Does Martin Lewis Recommend Equity Release in 2026?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Known for his financial wisdom, Lewis' take on equity release is a go-to for many, with his advice suggesting that you look at every alternative, seek unbiased counsel, and pick a plan green-lit by the Equity Release Council.

- Martin Lewis waves a yellow flag on equity release; he's not giving it a thumbs-up, but he's not dismissing it either, highlighting that it's cash-ready but not one-size-fits-all and urging a thoughtful approach.

- The perks? Instant cash flow without monthly dues. The drawbacks? It can dilute inheritance and come with steep interest.

Martin Lewis, the trusted financial expert and founder of MoneySavingExpert.com, has built a reputation for offering straightforward, practical advice. But when it comes to Martin Lewis equity release recommendations, what’s his stance on this popular retirement strategy?

With equity release growing in popularity, many retirees are looking to Martin for guidance—could this be the right financial move for you?

At SovereignBoss, we’ve done in-depth research to uncover Martin Lewis’s views and the latest market trends.

Let’s dive into his insights and explore further...

In This Article, You Will Discover:

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details provided in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of Martin Lewis. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Martin Lewis.

Who Is Martin Lewis, and What Makes Him a 'Money Saving Expert'?

Martin Lewis is a British financial journalist and broadcaster, widely known as the "Money Saving Expert" for founding MoneySavingExpert.com, a leading consumer finance website.

He is renowned for providing practical advice on saving money, managing personal finances, and navigating complex financial products, earning trust through his expertise and consumer advocacy.

Let's take a closer look:

Who Exactly Is Martin Lewis, the 'Money Saving Expert'?

Martin Lewis is a highly respected financial expert and public figure in the UK, often referred to as the most trusted man in the country by outlets like The Guardian.1

He founded the Money Saving Expert website from his home, turning it into one of the UK’s leading consumer finance platforms before selling it to MoneySupermarket.com.2

Lewis is well-known for his practical money-saving advice, which he shares weekly on popular programmes like This Morning and Good Morning Britain, helping millions of people manage their finances more effectively.

How Can You Contact Martin Lewis for Equity Release Advice?

Martin Lewis does not provide personalised advice or respond to individual queries directly; however, his guidance on equity release is readily available through the resources on MoneySavingExpert.com.

These include detailed articles, FAQs, and recommendations for seeking professional advice.

For further assistance, you can email the MoneySavingExpert team at furtherhelp@moneysavingexpert.com, where they may direct you to additional resources or trusted advisers.

What Does Martin Lewis Say About Equity Release and Lifetime Mortgages?

Martin Lewis says that equity release and lifetime mortgages can be suitable for homeowners seeking funds in later life but warns of potential long-term costs like compound interest, recommending thorough research, professional advice, and exploring alternatives first.

Here's what he has to say:

What Are Martin Lewis' Insights on Lifetime Mortgages?

Martin Lewis highlights the importance of approaching lifetime mortgages with caution, advising borrowers to fully understand how compound interest accumulates, its impact on inheritance, and the need for independent financial advice before committing.

Lewis has also noted that lifetime mortgage options have become more flexible over time.

He encourages borrowers to consider making interest payments, if affordable, to reduce the overall cost of borrowing and protect the value of their estate.3

What Is Martin Lewis's Stance on Equity Release?

Martin Lewis' stance on equity release advises caution, emphasising that it should be a last resort after exploring all other financial options.

He acknowledges that while equity release, such as lifetime mortgages or home reversion plans, can provide a way to improve your retirement lifestyle, it comes with significant costs and implications.

According to MoneySavingExpert4, Lewis highlights that equity release can reduce the inheritance left for loved ones; however, he also recognises that many people choose equity release to prioritise a comfortable retirement, focusing on improving their quality of life rather than solely preserving wealth for inheritance.

According to Martin Lewis, Is Downsizing a Better Option Than Equity Release?

Martin Lewis frequently advises that downsizing can be a more practical and cost-effective option than equity release.

Moving to a smaller, more manageable property can free up cash for retirement needs while also reducing ongoing living expenses like maintenance and utility costs.5

He stresses the importance of acting promptly, noting that many retirees delay downsizing and later regret waiting too long.

Ultimately

While equity release remains a viable option for those unable or unwilling to move, Lewis encourages exploring downsizing first as it avoids the interest accumulation and inheritance impact associated with lifetime mortgages or home reversion plans.

What Are Martin Lewis's Top Tips for Considering Equity Release?

Martin Lewis's top tips for considering equity release include borrowing only the minimum amount needed, exploring all alternative options like downsizing, consulting a qualified financial adviser, and involving the family in the decision-making process.

Take a look at more of these top tips:

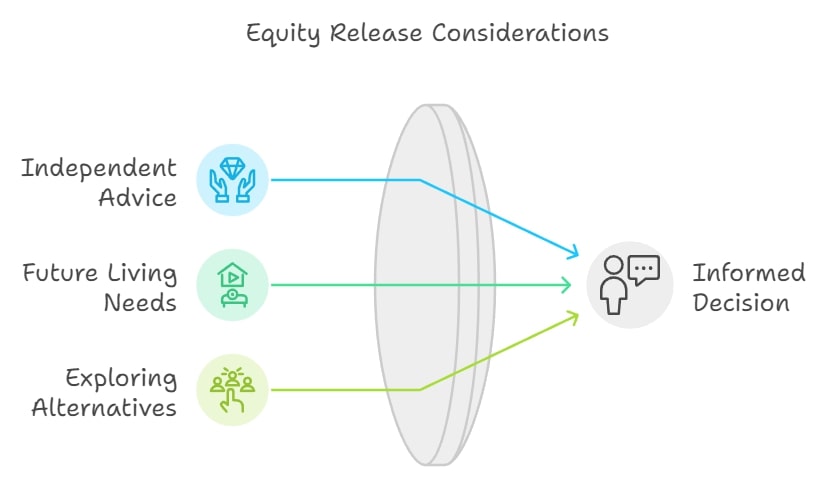

How Does Martin Lewis Advise on Equity Release Decisions?

Martin Lewis advises individuals to approach equity release decisions with caution and thorough research, recommending exploring all alternative financial options before committing and ensuring that equity release is a last resort.

Understanding the long-term costs, including interest accumulation and its impact on inheritance, is essential.

Here are some of his essential tips for equity release users:

Why Does Martin Lewis Advise to Only Borrow What You Need?

Martin Lewis advises borrowing only what you need to minimise the impact of compound interest, which increases the total amount repayable over time.

By delaying borrowing until absolutely necessary and taking out smaller sums as needed, you can reduce the amount of interest that accumulates; for example, instead of borrowing £50,000 all at once, borrowing £5,000 annually over 10 years can significantly lower the interest charges.

Interest is calculated as a percentage of the loan principal, so smaller, incremental borrowing results in a more cost-effective repayment strategy and reduces the overall financial burden.

Why Is Using Equity Release Council Members Recommended by Martin Lewis?

Martin Lewis recommends using Equity Release Council (ERC) members because they adhere to strict industry standards designed to protect homeowners.

One key guarantee is the no negative equity guarantee, which ensures that neither you nor your estate will owe more than the value of your property, regardless of how much interest accrues over the loan term.

ERC members also provide transparency, require independent legal advice, and follow ethical practices, making them a trusted choice for those considering equity release.6

How Important Is Professional Equity Release Advice According to Martin Lewis?

Martin Lewis considers professional equity release advice essential for making informed decisions, emphasising that independent financial advice helps you understand the long-term implications, compare products, and determine whether equity release is the right choice for your situation.

He specifically recommends consulting advisers who are members of the ERC who provide unbiased, whole-of-market guidance and can identify the best equity release companies and products tailored to your needs, ensuring your decision aligns with your financial goals.

Why Should You Be Aware of Benefits Impact When Considering Equity Release?

You should be aware of benefits impact when considering equity release because receiving a lump sum or regular payments could affect your eligibility for means-tested benefits, potentially reducing or eliminating the financial support you currently receive.

In this case, your equity release adviser will decide the best course of action.

How Can Martin Lewis's Equity Release Calculator Help You Plan Effectively?

While Martin Lewis doesn’t have his own equity release calculator, he acknowledges the value of using one to get a preliminary estimate of how much equity you could unlock from your home.

By entering key details such as your age and property value, these calculators can provide an idea of the funds available through equity release.

However, Lewis stresses that this is just an initial step and strongly advises consulting with an independent financial adviser for a detailed and tailored assessment.

How Does Martin Lewis Advise You to Choose the Right Equity Release Plan?

Martin Lewis advises you to choose the right equity release plan by comparing multiple options, ensuring the plan fits your financial needs, and checking for flexibility to thoroughly understand the long-term implications.

Furthermore, Lewis stresses the value of independent financial advice to ensure the chosen plan aligns with your personal financial situation and goals.

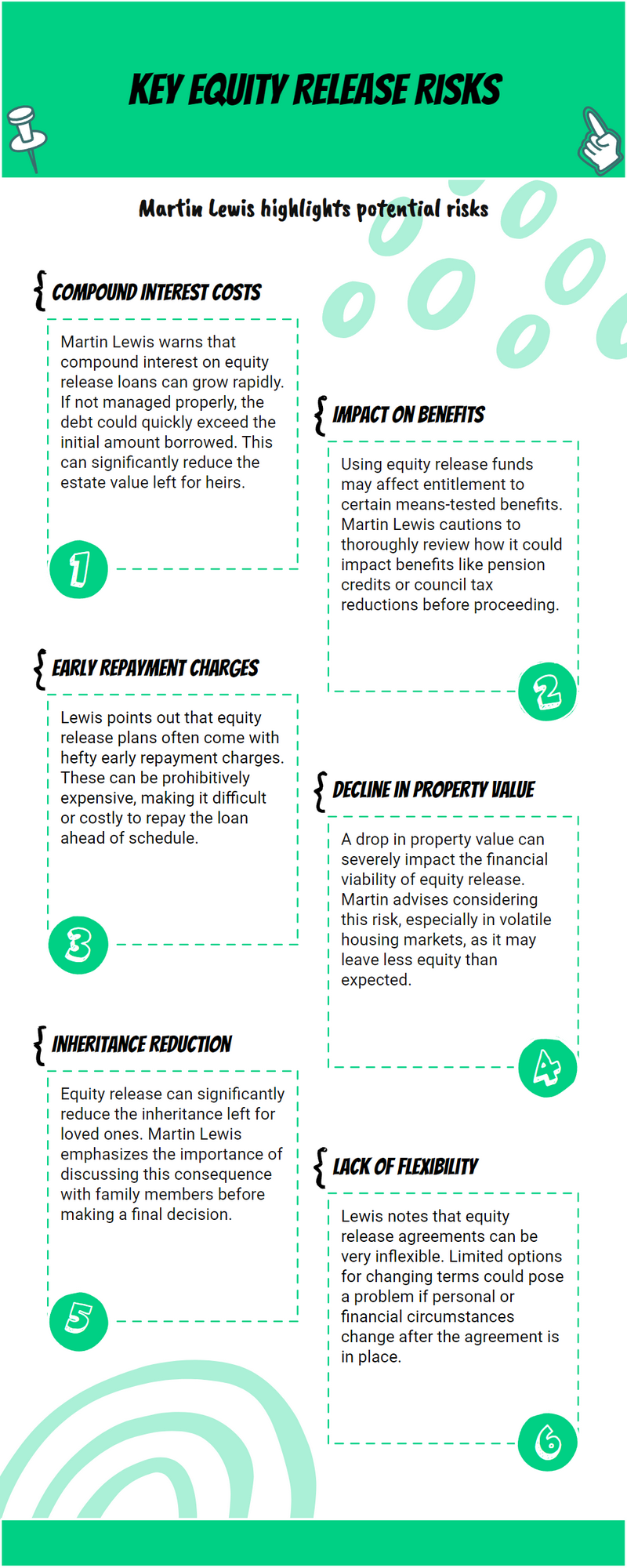

What Are the Key Risks and Warnings About Equity Release According to Martin Lewis?

Martin Lewis highlights several key risks associated with equity release; one major concern is the accumulation of compound interest, which can significantly reduce the inheritance left for loved ones.

He also warns that equity release could affect eligibility for means-tested benefits and emphasises the importance of fully understanding all associated costs and terms before committing.

Lewis advises evaluating the flexibility of the plan, including options for early repayments and the ability to move house without facing excessive penalties.

How Do Reviews and Feedback Reflect on Martin Lewis's Equity Release Advice?

Reviews and feedback on Martin Lewis's equity release advice often highlight his clear, balanced, and consumer-focused approach.

Many appreciate his emphasis on caution, transparency, exploring alternatives, and seeking professional advice, making his guidance widely trusted by homeowners.

Check out what's being said about Martin Lewis:

What Are the Reviews on Martin Lewis and Money Saving Expert Equity Release Saying?

The reviews on Martin Lewis and MoneySavingExpert equity release advice highlight his balanced and transparent approach, earning widespread trust among homeowners considering equity release options.

Reviews directly on Martin Lewis are not available; however, you can look into the Money Saving Expert reviews below.

- Money Saving Expert Society Reviews - UK.TrustPilot.com

- Review of Money Saving Expert - ReviewCentre.com

- Money Saving Expert Reviewed - SmartMoneyPeople.com

How Can You Go About Leaving Complaints or Compliments for Martin Lewis?

Should you wish to complain about or compliment Martin Lewis or Money Saving Expert, you should send them to furtherhelp@moneysavingexpert.com.

Frequently Asked Questions on Martin Lewis and Equity Release

Are There Any Job Openings Available With Martin Lewis's Team?

Is There a Martin Lewis Equity Release Calculator?

What Is Martin Lewis's Latest Advice on Equity Release?

Can You Trust Martin Lewis's Review on Equity Release?

What Pros and Cons Does Martin Lewis Highlight in His Equity Release Review?

What Suggestions Does Martin Lewis Offer for Equity Release Schemes?

Summarizing Insights on Martin Lewis and Equity Release

Martin Lewis’s advice highlights the importance of prioritising your quality of life in retirement over concerns about inheritance—his balanced perspective on equity release provides a valuable starting point for anyone considering this financial option.

To dive deeper into his guidance, visit the MoneySavingExpert website or subscribe to his newsletter for actionable tips; however, remember that no general advice can replace the tailored support of a qualified equity release adviser.

Take the next step toward securing your financial future with expert insights and personalised advice.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.