fees without hidden costs.

- Customer Service and Support – When and how it is available, response times, and available online educational resources. As well as online tools, like a calculator.

- Code of Conduct and Compliance – We only consider companies that adhere to recognised industry standards and codes.

- Industry Insights and Peer Reviews – We care about a company’s industry-wide reputation.

- Innovation and Technology – Is there a streamlined, digital application process?

- Client Testimonials – Success stories and the complaints resolution process.

This is an unaffiliated, independent review of Lloyds Bank.

Lloyds Bank Complaints

Lloyds’ complaints can be lodged in person, via it's online form, in writing, or by telephone.

More information:

- Via it's online form on it's complaints page.

- By telephone: +44 1733 462 267.

- In writing to: Lloyds Bank, Customer Services, BX1 1LT.

You can also complain in person at your local branch.

Alternatively, you can voice your concerns on review sites such as Trustpilot4 or Feefo5 for its attention.

Lloyds Core Information

When it comes to personal banking, Lloyds is one of the first names that come to mind.

From current accounts to home insurance, ISAs, mortgages, loans, and pensions, Lloyds Bank has a wide variety of financial services.

Lloyds understands how critical it is to obtain the best mortgage plan possible, regardless of your financial situation.

The bank prides itself in assisting retirees with better planning for their golden years.

Lloyds FCA Details

FCA Address

Lloyds, 25, Gresham Street, London, EC2V 7HN.

Trading Names

- Black Horse Specialist Mortgages

- Cheltenham and Gloucester

- Goldfish

- Lloyds Bank

- Lloyds DCNSP

- Lloyds TSB Bank

- loansdirect.co.uk

- MBNA

- Mayfair Private Banking

- Scottish Widows Bank

FCA Permitted Services

- Banking

- Insurance

- Mortgages and Finance

- Consumer Credit

- Payment services and E-Money

- Pension

- Investments

Regulators

- Financial Conduct Authority (FCA)

- Prudential Regulation Authority (PRA)

Registration Numbers

- FCA Ref Number: 119278

- Companies House Number: 00002065

FCA and Companies House Link

- FCA Link: FCA Link

- Companies House Link: Companies House Link

Lloyds Contact Number

Lloyds’ contact number is 0345 602 1997

Common Questions

Is Lloyds a Member of the Equity Release Council?

Who Owns Lloyds?

Where Can I Find Lloyds Jobs?

Where is Lloyds Located?

Does Lloyds Offer Equity Release?

Is Lloyds Safe?

Conclusion

Lloyds is a household name in the banking industry and has been around for over two centuries.

With such experience behind it, it is bound to have a financial solution for you.

If you are considering Lloyds for equity release, it cannot offer it to you, but it can put you in touch with Scottish Widows Bank for further assistance.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.