The Ultimate 2025 Guide to Retirement Interest-Only Mortgages

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

Key Takeaways...

- RIO mortgages cater to those over 60; this mortgage allows payment only on the interest through regular payments, with the loan's principal settled when the house is sold after you pass away or move into care.

- Pros include lower monthly costs, no looming deadline, and a potential boost to your family's inheritance, while cons include house price dips that could mean debt and needing a repayment plan.

- If you want to apply, chat with a broker or lender, check if you fit the bill, and tackle their paperwork.

Are you nearing retirement age and wondering how a retirement interest-only mortgage can free up some of the equity in your home?

At SovereignBoss, our team breaks down everything you need to know about RIO mortgages, including how they work, interest accumulation, repayment structure, and how your borrowing limit is determined, spending countless hours researching the equity release market and all it offers.

It's our goal to provide you with all the relevant and accurate information for your retirement years, so you don't have to worry about doing the work.

Let's get right into it...

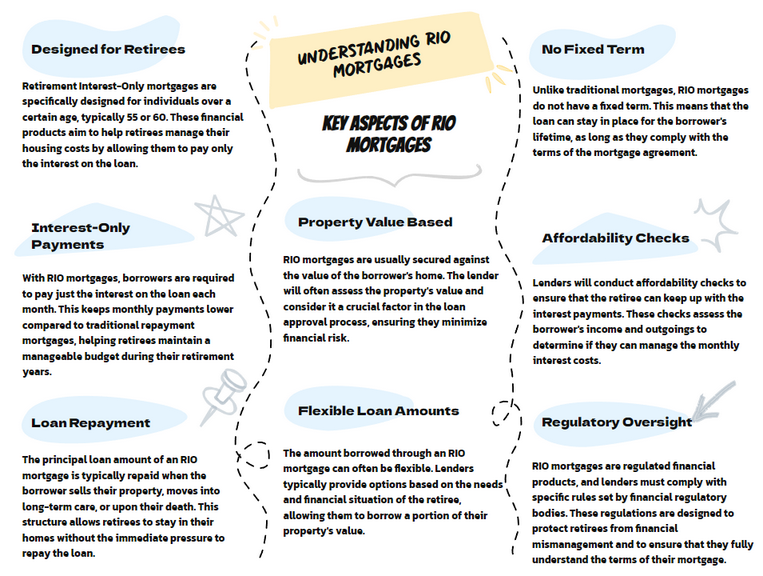

What Defines a Retirement Interest-Only (RIO) Mortgage?

A retirement interest-only (RIO) mortgage is defined as the concept of letting retirees pay just the interest each month, with the principal only being repaid when the home is sold.

Let's take a closer look:

How Are RIO's a Unique Financial Solution for Retirees?

RIO mortgages are a unique financial solution for retirees as they are a newer product in the UK equity release market, designed for those in or nearing retirement.

They provide a unique way to tap into your home’s equity while maintaining financial flexibility.

How Does a RIO Mortgage Work?

An RIO mortgage works by allowing you to secure a loan against your home while you pay only the interest each month, rather than the principal, proving to be a smart solution for retirees looking to access equity in their homes without the burden of repaying the principal during their lifetime.

Here's a quick summary:

- Monthly Interest Payments: You only pay the interest each month, helping you manage your finances more easily.

- Principal Repayment: The capital balance is repaid when the property is sold, typically when you pass away or move into long-term care.

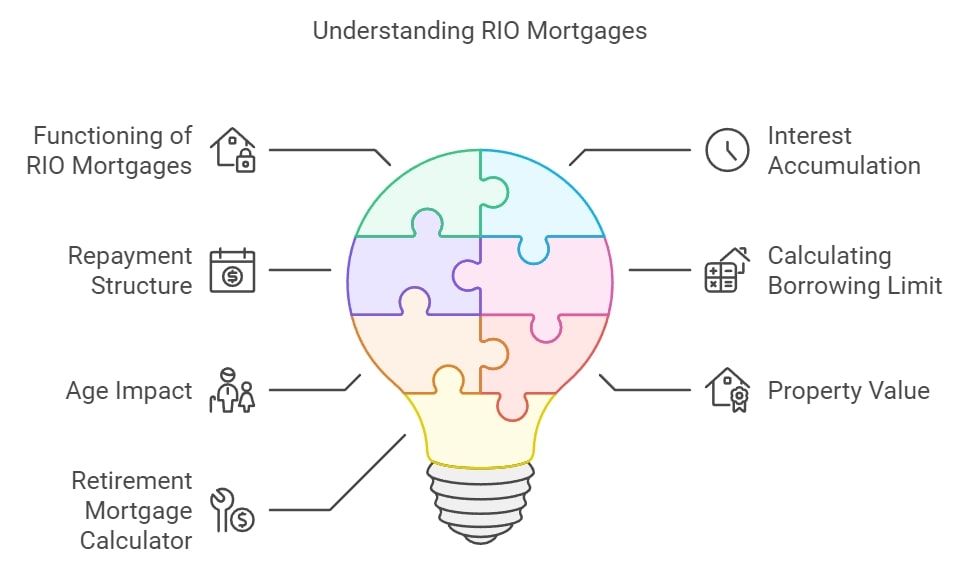

What Are the Mechanics of an RIO Mortgage, and How Can You Calculate Your Potential Borrowing?

The mechanics of an RIO mortgage display a clear breakdown of the ability to pay interest payments with the principal due later, and you can calculate your potential borrowing using lenders' online tools based on income and property value.

This is what you need to know:

How Do Retirement Interest-Only Mortgages Function?

RIO mortgages function similarly to interest-only lifetime mortgages; the significant difference is that the primary principle of an RIO mortgage is that you borrow a percentage of the value of your home, and then only make repayments on the loan's interest.

The loan itself does not decrease over time, and the capital amount borrowed is repaid when the property is sold, allowing you to release equity without the stress of meeting substantial monthly repayments.

Let's look at the inner workings:

How Is Interest Accumulated on a RIO Mortgage?

Interest on an RIO mortgage is, depending on the specific terms, accumulated monthly on the outstanding balance with fixed or variable interest rates.

This differs significantly from a traditional equity release scheme, where interest rolls up and increases the total amount to be repaid.

You make monthly payments towards the interest accrued on the loan, ensuring that the amount you owe remains the same throughout the loan term.

What Is the Repayment Structure of a RIO Mortgage?

The repayment structure of an RIO mortgage means that only the interest is repaid monthly—this is unlike traditional mortgages, where you pay off both the interest and principal monthly.

The principal, or original loan amount, is repaid at the end of the mortgage term, typically from the proceeds of selling your home, allowing you to lower your monthly payments and thus reducing financial stress during your retirement years.

How Can You Calculate Your Borrowing Limit with a RIO Mortgage?

You can calculate your borrowing limit with an RIO mortgage by assessing 2 main factors: your age and the value of your property.

Bear in mind, however, that the actual amount you obtain will vary from lender to lender.

Here's what you need to consider:

How Does Age Impact Your Borrowing Limit on a RIO Mortgage?

Age impacts your borrowing limit on an RIO Mortgage by working according to how much older you are; older borrowers can often secure higher amounts due to the shorter expected loan duration.

This is because the lender's risk is offset by the higher likelihood that the loan will be repaid sooner due to advanced age.

What Role Does Property Value Play in Determining Your RIO Mortgage Limit?

Property value plays a crucial role in determining your RIO Mortgage limit, with higher values typically allowing for larger loan amounts to be borrowed.

This means that if you are in an area with high property values, like London and South East England, you may be able to access larger loans.

How Can You Effectively Use a Retirement Mortgage Calculator?

You can effectively use a retirement mortgage calculator by inputting accurate financial and property information to estimate potential loan amounts and monthly repayments for planning purposes, along with details such as your age, property value, and desired loan amount.

A retirement mortgage calculator is an excellent tool to help estimate potential monthly interest payments and overall costs associated with an RIO mortgage.

This can provide a clearer picture of a RIO mortgage's impact on your finances, allowing you to plan accordingly.

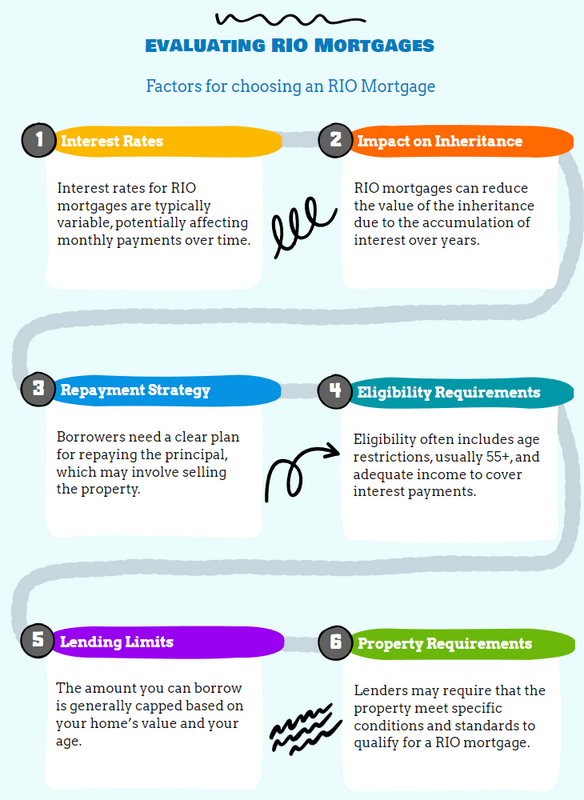

What Are the Financial Considerations of Opting for a RIO Mortgage?

The financial considerations of opting for an RIO Mortgage include interest rates, the potential impact on inheritance, and the need for a repayment strategy for the loan's principal.

Let's assess the financial aspects:

What Are the Costs Associated with a Retirement Interest-Only Mortgage?

The costs associated with a retirement interest-only mortgage include application fees, ongoing interest payments, and potential early repayment charges.

What Application Fees Can You Expect with a RIO Mortgage?

The application fees you can expect with an RIO mortgage include fees that cover the cost of assessing and processing your mortgage application; these can vary significantly between lenders.

Factoring these costs is essential when considering a RIO mortgage.

What Are the Interest Rates for RIO Mortgages in 2025?

In 2025, interest rates for RIO mortgages vary by lender and are either fixed or variable, with rates influenced by market conditions and the borrower's financial profile.

Fixed rates ensure your monthly payments remain the same for a set period, while variable rates can fluctuate based on market conditions.

Your monthly payments go entirely towards the interest, leaving the capital to be paid off when the property is sold.

What Interest Rates Are Expected for RIO Mortgages in 2025?

RIO mortgage rates in 2025 can vary widely depending on the lender, your circumstances, and the wider economic environment.

Initial RIO mortgage interest rates can be as low as 4.59%1, with an overall 6.0%* APRC, which gives an overall cost for comparison.

It is important to remember that the best rate for you will depend on your unique circumstances, and it is wise to seek independent advice or use a mortgage broker to find the most suitable deal.

*While we regularly review interest rates, these may have changed since our last update.

What Repayment Options Are Available for a RIO Mortgage?

Repayment options for an RIO mortgage typically include regular monthly interest payments or overpayments, with the principal due upon the sale of the property, the borrower's death, or moving into long-term care.

Regular Payments

With a RIO mortgage, you are required to make regular monthly payments that cover the interest on your loan.

These payments do not reduce the original loan amount but ensure that the debt does not increase over time.

Overpayments

Some lenders allow overpayments on RIO mortgages, which can be a way to reduce the capital balance over time.

This flexibility can be beneficial if your financial situation allows for it, but it is crucial to check your specific mortgage terms, as there may be early repayment charges.

What Happens on Death or Moving to Long-Term Care?

On death or moving to long-term care, the RIO mortgage must be repaid, typically through the sale of the property or other means arranged by the borrower's estate.

Any remaining equity after repaying the loan can then be distributed as part of your estate.

If the sale of the property does not cover the loan amount, some lenders offer a 'no-negative-equity' guarantee, meaning you or your estate will not be required to pay more than the sale proceeds of the property.

How Can You Manage Your Retirement Interest-Only Mortgage?

You can manage your retirement interest-only mortgage by keeping up with interest payments, reviewing your financial strategy regularly, and consulting with your lender for any adjustments.

Deep dive...

The Impact of Missed Payments

Maintaining regular monthly payments is crucial when managing a RIO mortgage; if payments are missed, this can lead to various consequences.

Missed payments may result in additional charges and fees, potentially increasing the overall cost of the mortgage.

It can also negatively impact your credit rating, making it harder to secure credit in the future.

Therefore, it is essential to plan and budget your finances accordingly to avoid missing payments.

Early Repayment Charges

Before entering into an RIO mortgage, it is vital to understand the terms and conditions regarding early repayment charges.

These charges are typically imposed if you decide to repay the mortgage in full or switch to a different product within a specific period.

Early repayment charges can vary among lenders, so it is crucial to carefully review the terms and seek professional advice to fully understand the implications before making any decisions.

Refinancing a RIO Mortgage

Refinancing a RIO mortgage involves switching to a new mortgage product or provider to achieve more favourable terms or rates.

It can be a viable option if you find a better deal or if your financial circumstances change.

However, remember that refinancing may come with associated costs, such as arrangement fees, legal fees, and valuation fees.

Who Qualifies for an RIO Mortgage, and What Should You Consider Before Applying?

To qualify for an RIO mortgage, applicants typically need to be older homeowners; considerations before applying include long-term affordability and impact on estate planning.

What Are the Eligibility Criteria for a Retirement Interest-Only Mortgage?

The eligibility criteria for a retirement interest-only mortgage include age, income sources, property value, and the ability to meet ongoing interest payments.

What Are the Age Requirements for a RIO Mortgage?

To be eligible for a RIO mortgage, you typically need to be at least 55 years old.

Some lenders may set a higher age limit, so it is crucial to check the specific requirements of each lender.

What Income Criteria Apply to RIO Mortgage Applicants?

RIO mortgage applicants must meet specific income criteria to prove they can sustain regular interest payments, including pensions, investments, and other reliable income sources.

How Should You Compare Offers When Choosing a Retirement Interest-Only Mortgage?

When comparing retirement interest-only mortgage offers, look beyond the interest rates to the overall terms and conditions.

Consider the lender's reputation, the flexibility for overpayments or early repayment, and any associated fees, such as application or valuation fees.

It’s also wise to evaluate the impact of these mortgages on your future financial situation and estate planning, ensuring the choice aligns with your long-term goals.

Is Opting for a Retirement Interest-Only Mortgage Advisable?

Opting for a retirement interest-only mortgage can be advisable for those needing income or capital while wanting to retain home ownership, but it requires careful consideration of the financial implications.

Like any financial product, RIO is not suitable for everyone.

It's best suited to those with a regular income who can meet the monthly interest payments and are comfortable with their property being sold to repay the loan at the end of the term.

Which Lenders Offer the Best RIO Mortgage Rates in 2025?

In 2025, the best RIO mortgage rates are offered by lenders who provide competitive interest rates, flexible terms, and excellent customer service, varying by applicant's circumstances.

Some of the top retirement interest-only mortgage providers in the field are:

- Halifax retirement interest-only mortgage

- Lloyds retirement interest-only mortgages

- Leeds Building Society retirement interest-only mortgage products

- Santander retirement interest-only mortgage

These lenders offer competitive interest rates and flexible terms, but it is essential to shop around and compare different products to find the best fit for you.

What Are the Advantages and Disadvantages of Choosing a RIO Mortgage?

Choosing an RIO mortgage offers advantages such as maintaining home ownership and manageable repayments, but disadvantages include potential interest accumulation and impact on inheritance.

What Are the Pros and Cons of a Retirement Interest-Only Mortgage?

The pros of a retirement interest-only mortgage include potentially being able to leave a larger inheritance to your loved ones, but the cons include your property possibly being seized if the monthly repayments are not met.

More of the advantages and disadvantages...

What Are the Advantages of RIO?

Advantages of retirement interest-only mortgages include:

- Interest rates – The retirement interest-only mortgage rates can be lower than that of lifetime mortgage schemes.

- Advice not compulsory – You do not need financial advice, even though most financial experts recommend it.

- More capital – You can borrow more capital with RIO mortgages than you can with lifetime mortgage products.

- Pay back any time – You can repay the mortgage plan early, although there may be associated early repayment charges.

- Relocate – You have the right to move homes or downsize, as with a lifetime mortgage.

What Are the Disadvantages of RIO?

Disadvantages of retirement interest-only mortgages include:

- Affordability checks – You will need to successfully pass the mortgage provider’s income and affordability checks to prove you can cover the monthly interest payments.

- Variable RIO mortgage rates – Your interest rate may be fixed for the short term and could go up or down in the future (depending on your plan and provider).

- Mortgage renewal – You must renew the mortgage scheme at the end of the initial interest-rate period, potentially incurring new costs and charges associated with taking out a residential loan policy.

- Less inheritance – As with lifetime mortgage schemes, your estate will ultimately be sold to repay the mortgage provider, affecting the amount of inheritance you may leave behind.

How Does a RIO Mortgage Impact Your Estate and Inheritance?

An RIO mortgage impacts your estate and inheritance by reducing the property's value passed on due to the loan being repaid from the estate's assets.

As the capital borrowed through an RIO mortgage is typically repaid from the sale of the property, it may reduce the value of your estate and the inheritance you leave behind for your loved ones.

How Does a RIO Mortgage Affect Your Inheritance?

Since a RIO mortgage requires the repayment of the borrowed capital from the sale of the property, it can reduce the amount of inheritance you leave to your beneficiaries.

It is a good idea to have open conversations with your family members about your financial decisions, including the choice of a RIO mortgage, to manage expectations and address any concerns.

Impact on Means-Tested Benefits

Another consideration when managing an RIO mortgage is its potential impact on means-tested benefits, as it may increase your overall assets or income.

How Do RIO Mortgages Compare to Other Retirement Mortgage Options?

RIO mortgages compare to other retirement mortgage options by offering interest-only payments, differing in potential impacts on estate value and repayment strategies.

Comparing RIO Mortgages and Lifetime Mortgages: What Are the Key Differences?

The key differences between RIO mortgages and lifetime mortgages lie in repayment methods—RIO requires monthly interest payments, whereas Lifetime Mortgages accrue interest until the loan is repaid.

A RIO mortgage is a type of mortgage designed specifically for retirees, where you are required to make monthly interest payments while the capital remains outstanding.

The loan is repaid either upon the sale of the property or upon your passing.

On the other hand

A lifetime mortgage is a type of equity release product designed for individuals aged 55 and older.

You can borrow against the value of your property, either in a lump sum or in smaller amounts over time.

Unlike a RIO mortgage, you do not have to make monthly interest payments as the interest accrues and is added to the loan amount.

The total loan, including the interest, is then repaid from the sale of the property or upon your passing.

What Are the Alternatives to Retirement Interest-Only (RIO) Mortgages in the UK?

The alternatives to RIO mortgages in the UK include downsizing and home reversion plans.

Other alternatives include:

- Retirement Mortgages: Retirement mortgages are specifically designed for retirees and typically have more relaxed affordability criteria. These mortgages allow you to borrow into your retirement years and provide options for lump-sum payments or regular income.

- Downsizing: Downsizing involves selling your current property and purchasing a smaller, less expensive property. The excess funds from the sale can be used to support your retirement lifestyle or to purchase a more suitable property.

- Home Reversion Plans: Home reversion plans involve selling a percentage of your property to a provider in exchange for a lump sum or smaller regular payments. You retain the right to live in the property until your passing or until you move into long-term care.

What Steps Should You Follow When Applying for a Retirement Interest-Only Mortgage?

The steps you should follow when applying for a retirement interest-only mortgage start with evaluating your financial situation and deciding how much you need to borrow.

Next, consult with a financial advisor specialising in retirement mortgages to understand the best options available.

After choosing a lender, you’ll need to provide documentation on your income, assets, and the property in question.

The lender will conduct a valuation of your property and assess your application before making an offer. Following acceptance, legal checks are carried out before the mortgage is finalised and funds are released.

Frequently Asked Questions

Can I Refinance My RIO Mortgage?

Can I Take a Payment Holiday With a RIO Mortgage?

Is the Interest on a RIO Mortgage Tax-Deductible?

What are the Benefits of a Retirement Interest Only Mortgage?

Can I Move House With a Retirement Interest-Only Mortgage?

What Happens if I Am Unable to Make Payments on My RIO Mortgage?

Does Age Affect the Amount I Can Borrow With a RIO Mortgage?

Can I Switch From a Regular Mortgage to a RIO Mortgage?

How Does a RIO Mortgage Affect My Inheritance?

Can I Get a Joint RIO Mortgage?

What are the Risks of a Retirement Interest Only Mortgage?

How Can I Apply for a Retirement Interest Only Mortgage?

How Does a Retirement Interest Only Mortgage Work in the UK?

Concluding Thoughts

Interest-only retirement mortgages are a viable way to access home equity and possibly still leave an inheritance for your heirs.

Before signing up for a RIO, it is worth consulting your financial adviser and exploring your options and alternatives.

You must ensure you understand all your options, including a retirement interest-only mortgage when planning for your senior years.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?