Best Investment Banks of 2026: Top 10 Picks

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- The top-ranked investment banks in the UK include Barclays, HSBC, and Lloyds Banking Group.

- Leading institutions in this sector offer a variety of services, including equity release, wealth management, and investment advising.

- Choosing the right one involves considerations such as interest rates, fees, and the institution's reputation and services.

- Interest rates offered by these entities can vary and are typically influenced by factors like the Bank of England's base rate and market conditions.

- Utilizing leading institutions can provide benefits such as professional financial advice, competitive interest rates, and the security of working with reputable entities.

So, you’re thinking of investing and trying to find the Best Investment Bank in the UK?

Are you looking for a place to invest your money where you will see significant returns, but you’re too afraid of the great unknown that is investment banking?

You’re not alone. Only 5% of Brits have a stocks & shares ISA account1.

But don’t be left out. We’ve got the answer for you.

In This Article, You Will Discover:

Are you ready to join the 5% of Britons who have invested in stocks and shares?

What Features Determine Which Are the Best Investment Banks in the UK?

The features that determine which are the best investment banks in the UK depend on the level of expertise they provide to their customers.

This will depend on how well banks help their clients with financing, researching, and trading.

What’s Investment Banking & How Does It Work?

Investment banking is the industry that offers financial services to corporate and institutional clients.

It works by organising mergers and acquisitions, raising funds, and investing.

An investment bank's main focus is to strengthen a company's or individual's value.

What Are Tier 1 Investment Banks?

Tier 1 banks are banks with significant financial strength.

This means that these banks have big revenues in terms of equity capital and disclosed reserves.

How does this work…

Tier 1 capital calculates a bank's financial stability and is the main capital kept in its reserves to assist clients in its business processes.

Some of the largest investment banks include JPMorgan Chase, Goldman Sachs, and Credit Suisse.

Top 5 Investment Banks In the UK

Barclays

Barclays was founded in 1690 in London and is a renowned name in the investment banking world.

It comprises 2 sectors, Barclays UK and Barclays International.

The UK division handles UK-based clients, small businesses, consumer credit cards, and retail finance.

The International division specialises in international wealth management and corporate banking franchises worldwide2.

Credit Suisse

Credit Suisse was founded in London in 1856 and is headquartered in Zurich, Switzerland.

The bank has over 160 years of expertise.

It specialises in holistic wealth management and investment banking solutions.

The bank describes itself as a leading wealth manager with strong global banking and asset management capabilities3.

HSBC Holdings

HSBC Holdings was established in London in 1865.

The bank strives to handle corporate, social, and environmental issues, going so far as to employ a faction that combats climate change and aims for cleaner cities.

The bank offers two portfolios - sustainable and regular portfolios4.

JPMorgan Chase

JPMorgan Chase is known as the world's largest and oldest financial institution.

JP Morgan stands out from most other brands for their rich history and merging companies.

JP Morgan manages 6 lines of business, including investment banking, commercial banking, asset management, and card services5.

Lloyds Banking Group

Lloyds is the 3rd largest bank in the UK, also in terms of total assets, after HSBC and Barclays.

It has total assets worth more than 1 trillion euros in 2021.

It’s also regarded as the 11th largest bank in Europe6.

How Do the Top Investment Banks Differ From Each Other?

The top investment banks differ from each other because they specialise in different products.

Generally, banks try to uphold a competitive advantage over their competitors in a certain area or product.

Some banks focus on niches and adapt by specialising in a company-size niche.

For example…

Deutsche Bank takes reign over US competitors by trying to get into as many deals as possible to rise in the league tables.

Regional investment banks sometimes aim to work with companies primarily from their geography.

Investment banks' reputations differ in terms of their inner corporate culture and the overall work environment of their employees.

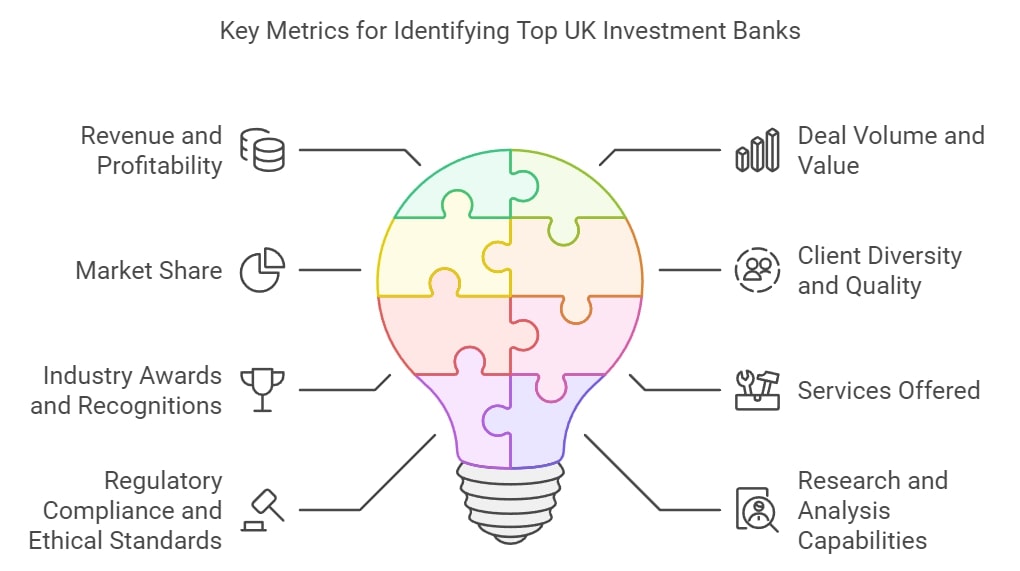

How Did We Identify the Top Investment Banks in the UK?

To identify the top investment banks in the UK, several key metrics were evaluate.

These included:

- Revenue and Profitability: Income from mergers, acquisitions, underwriting, and other banking services was assessed.

- Deal Volume and Value: The number and size of transactions facilitated were considered.

- Market Share: The bank's presence in specific sectors or products was examined.

- Client Diversity and Quality: The variety and significance of their client base were evaluated.

- Industry Awards and Recognitions: Awards and honours received from reputable sources were considered.

- Services Offered: The breadth and quality of financial services provided were reviewed.

- Regulatory Compliance and Ethical Standards: Adherence to laws and ethical guidelines was checked.

- Research and Analysis Capabilities: The quality of market research and financial analysis was considered.

- Employee Talent and Leadership: The expertise and leadership qualities of the bank's staff were assessed.

- Technological Innovation: The use of technology in trading, risk management, and customer service was examined.

This comprehensive assessment was based on data from financial databases, reports, and proprietary methodologies, enabling the ranking of investment banks according to their market position, operational excellence, and reputation.

How Do You Find the Best Investment Bank for You?

Finding the best investment bank for you is a rigorous process that can’t be taken lightly.

You’ll be spending a lot of close time with your preferred banker; it’s important to take note of the establishment's reputation.

A good place to start is with the team:

- Are they experienced in your transactions and sectors?

- Have they completed transactions within your scope?

- What do they know in terms of research?

Your chosen team should be efficient in answering all your questions but also open up new avenues of knowledge for the future of your transactions.

Common Questions

Who Are the Top Ranked Investment Banks in the UK?

What Services Do the Best Investment Banks in the UK Provide?

How to Choose the Best Investment Bank for Equity Release?

What Are the Interest Rates Offered by the Best Investment Banks?

What Are the Benefits of Using the Best Investment Banks for Equity Release?

In Conclusion

The right time to invest is now!

You have all the information you need at your fingertips to find the best bank for you.

Get in touch with any of the UK’s best investment banks to secure your financial future.