Types of Equity Release in 2026: Which One Is Best for You?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- The different types of equity release are primarily lifetime mortgages and home reversion plans.

- Lifetime mortgages involve borrowing a portion of your home's value, while home reversion means selling a share of your property for less than market value.

- The best type of equity release for your situation depends on factors like your age, property value, and inheritance plans.

- There can be risks involved in equity release, including the possibility of negative equity or changes to your eligibility for means-tested benefits.

- Costs associated with different types might include arrangement fees, legal costs, valuation fees, and potentially early repayment charges.

If you are considering releasing equity from your home, you may be wondering about the different types of equity release plan available in 2026.

If you are one of the 35% of UK retirees with less than £10,000 in your pension fund1, equity release could be a suitable solution (depending on your individual circumstances).

While it is great to have a wide variety of plans to compare, the fact that there are so many to choose from can make the process quite daunting.

But knowledge is power, and the first step is to understand the types of plan available. That is exactly what this article's been designed to help you do.

In This Article, You Will Discover:

At SovereignBoss, our research team has spent countless hours reviewing the types of equity release available and putting all the information together in an easy-to-use format.

Here is what you need to know:

What Is Equity Release?

Equity release is a financial product designed for homeowners, typically aged 55 or older, that allows them to access the value or equity tied up in their property without selling it.

In the UK, equity release enables individuals to convert a portion of their home's value into tax-free cash, providing a viable option for financial flexibility in retirement.

What Are the Different Types of Equity Release Plans?

You may wonder about the types of equity release mortgages in the UK.

The two main types are lifetime mortgages and home reversion plans.

What Are the Types of Lifetime Mortgages?

A lifetime mortgage is a long-term loan secured on the borrower's property.

The key types are:

- Lump sum lifetime mortgages

- Drawdown lifetime mortgages

- Enhanced lifetime mortgages

Each offers different benefits depending on your circumstances.

What is a Home Reversion Plan All About?

A home reversion plan involves selling part or all of your home to a reversion company in exchange for a tax-free lump sum or regular payments.

Something to know about home reversion plans is you can continue to live in the house rent-free (in most cases) until you pass away or move into long-term care.

Custom Equity Release Plan Options

Custom equity release plans are tailored to fit the specific needs of the borrower.

This could involve taking smaller amounts over time, making voluntary repayments, or increasing the amount drawn down in response to changing circumstances.

Drawdown Plans

Drawdown equity release plans offer flexibility since you will be receiving a lump sum upfront, and you can draw down money as and when you need it from a cash facility.

Importantly, you will only pay interest on the money you have unlocked from your cash facility.

Lump Sum Plans

Lump sum plans provide the borrower with a single, large payment.

This may be ideal for those needing a significant amount of money immediately, such as for a major home renovation or to pay off existing debts.

However, note that equity release is not instant and takes approximately 8 weeks.2

Enhanced Plans

Enhanced plans are for those with health conditions or lifestyle habits that may shorten their life expectancy.

These plans may allow you to release more equity from your home than standard plans.

Voluntary Repayment on Plans

Voluntary repayment lifetime mortgage plans are not relevant for new borrowers because all new lifetime mortgage equity release plans allow voluntary repayments.

This means you can pay back some of the loan and interest without incurring an early repayment charge.

This can help manage the overall cost of the loan.

Equity Release Differences Table

Home Reversion Scheme A scheme that allows you to sell all or part of your property below its market value in exchange for a tax-free lump sum. | Lifetime Mortgage A loan for over-55s secured against your primary residence, while you still retain 100% property ownership. | |

|---|---|---|

| The lender will have a registered charge on your home. | N/A as you will be selling all or part of your property. | Yes—this will work in the same way as a traditional mortgage. |

| The loan comes with a significant life event exemption. | No | Yes |

| The loan comes with downsizing protection | No | With some plans |

| The loan comes with fixed interest rates. | N/A as you are selling all or part of your property in exchange for equity. | Yes, or capped variable rates. |

| The maximum age to qualify for the plan. | Usually none, but may differ from one lender to the next. | Usually none, but may differ from one lender to the next. |

| The maximum amount of equity that you can unlock. | This will be based on your age and the value of your property. | This will be based on your age and the value of your property. |

| The minimum age of the youngest applicant. | Usually 60 | Usually 55 |

| You can opt for voluntary repayments. | Depends on the plan and lender. | Usually, yes |

| You have the option to move home if you wish. | No | Yes, with some restrictions |

| You will retain 100% ownership of your property. | No | Yes |

| You will be able to live in your home for the rest of your life. | Yes | Yes |

| You will need to cover mandatory monthly repayments. | No | No |

| You will need to undergo an affordability check. | No | No |

What is the Most Common Type of Equity Release?

The most common type of equity release in the UK is the lifetime mortgage.

So much so

Less than 1% of homeowners opt for a home reversion plan.³

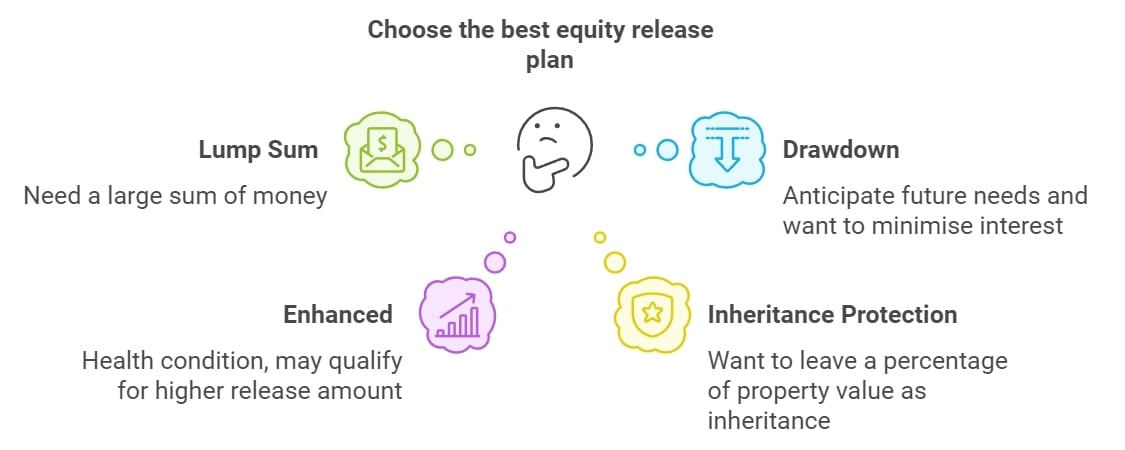

What is the Best Type of Equity Release Plan for Me?

Choosing the best type of equity release plan for you depends on several factors, including:

- Your Age and Health: This will affect the amount of money you can release and the type of plans available to you. For instance, enhanced plans may be more beneficial if you have a health condition.

- Your Financial Goals: If you need a large sum, a lump sum plan could be the best choice but if you anticipate future needs and want to minimise interest, a drawdown plan may be more suitable.

- Your Property Value: This will play a role in determining how much equity you can release and if there is enough to satisfy your financial requirements.

- Your Inheritance Intentions: Some plans allow you to protect a percentage of your property's value as an inheritance.

- Your Long-Term Care Considerations: A no-negative equity guarantee ensures that you will never owe more than the value of your home. This could be important if you foresee a need for long-term care.

The decision should ideally be made after consulting with a financial advisor or broker who can understand your specific circumstances and guide you accordingly.

Additionally, discuss your intentions with family members as equity release will impact the value of the estate you leave behind.

Only ever consider types of equity release that are regulated by the Financial Conduct Authority⁴ and / or the Prudential Regulatory Authority and overseen by the Equity Release Council.⁵

Common Questions

What Are the Key Differences between a Lifetime Mortgage and a Home Reversion Plan?

What is a Shared Appreciation Mortgage (SAM) and Is It an Equity Release Type?

Are Retirement Interest-Only Mortgages (RIOs) a Type of Equity Release?

What is a Retirement Mortgage and Is It the Same as Equity Release?

Do All Equity Release Types Require Repayments?

Can You Get Equity Release on Buy-To-Let?

What Are the Different Types of Equity Release?

) How Do Different Types of Equity Release Schemes Work?

Which Type of Equity Release is Best for My Situation?

Are There Risks Involved in Different Types of Equity Release?

What Are the Costs Associated With Different Types of Equity Release?

Conclusion

The world of equity release can seem complex, but understanding the different types of plans available is key to making an informed decision.

From lifetime mortgages to home reversion plans, each option provides a unique pathway to tap into the value of your property and enhance your financial security in retirement.

It is crucial to seek professional advice and consider your personal circumstances, future plans, and financial goals before committing to any specific plan.

Remember, the right equity release type is the one that fits your needs and provides you with a comfortable and sustainable financial solution in your later years.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.