Who Are the Best Equity Release Companies in 2026?

SovereignBoss adheres to a stringent code of editorial guidelines, but some articles may feature partner references. Here is an explanation for how we make money.

- Comparing providers helps save costs, as interest rates, fees, and product features vary between equity release companies.

- Leading providers in 2026 include Legal & General, Aviva, and Pure Retirement, among others.

- Equity release benefits include access to tax-free cash and no monthly repayments, but drawbacks include reduced inheritance and potential early repayment charges.

- Downsizing, remortgaging, or using savings may be viable options instead of equity release.

Finding the UK's top equity release companies can seem like a daunting task, but with a remarkable £2.3 billion released from UK homes in 2025 alone1, selecting the right provider could make a world of difference to your financial future.

Choosing poorly could lead to costly mistakes and long-term regrets.

In this comprehensive guide, the SovereignBoss team will help you navigate the process by highlighting the key factors to consider when choosing the best lenders in the UK.

Stay with us as we explore the best choices among equity release companies...

In This Article, You Will Discover:

What Is Equity Release?

Equity release is a financial product that allows homeowners, typically those aged 55 or older, to access a portion of the equity tied up in their property without the need to sell it.

This can provide a source of tax-free funds, received either as a lump sum or in instalments, and homeowners can continue to live in their homes.

What Types of Equity Release Are There?

There are two main types of equity release: lifetime mortgages and home reversion plans.

Lifetime Mortgages

A lifetime mortgage is a loan secured against the value of a home that allows the homeowner to retain ownership of the property.

The homeowner receives a tax-free lump sum or access to a drawdown facility.

There are no mandatory monthly repayments; instead, the interest is added to the loan amount, which grows over time.

Important

The interest on the loan is compounded, meaning it accumulates over the life of the mortgage.

The loan, plus the accumulated interest, is usually repaid from the sale of the property when the homeowner dies or moves into long-term care.

Home Reversion Plans

Home reversion plans are a type of equity release product that allows homeowners aged 65 and over to sell a part or all of their home to a home reversion provider in exchange for a lump sum or smaller payments.

With this kind of plan, homeowners sell a share or the entirety of their property to a provider while retaining the right to live in the property for the rest of their life.

Important

The amount received is usually below the market value of the property.

Why Compare Equity Release Companies?

Comparing equity release companies is important for several reasons.

These include:

- Interest Rates: Different companies offer varying interest rates, which can significantly affect the total cost of the loan.

- Product Features: Each company provides different features and options, such as payment-term lifetime mortgages or no Early Repayment Charges.

- Customer Service: The quality of customer service can vary, and it's important to choose a company that provides excellent support.

- Fees and Charges: Companies may have different fees associated with their products, which can affect the overall cost of the loan.

By comparing these factors, you can make an informed decision that best suits your financial needs and circumstances.

Top 9 Equity Release Companies in 2026

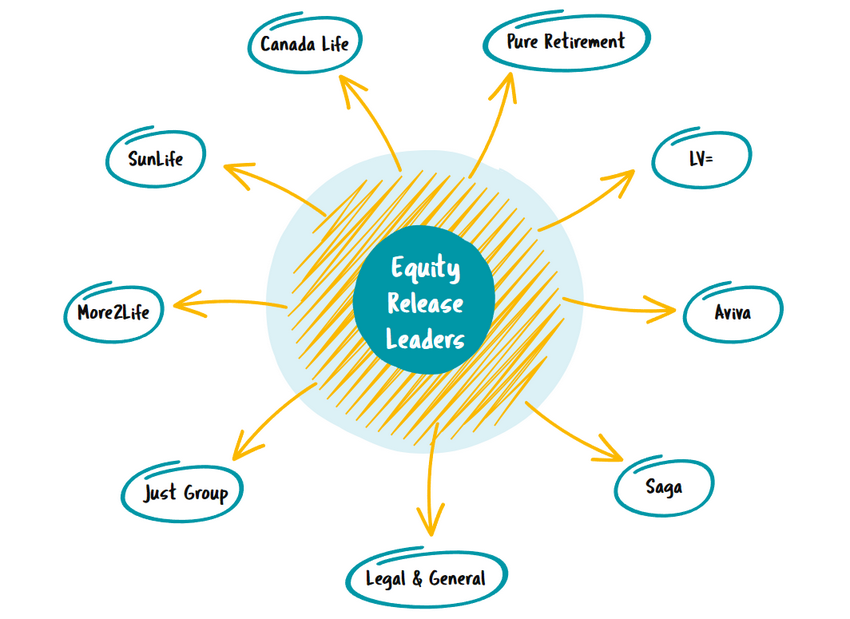

The top 9 equity release companies in 2026 include big names such as Aviva, Pure Retirement, and SunLife.

As the UK's equity release market grows, it's crucial to know which companies stand out in 2026 for their innovative and flexible financial solutions for retirees.

Here are the companies that have established themselves as leaders:

#1. Legal & General

Legal & General remains a leader in the equity release sector since acquiring New Life Home Finance in 2015.

They have facilitated the release of more than £6.5 billion through equity release loans.2

Their plans are tailored for flexibility, offering options for partial repayment without early charges, thus appealing to a broad range of financial retirement strategies.3

Early Repayment Charges are also waived after five years if you move to a new property that doesn't meet Legal & General's lending criteria, or into sheltered accommodation.4

Legal & General won Best Provider for Products at the 2025 Equity Release Awards.5

#2. Aviva

Since 1998, Aviva has equipped over 282,000 UK homeowners with lifetime mortgage plans, distributing more than £11 billion.6

Aviva's lifetime mortgages offer all the standard benefits and allow for potential additional borrowing in the future.7

Aviva received the 2025 What Mortgage Awards for Best Equity Release Lender Customer Service and Best Equity Release Lender.8

#3. More2Life

More2Life, founded in 2008 and the first to offer enhanced lifetime mortgages9, offers a wide range of product options tailored to diverse customer needs.

This includes, for instance, a plan that offers up to a 0.75% interest rate reduction in exchange for a 15-year commitment to making payments.10

Their products are designed to provide flexibility for retirees wishing to access their home equity.

More2Life received the Times Money Mentor 'Best Equity Release' award for 2023.11

#4. Just Group

Operating since 2005 and born from a merger between Just Retirement and Partnership Assurance, Just Group offers highly flexible equity release solutions.

Making interest payments of at least 26% on your lifetime mortgage from Just may qualify you for a rate reduction of between 0.2% and 1.0%.12

Furthermore, a valid Energy Performance Certificate rating of C or above will be rewarded with a 0.1% interest rate reduction.13

#5. LV=

Established in 1843 and rebranded in 2007 as LV=, this company has been offering lifetime mortgages since 2002.14

To help clients borrow less, LV= offer a 1% cashback on all their lifetime mortgage plans.15

LV='s lifetime mortgages have received 4- and 5-star ratings from Moneyfacts.16

#6. Pure Retirement

Based in Leeds since 2014, Pure Retirement prides itself on its transparent fees.17

They offer homeowners lump sum or drawdown options, emphasising clarity and support throughout the equity release process.

Pure Retirement won Best Provider for Service and Best Provider for Adviser Support, Training & Development at the 2025 Equity Release Awards18, and Best Innovation in the Mortgage Space at the 2025 Mortgage Awards19.

#7. Canada Life

Tracing its origins to 1847, Canada Life manages over £36 billion in assets.20

Canada Life offers versatile plans with features like voluntary partial repayments to actively manage loan balances.21

#8. SunLife

SunLife offers a lifetime mortgage that has received a 5-star Defaqto rating.22

This lifetime mortgage provides all the standard flexible features.

#9. Saga Equity Release

Originally a travel company, Saga now provides a variety of services including equity release in the form of a lifetime mortgage provided by Just.23

The Saga lifetime mortgage includes a 6-month money-back guarantee in case your financial circumstances change and you decide you don't need your equity release loan anymore.24

How We Ranked the Top Equity Release Providers

We ranked the top equity release providers by considering a number of relevant factors.

The included:

- product offering

- features

- membership of the Equity Release Council (ERC)

- industry recognition.

How Do the Best Equity Release Rates Compare in 2026?

In 2026, the best equity release rates compare favourably in terms of competitiveness and flexibility, often fluctuating based on market conditions and the lender's criteria.

While rates are typically lower among the most reputable companies, reflecting their efficiency and financial stability, the best rate for one individual may not be the best for another, as rates also depend on personal factors such as age and the amount of equity being released.

Additionally, the presence of features like drawdown facilities and Inheritance Protection can also affect how attractive a rate is.

Look at rates in the table below:

| Provider | Monthly (Rate) The amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. | AER (Annual Equivalent Rate) The percentage of interest on a loan or financial product if compound interest accumulates over a year during which with no payments are made. | APR (Annual Percentage Rate) The number that represents the total yearly cost of borrowing money, expressed as a percentage of the principal loan amount. |

|---|---|---|---|

| Pure Retirement | 5.97% | 6.14% | 6.14% |

| Canada Life | 6.13% | 6.31% | 6.31% |

| Canada Life | 6.16% | 6.34% | 6.34% |

| Aviva | N/A | 6.35% | 6.30% |

| Canada Life | 6.20% | 6.38% | 6.30% |

| Canada Life | 6.24% | 6.42% | 6.38% |

| Just Retirement | 6.25% | 6.43% | 6.42% |

| Just Retirement | 6.25% | 6.43% | 7.20% |

| Canada Life | 6.27% | 6.45% | 7.20% |

| Just Retirement | 6.28% | 6.46% | 6.45% |

Last update: 17 February 2025

Scenario

- 60 Year Old Single Male

- £300k Property Value

- £30k Release

*This rate was accurate upon publication. While we review our figures regularly, they may have changed since this article was last updated.

What Are the Average Interest Rates in the UK in 2026?

The average equity release interest rate is 5.97% to 6.28% (APR)*, according to the Spring Market report released by the ERC.21

*This rate was accurate upon publication. While we review our figures regularly, they may have changed since this article was last updated.

Benefits of Equity Release

The benefits of equity release include its customisability when it comes to protecting inheritance and retaining the option to downsize.

Other pros are:

- Access to Cash: Provides tax-free cash against the value of your home without forcing you to move.

- No Monthly Repayments: No mandatory monthly repayments; the loan is repaid when the home is sold.

- Retain Ownership: You remain the owner of your home.

- Flexibility: Options to take a lump sum or drawdown funds as needed.

- No Negative Equity Guarantee: Ensures you or your estate will never owe more than your home eventually sells for.

Drawbacks to Equity Release

Drawbacks to equity release include the overall cost, which can be substantial compared to other types of borrowing.

Other cons are:

- Reduced Inheritance: The loan and accrued interest reduce the value of your estate.

- Interest Accumulation: Interest compounds over time, increasing the total amount repayable.

- Impact on Benefits: Equity release may affect your entitlement to means-tested state benefits.

- Costs and Fees: There will be fees associated with setting up the equity release plan.

- Complexity: Equity release products can be complex and require professional advice to understand fully.

- Early Repayment Charges: Repaying your loan in full may compel you to pay a substantial penalty.

Is Equity Release Right for You?

Equity release may be right for you depending on your unique needs and circumstances.

To make sure what your best course of action is, speak to an advisor and consider your alternative options.

Speak to an Equity Release Advisor

Speaking to an equity release adviser is important for several reasons.

These include:

- Expert Guidance: They provide expert advice tailored to your unique financial situation and needs.

- Product Knowledge: Advisors have in-depth knowledge of various equity release products and can help you choose the most suitable option.

- Understanding Implications: They explain the potential impact on your estate, inheritance, and benefits, ensuring you make an informed decision.

- Avoiding Pitfalls: Advisers help you navigate the complexities of equity release, avoiding common pitfalls and ensuring you meet all legal and regulatory requirements.

- Access to Best Deals: They have access to a wide range of providers and can secure the most competitive rates and terms for you.

An equity release adviser can provide invaluable support and ensure you make the best decision for your financial future.

Consider Alternatives to Equity Release

Your advisor will discuss the potential alternatives to equity release with you.

These may include:

- Downsizing: Selling your current home and moving to a smaller, less expensive property to release capital.

- Remortgaging: Switching to a new mortgage deal or borrowing more on your existing mortgage.

- Savings and Investments: Using personal savings, investments, or pensions to access funds.

- Family Assistance: Receiving financial support from family members or arranging a family loan.

- Renting Out a Room: Letting out a part of your home to generate additional income.

- Government Grants and Benefits: Exploring available government grants, benefits, or schemes for financial support.

Each option comes with its own advantages and considerations, so it's important to evaluate which one best suits your financial situation and long-term goals.

Common Questions

Which Equity Release Companies Should You Avoid?

What Role Do Equity Release Introducers Play?

What Criteria Should I Consider When Choosing the Best Equity Release Company?

How Are High Street Banks Involved With Equity Release?

How Can I Make a Complaint About an Equity Release Company?

Where Can I Find Reviews for the Best Equity Release Companies?

What Types of Providers Are Involved in Equity Release?

Which Companies Offer the Best Equity Release Alternatives?

Which Are the Best Equity Release Information Portals for 2026?

What Should I Do If My Equity Release Company Dissolves?

Which Companies Have Stopped Offering Equity Release?

Who Are the Best Equity Release Companies in the UK?

Which Equity Release Companies Offer the Best Interest Rates in 2026?

In Short: Top Equity Release Providers

Top equity release providers like Legal & General, Aviva, LV=, and More2Life, have set the standard for innovation, customer care, and ethical practices.

With so many options available, you can trust these leaders to offer tailored solutions for your needs.

Once you've done your research, the next step is always to speak with an independent financial adviser to ensure you choose the best plan for your future.

Find out whether one of the best equity release companies could form part of your retirement strategy today.

The features mentioned and the amounts raised in this article are subject to the lender’s criteria and terms and conditions. Lenders may take into account a borrower's age and health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

WAIT! Before You Start…

Equity Release Calculator

How Much Equity Can You Release?

Spotted a Mistake? Let us know here.