NatWest Equity Release Review (2026): Should You Choose Them?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- NatWest offers alternatives to equity release, such as lifetime mortgages and retirement interest-only mortgages.

- NatWest provides financial advice and products suitable for homeowners over 55, including retirement planning solutions.

- The interest rates are typically fixed for life, making it a stable and predictable option for homeowners over 65.

- Explore NatWest's range of retirement planning options beyond equity release for flexible and tailored solutions.

- Discover NatWest's retirement mortgage options tailored to your financial needs and circumstances.

Are you considering equity release to help fund your retirement and are you curious to see if NatWest can help?

NatWest is a well-known name in the financial market, but the question is if it can help realise your equity release dreams.

In This Article, You Will Discover:

As experts in the equity release field (we have now reviewed more than 250 schemes), we have combed the market to bring you the latest information.

Does NatWest have a solution for your later-life lending challenge?

NOTE: SovereignBoss is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of SovereignBoss only and may not reflect the views or opinions of NatWest. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by NatWest.

What Is Equity Release?

Equity release allows homeowners, typically 55 or older, to access cash from the value of their home without selling it.

The most common types are lifetime mortgages, where the loan and interest are repaid when the homeowner dies or moves into care, and home reversion plans, where part of the home is sold in exchange for a lump sum.

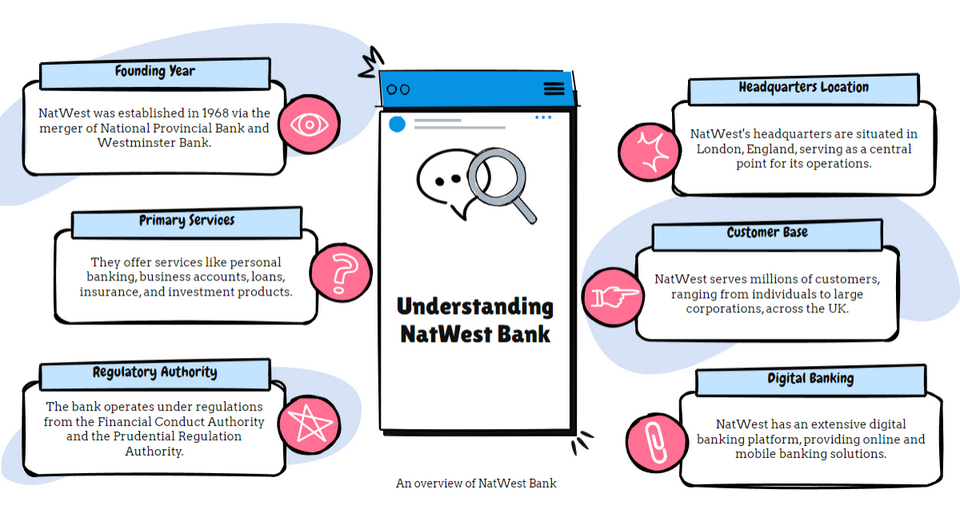

Who Is NatWest?

NatWest, or National Westminster Bank, is a major British retail and business bank.

Established in 1968 following the merger of National Provincial Bank and Westminster Bank1, NatWest became part of the Royal Bank of Scotland Group in 2000 and is now known as the NatWest Group.

NatWest offers a wide range of financial services including mortgages, investments, insurance and general banking.

Equity release is, unfortunately, not one of its offerings.

Why You Can Consider NatWest

You can consider NatWest for the wide range of financial products it has to offer, and the fact that it has a proven track record in the industry.

Other reasons to consider NatWest include:

- Remortgaging with NatWest could secure you a better deal than what you currently have.

- It's dedication to sustainability and tackling climate change is evident with it's Green Mortgage product offering that offers discounted fixed-rate mortgages on energy-efficient homes.

- It offers a paperless online application process.

- In certain instances, it may pay your legal and valuation fees on a standard remortgage.

- It is authorised and regulated in the UK by the Financial Conduct Authority (FCA)1 and the Prudential Regulatory Authority (PRA).

Learn More: 5 Year Fixed Rate Mortgage

Does NatWest Offer Equity Release or Lifetime Mortgages?

No, NatWest does not offer equity release, but an alternative option that may be worth your consideration is it's remortgaging option.

Remortgaging is essentially moving your mortgage from one provider to another, which could secure you a much better rate and subsequently save you money.

NatWest's Interest Rates

NatWest's mortgage interest rates range from 5.97% to 6.28%* on a fixed-term basis.

In terms of equity release however, the annual interest can be available from 5.97% to 6.28%*.

The latest equity release interest rates can be viewed here.

*While we regularly review our rates, these may have changed since our last update.

What Are NatWest's Fees?

NatWest's remortgaging fees may include valuation and legal fees although in certain instances these can be waived.

Other fees may include:

- Product fees

- Valuation fees

- Broker fees

In terms of equity release, the general fees normally range from £1,500 to £3,0003.

Does NatWest Have an Equity Release Calculator?

No, NatWest does not offer equity release and therefore does not have an equity release calculator available.

You will, however, be able to find a range of calculators on it's website, including a card currency calculator, carbon footprint calculator, overdraft cost calculator, and a mortgage overpayment calculator, to name a few.

It's mortgage equity calculator, although not an equity release calculator, can give you an idea of how much equity there is in your home and how much you could potentially borrow with a mortgage.

If you are curious to know approximately how much equity you can release from your home, why not try our easy-to-use calculator below?

Learn More About NatWest

NatWest, as part of the NatWest Group, believes in people, families, and companies achieving their full potential.

It helps it's clients succeed in the UK and worldwide by being secure, easy, and smart.

The company also emphasises collaboration, keeping commitments, and assisting customers with their personal, private, and commercial banking requirements.

NatWest provides businesses with industry expertise in sectors like manufacturing and technology.

It provides access to specialised entrepreneurial assistance, in addition to a comprehensive variety of banking services.

For more than 21 years, this financial giant has conducted MoneySense4, an unbiased financial education programme for children aged five to eighteen.

NatWest has also collaborated with National Trading Standards (NTS)5 to create the ‘Friends Against Scams Initiative'.

In addition to this, it has worked with the British Standards Institute, Age UK and NTS to produce a national industry standard for fraud protection.6

How Did We Review the Information On NatWest?

We reviewed NatWest based on the following:

- Reputation and History – How many years they have been in business, customer reviews, and industry rewards received.

- Financial Strength – Ensuring it is going strong and has adequate funds to meet long-term commitments.

- Product Range – We favour companies offering a variety of equity release schemes with greater product flexibility.

- Interest Rates and Fees – We review competitive rates compared to industry averages and they must be fully transparent about rates and fees without hidden costs.

- Customer Service and Support – When and how it is available, response times, and available online educational resources. As well as online tools, like a calculator.

- Code of Conduct and Compliance – We only consider companies that adhere to recognised industry standards and codes.

- Industry Insights and Peer Reviews – We care about a company’s industry-wide reputation.

- Innovation and Technology – Is there a streamlined, digital application process?

- Client Testimonials – Success stories and the complaints resolution process.

This is an unaffiliated, independent review of NatWest.

NatWest Customer Reviews

NatWest's customer reviews have been mixed, with it obtaining a 1.4 and a 4.4 star rating across different online customer review websites.

Find out what it's customers have to say here:

- UK.TrustPilot.com review for NatWest Reviews

- NatWest customer reviews on Review.io

- NatWest reviewed on SmartMoneyPeople.com

NatWest Complaints

NatWest complaints can be made directly on it's website, by phone, email or in person.

It's handy online complaints guide2 will point you in the right direction.

Should you wish you voice your complaint more publicly, you could use a review site such as Trustpilot3 or Feefo.4

FCA Details

FCA Address

250, Bishopsgate, London, EC2M 4AA, UK.

Trading Names

- Ulster Bank

- NatWest Premier

- Payit

- Mettle

- Tyl

- Bó

- Mentor

- National Westminster Bank Plc

FCA Permitted Services

- Banking

- Insurance

- Mortgages and home finance

- Consumer credit

- Payment services and e-money

- Pensions

- Investments

Regulators

Registration Numbers

- FCA Ref Number: 121878

- Companies House Number: 00929027

FCA and Companies House Link

- FCA Link: FCA Link

- Companies House Link: Companies House Link

NatWest Contact Number and Address

- +44 345 7888 444

- enquiries@natwest.com

- 250, Bishopsgate, London, EC2M 4AA, UK.

Common Questions

Is NatWest a Member of the Equity Release Council?

Who Owns NatWest?

Where Can I Find NatWest Jobs?

Where Is NatWest Located?

What Are the Key Features of Equity Release?

Is NatWest Safe?

Is Equity Release a Good Deal for Seniors?

What Are the Interest Rates for NatWest?

Conclusion

NatWest is a huge name in the financial industry and is a viable option for most financial services.

Being authorised and regulated in the UK by the FCA and PRA speaks to its safety, but its longevity in the industry and commitment to sustainability speak volumes about it's value system.

Although NatWest does not offer equity release in the form of lifetime mortgages or home reversion plans, it's remortgaging option could be a great alternative for you.

Read More: HSBC Equity Release

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.