More2Life Equity Release Review (2026): Detailed Analysis

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- More2Life has advantages such as flexible payment options and potential inheritance protection but also carries risks including reducing your estate value and potentially impacting means-tested benefits.

- As a member of the Equity Release Council, they are generally considered reliable, offering regulated plans to safeguard homeowners.

- They tend to offer more flexible payment options and competitive interest rates compared to some alternatives, but it's crucial to compare individual plans to find the best fit.

- Their interest rates vary between 5.97% to 6.28%* depending on the specific plan chosen, so it's important to review the terms carefully.

- The customer reviews are generally positive, praising the company's customer service and flexibility, but as with any financial product, experiences can vary.

Is More2Life equity release a viable option?

If you're looking for ways to access extra cash during retirement, you may have started exploring equity release as an option.

With so many plans and providers to choose from, the whole concept can be rather daunting.

We are here to help!

In This Article, You Will Discover:

Our team at SovereignBoss has combed the market and researched all equity release service providers to bring you the information you need.

Is More2Life the ideal equity release loan company to assist you and your family?

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of More2Life. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by More2Life.

Who Is More2Life?

More2Life is one of the UK’s leading lifetime mortgage lenders.

From its inception, More2Life has been exclusively focused on equity release, assisting advisers, and prioritising the interests of its clients.

Why You Should Consider More2Life

You should consider More2Life as it has chosen to focus solely on later-life lending, making it one of the UK's leading equity release specialists.

It also offers the widest variety of modern lifetime mortgage plans available on the market.

On the technology front, More2Life has developed an online portal, "fastpath" which reduces the admin involved in equity release making the whole process much quicker.

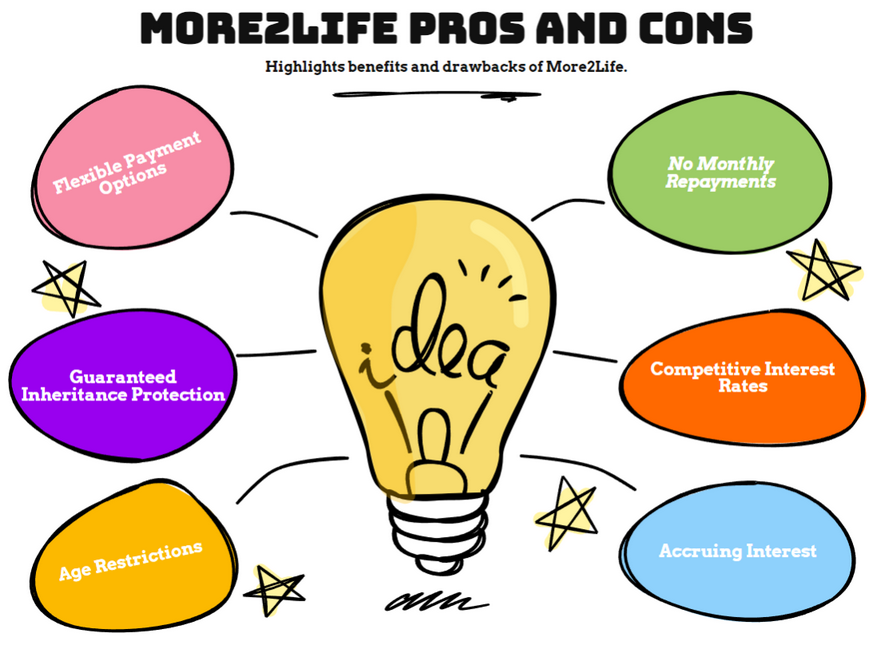

What Are the Advantages and Disadvantages of Using More2Life?

The advantages and disadvantages of More2Life include that it is focused on offering plans to those over 55, but does not offer anything other than lifetime mortgages.

The full scope:

Pros

We have compiled a list of pros for you to look at:

- The company’s sole focus is equity release.

- It offers free valuation.

- There are no application fees.

- Early repayment charge exemptions are available.

- Enhanced lifetime mortgages.

Cons

These are the cons you shoud be aware of:

- Your interest can compound quickly if you do not opt for a repayment plan.

- You will need to seek professional advice before committing to a plan.

- Once you have taken out an equity release plan, no other borrowing can be taken out using your home as security.

- Equity release may not be suitable for everyone, which is why your adviser will ask you to consider other options before proceeding.

- Equity release will impact on your entitlement to means tested benefits now or in the future.

More2Life Qualification Criteria

Consider the following qualification criteria:2

- Minimum Amount of Equity Offered: £10,000

- Maximum Amount of Equity Offered: £1.5mln

- Minimum Age Limit: 55

- Maximum Age Limit: 95 (plan dependent)

- Property Minimum Value: £70,000

- Location: Mainland England (including the Isle of Wight), Wales, and mainland Scotland

- Tenure: Freehold in all regions, leasehold in England and Wales, and absolute ownership in Scotland.

More2Life Equity Release Schemes

More2Life offers six (one currently not available)3 different equity release schemes in the form of lifetime mortgages.

Options are:

- Flexi Lifetime Mortgage

- Capital Lifetime Mortgage

- Tailored Lifetime Mortgage *

- Maxi Lifetime Mortgage *

- Prime Lifetime Mortgage * (currently unavailable)

- Apex

More detail:

* The Tailored, Maximum and Prime options are temporarily unavailable.

Flexi

The More2Life Flexi Choice Lifetime Mortgage4 is available to those aged between 55 and 84.

It offers LTVs from 5% to 44% and offers lump sum or drawdown options.

Other features include:

- Option to make partial repayments from the start

- Downsizing protection

- Fixed early repayment charges

- ERC exemption

Capital

The More2Life Capital Lifetime Mortgage5 comes with a free valuation and no application fees.

It is available to customers between 55 and 95.

It offers lump sum and drawdown options, with LTVs between 4.5% and 55%.

Other features include:

- Fixed early repayment charges

- Repayment options from the start

- Downsizing protection

- ERC exemption

The More2Life Prime Lifetime Mortgage is temporarily unavailable.

Tailored

The More2Life Tailored Lifetime Mortgage is available for clients aged 55 to 85.

It offers LTVs from 1% to 30.5% and you can opt for a lump sum or drawdown, partial repayments, fixed ERCs and cashback.

Maxi

A More2life Maxi Lifetime Mortgage is also available for homeowners aged 55 to 84.

It only has a lump sum option, with LTVs between 19.5% and 46.6%.

Features include:

- Fixed early repayment charges

- Voluntary repayments

- Cashback

- ERC exception

Prime

More2Life Prime Lifetime Mortgages are temporarily unavailable for new lifetime mortgage customers.

Apex

The More2Life Apex Lifetime Mortgage is said to have the highest LTVs and shortest fixed ERC period in the market.6

It is available for clients aged 55 to 84.

*While we regularly review our rates, these may have changed since our last update.

Learn More: Top Mortgage Deals

More2Life's Equity Release Interest Rates

More2Life's interest rates range from 5.97% to 6.28%*.

You can see what the current equity release rates are here.

Have a look at all the equity release schemes available on the market.

*While we regularly review our rates, these may have changed since our last update.

What Are More2Life's Fees?

More2Life fees are as follows:

- Arrangement fees - For most More2life products, arrangement fees are free however, you will pay £695 to arrange the Tailored Enhanced lifetime mortgage and £500 for the Flexi plan; however, the Flexi lifetime mortgage does have a fee-free option.

- Valuation fees - More2life offers a free valuation on all it's lifetime mortgage products.

- Re-inspection fee - You can expect to pay a re-inspection fee of £75 if your property needs an additional visit after major upgrades.

- Re-evaluation fee - Tailored lifetime mortgages have a re-evaluation fee of £110 if your initial valuation expires.

- Legal fees - You will pay £1,025 across plans, but £510 for tailored plans.

- Funds transfer fee - You will pay a funds transfer fee between £30 and £35 for most plans when the money is sent to your solicitor.

- Further lending - If you borrow more on your lifetime mortgage, you may need to pay additional fees for a valuation and various administrative needs.

More About More2Life

Since it was established, More2Life has focused only on lending to people in their later years.

Now, More6Life assists over 1,000 people each month in safely releasing cash from their homes.7

The company has created plans that reflect today’s consumers’ shifting retirement demands.

By providing tools such as its web portal, “fastpath”, More2Life helps advisers spend less time on administration and more time ensuring its customers have the retirement they deserve.

More2Life provides you with personalised business development and telephone assistance from the minute you join.

It also provides access to online tools never seen before in the equity release market, resources, and CII-recognised webinars that you can use anywhere, anytime – even while you are on the road.

No other lender can match the variety of current plans, LTVs, features, bonuses, and low rates that More2Life can supply to customers.

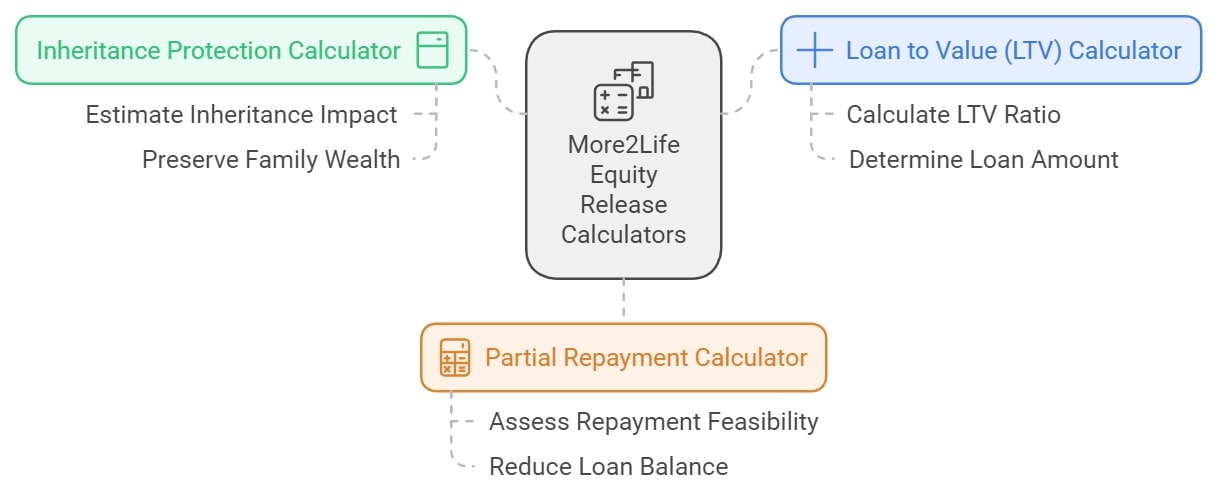

Does More2Life Have an Equity Release or Lifetime Mortgages Calculator?

Yes, you can get a More2Life equity release calculator on it's website. In fact, there are a few.

These include the following:

- Inheritance protection calculator

- Loan to value (LTV)1 calculator

- Partial repayment calculator

If you like to see approximately how much equity you could release from your home, why not try our easy-to-use calculator below?

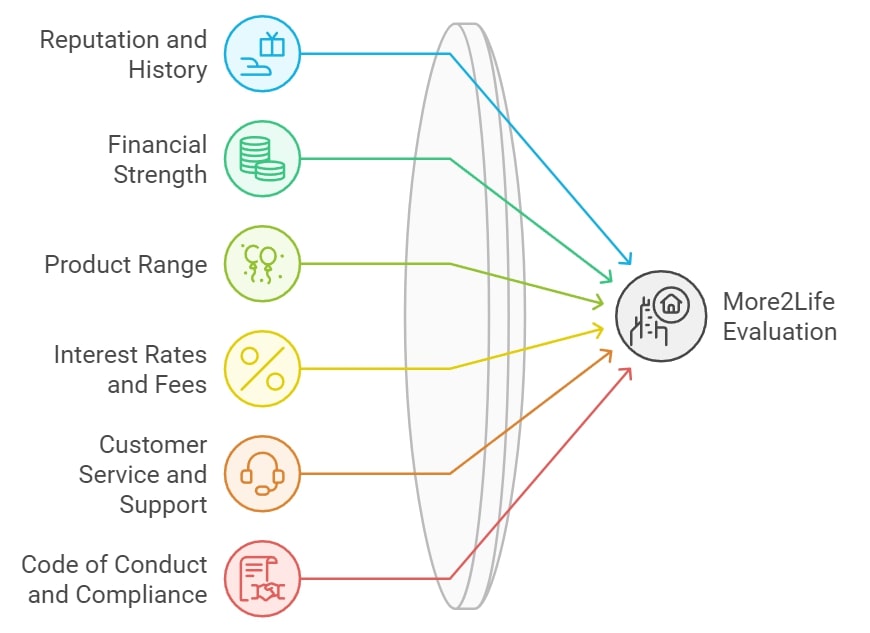

How Did We Review the Information On More2Life?

We reviewed More2Life based on the following:

- Reputation and History – How many years they have been in business, customer reviews, and industry rewards received.

- Financial Strength – Ensuring it is going strong and has adequate funds to meet long-term commitments.

- Product Range – We favour companies offering a variety of equity release schemes with greater product flexibility.

- Interest Rates and Fees – We review competitive rates compared to industry averages and they must be fully transparent about rates and fees without hidden costs.

- Customer Service and Support – When and how it is available, response times, and available online educational resources. As well as online tools, like a calculator.

- Code of Conduct and Compliance – We only consider companies that adhere to recognised industry standards and codes.

- Industry Insights and Peer Reviews – We care about a company’s industry-wide reputation.

- Innovation and Technology – Is there a streamlined, digital application process?

- Client Testimonials – Success stories and the complaints resolution process.

We are an unaffiliated, third-party reviewer, and our article on More2Life is therefore independent.

More2Life Customer Reviews

More2Life customer reviews are mostly very positive.

Read what its customers have to say on these popular online review platforms:

More2Life's Equity Release Schemes Reviews

More2Life has a wide scheme offering to suit all needs.

It's lifetime mortgages are tailored to individual needs to give you the financial freedom you require in later life.

More2Life's lifetime mortgages plans are:

- More2Life Flexi Plans

- More2Life Tailored Plans

- More2Life Maxi Plans

- More2Life Capital Plans

- More2Life Prime Choice Plans (currently unavailable)

- More2Life Apex Plans

More2Life Complaints

If you are dissatisfied with More2Life and want to make a complaint, the best thing to do is to email or call them.

Here are the necessary contact details for ease of reference:

- Email: servicing@more2life.co.uk

- Phone: 03454 150 150

You can also contact More2Life via its website should you prefer to do so.

FCA Details

Trading Names

Current

More2Life Ltd

Previous

Senior Home Loans Ltd

FCA Permitted Services

Mortgages and Home Finance

Regulators

- Financial Conduct Authority (FCA)8

Registration Numbers

- FCA Ref Number: 459669

- Companies House Reg Number: 5390268

FCA and Companies House Link

- FCA Link: FCA Link

- Companies House Link: Companies House Link

More2Life Contact Number and Address

- +44 345 415 0150

- info@more2life.co.uk

- More2Life, Baines House, 4, Midgery Court, Fulwood, Preston PR2 9ZH.

Common Questions

What Are the Pros and Cons of More 2 Life Equity Release?

Is More 2 Life Equity Release a Reliable Option for Investment?

How Does More 2 Life Equity Release Compare to Other Options?

What Are the Interest Rates for More 2 Life Equity Release?

What Are the Customer Reviews for More 2 Life Equity Release?

Conclusion

More2Life has established itself as a leading later-life lender with it's wide range of lifetime mortgages and innovative technology.

As with all big life decisions, the first step is to contact an experienced equity release advisor to guide you through the process.

If you are looking for a variety of options from one lender, then More2Life's equity release plans are definitely a good place to start.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.