Halifax Equity Release Review (2026): What to Expect

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Halifax offers a variety of savings accounts and ISAs that can help over 55s grow their savings securely, presenting an alternative to equity release.

- Halifax's range of mortgage options might include products aimed at older homeowners seeking alternatives to equity release.

- Halifax provides personal financial advice, helping those over 55 understand their options beyond equity release for funding retirement.

- Consider Halifax's investment products for a potential increase in your financial assets without the need to opt for equity release.

- Halifax's insurance solutions can protect your estate and provide financial security, serving as a prudent alternative to equity release for those planning their legacy.

Are you wondering if Halifax offers equity release?

With so many financial institutions in the UK, it can be difficult to know which institution provides what, and which is the best to turn to.

We are here to assist you.

In This Article, You Will Discover:

As experts in the equity release field, we have combed the market and researched all service providers to see what may be the best option for you.

Is Halifax an equity release company?

Discover more here:

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Halifax. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Halifax.

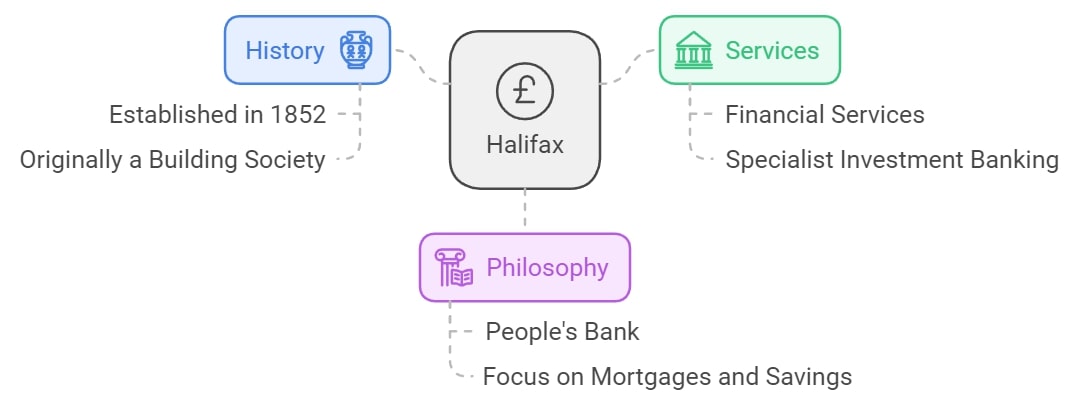

Who is Halifax?

Halifax, previously Halifax Building Society, is a British banking brand and a division of the Bank of Scotland.

It is a wholly-owned subsidiary of Lloyds Banking Group.1

It was founded as a building society in 1852 but was demutualized in 1997.

Why You Should Consider Halifax

You should consider Halifax as it offers a wide range of financial products.

These include bank accounts, ISAs, savings, investing, loans, mortgages, and more.

Does Halifax Offer Equity Release and Lifetime Mortgage Products?

No, Halifax does not offer equity release products.

Does Halifax Have an Alternative to an Equity Release Calculator?

No, Halifax does not have an equity release calculator, but you can try its mortgage calculator here.

If you are specifically looking for an equity release calculator, you can try our one below for an approximation.

Halifax Customer Reviews

We have compiled a list of online reviews on Halifax for easy access:

- ReviewCentre.com reviews for Halifax

- Customer reviews of Halifax on UK.TrustPilot.com

- Halifax reviewed on SmartMoneyPeople.com

How Did We Review the Information on Halifax?

We reviewed Halifax based on the following:

- Reputation and History – How many years they have been in business, customer reviews, and industry rewards received.

- Financial Strength – Ensuring it is going strong and has adequate funds to meet long-term commitments.

- Product Range – We favour companies offering a variety of equity release schemes with greater product flexibility.

- Interest Rates and Fees – We review competitive rates compared to industry averages and they must be fully transparent about rates and fees without hidden costs.

- Customer Service and Support – When and how it is available, response times, and available online educational resources. As well as online tools, like a calculator.

- Code of Conduct and Compliance – We only consider companies that adhere to recognised industry standards and codes.

- Industry Insights and Peer Reviews – We care about a company’s industry-wide reputation.

- Innovation and Technology – Is there a streamlined, digital application process?

- Client Testimonials – Success stories and the complaints resolution process.

This is an unaffiliated, independent review of Halifax.

Halifax Complaints

If you are unhappy with Halifax and would like to make a complaint, the best way to do this is to reach out directly on its website.

Halifax cares about its customers and will forward you to the relevant department.

The alternative is to use a review site such as Trustpilot or Feefo and leave a review, and they will quickly reach out to you to assist.

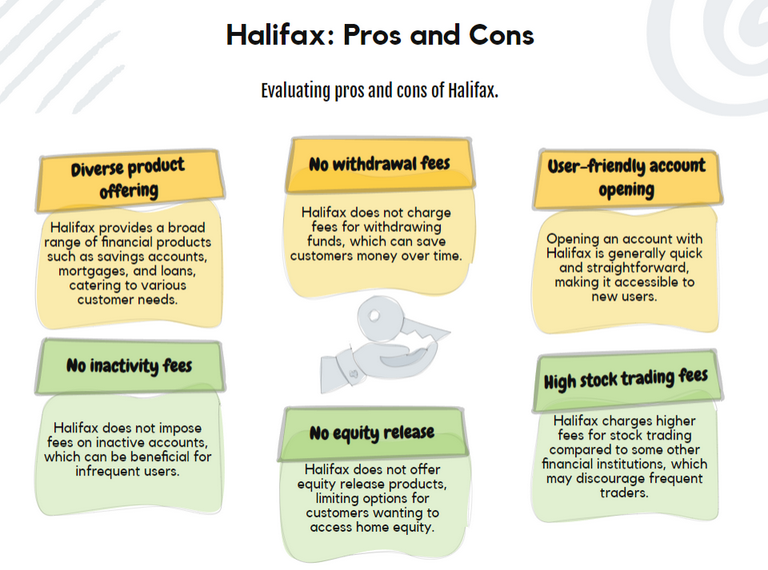

Pros and Cons of Halifax

The pros of Halifax include the large product offering, and the cons include that it does not offer equity release.

More information:

Pros

Here is a list of pros to consider:

- There are good options for deposits and withdrawals.

- Quick and easy account opening.

- There is no withdrawal fee.

- There is no inactivity fee.

Cons

Here is a list of cons to keep in mind:

- High stock trading fees.

- No equity release products.

- Yearly account fee.

- Fixed reviews.

Learn More About Halifax

Halifax was founded in 1853 and became a public limited company in 1997.2

In 2001, Halifax Plc merged with the Bank of Scotland, forming HBOS.3

In 2006, the assets and liabilities of the Halifax chain were transferred to the Bank of Scotland, and in 2009, HBOS was taken over by Lloyds TSB.

Halifax aims to provide outstanding service to all its customers.

As a result, you can expect equal access, facilities, and treatment, regardless of your requirements or ability.

The majority of its 800 locations are open-concept, making it simple to obtain in and out, as well as move about within.

The majority of its locations also feature a front desk, where you can discuss your requirements with a member of staff.

Halifax employees will also be able to answer your inquiries and assist you to the best of their abilities.

FCA Details

Regulators

Registration Numbers

- FCA Ref Number: 309513

- FCA Reg Number: 02791889

FCA and Companies House Link

- FCA Link: FCA Link

- Companies House Link: Companies House Link

Halifax Contact Number and Address

- +44 345 720 3040

- enquiries@halifax.co.uk

- 118, 132 New Oxford St, London WC1A 1HD, UK.

Common Questions

Is Halifax a Member of the Equity Release Council?

Who Owns Halifax?

Where Does Halifax Advertises It's Available Jobs?

Where Is Halifax Located?

Does Halifax Offer Telephone Banking?

Is It Possible to Close Your Halifax Account Online?

Is Halifax a Safe Option for Retirement?

Are There Any Hidden Fees When Using Halifax Financial Products?

In Conclusion

While Halifax may not offer equity release, it is a financial institution worth considering for other products.

With its comprehensive suite of financial services tailored for the over-55 market, including competitive savings accounts, tailored mortgage options, personalised financial advice, diverse investment opportunities, and robust insurance solutions, Halifax presents a holistic approach to managing your finances in retirement.

For those looking to secure their financial future without tapping into home equity, Halifax's offerings can provide viable alternatives, with products that not only aim to grow and protect your wealth but also offer peace of mind through financial stability and security.

We always suggest you work with a financial adviser or broker, before making major financial decisions.

Additional Reading:

- Age Partnership reviews

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.