What Does MoneySavingExpert ACTUALLY Think About Equity Release in 2026?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- As a trusted source of financial guidance, Money Saving Expert equity release is generally considered reliable, but it's recommended to cross-check with other reviews to make an informed decision.

- User feedback indicates that they are comprehensive and useful, but experiences may vary based on individual circumstances.

- The review rate equity release companies based on factors such as customer service, product features, and company reputation.

- It can be found on the Money Saving Expert website under their 'Money' section.

- While it provides thorough evaluations, it generally does not recommend specific companies, instead presenting an unbiased overview for readers to make their own decisions.

Have you heard of Money Saving Expert and are wondering what it thinks of equity release?

Money Saving Expert is a great place to start if you are looking for hints, tips, and opinions on equity release.

In This Article, You Will Discover:

Our equity release information has been complied by our expert team of professionals following countless hours of research.

Here is what we found about Money Saving Expert.

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details provided in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Money Saving Expert. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Money Saving Expert.

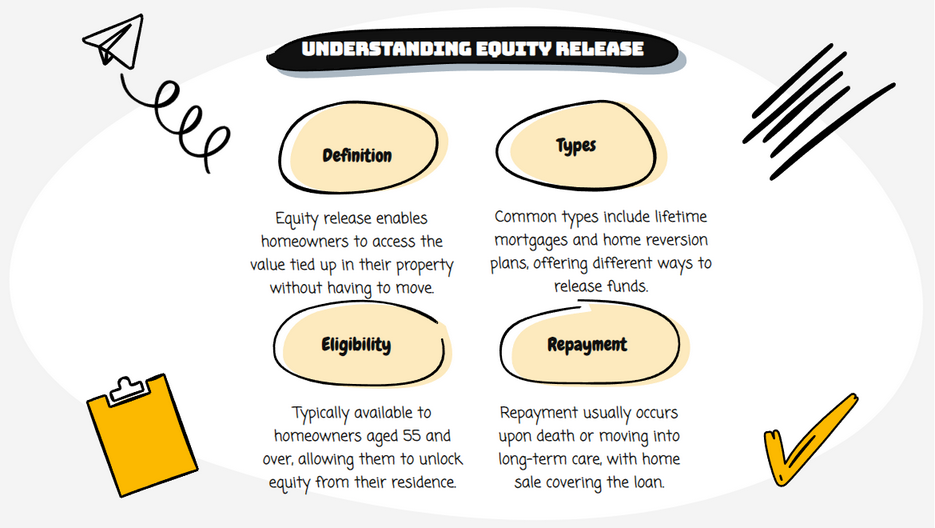

What Is Equity Release?

An equity release mortgage is, in simple terms, a loan that allows homeowners to access the equity in their property while still living in it.

The loan, along with the accumulated interest, is not repaid through monthly payments as with traditional mortgages.

Instead, the full amount is paid back to the lender when the homeowner either passes away or moves into permanent care. This repayment is usually made by selling the property, with the proceeds covering the loan and interest.

Equity release mortgages provide a way for older homeowners to unlock funds for various needs without the immediate financial burden of regular repayments.

Who Is MoneySavingExpert?

Martin Lewis started MoneySavingExpert.com,1 a website focusing on equity release news, credit cards, shopping, special deals, mortgages, council tax, interest rate payments, freebies, and other topics.

Why Consider MoneySavingExpert for Equity Release Information?

You should consider MoneySavingExpert for equity release advice as the site is run by a leading industry professional.

Learn More About MoneySavingExpert

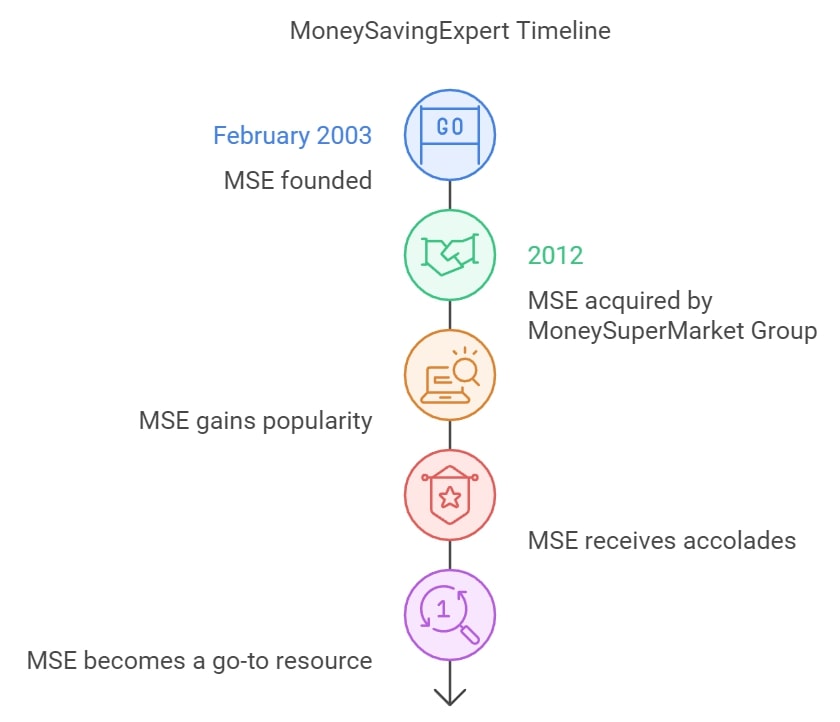

MoneySavingExpert (MSE) was founded in February 2003 for £1002 by Martin Lewis, its founder, and executive chairman.

It was bought by the MoneySuperMarket Group in 2012.

The site's ethical position and consumer vengeance strategy have made it the most popular money site in the UK.

It has received several accolades and has become a go-to resource for both consumers and officials.

Here is what MSE offers:

- Weekly MSE Money Tips Emails – MSE's money tips newsletter3 is sent to almost 7.5 million people every week.

- Detailed MoneySaving Guides – Financial products, consumer rights, and budget flight refunds are just a few topics covered on the leading site. The guides provide super-detailed product analysis rather than just suggesting you browse around.

- Nifty Free MoneySaving Tools – From the income tax calculator to the MSE budget planner, the site is jam-packed with valuable tools to help you better manage and examine your finances, and earn money.

- MoneySaving Forum – One of the largest social networks in the UK is the MSE Forum. It has over 1.8 million4 users, and thousands of them are discussing strategies to save money and encouraging one another.

MoneySavingExpert also has a small campaign team that works with Martin to communicate with charities and politicians on behalf of consumers.

They advocate for topics such as financial literacy, payday loans, and claims management regulation.

They also aim to ensure that the consumer's voice is heard in the halls of power.

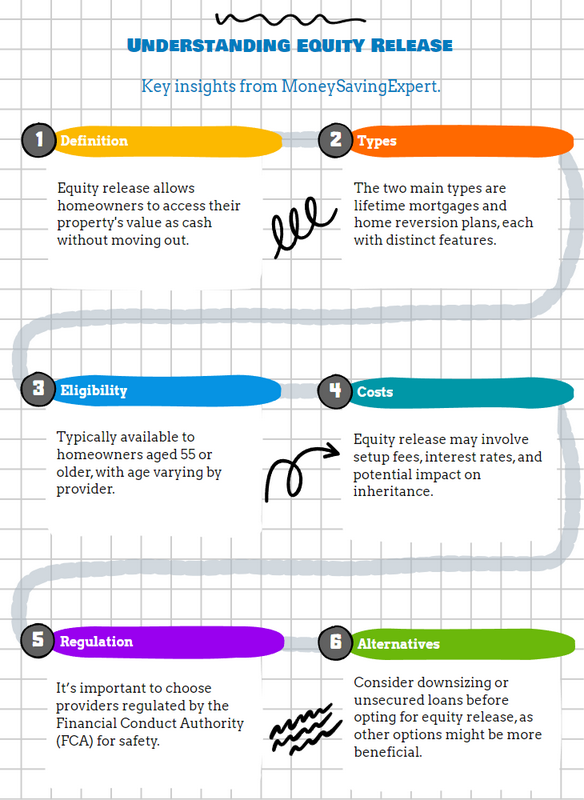

What Does MoneySavingExpert Say About Equity Release?

MoneySavingExpert says that equity release is a term used to describe lifetime mortgages and home reversion schemes.

It also educates on switching equity release plans and has an accurate equity release calculator.

Overall, equity release is a good idea, but you must tread cautiously when pursuing professional advice.

It is always best to seek a personalised answer to your finances.

Who Is Martin Lewis?

Martin Steven Lewis OBE5 is an English financial journalist and broadcaster.

He founded the website MoneySavingExpert.com.

Born: 9 May 1972, Withington, Manchester, United Kingdom

Spouse: Lara Lewington (m. 2009)

Education: London School of Economics and Political Science, Cardiff University, The King's School

How Did We Review the Info On MoneySavingExpert?

We reviewed the information on MoneySavingExpert by doing immense research on what it offers, confirming the validity of the articles, and reviewing the history and achievements of Martin Lewis.6

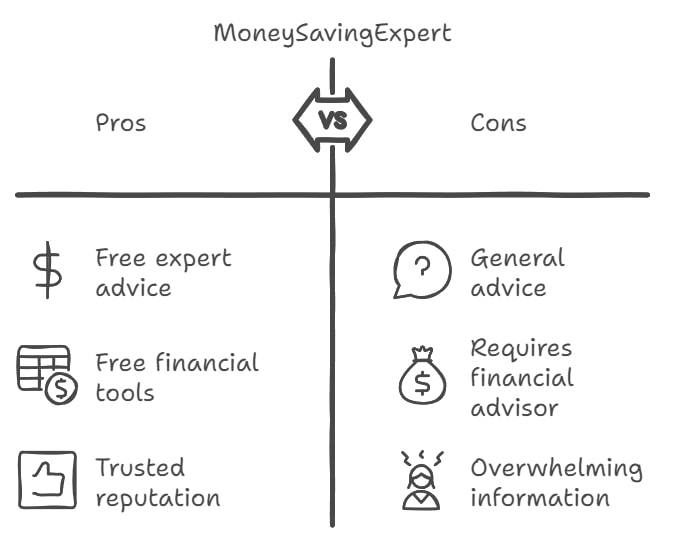

What Are the Pros & Cons of MoneySavingExpert?

The pros and cons of MoneySavingExpert include receiving free equity release advice, but not direct equity release plans.

Pros of MoneySavingExpert

Other pros of MoneySavingExpert include:

- Expert advice at no cost to you.

- Free guides and tools to better manage your finances.

- Martin is a trusted and reputable voice in the equity release industry.

Cons of MoneySavingExpert

Other cons of MoneySavingExpert include:

- General advice that is not personalised for your financial circumstances.

- You still need to consult a financial advisor to decide what is right for you.

- The information can be overwhelming and you may have a lot of questions or points of clarity.

MoneySavingExpert Customer Reviews & Ratings

Read MoneySavingExpert customer reviews below:

- MoneySavingExpert Society customer reviews on UK.TrustPilot.com

- Review of MoneySavingExpert on ReviewCentre.com

- MoneySavingExpert Reviewed on SmartMoneyPeople.com

FCA Details

Trading Names

- MoneySavingExpert.com

- MoneySuperMarket

- TravelSupermarket.com

- OnTrees

- Insuresupermarket.Com

- Moneysupermarket.Com

- Mortgage 2000 Group

- Paaleads.Com

- Professional Advisor Alliance

- Travelsupermarket.Com

- Moneysupermarket.com Financial Group Limited

FCA Permitted Services

- Mortgages & Home Finance

- Insurance

- Consumer Credit

Regulators

- Financial Conduct Authority (FCA)7

- Financial Services Authority Now the

- Prudential Regulation Authority (PRA)8

Registration Numbers

- FCA Ref Number: 587302

- FCA Reg Number: 08021764

FCA Link

- FCA Link: FCA Link

- Companies House Link: Companies House Link

MoneySavingExpert Contact Number & Address

- +44 203 846 2796.

- furtherhelp@moneysavingexpert.com

- One Dean Street, London W1D 3RB.

Common Questions

Who Owns Money Saving Expert?

Where is Money Saving Expert Located?

Who Founded Money Saving Expert?

Is the Money Saving Expert Equity Release Review Reliable?

What Do Users Say About the Money Saving Expert Equity Release Review?

How Does the Money Saving Expert Review Rate Equity Release Companies?

Where Can I Find the Money Saving Expert Equity Release Review?

Does the Money Saving Expert Equity Release Review Recommend Specific Companies?

Conclusion

Started by Martin Lewis, MoneySavingExpert is a leading financial information portal in the UK.

If you are just starting to look into equity release, then the Money Saving Expert website is a great source of information.

Although MoneySavingExpert can not offer you an equity release plan, it will likely be able to help you discover if equity release is the right choice for you.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.